Part 1. Entrepreneurial Investments

1,132 BNP Paribas Wealth Management interviewed more than 1,000 of the most successful entrepreneurs from around the world to uncover the investment

strategies that has driven their portfolio allocation in 2019 and beyond.

0,000

entrepreneurs interviewed

0,000

entrepreneurs interviewed

$00.0 BN

total investable wealth

$00.0 BN

total investable wealth

0,000

entrepreneurs interviewed

$00.0 BN

total investable wealth

For the second year in a row, Elite Entrepreneurs favour investing in Equities and into their Own Business, with these two assets classes representing a total of

38% of their portfolio allocations.

2019 PORTFOLIO ALLOCATION SNAPSHOT

19%

OWN BUSINESS

19%

STOCKS

14%

FIXED INCOME

13%

CASH

10%

PRIVATE EQUITY

10%

REAL ESTATE

5%

HEDGE FUNDS

4%

SUSTAINABLE INVESTMENTS

3%

ANGEL INVESTMENTS

2%

PHILANTHROPY / DONATIONS

Another notable trend this year is that more than half of entrepreneurs perceive Real Estate and Cash as "non-risky" assets. Findings also

show that perception of investment risk differs greatly according to age and geography.

KEY FINDINGS

39%

Say low interest rates are pushing them to invest more in their own businesses

58%

Believe sustainable investing requires a long-term sacrifice of returns

38%

Direct their investable wealth to Equities and their own business

The report also shines a light on Sustainable Investments and Elite Entrepreneur's motivations to commit to positive impact with the majority selecting

climate changes as key priority.

70%

of entrepreneurs globally are more willing to invest sustainability than 18 months ago

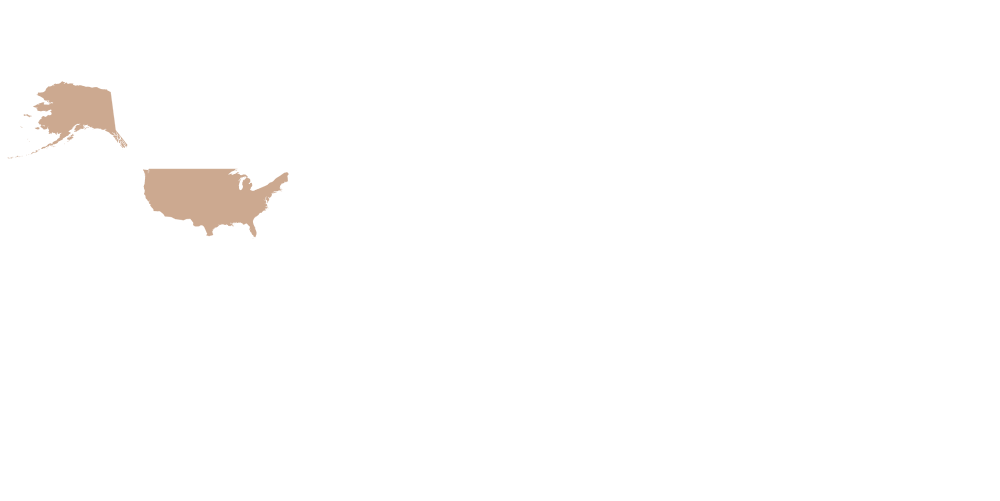

USA

70%

APAC

64%

EUROPE

70%

MIDDLE EAST

82%