Macro Update:

Several markets in Asia Pacific hit record highs

Stock indices in Japan, Taiwan and India hit new all-time highs yesterday, while the South Korean stock market hit its highest level in over two years. The US market was closed for Independence Day and political developments were in focus. Exit polls pointed to a victory for Labour in the UK General Election. Polls also suggested far-right parties will not achieve a majority in the final round of voting in France this Sunday. Meanwhile, pressure is mounting for President Biden to step aside and Vice President Harris’ odds of winning are now ahead of Biden in betting markets. US non-farm payrolls data released tonight will feed into the Fed’s thinking about the state of the labour market.

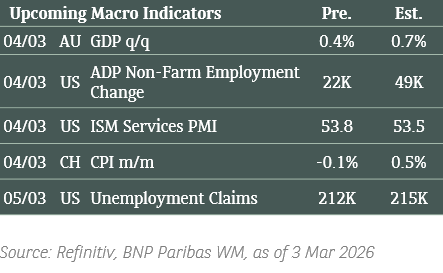

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US market was closed yesterday due to Independence Day holiday. Traders’ key focus will be today’s release of June’s Non-Farm Payrolls, whereby consensus is forecasting +190k jobs.

EUROPE EQUITIES

European stocks rallied, prior to the 2nd round of election in France this upcoming weekend. Within the CAC 40 Composite, the Technology, Financials and Industrials spearheaded with advances yesterday.

HK EQUITIES

HK stocks staged a broad-based rally yesterday, spearheaded by Tech, Communications and Consumer Discretionary sectors. Hang Seng Index closed above the critical 18,000 threshold. Looking ahead, all eyes are on the upcoming Third Plenum Meeting scheduled on July 15-18.

Volkswagen (VOW3 GY)

Volkswagen said EU moves to impose provisional extra duties of up to 38% on Chinese EV imports over subsidy concerns were “detrimental” to the EU market. In fact, Volkswagen wrote in a statement, “countervailing duties are generally not suitable for strengthening the competitiveness of the European automotive industry in the long-term”. Share price of Volkswagen +1.0% yesterday.

MARKET CONSENSUS: 16 BUYS, 7 HOLDS, 3 SELLS, AVERAGE TP EUR151.7

Continental AG (CON GY)

Continental, a Germany-based auto parts provider, its share price surged by +9.5% yesterday (albeit a poor performance of -23.2% in YTD 2024), on the news that the company expects China to be a “main growth driver” in 2H 2024, offsetting the sluggish demand in Europe.

MARKET CONSENSUS: 11 BUYS, 12 HOLDS, 2 SELLS, AVERAGE TP EUR74.76

Barclays (BARC LN)

Share price of Barclays surged by +2.8% yesterday and closed at its 52-week high. The positive trigger pertained to the news that Barclays will sell its German Consumer Finance business to Bawag (an Austria-based financial institution) for a non-disclosed amount. Separately, Barclays is scheduled to release its 2Q results on August 1 and analysts are forecasting enhancements in both its Net Interest Margins and Investment Banking revenues.

MARKET CONSENSUS: 14 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP GBp255

ICBC (1398 HK)

Ahead of upcoming ex-dividend of RMB0.3064/share on July 8, ICBC’s share price rallied by +2.1% yesterday and reached its 52-week high. In fact, ICBC’s share price had registered stellar performance, with +26.4% YTD 2024. ICBC, along with other China’s state-owned banks had been recipients of fund flows. Despite this, ICBC’s share still only trades at 4.6x FY24 PE but offering 6.8% dividend yield.

MARKET CONSENSUS: 20 BUYS, 2 HOLDS, 1 SELLS, AVERAGE TP HKD5.20

Sinopec (386 HK)

Various analysts in the street had lifted FY24-25 earnings estimates on Sinopec, pointing for positive expectations from Sinopec’s midstream and refinery businesses. Sinopec’s share price rose by +2.7% yesterday and reached its 52-week high. This stock is now trading at 9.0x FY24 PE and offering 6.7% dividend yield.

MARKET CONSENSUS: 15 BUYS, 4 HOLD, 0 SELL AVERAGE TP HKD5.48

Earnings Announcements

US Market

Rockwell Automation, Emerson Electric, Disney, Lyft, Warner Bros

European Market

Zurich Insurance, Siemens AG, Rheinmetall

HK - China Market

Cathay Pacific, Swire Properties, China Mobile, Moutai

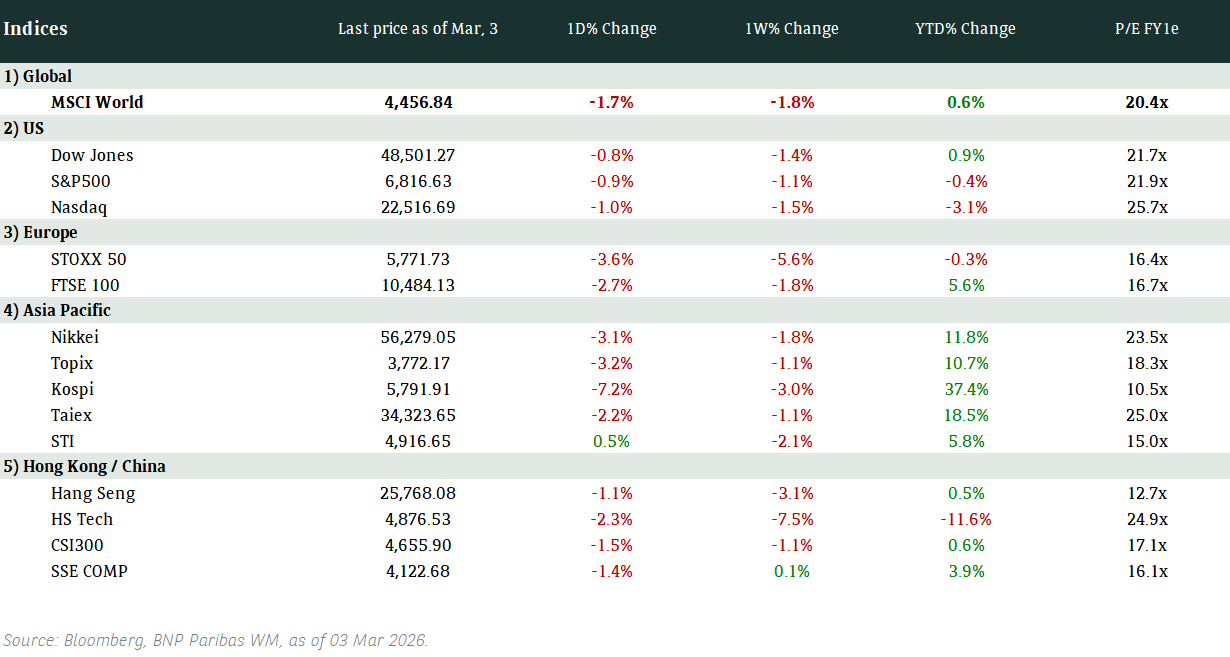

Global Indices Changes (%)

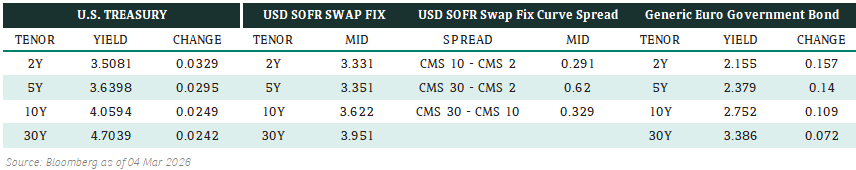

Fixed Income Market Updates

Bond market sentiment was well supported by Powell’s recent dovish comment. It was also fuelled by the weaker-than-expected US ISM service index and ADP employment data. Recent PCE also showed that US inflation is cooling down. Bottomline, recent US macro data suggest that the perfect scenario for fixed income investors – softening labor market and cooling inflation – is just around the corner. This echoes with our constructive view on fixed income for the second half.

EUROPEAN BANK COCO (AT1)

European bank AT1s had a strong day. Bond prices were 0.25-1 point higher. There were strong demand from both institutional and retail investors. The weaker-than-expected US ISM service index and Powell’s relatively dovish comment fueled AT1’s rally. In particular, French bank’s AT1 were popular after the first-round election result. We remain comfortable with selected French bank AT1 and believe every meaningful correction would be a good opportunity to add exposures.

ASIA INVESTMENT GRADE (IG)

Asia IG had a quiet day due to US holiday. The market was slightly softer, mainly led by China IG bonds which was 1-2 basis points wider in credit spread. Outside of China, Japan IG was also softer with Softbank being the key outperformer after the news that it has no immediate share buyback plan. Korea IG was stable with spreads largely unchanged. Overall, we expect Asia IG will stay quiet until US nonfarm payroll data is out.

ASIA HIGH YIELD (HY)

Asia HY had a good day led by strong demand in Macau Gaming bonds, which was up 0.25-0.375 points higher. Private bank clients were generally the better buyer. In China property, Road King continued its outperformance and rallied 1-3 points with good demand from hedge funds and retail investors after its exchange offer was approved. We expect the HY market will remain stable on the back of Powell’s more dovish comments recently.

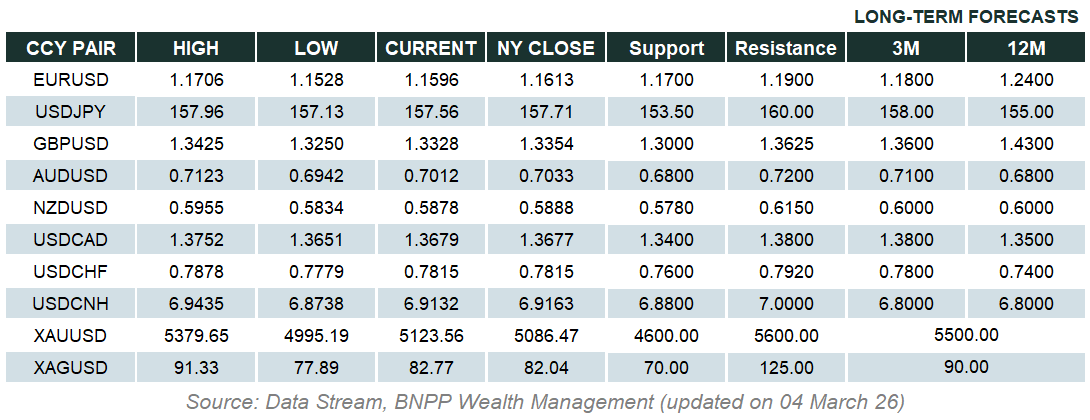

Forex Market Updates

The US Dollar fell on the July 4th holiday as markets digest the previous day’s poor data and await tonight’s highly focused non-farm payroll figures (as mentioned above). Gold prices were flat near a two-week high on Thursday after softer-than-expected US economic data spurred hopes of interest rate cuts as early as September.

USD

The US Dollar fell on softer-than-expected U.S. economic data, including a weak services report and ADP employment report, depicting a slowing economy, after a rise in initial applications for unemployment benefits last week. Markets now see nearly 50 basis points of Federal Reserve interest rate cuts in 2024, most likely starting with a 25-basis-point move in September and a second by year-end.

The Dollar Index could test 105.00 ahead of tonight’s crucial NFP report.

AUD

The Australian Dollar stood tall near a six-month high on Thursday, after cracking major resistance levels overnight as soft U.S. economic data fanned hopes of a September rate cut, supporting bonds. The Aussie also made further gains on its New Zealand cousin and scaled a fresh 33-year peak versus the battered yen due to robust demand from carry trades - where traders borrow a currency with low interest rates to invest in a currency with higher yields.

Aussie bulls could target a near term push high towards immediate resistance around 0.6775.

GBP

The British Pound gained on Thursday against a broadly weaker dollar which was hurt by soft U.S. economic data, as Britons voted in a parliamentary election that investors hope will bring some stability to British politics. The pound has spent most of 2024 down slightly against the dollar - while outperforming other major currencies - though Wednesday's dollar weakness meant sterling was last up 0.23% against the dollar this year.

If tonight’s NFP figures disappoint, we could see Sterling approach resistance level of 1.2860.

XAU

Gold prices were flat near a two-week high on Thursday after softer-than-expected U.S. economic data spurred hopes of interest rate cuts as early as September, and the market spotlight is now on tonight’s non-farm payrolls data. Bullion prices in the previous session gained more than 1% after a weak services report and ADP employment report on Wednesday depicted a slowing U.S. economy.

The precious metal appears to have some resistance at the 2370 level.