Macro Update:

Market awaits more policy signals after soft data in China

Profits earned by China's industrial firms dropped by 3.5% yoy in the first nine months of 2024, reversing a 0.4% growth in the prior period. The Sunday released figure reflected an economy facing persistent demand woes and structural property issues. Meanwhile, investors continued to assess the impact of recent stimulus measures on the economy and markets, while also anticipating further policy signals at the upcoming NPC Standing Committee, which is now scheduled to be on the 4-8th of November, keeping in mind that the US elections is on the 5th of November.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equity market closed the week mixed as investors brace for a week of mega-cap earnings including Apple, Microsoft, Alphabet and Amazon

EUROPE EQUITIES

European stocks closed mixed as investors weighed the implications of results from Mercedes’ underwhelming results to the positive impact of Sanofi’s upbeat update.

HK EQUITIES

HKCN equities traded stronger on Friday, partly recovering from Thursday’s dip amid broad gains across sectors.

Market sentiment was upbeat, lifted by gains in Chinese markets as traders anticipated the upcoming session of China’s top legislature on November 4-8, as mentioned earlier.

Colgate-Palmolive (CL US)

Colgate Palmolive 3Q net sales increased 2.4% on year to $5B. Net income grew by 4% to $737M, while the diluted EPS added 4.7% annually and stood at $0.90.

The company revised its 2024 guidance up, expecting net sales growth of 3% to 5% and organic sales growth of 7% to 8%.

Consecutive price hikes, implemented to counter rising raw materials and packaging costs, helped expand profit margins by 260bps to 61.1%.

MARKET CONSENSUS: 14 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP USD105.83

Boeing (BA US)

Boeing is looking for buyers to sell its Starliner spacecraft and other NASA projects, the Wall Street Journal revealed in a report.

According to the report, the firm plans to avert the company's growing financial crisis by streamlining it and cutting its losses. As part of these efforts, the company plans to sell its NASA business, including the operations supporting the International Space Station.

In other news, Boeing reportedly plans over $15B capital raise as early as Monday.

MARKET CONSENSUS: 19 BUYS, 11 HOLDS, 3 SELLS, AVERAGE TP USD186.48

Alphabet (GOOGL US)

Google reportedly is set to roll out the next version of the company's AI model, Gemini 2.0, in December.

The report revealed that Google is gearing up for an extensive release of Gemini's new version. However, it appears that the model isn't delivering the performance enhancements anticipated.

Nonetheless, there are expectations that it will showcase some "interesting" new features.

MARKET CONSENSUS: 58 BUYS, 12 HOLDS, AVERAGE TP USD202.85

Mercedes-Benz (MBG GR)

Mercedes unveiled on Friday that its revenue for 3Q24 tumbled 6.7% on year, to land at EUR34.5B.

"The Q3 results do not meet our ambitions. Nonetheless, Mercedes-Benz continues to generate solid cash flows even in challenging times. We are taking a prudent view about market evolution going forward and we will step up all efforts on further efficiency increases and cost improvements across the business,“ the firm said.

As with other European rivals, a weakened Chinese market will continue to put pressure on share price.

MARKET CONSENSUS: 15 BUYS, 9 HOLDS, 4 SELLS, AVERAGE TP EUR69.97

Sanofi (SAN FP)

Sanofi’s share rose Friday after the firm posted results better than market’s expectations buoyed by strong vaccine revenues and robust early sales of Beyfortus, its respiratory syncytial virus treatment.

"Based on the strong business performance in the quarter, we recently upgraded our business EPS guidance. This momentum is already paving the way for the strong rebound we said we expected in 2025 business EPS,“ the firm added.

MARKET CONSENSUS: 18 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP EUR113.38

Earnings Announcements

US Market

On Semiconductor

European Market

Koninklijke

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

With strong US consumer sentiment last Friday, US Treasury yields continue to steepen. While the fixed income market may be more undecided on duration as the US election nears, we maintain adding duration (7 to 10 years) now given that yields may retrace post US elections.

European AT1

AT1 space closed the day around 0.125 point higher as risk appetite improved with asset managers buying into USD and EUR AT1 bonds. Deutsche Bank 4.789 Perpetual callable in April 2025 continue to fall (75c to 1 pt lower this week) after a fixed income call as investors priced in a higher likelihood of non-call. We prefer to stick to banks which have a consistent track record of early call. AT1's seemingly want to rally against a benign credit backdrop and good Q3 earnings, but are being held back by rates. Despite the strong technicals, we prefer more defensive AT1's for now.

ASIA INVESTMENT GRADE (IG)

Asia IG space was overall resililent last week despite the US Treasury volatility. China State-Owned Entities (SOE's) had an intitial sell-off but recovered on the week. There is net buying in the 1 to 3 year front end spacce and 10-30 year long end space from real money. Hong Kong names are also very resilient as benchmark names such as CK Hutchison and AIA closed 1-4 bps (basis points) tighter. Outside of China, Malaysia had good volumes in quasi-sovereign names as the higher rates draw out yield buyers. In Thai space, the financials and T2's are holding up extremely well as Treasury desks and real money adding risk once spreads look palatable.

ASIA HIGH YIELD (HY)

Prices stabilised and volume remained low as uncertanities remain for further stimulus support in China and some investors are waiting for US elections. In China property we are closing anywhere from -1 to + 1.5pt (point) on the week depending on technical. Distressed space is holding up well, trading +0.5-1pt higher on continued fast money buying over the last couple of session in names like Sunac, Agile and Kwg. In HK, New World Development is sideways. Better buying in front-end perp and bullets vs trimming the lower cash price part of the curve. There is switching into more yield driven rather than downside recovery protections. In Gaming space we are closing -0.25-1pt lower with higher yielding names like Studio City . Outside of China, flows were better selling, but most bonds are still well bid with dealers presumably covering shorts. The space is broadly unchanged to 0.25 (pt) lower. vedanta tapped 300mm at reoffer of 102.75 (separate tranche, fungible after 40 days). The tap is a touch lower than reoffer given the weaker market sentiment at the time, closing 102.55/102.85 into the week. Biocon Biologics underperformed, trading 1 pt lower after Johns Hopkins researchers sued a Biocon subsidiary for stealing a patented cancer-immunotherapy technology.

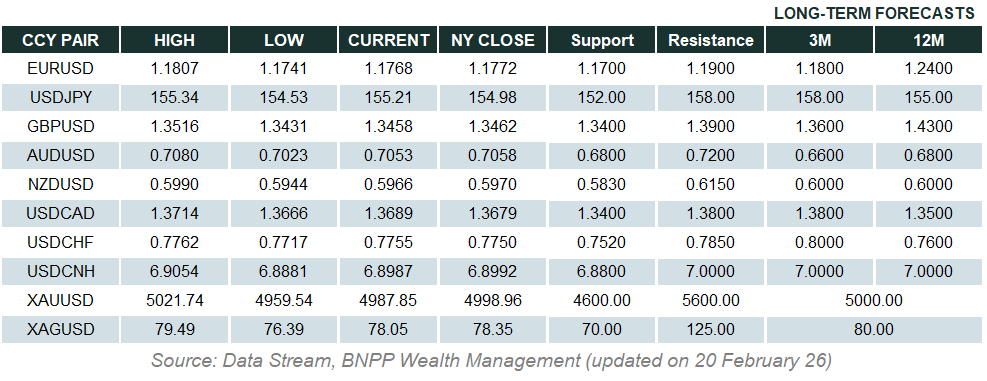

Forex Market Updates

The US Dollar rose on Friday after a better-than-expected US consumer sentiment report kept Fed rate cut expectations in check.

USD

The US Dollar strengthened modestly on Friday, locking in a fourth consecutive week of gains against a basket of other major currencies as a survey of US consumer sentiment beat estimates to keep the greenback within the ballpark of 12-week highs. As focus turns increasingly to election-related developments, most analysts expect more USD gains heading into 5th Nov. thanks to growing “Trump trade” momentum, especially with latest polls confirming that Trump is slightly ahead in swing states and has scored better approval ratings in surveys about his plans for the US economy.

The Dollar Index is likely to maintain upside momentum above 103.50 ahead of Friday’s key NFP data.

EUR

The Euro retreated on Friday in the face of broad USD strength despite an unexpected improvement in the latest survey of German business sentiment, which offers some respite to Europe’s largest economy in its battle with industrial woes and soft global demand. Elsewhere, ECB President Lagarde said that Eurozone inflation is “well on track” to hit the central bank’s 2% target next year, while ECB policymaker Simkus stated that he sees no obvious case for a jumbo-sized 50bps cut in December.

The common currency’s near term outlook remains bearish, with technicals pointing to more losses towards 1.0750 moving forward.

GBP

The British Pound posted slight losses at the end of the week after a report showed that UK consumer confidence fell to its lowest level since March as concerns about possible tax hikes dented sentiment in the lead-up to the new Labour government’s first budget this Wednesday. UK Finance Minister Reeves has said that she will not allow public debt to balloon, and reports that she is planning around GBP 40bn worth of fiscal measures to meet her pledge has increased the likelihood of the BoE having to keep rates higher for longer.

Sterling could see some consolidation between 1.2900 and 1.3100 heading into Wednesday’s UK Budget.

XAU

Gold prices edged higher on Friday after recovering from a bout of profit-taking as escalating Middle East tensions and US election uncertainty continued to boost the safe haven allure of bullion. Most analysts say that the precious metal’s eye-catching rally still has legs to run, citing a high likelihood of continued geopolitical uncertainty as well as a lower global interest rate environment moving forward as supportive factors for more bullion gains heading into 2025.

The precious metal is likely to remain well-supported above 2670 in the near term.