Macro Update:

JOLTS report suggests softening of the labour market

Softer than expected labour market data momentarily increased expectations that the Fed will be more aggressive on interest rate cuts going forward. The JOLTS report showed that the number of job openings in the US was the smallest since January 2021 and layoffs rose, hinting at a cooling job market before FOMC next week. Nonetheless, the odds for a 25bps rate reduction next week currently stand around 95%, in line with our forecast. The market will now turn their attention to other crucial economic data set to be released later in the week.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

The US market closed mostly higher with the Nasdaq on another record high ahead of the tech sector’s earnings releases expected after the bell.

Key earnings were mixed with Alphabet cheered and AMD dipped in afterhours trading.

EUROPE EQUITIES

European equities fell on Tuesday after a new batch of earnings reports was released.

Heavyweights BP and Novartis did not fair as expected.

HK EQUITIES

Hong Kong equities closed Tuesday higher with HSBC leading advance.

CSI300 however fell 1% with some profit-taking action seen in renewables after their recent surges.

HSBC (5 HK)

HSBC posted a 1% rise in 3Q profit, beating market estimates as its wealth and wholesale banking benefited from slower-than-expected rate cuts while it embarks on one of the largest overhauls in its history.

The bank said it will pay an interim dividend of $0.10 a share, its third payout in 2024 following payments worth $0.41 announced earlier this year.

HSBC announced an additional share buyback up to $3B, on top of a $6B buyback programme. Market should react positively to the results.

MARKET CONSENSUS: 14 BUYS, 8 HOLDS, 1 SELL, AVERAGE TP HKD80.02

Alphabet (GOOGL US)

Alphabet reported 3Q sales that climbed more than market expectations, helped by robust demand for cloud computing services from companies racing to develop and adopt AI.

Revenue (excluding partner payouts) increased to $74.6B, up 16% on year and 2.3% higher than market expectations. As its main search business matures, Google is betting on growth from its cloud division and the firm is “attracting new customers and winning larger deals,” Alphabet’s CEO said.

MARKET CONSENSUS: 58 BUYS, 12 HOLDS, AVERAGE TP USD203.31

BP (BP/ LN)

BP maintained the pace of its quarterly buybacks even as weak oil prices put pressure on the firm’s statements.

Net debt increased by $1.7B to $24.3B, the highest since 2022. While that helped maintain its buyback, BP suggested the level could change in February next year when it update its strategy and financial guidance.

Quarterly profits stands as the lowest in almost 4 years amid lower oil prices.

MARKET CONSENSUS: 12 BUYS, 11 HOLDS, 1 SELL, AVERAGE TP GBp500.952

Adidas (ADS GR)

Adidas reported strong 3Q growth across most regions in a sign a revival plan led by CEO Bjorn Gulden is starting to work. Currency-neutral revenue grew by double digits in most places (except North America). Operating profit jumped to EUR598M, +46% YoY.

Earlier this month, Adidas raised its annual profit target for the 3rd time. They now expect operating profit of ~EUR1.2B, up from the previous ~EUR1B.

MARKET CONSENSUS: 17 BUYS, 12 HOLDS, 5 SELLS, AVERAGE TP EUR250.8

Novartis (NOVN SW)

3Q net income soared by 111% on year to reach $3.18B, while its operating income jumped by 106% to $3.63B. EPS is up 116% to $1.58.

However, sales of Novartis’ best selling drug and a key new cancer medicine posted disappointing sales last quarter, even as the drugmaker lifted profit guidance for a 3rd quarter.

Sales of heart failure medication Entresto fell short of expectations, while closely watched cancer drug Pluvicto only beat estimates due to a one-time gain.

MARKET CONSENSUS: 10 BUYS, 17 HOLDS, 2 SELLS, AVERAGE TP CHF103.01

Earnings Announcements

US Market

Microsoft, Meta, Starbucks

European Market

ASM, UBS, Ubisoft, GSK , Stanchart

HK - China Market

COSCO Shipping

Global Indices Changes (%)

Fixed Income Market Updates

We expect the next two weeks will be very volatile for fixed income investors as we get closer to US election. The market is now aggressively pricing in a Republican-Sweep scenario with 10-year US Treasury yield climbing to about 4.3%. At this level, we believe risk-reward is favourable and suggest extending duration with 7-10 year good quality IG bonds.

European AT1

European AT1 had a soft day. Long dated coco bonds were under some pressure before US election as more investors start to take profit. Bonds were generally weaker and 0.25-0.75 points lower. Overall, we believe European AT1 valuation is not cheap and further capital upside is unlikely. However, we expect bond prices to hold up well due to strong technical support amidst rate cut cycle.

ASIA INVESTMENT GRADE (IG)

Asia IG had a mixed day. China IG space remains well bid with good demand. GLP China bonds were 1-1 points lower after its decision to cancel the 3-year USD bond deal. China tech space performed well and traded 1 basis points tighter. Hong Kong space also did well, except New World bond which had some selling. India IG had a busy day with lots of institutional investors buying the Adani bond which were up 0.125-0.25 points. Korea IG was largely stable with credit spread slightly tighter. We expect the IG bond momentum will remain stable despite volatile US Treasury movement.

ASIA HIGH YIELD (HY)

For Asia HY, China property was largely unchanged. We expect the sentiment for China HY will remain quiet until we see more progress on government policy stimulus. Outside of China, better quality India IG were in good demand. We saw institutional investors chasing names like JSW Steel and GMR airport. Overall, we expect Asia HY bonds trading activities to remain relatively subdue as investors tend to stay put before US election.

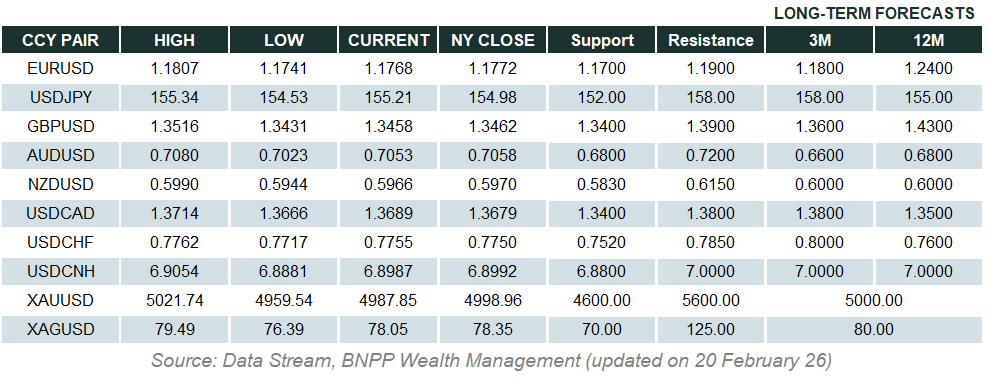

Forex Market Updates

The US Dollar consolidated around three-month highs against a basket of other currencies ahead of a slew of key US data later this week.

USD

The US Dollar remained steady near three-month highs, with a 3.6% rise against a basket of other currencies in October thus far marking its strongest monthly gain since April 2022. Markets are focused on upcoming US election results and key economic data, including the Fed’s preferred inflation measure and NFP this week, which will influence the path of Fed policy. Despite recent signs of a cooling labour market, resilient consumer confidence has buoyed the dollar, with limited downside expected ahead of both the election and the November Fed meeting.

Upside momentum in the Dollar Index is likely to remain intact above 103.50.

JPY

The Japanese Yen held steady as political uncertainty following Japan’s recent election raised doubts about the timing of potential BoJ rate hikes moving forward. Opposition leader Tamaki urged the BoJ to avoid major policy shifts until real wages increase, a stance supported by smaller parties who are gaining influence. Japan Finance Minister Kato also signalled vigilance on foreign exchange moves as the Yen remains near three-month lows amid expectations of prolonged monetary easing.

The Yen's near term outlook remains bearish, with 155 being the next potential target.

AUD

The Australian Dollar continued its decline yesterday, hitting 2.5-month lows around 0.6560 as rising US yields bolstered the greenback. Today’s Q3 inflation report is likely to influence the RBA’s rate outlook ahead of the next central bank on 05-Nov. While headline inflation is expected to ease, any upside surprises are almost certain to rule out a December rate cut, especially with the RBA the least dovish among the major central banks. Markets currently see only a 34% chance of a RBA cut this year, with easing likely to start next April.

AUDUSD is likely to remain under pressure and could test the next support level the 0.6500 handle.

XAU

Gold prices surged 1% to a record high of 2774 yesterday, driven by US election uncertainty, ongoing Middle East tensions, and a 98% likelihood of a Fed rate cut next week. With a 34% rise year-to-date, gold continues to appeal as a hedge against volatility and market uncertainty, and analysts expect bullion’s rally to extend into 2025. Silver prices rose in tandem, gaining almost 2% overnight.

The precious metal is likely to remain well-supported above 2700 in the near term.