Macro Update:

US economic data remains solid

US GDP rose at a solid 2.8% in 3Q, led by a 3.7% rise in personal consumption. US ADP private employment also rose 233k in October, well above expectations of a 111k. The data strengthens our base case scenario of a soft-landing. Any near term volatility due to uncertainty in US elections could be buying opportunity as market tends to be risk-on when the election outcome is clear and a global synchronised rate cut cycle improves market liquidity.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities experienced a modest decline on Wednesday after a mixed session on Tuesday.

Continued earnings announcements are likely to contribute to market volatility in the short term.

EUROPE EQUITIES

Major EU stock markets closed lower after a day filled with macro data releases.

Some ECB policy makers suggested that a deteriorating economic outlook could warrant a larger rate cut and this could trigger market movement.

HK EQUITIES

Hong Kong/Chinese equities closed a choppy session lower on Wednesday.

Auto sector dragged, tracking ADR weakness as EU finalizes tariffs on Chinese EVs. Potential stimulus from China can swing shares back into green.

Broadcom (AVGO US)

OpenAI reportedly is working with Broadcom to develop a new AI chip specifically focused on running AI models after they have been trained.

The firms are also consulting with TSMC, the report added. The process for taking a chip from design to production is long and expensive. OpenAI is looking for a specialized chip that will run the software and respond to user requests, a process called inference.

Demand for inference chips are expected to grow as more firms adopt AI models to field more complex tasks.

MARKET CONSENSUS: 42 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP USD193.78

Kyocera (6971 JP)

Kyocera plans to sell down its stake in KDDI over the next 5 years, the latest company to take part in a gradual unwinding of cross-help shares in Japan. The firm plans to sell about a third of their holdings and will use the proceeds to bolster its finances, it said.

Kyocera on Wednesday slashed its annual operating income forecast, citing weakness in its semiconductor devices business.

MARKET CONSENSUS: 5 BUYS, 12 HOLDS, AVERAGE TP JPY1992.13

Microsoft (MSFT US)

Microsoft reported net income of $24.7B for the quarter ending September 30, marking an 11% increase. The company attributed the solid performance to robust growth in its cloud computing and AI businesses.

However, the firm warned that its gross margin outlook for its crucial cloud division was going to be lower just as its investment in AI infrastructure was set to grow.

Share prices are projected to experience downwards pressure over the next trading session.

MARKET CONSENSUS: 64 BUYS, 5 HOLDS, AVERAGE TP USD500.16

UBS (UBSG SW)

UBS posted 3Q profit that almost doubled expectations, leading shares to its peak since 2008. Total revenue rose to $12.3B, up from $11.7B a year earlier, while operating profit before tax reached $1.9B.

The bank's diluted EPS were $0.43, a drop from $1.29 a year before, representing a decline of approximately 66% but 80% ahead of market’s expected $0.24.

This earnings season, banks looks to be navigating a softening operating environment, but outlook remains favourable.

MARKET CONSENSUS: 11 BUYS, 10 HOLDS, 5 SELLS, AVERAGE TP CHF28.2

Meta (META US)

Meta warned of "significant acceleration" in AI-related infrastructure expenses next year, while beating analysts' estimates for 3Q revenue and profit.

The results sent mixed signals to investors about whether digital ad sales from Meta's core social media business would continue to cover the cost of its massive AI buildout.

Despite some potential selling pressure post results, underlying support is expected to limit declines.

MARKET CONSENSUS: 69 BUYS, 7 HOLDS, 3 SELLS, AVERAGE TP USD614.14

Earnings Announcements

US Market

Apple, Amazon, Mastercard

European Market

Aker, TotalEnergies, Shell, SocGen, ING, STMicro

HK - China Market

Budweiser

Global Indices Changes (%)

Fixed Income Market Updates

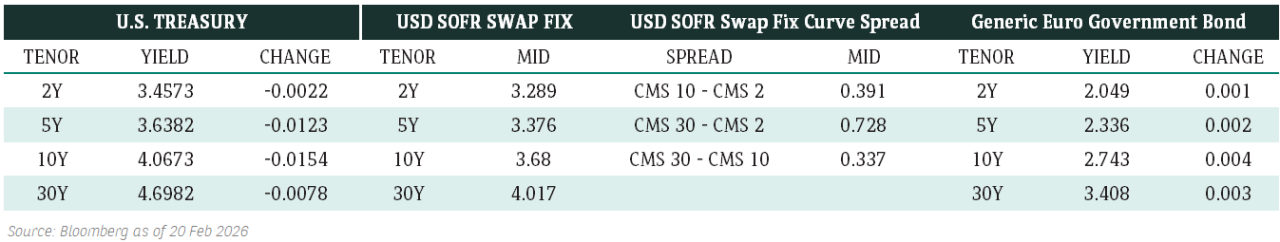

Overnight bond market sentiment weakened slightly due to the stronger-than-expected US ADP employment data. We reiterate our view that any sell-off would be a good opportunity to add fixed income exposures and we see the sweet spot being 5-10 year good quality IG bonds after recent sell-off in US Treasury.

EUROPEAN AT1

European AT1 had a soft day and prices continue to drift lower especially for new issues and longer dated coco bonds. Bonds were generally weaker and 0.25-0.75 points lower. Overall, we believe European AT1 valuation is not cheap and further capital upside is unlikely. Front-end paper is defensible and we would be in monitoring mode for longer end.

ASIA INVESTMENT GRADE (IG)

In China IG, it seems that investors were staying on the sidelines before the US election with credit spreads wider mainly driven by rates moves. There was some selling on the long-dated Technology sector names. Even though there were some trade activities in recent new issues, they just wrapped around reoffer levels into the afternoon. Outside of China, there were muted sessions with balance flows for Indian IG. Credit spreads were 1 basis point. Trade flows were two-way with better selling due to risk off from institutional accounts. .

ASIA HIGH YIELD (HY)

For Asia HY, sentiment is very firm but overall flows are quiet as investors are generally waiting for both the US elections and more announcements from the Chinese government next week. China property was largely unchanged to slightly higher to better buying for certain lines. Chinese industrials is more idiosyncratic as certain names drifted lower. Outside of China, better quality India IG were in good demand especially Adani's front end paper.

Forex Market Updates

The British Pound fell on Wednesday as concerns were raised that the Labour government's first Budget could weigh on economic growth in the medium to long run.

USD

The US Dollar saw a modest retreat from three-month highs on Wednesday despite an unexpected surge in US private payrolls, while separate data showed that the US economy grew at an annualized rate of 2.8% in 3Q2024. While a 25bps cut at next week’s Fed meeting is as good as a done deal, some analysts say that another cut in December remains a coin toss thanks to robust US growth indicators and consumer and business sentiment that remains largely confident.

The Dollar Index looks set to consolidate October’s solid gains above 103.50 moving forward.

EUR

The Euro rose for the third consecutive session on the back of stronger-than-expected Eurozone data, with quarterly GDP figures from Germany, France and Spain all coming in above estimates. Elsewhere, ECB policymaker Schnabel pushed back against calls for ultra-easy monetary policy, saying that gradual rate cuts remain appropriate as inflation looks unlikely to ease below the central bank’s 2% target. Analysts seem to agree with Schabel for now, saying that this week’s Eurozone data strengthens the case for maintaining the 25bps easing pace in December rather than a jumbo-sized 50bps cut.

Euro bulls could target another push higher towards the 1.0900 handle before the end of the week.Sterling looks poised to see some near term consolidation below 1.3100.

GBP

The British Pound weakened yesterday, falling back below the 1.3000 handle against the USD as markets balked at investment plans laid out in the UK Labour Government’s first Budget yesterday. While new Chancellor Reeves managed to increase borrowing without triggering the bond market meltdown that brought down former PM Truss in 2022, critics say that the planned 40bn pounds worth of tax hikes, the biggest increase in three decades, could hurt private sector investment in the UK and sap Britain of its entrepreneurial spirit, which could in turn negatively impact economic growth.

Sterling looks poised to see some near term consolidation below 1.3100.

XAU

Gold prices touched another record high on Wednesday as geopolitical tensions and US election uncertainty continued to boost safe haven demand for bullion. Analysts are mostly in agreement that the precious metal, already up 35% this year and on course for its best yearly performance since 1979, could see more gains in 2025 amid the ongoing Middle East conflict, emerging market concerns, inflows into gold ETFs and post-election adjustments. Elsewhere, silver prices retreated around 2% on the day but remain just off 12-year highs, with the technical outlook continuing to look constructive.

Bullion prices are likely to remain well-supported above 2720 in the near term.