Macro Update:

Tech giants drag US stocks lower

US equities dropped sharply on Thursday, led by the tech-heavy Nasdaq, as disappointing earnings guidance from Big Tech giants Microsoft and Meta raised concerns about their high AI costs and potential profit pressures. Nevertheless, volatility presents opportunity, as US equities historically moves higher post elections. On the data front, a slew of US data on Thursday lowers hope for larger and faster Fed rate cuts. The latest PCE index showed core inflation rose 2.7% annually in September, while jobless claims dropped to a five-month low of 216,000, indicating a robust labour market. Personal spending also rose more than expected, highlighting the resilience of the US consumer to higher interest rates. Nevertheless, we continue to see a 25bps rate cut in the November FOMC, followed by another 25bps cut in December this year.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities experienced a risk-off day on Thursday, driven by a combination of disappointing earnings report and a less dovish outlook from Fed.

Near term market volatility remains driven by earnings reports, with over 75% of S&P beating earnings expectations so far.

EUROPE EQUITIES

European equities extended their losing streak to 3 days on Thursday, as investors adopted a cautious stance in light of recent economic data and upcoming releases.

HK EQUITIES

HK equities traded choppily, closing the day slightly lower, but still managed to outperform regional markets.

This was helped by Chinese macro data, which continues to be a recurring theme in the near term. House view remains positive on the market.

Samsung Electronics (005930 KS)

Samsung said it would focus on producing high-end chips to improve profitability after reporting a 40% QoQ plunge in chip profit, in a stark contrast with rivals TSMC and SK Hynix which have posted record earnings.

Samsung said it has completed an important phase in the qualification of HBM3E to Nvidia, hinting that supply could start soon and it is looking to expand HBM sales to multiple customers.

Faster-than-expected progress in HBM migration versus Hynix and faster-than expected demand recovery in servers, smartphones, and IT devices could be upside catalysts for the stock.

MARKET CONSENSUS: 38 BUYS, 5 HOLDS, AVERAGE TP KRW87260.87

UBER (UBER US)

Uber announced 3Q revenue jumped 20% YoY to $11.2B, exceeding expectations. Net income surged 99% to $2.6B and EPS soared from $0.10 in 3Q23 to $1.20.

Gross bookings amounted to $41B, growing 16% annually but came in below market estimates.

Shares are likely to face some selling pressure in the near term, especially after Tesla announce its Cybercab that could be a potential competing service.

MARKET CONSENSUS: 53 BUYS, 6 HOLDS, AVERAGE TP USD90.38

Apple (AAPL US)

Apple, heading into its most critical sales period of the year, sparked fresh concerns about revenue growth and lingering weakness in an intensely competitive China market.

Following the earnings report, Apple said that total sales in the December period will rise by low-mid single digit percentage while market projected higher.

The concerns are likely to weigh on the shares in the near term.

MARKET CONSENSUS: 39 BUYS, 18 HOLDS, 3 SELLS, AVERAGE TP USD245.02

Merck (MRK US)

Merck beat profit and sales estimates for the third quarter, but lowered guidance due to deals with partners Curon Biopharmaceutical and Daiichi Sankyo.

Sales were boosted by better than anticipated revenue growth in the oncology portfolio, which counterbalanced the declines in diabetes and the mixed performance in vaccines.

MRK's flagship oncology drug Keytruda continued its strong performance, with sales rising 17% Y/Y to $7.4B, slightly above expectations.

MARKET CONSENSUS: 28 BUYS, 4 HOLDS, AVERAGE TP USD134.81

Shell (SHEL LN)

Shell’s 3Q24 adjusted earnings decreased by 4% to $6B, compared to $6.2B a year ago. The result comes while the company struggles with lower crude prices and weak refining margins.

"We continue to deliver more value with less emissions whilst enhancing the resilience of our balance sheet. Today, we announce another $3.5B buyback programme for the next three months, making this the 12th consecutive quarter in which we have announced $3B or more in buybacks," the firm said.

MARKET CONSENSUS: 16 BUYS, 9 HOLDS, AVERAGE TP GBp3080.05

Earnings Announcements

US Market

Exxon Mobil, Bristol-Myers Squibb

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Primary market activity will likely slow down as U.S. election draws closer next week. Overnight, Ford Motor Credit priced a new US$1.0bn 7-year bond in line with its secondary USD curve. We prefer to be more selective in the global auto sector.

EUROPEAN AT1

European AT1 CoCos traded on a soft tone, moving 1pt lower during the day before retracing to close 0.25pt to 0.625pts lower amid the rates rally in the afternoon. Most of the interests were seen on AT1s with high reset coupons and longer call dates. We think AT1 CoCos will continue to trade range-bound. Although capital upside will likely be limited in the near-term, we continue to watch out for better entry opportunities for carry play in the AT1 space.

ASIA INVESTMENT GRADE (IG)

Activities were generally slow with low trading volume into the month-end of October as majority of investors await non-farm payrolls data tonight. Nonetheless, buying interests remained bias towards duration as investors take the opportunity to add risk amid the rates volatility. In China IG space, small buying flows on short-dated papers were mostly driven by retail investors but spreads were largely unchanged at market close with a lack of major catalyst. Away from China, activities were also muted with Singapore out on holiday. Overall theme remained the same with continued demand for banks and quasi-sovereign/government-related papers with 5-year to 10-year maturity across Southeast Asia and Korean IG space. Short-dated 2025-2026 papers near 5% yield were also in demand.

ASIA HIGH YIELD (HY)

Asia HY space had a slower-than-usual activities for month-end. China HY saw mixed flows on property names like Longfor, Vanke, and Dalwan. Two-way flows were also seen on GLP bonds with better buying interest for their short-dated bonds. Outside of China HY, flows were skewed to better buying despite rates sell-off with demand mostly seen on Indian/Indonesian HY bonds with maturities up to 5 years.

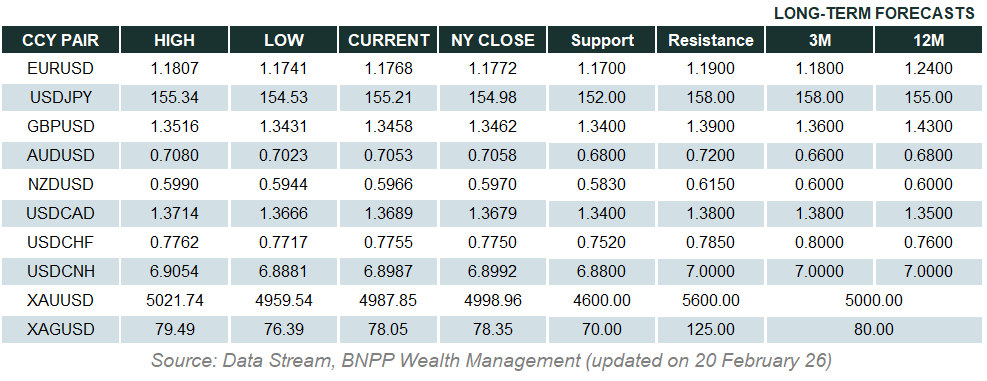

Forex Market Updates

The U.S. Dollar dipped as markets took profit and consolidated near its 3-month-high, with investors keeping an eye out for the jobs data to be released later today.

USD

The US Dollar eased broadly on Thursday after U.S. data suggested upward price pressures continue to ease, keeping Federal Reserve policymakers on track to cut short-term U.S. borrowing costs by a quarter percentage point next week. The increrase in US consumer spending is also putting the economy on a higher growth trajectory heading into the final three months of the year.

The Dollar Index looks set to consolidate October’s solid gains above 103.50 moving forward.

CAD

The Canadian Dollar steadied near a 12-week low against its U.S. counterpart on Thursday and posted its biggest monthly decline in more than two years, as the domestic economy stalled in August and investors globally grew risk averse. The Canadian economy is likely to miss the Bank of Canada's revised third-quarter forecast of annualized 1.5% growth after a slew of temporary factors led to a flat reading for gross domestic product in August.

USDCAD should find some resistance around the 1.4000 level as traders take profit before tonight's jobs data.

GBP

The British Pound fell on Thursday, set for its worst two-day loss against the euro in two years, a day after new British finance minister Rachel Reeves announced a tax-and-spend budget that investors worried would reignite inflation and weigh on growth. Reeves' budget on Wednesday contained the biggest tax increases since 1993 as she sought to repair Britain's public services, and she also changed the government's fiscal rules to increase borrowing for long-term investment to boost the economy.

Sterling is likely to continue its weakening trend, testing the support level of 1.2800.

XAU

Gold prices retreated on Thursday as prices consolidated after hitting a record high, while safe-haven demand ahead of the U.S. presidential election helped the precious metal log its fourth straight monthly gain. Underlying forces spurring demand for gold include geopolitical tensions and uncertainties about the outcome of the election, with the market remaining in a "buy-on-dips" mode. Investors now await the payrolls report on Friday, and see a 95% chance of a quarter-basis point U.S. interest rate cut next week, which would further benefit non-yielding gold.

Bullion prices are likely to remain well-supported above 2720 in the near term.