Macro Update:

Non-Farm Payrolls Weaker Distorted By Strikes & Hurricanes

The October US non-farm payrolls registered +12k well below expectations. However, the number was impacted by strikes and hurricanes. However, the revision to the prior two months data was negative indicating a slowing jobs market. Therefore, we reiterate our call for a 25 bps cut at this week’s Federal Reserve meeting. This is in-line with our soft landing and slowing economy view. Recently and before these figures the market had moved to a no landing view.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks closed higher on Friday, rebounding from the previous day’s selloff as strong earnings from Amazon buoyed sentiment.

EUROPE EQUITIES

European equities rose on Friday, led by banks as investors continue to assess economic developments, corporate earnings and the upcoming US election.

HK EQUITIES

Stocks in Hong Kong closed higher on Friday after property sales in China returned to growth for the first time this year, adding to evidence of economic stabilisation on the mainland.

Microsoft (MSFT US)

Microsoft announced on Friday that it plans to invest around USD10B in the cloud-computing startup CoreWeave between 2023 and 2030, potentially strengthening the company’s foothold in the AI space and providing further upside to its share price.

The tech giant reportedly plans to run artificial intelligence models using CoreWeave's data centers, with the total value of signed contracts reaching USD 17B.

MARKET CONSENSUS: 62 BUYS, 6 HOLDS, AVERAGE TP USD498.92

Nvidia (NVDA US)

S&P Dow Jones Indices said on Friday that Nvidia will replace Intel on the blue-chip Dow Jones Industrial Average Index after a 25-year run, a likely positive for the former’s share price.

The news also marks another setback for struggling Intel, as its shares have declined more than 50% in 2024, making it the worst performer on the index that it is about to exit.

MARKET CONSENSUS: 67 BUYS, 6 HOLDS, 2 SELLS, AVERAGE TP USD148.37

Chevron (CVX US)

Chevron on Friday beat Wall Street estimates for 3Q24 results, despite a year-on-year slowdown, helped by higher oil and gas output. Nevertheless, lower oil prices is likely to remain a headwind for the company going forward.

The US energy giant’s 3Q24 was at USD50.7B vs. USD49.3B expected, while adjusted EPS was at USD2.5 vs. USD2.4 expected.

MARKET CONSENSUS: 19 BUYS, 9 HOLDS, AVERAGE TP USD168.8

Nomura (8604 JP)

Nomura on Friday delivered its highest quarterly profit in four years, marking its sixth straight quarter of growth as strong performance at its wholesale and wealth management businesses boosted results.

The Japanese brokerage firm in FY2Q25 more than doubled its adjusted net profits to JPY98.4B vs. JPY60.8B expected, with revenue also beating expectations at JPY483.3B vs. JPY445.9B expected.

MARKET CONSENSUS: 3 BUYS, 5 HOLDS, 1 SELL, AVERAGE TP JPY946.25

Nissan Motor (7201 JP)

Nissan is reportedly reducing production of its main US models by approximately 30%, weighed by sluggish sales figures.

The news is a likely negative for the company as it puts its goal of reaching global sales of 3.65M units in FY2024 at risk. The news also followed Nissan’s recent downward revision of its operating profit forecast to JPY500B for FY2024, approximately 16% lower vs. its previous forecast.

MARKET CONSENSUS: 3 BUYS, 8 HOLDS, 8 SELLS, AVERAGE TP JPY438.46

Earnings Announcements

US Market

Zoetis, Constellation Energy

European Market

Ryanair, BioNTech, NXP Semiconductors

HK - China Market

Yum China Holdings

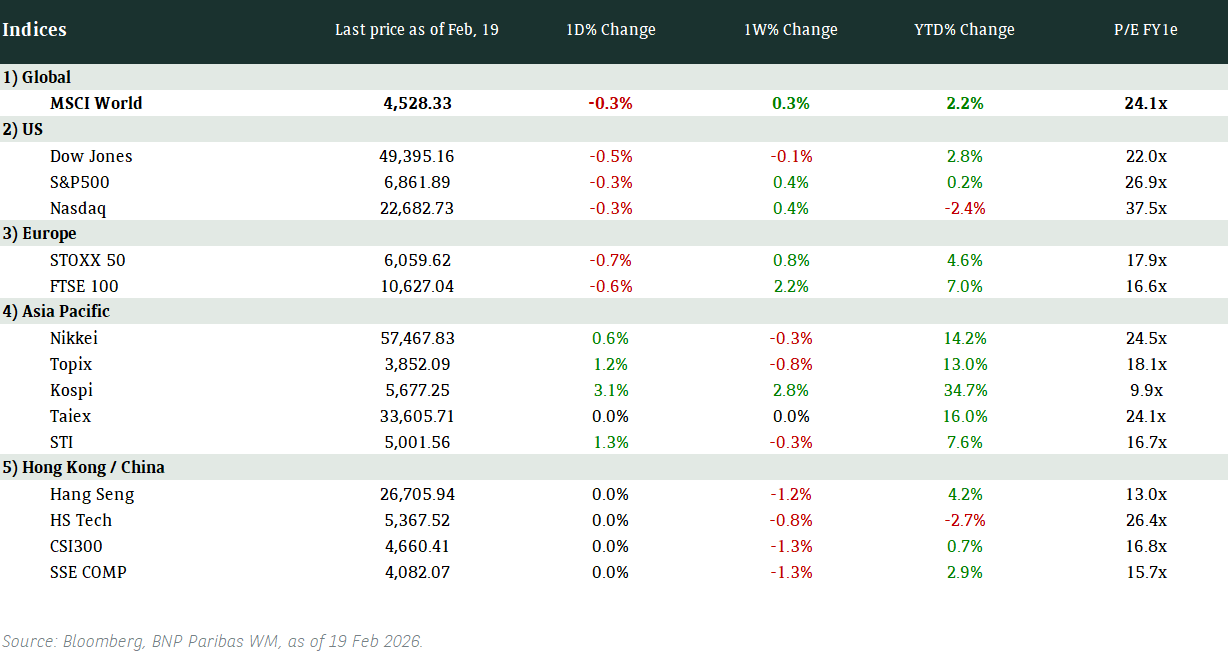

Global Indices Changes (%)

Fixed Income Market Updates

The bank AT1 market is finally catching a breather. Any further widening post U.S. elections would provide a good entry for bank AT1, particularly for those with short call dates and high reset coupon.

EUROPEAN AT1

European AT1 CoCos closed 0.125pt to 0.75pt higher last Friday amid an active, firm session. Recently issued AT1 CoCos from Societe Generale and Lloyds continued to outperform, closing 0.75pt higher on the day. There was also demand for USD AT1 CoCos, particularly for those with short-call dates and those that were 3pts-4pts away from their recent high levels. In contrast, recently issued Skandinaviska Enskilda Banken (SEB) 6.75% AT1 CoCo lagged behind peers, closing 1pt to 1.25pt below issue price. While spreads generally look tight in this space, we think the recent rates-driven move opens a better entry point compared to a few weeks ago.

ASIA INVESTMENT GRADE (IG)

Asia IG spreads closed generally unchanged to slightly wider last week. Investors were mostly cautious and remained on the sidelines ahead of the key events this week (i.e., U.S. elections and FOMC). Spreads of low beta names in the China technology/media/telecom sector were largely unchanged to 2-3bps wider with some investors off-loading the longer dated bonds. Away from China IG, investors continued to pick up Singapore banks’ and Thai banks' USD senior and Tier 2 bonds while some trimmed their position on Australian banks' Tier 2 bonds with longer call dates. Meanwhile, short-dated bonds continued to receive decent demand as investors continued to deploy and park some cash there.

ASIA HIGH YIELD (HY)

It was a slow day in Asia HY space, ahead of the U.S. data released last Friday night and the key events this week. Flows were mostly two-way, albeit light. In China HY, flows remained mixed with better buying interest on Longfor and better selling flows on the likes of Road King and Future Land. Outside of China HY, bonds broadly closed unchanged to 0.125pt lower. Flows were skewed to better selling but was easily absorbed by the street.

Forex Market Updates

The U.S. Dollar recovered to close the week near the same level as it started, with markets likely to remain on the sidelines as an event-filled week begins.

USD

The US Dollar rebounded against most major currencies on Friday after traders digested data showing U.S. job growth slowed sharply in October amid disruptions from hurricanes and strike action by aerospace factory workers. Nonfarm payrolls rose by 12,000 jobs after a downwardly revised 223,000 in September, the Labor Department's Bureau of Labor Statistics said. Economists polled by Reuters had forecast October payrolls rising 113,000.

The Dollar Index looks set to consolidate above 104.00 moving forward.

CAD

The Canadian Dollar is expected to rally against its U.S. counterpart in the coming year as lower borrowing costs boost the domestic economy but the result of the U.S. presidential election could unsettle the outlook. Republican candidate Donald Trump has proposed sweeping tariffs on imported goods. Canada sends about 75% of its exports to the United States.

USDCAD should find some resistance around the 1.4000 level as markets take profit ahead of this week's key activities.

GBP

The British Pound stabilised on Friday after a volatile few sessions, but still headed for its longest stretch of weekly losses in nearly six years, as political and monetary uncertainty has prompted investors to favour the dollar lately. UK finance minister Rachel Reeves last week delivered her first budget since the Labour party came to power in July - a high-tax, high-spend and high-borrowing set of proposals that unnerved the British bond market and dented sterling.

Sterling is likely to continue its weakening trend, testing the support level of 1.2800.

XAU

Gold prices edged down on Friday, pressured by a stronger U.S. dollar and Treasury yields, but a weak job growth data from the world's biggest economy prompted analysts to increase bets for a rate cut from the Federal Reserve, limiting some losses. Economists see a 100% chance of a 25-basis-point cut by the Fed next week, versus a 91% chance before the jobs data.

Bullion prices are likely to remain well-supported above 2720 in the near term.