Macro Update:

Oil bounces on output cuts as markets await US elections

OPEC+ delayed a production increase by one month, boosting oil prices by 2%. Meanwhile tension in the Middle East remains. However, oil supply overall remains ample. It will be a busy week with US elections on Tuesday, and the Federal Reserve meeting on Thursday where the market is pricing in a 25 bps cut, in-line with our estimates. Finally, the NPC meetings in China occur from November 4th to the 8th where the markets will assess the level of stimulus announced.

Main Upcoming Macro Indicators

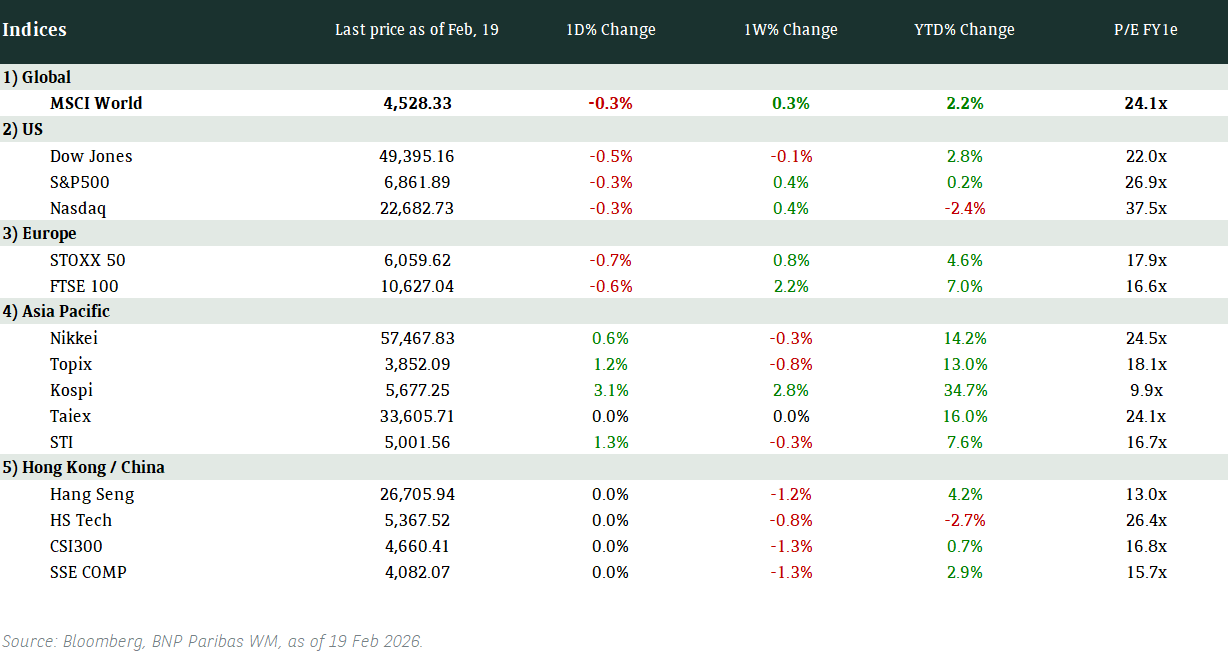

Equity Market Updates

US EQUITIES

US equities closed slightly lower on Monday as investors braced for both the US presidential elections as well as the Fed’s policy statement.

Stocks will have a clearer direction after these major events this week

EUROPE EQUITIES

European shares dipped on Monday as losses in technology stocks offset gains in banks and oil companies.

HK EQUITIES

Stocks in Hong Kong rose on Monday, led by electric vehicle makers amid record sales, as investors continue to await fresh catalysts from policymakers in Beijing.

Tesla (TSLA US)

The China Passenger Car Association revealed in a preliminary report on Monday that Tesla experienced a 5.3% YoY plunge in sales of electric vehicles made in China as fierce competition weighed, likely dampening the company’s growth outlook going forward.

Meanwhile, rival BYD’s passenger vehicle deliveries amounted to 500,526 units, reaching a monthly record and growing 66.2% YoY.

MARKET CONSENSUS: 26 BUYS, 20 HOLDS, 15 SELLS, AVERAGE TP USD232.25

Palantir (PLTR US)

Palantir on Monday announced strong beats in its 3Q24 results with revenue at USD725.5B vs. USD703.7B expected, and net income at USD143.5M vs. USD105.0M expected.

The company also raised its full-year revenue guidance to between USD2.805B and USD 2.809B from USD2.742B and USD2.75B previously, providing further evidence that strong spending from governments and other businesses looking to adopt generative AI (GenAI) technology. This should support upward movements in the company’s share price going forward.

Palantir has benefited from a boom in GenAI technology, as more companies turn to its AI platform, which is used to test, debug code and evaluate AI-related scenarios.

MARKET CONSENSUS: 4 BUYS, 10 HOLDS, 7 SELLS, AVERAGE TP USD28.54

Schneider Electric (SU FP)

Schneider Electric announced on Monday that its Board of Directors unanimously appointed Olivier Blum as its new chief executive officer with immediate effect.

The appointment is intended to accelerate its strategy's implementation and embark on the following stages of its development.

Blum has been with Schneider for over thirty years, holding positions such as Director of Strategy and Sustainable Development and Group Director of Human Resources and, most recently, leading its Energy Management division.

MARKET CONSENSUS: 16 BUYS, 7 HOLDS, 4 SELLS, AVERAGE TP EUR248.23

Ryanair (RYA ID)

Ryanair trimmed its passenger growth target for 2025 on Monday due to Boeing delivery delays, but said weakness in fares was moderating following a poor summer. Nevertheless, the announcement still confirms the company’s headwinds going foward and is likely to put downward pressure to its stock price.

The news followed Ryanair’s FY1H25 results announcement which featured a slight net profit beat at EUR1.79B vs. EUR1.74B expected, and revenues that was largely in line with expectations at EUR8.7B.

MARKET CONSENSUS: 16 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP EUR20.37

Kuaishou (1024 HK)

Kuaishou’s international version, Kwai, on Monday officially announced the launch of it’s e-commerce platform Kwai Shop in Brazil, further extending its business footprint overseas.

Kuaishou currently already has around 60M active users in Brazil, with almost 70% of small businesses having already used social networks such as Kwai to enhance visibility.

Brazil has the potential to be a significant revenue source for Kuaishow going forward.

MARKET CONSENSUS: 49 BUYS, 5 HOLDS, 1 SELL, AVERAGE TP HKD64.82

Earnings Announcements

US Market

Emerson Electric, Yum! Brands Inc

European Market

Ferrari

HK - China Market

Melco Resorts & Entertainment

Global Indices Changes (%)

Fixed Income Market Updates

This week will be extremely volatile for fixed income investors and key focus will be US election outcome. Having said that, with 10-year US Treasury yield trading at ~4.3%, we believe the market has well-priced in a Republican Sweep scenario, which may not necessarily happen. We thus see now as a good opportunity to add fixed income exposures via 7-10 year good quality IG bonds.

EUROPEAN AT1

European AT1 was generally 0.5-1 point lower as market participants were in risk reduction mode. Sentiment was further weakened by recently new bond issuance that was tightly priced. We believe European AT1 valuation is not cheap. However, we expect bond prices to hold up well due to strong technical support amidst rate cut cycle. Recent bank earnings also confirm our view that banks’ credit fundamental remain solid.

ASIA INVESTMENT GRADE (IG)

It was a quiet day for Asia IG due to Japan holiday. Investors tend to stay cautious ahead of US election. Overall, Asia IG credit spread was mostly stable and slightly tighter. We saw some bond inflow from multi-asset manager who took profit on equity before election as part of their defensive strategy. Country wise, Korea IG had relatively better demand as it is relatively more immune from US election risk. We expect Asia IG to remain stable until US election.

ASIA HIGH YIELD (HY)

Asia HY had a slow day. China HY was more active as market expects the NPC meeting this week would reveal an aggressive stimulus package for the economy. However, China HY property stayed under pressure to sell by institutional investors. Likewise, HK HY bonds were also 0.5-1.5 points lower. We expect the selling pressure in HK and China HY remain as investors turned cautious on the sector before US election.

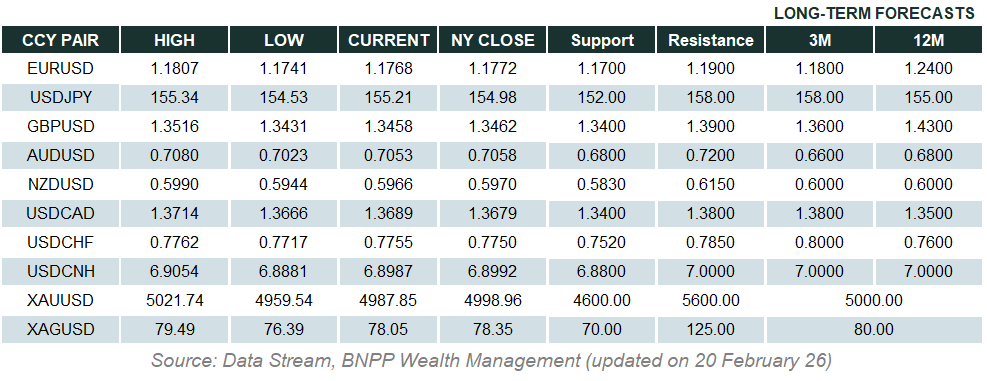

Forex Market Updates

The U.S. Dollar saw slight losses on Monday amid broad market caution heading into the final stages of US elections.

USD

The US Dollar traded modestly softer against a basket of other major currencies at the start of the week, with Trump trades being unwound due to a big pullback in the likelihood of a Republican sweep as implied by polls and betting markets. Apart from the US Presidential Election, markets are also looking ahead to this Thursday’s FOMC meeting, where focus is likely to be on Fed Chair Powell’s guidance for the December meeting, especially after last week’s soft NFP figures.

The Dollar Index looks likely to be capped by technical resistance around 104.50 for the time being.

EUR

The Euro recovered almost all of Friday’s losses during yesterday’s session, benefitting from USD weakness as well as better-than-expected Manufacturing PMI figures out of Germany and Spain, as well as for the overall Eurozone. The data came as factories reduced their prices at then fastest rate since April, in part justifying the ECB’s ongoing policy easing cycle. With the majority of ECB policymakers saying that the battle against inflation is not yet won, the central bank looks highly likely to cut rates by 25bps again in December.

The common currency looks primed for some near term consolidation between 1.0750 and 1.0950.

AUD

The Australian Dollar saw modest gains yesterday as risk-proxy currencies cheered the unwinding of Trump trades amid new polling statistics showing Harris gaining an edge on Trump. On the central bank front, the RBA is expected to stand pat on rates at today’s meeting, although markets are likely to be sensitive to any tweaks to the statement, particularly on policy needing to be “sufficiently restrictive” and the RBA not “ruling anything in or out” on rates.

The Aussie could edge higher toward 0.6650 if markets continue to scale back on expectations of a Trump victory.

XAU

Gold prices held their ground above one-week lows on Monday as investor caution prevailed heading into the final stages of the US Presidential Election as well as Thursday’s FOMC meeting. Bullion is expected to see elevated volatility as the election results come in over the next two to three days, with some analysts saying that a Trump victory could propel gold to as high as 2900 due to his proposed tariff and immigration policies.

The precious metal looks poised to be supported above 2670 for the time being.