Macro Update:

Fed’s Powell says no need to rush rate cuts

Fed Chair Powell said the strong economy allows the FOMC to move carefully to lower rates, opening the door for a slower pace of cut. We expect a 25bp rate cut in December and then a quarterly cut until September in 2025.

Meanwhile, the ECB minutes showed concern around a possible inflation undershoot in 2025. We expect more rate cuts from the ECB next year (vs less rate cuts from the Fed). The higher rate differential suggests renewed USD strength in the medium term. We have revised our EUR/USD 3-month target to 1.06 and 12-month target to 1.02.

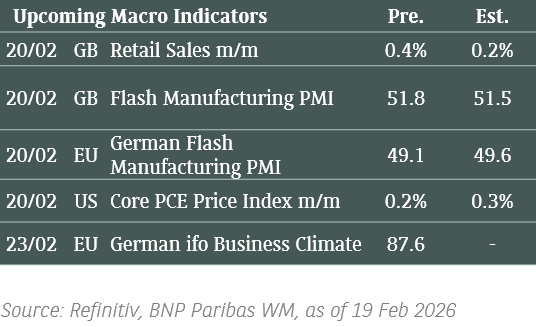

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

Stocks in the US traded lower on Thursday after comments from the Fed pointed to a slower path of rate cuts.

EUROPE EQUITIES

European shares rose on Thursday, rebounding from prior session losses, driven by strong performances in the energy and technology sectors. Positive earnings reports also added to the upbeat mood.

HK EQUITIES

Hong Kong stocks slid on Thursday as investors await earnings announcements from China’s bellweather companies.

Microsoft (MSFT US)

The US Federal Trade Commission on is reportedly planning to set into motion an investigation into Microsoft's cloud computing business and its potential anti-competitive practices.

The agency is currently looking into accusations that the tech giant is exploiting its market power by applying corrective licensing terms to stop its customers from moving data from Azure to rivaling platforms. Among some of the behaviors being exercised are slapping higher subscription fees on those trying to leave, as well as imposing huge exit fees and programming its Office 365 products to not be compatible with competitors' clouds.

Developments regarding this investigation is likely to add volatility to the company’s share price going forward.

MARKET CONSENSUS: 62 BUYS, 6 HOLDS, AVERAGE TP USD499.31

Disney (DIS US)

Shares of Disney rose on Thursday after it posted solid beats to both FY4Q24 top- and bottom-line, while also providing a bullish outlook. The company’s revenue stood at USD22.6B vs. USD22.5B expected, while adjusted EPS was at USD1.14 vs. USD1.10 expected.

Adding to optimism is Disney’s forecast that its profit would jump over the next three years, likely putting to rest any investor concerns about earnings pressure from theme park weakness, supporting share price in the near to medium term.

MARKET CONSENSUS: 31 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD114.13

Siemens (SIE GY)

Shares of Siemens rose on Thursday after the company posted a solid FY4Q24 results print despite macroeconomic challenges. The company’s revenue during the quarter was at EUR20.8B vs. EUR20.7B expected, while adjusted EPS was at EUR2.57 vs. EUR2.53 expected.

Siemens also said that the boom in power-hungry data centres will drive demand for its transformers and grid technology, potentially driving material growth in the company’s bottom line and supporting its share price going forward.

MARKET CONSENSUS: 22 BUYS, 2 HOLDS, 2 SELLS, AVERAGE TP EUR202.25

ASML (ASML NA)

ASML on Thursday reaffirmed its bullish outlook on AI-driven demand as it forecasts annual revenue of EUR44B to EUR60B by 2030 with gross margins between 56% and 60, in line with its previous forecast.

The announcement is likely to swing the company’s share price to the upside as it reassures investors of ASML’s growth prospects going forward.

ASML’s outlook came after the company’s order intake significantly missed street estimates in 3Q24, sparking a recent selloff in the company’s shares.

MARKET CONSENSUS: 30 BUYS, 10 HOLDS, AVERAGE TP EUR857.95

JD.com (JD US)

JD.com announced on Thursday a 3Q24 bottom-line beat with adjusted net income at RMB13.2B vs. RMB11.4B expected, attributable to both higher non-operating income a sharp fall in effective tax rate. The company’s revenue, however, was in-line at RMB260.4B.

JD.com’s results showed that its growth remained resilient despite macro struggles in China, potentially supporting share price going forward.

Separately, JD.com has completed the last USD3B share repurchase program initiated in March 2024 and has launched a new USD5B budget for September 2024 to August 2027.

MARKET CONSENSUS: 42 BUYS, 5 HOLDS, AVERAGE TP USD49.2

Earnings Announcements

US Market

-

European Market

Vallourec SACA

HK - China Market

Alibaba

Global Indices Changes (%)

Fixed Income Market Updates

China's new USD government bonds priced flat to US Treasuries and rallied from there to trade up to 30bps lower - the Chinese government can now borrow US Dollars at 4.00% for 3 years, around 0.30% p.a. cheaper than the US Government which actually prints the US Dollar.

EUROPEAN AT1

Primary market was active in the AT1 space with 3 new issues announced. Deutsche Bank printed a EUR-denominated AT1 at 7.375% (initial price guide was 8%) with books more than 7 times oversubscribed. This new issue did well in the secondary and closed around 1point higher, lifting the prices of other Deutsche Bank's AT1 bonds up as well both in EUR and USD. The other 2 new issues were USD-denominated Societe Generale, which printed at 8.125% (initial price guide was 8.75%, books were more than 9 times oversubscribed), and NatWest, which printed at 7.3% (initial price guide was 7.75%). These 2 new issues also traded up in the secondary market. Investors' appetite for AT1s were strong as the hunt for yield continues.

ASIA INVESTMENT GRADE (IG)

New China sovereign bonds were most actively traded in Asia IG space with onshore accounts topping up allocations. Bonds in the Technology, Media and Telecoms space and Asset Management Companies remained sought after by global asset managers, especially in the 5-year, with spreads around 1-2bps tighter in general. Away from China, in the India IG space, spreads were unchanged to 2bps tighter on the back of buying from private bank accounts. Bonds in the insurance sector in Japan traded around 0.25-0.625point lower due to consistent selling pressure especially in higher cash priced bonds and benchmark names. Nissan continued to underperform and was around 5-10bps wider across the curve. We are cautious in the auto sector and are highly selective of bonds in this space.

ASIA HIGH YIELD (HY)

It was a relatively quiet day due to the typhoon in Hong Kong. China HY property benchmark names were marked unchanged to slightly lower with equities still trending lower. Shui On was the underperformer in this space, with the curve down around 2.5 points. Even India HY space was relatively muted with not much trading going on and the space closed broadly unchanged to a touch lower on the day.

Forex Market Updates

The US Dollar continues its bullish run, strengthening for the fifth straight session as markets continued the "Trump Trades" sentiment along with the release of higher producer price index data.

USD

The US Dollar strengthened against major peers on Thursday, trading at a one-year high and headed for a fifth straight session of gains, propelled by market expectations since Donald Trump clinched a dramatic return to the White House. U.S. producer prices picked up in October, the Labor Department reported on Thursday, a day after data showed that consumer inflation had barely budged last month. The number of Americans filing new applications for unemployment benefits fell last week, suggesting labor market strength, according to the Labor Department.

The Dollar Index could see more near term strength, with USD bulls likely to target the previous high of 107.34.

CAD

The Canadian Dollar weakened further beyond a key psychological level against its U.S. counterpart on Thursday, pressured by broad-based gains for the American currency and the potential for U.S. trade tariffs to hurt the domestic economy. Currency forecasters have turned overwhelmingly bearish on the currency in recent months, with domestic weakness seen intersecting with U.S. outperformance and a constant drumbeat of trade threats to drive the exchange rate lower.

The Loonie is on an increasingly weaker outlook, with USDCAD targetting the 1.4667 level.

GBP

The British Pound dropped to its lowest against the dollar since early July on Thursday, brushed aside by the U.S. currency's relentless rise. Those developments are swamping British news for investors, although they will be keeping an eye on finance minister Rachel Reeves' first Mansion House speech to leaders of the City, as well as remarks from Bank of England governor Andrew Bailey. Reeves said in advance that she wants Britain to build a slew of "megafunds" with up to 80 billion pounds ($102 billion) in fresh investment firepower, under plans for the biggest shake-up in British pensions seen in decades.

Sterling looks poised to see more near term losses towards immediate support around 1.2600.

XAU

Gold prices were subdued after hitting a two-month low on Thursday, pressured by a strong dollar rally, though traders have not lost confidence in a December rate cut following the latest U.S. economic data. The U.S. dollar index .DXY continued its relentless march higher, trading at a one-year high, making gold more expensive for overseas buyers. Easing labor market conditions are expected to encourage the Federal Reserve to deliver a third interest rate cut next month, even as data showed progress in lowering inflation has stalled.

The precious metal could weaken towards 2500 as the next psychological barrier.