Macro Update:

Lower expectations of rate cuts weighed on markets

Powell reiterated on Friday that there is no urgency for the Fed to cut rates, citing the economy's strength, a solid labour market, and persistent inflationary pressures. Fresh economic data reinforced this view, as retail sales exceeded forecasts while both export and import prices rose unexpectedly. We still see a 25bps rate cut in the upcoming December FOMC, followed by three quarterly cuts of 25bps in 2025. On the markets front, US post election gains fade, but this should provide opportunity for US equities, which we are positive on.

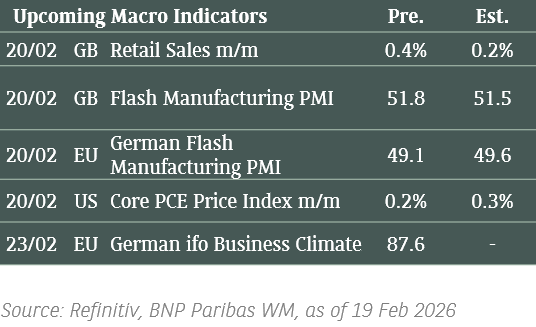

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities closed lower on Friday on concerns about slower interest rate cuts and as investors reacted to cabinet picks by US President-elect Donald Trump.

EUROPE EQUITIES

Stocks in Europe traded lower on Friday, notching a weekly loss, as downbeat earnings from automakers dented sentiment.

HK EQUITIES

Hong Kong stocks gave up early gains to close flat on Friday as concerns regarding the lack of fiscal stimulus offset optimism from upbeat Chinese economic data.

Palatir (PLTR US)

Shares of Palantir surged on Friday, hitting a record high, after it announced late on Thursday that it would list on the Nasdaq (effective on 26 November 2024) and expects eligibility to join the Nasdaq 100 index.

This could drive further upside to the company’s share price in the near term as a listing on the Nasdaq 100 means that anyone who uses the index as their benchmark would then have to buy Palantir shares as well.

MARKET CONSENSUS: 3 BUYS, 10 HOLDS, 7 SELLS, AVERAGE TP USD36.87

T-Mobile (TMUS US)

T-Mobile’s network was reportedly one of the systems hacked in a damaging cyber-espionage operation that gained entry into multiple US and international telecommunications companies, potentially impacting the company’s reputation in the near term.

Uncovered in October, the attack originated from Chinese hacker group Salt Typhoon. The group was able to breach T-Mobile as part of a months-long campaign to spy on the cellphone communications of high-value intelligence targets.

MARKET CONSENSUS: 26 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP USD242.29

Alibaba (9988 HK)

Alibaba on Friday posted a strong FY2Q25 revenue that was largely in line with expectations at RMB236.5B. The figure grew 5% YoY, mainly driven by growth in the company’s cross border business.

One bright spot in Alibaba’s results was its net income beat at RMB43.9B vs. RMB32.7B expected, boosted by its high-margin cloud business and its massive bet on AI. This likely reassures investors that Alibaba is making solid progress in the highly lucrative AI space, potentially driving upside to share price in the medium term.

MARKET CONSENSUS: 40 BUYS, 3 HOLDS, AVERAGE TP HKD119.49

Samsung Electronics (005930 KS)

Samsung’s shares surged on Friday after it announced that it plans to buy back shares worth around KRW10T over a one-year period to boost shareholder value.

The move is likely to support the company’s share price in the near term, potentially stopping its recent slide to four-year lows amid concerns about the impact of US tariffs under a new Trump administration.

In 2024, the South Korean tech giant is the worst performing stock among global chipmakers like TSMC and Nvidia.

MARKET CONSENSUS: 38 BUYS, 5 HOLDS, AVERAGE TP KRW84021.21

Lenovo (992 HK)

Lenovo on Friday posted FY2Q25 results that beat estimates as it begins to reap benefits from its bets on artificial intelligence. The company’s FY2Q25 revenue stood at USD17.9B vs. USD16.3B expected and net income at USD325.5M vs. USD343.3M expected.

Lenovo also hiked its outlook for global shipments in 2025 to double-digit percentage growth from a previous forecast of between 5%-10%, stating that AI features will continue to boost sales next year, on top of the PC replacement cycle facilitated by Windows 11.

The forecast upgrade could potentially swing Lenovo’s share price upwards in the near to medium term as it provides further evidence of Lenovo’s position as a major AI beneficiary..

MARKET CONSENSUS: 29 BUYS, 2 HOLDS, AVERAGE TP HKD12.65

Earnings Announcements

US Market

-

European Market

-

HK - China Market

Xiaomi

Global Indices Changes (%)

Fixed Income Market Updates

With Treasury yields back up and the US 10Y treasury yield around the 4.45-4.5% levels, we reiterate to long 10 year duration here. New issue AT1's last week didnt provide enough premium and are now under reoffer in secondary, which we would be buyers of.

EUROPEAN AT1

Flow was skewed to selling throughout the day although the move lower really occurred as US 10Y yields hit 4.5%. Credit spreads are far from levels that would invite new (spread) investors to buy the dip so prices are dependent on continued demand for yield. The particularly tight spreads in USD mean that new deals are struggling – as much as investors like coupons, the reset spread has to be somewhat reflective in the price. However, we expect buy-the-dip from yield buyers.

ASIA INVESTMENT GRADE (IG)

In China IG, a very slow session but felt slightly weaker and ran into supply from the RMs. Levels are generally slightly wider but the China sovereign new issue just grinded more tighter with rates moves. SP Group Treasury priced $700mn 5yr bond at T5+45 bps. The bond has been well chased in the secondary market and gapped -5bp from the reoffer level to start the morning session. In rest of the SEA space, risk sentiment turned weaker. Spreads 2-4bp wider across the beta names like Petronas Capital and bank T2s.

ASIA HIGH YIELD (HY)

The weak sentiment in China HY continued today with survivors quoted another -0.25-0.75 pt lower despite the equity sell off stopping. In Hong Kong, New World Development down 1-2pt (points) lower which is around 1pt higher from intraday lows, and net we moved 3-6pt lower this week with the high cash px step-up perps underperforming. In Industrials, Fosun new issue continues to see sellers and it has now sunk below reoffer for the first time since issuance. The Gaming sector is marked unchanged to 0.25pt lower, buying flows from retails account have paused today. In India/Indon HY, it is -0.125-0.25pt lower. UPL corp outperformed on the back of the headline on notice of rights issue committee. The perps up +4pt higher and ran into some profit taking from real money accounts.

Forex Market Updates

The US Dollar ended the week on a strong note, as markets continue to bet on fewer rate cuts in the coming year due to potentially inflationary policies to be implemented by President-elect Trump.

USD

The US Dollar got its biggest weekly gain in over a month on Friday, as markets reassessed expectations of future interest rate cuts and with the view that President-elect Donald Trump's policies could be inflationary. The dollar has benefited from market expectation that Trump administration policies, including tariffs and tax cuts, could stoke inflation, leaving the Federal Reserve less room to cut interest rates, reinforcing the hawkish comments by Fed Chairman Jerome Powell on Thursday.

The Dollar Index could see more near term strength, with USD bulls likely to target the previous high of 107.34.

CAD

The Canadian Dollar weakened to a 4-1/2 year low against its US counterpart on Friday as oil prices fell and a wider gap between US and Canadian yields reduced the incentive for investors to hold the currency. For the week, the currency was down 1.2%, its sixth weekly decline in the last seven weeks. The gap between the Canadian 2-year yield and its U.S. equivalent widened by 5.5 basis points to roughly 115 basis points in favor of the US note, near its widest since 1997. Investors tend to favor higher yielding currencies.

The Loonie is on an increasingly weaker outlook, with USDCAD targetting the 1.4667 level.

GBP

The British Pound headed for its biggest weekly loss since January on Friday, under pressure from weak UK economic data and a surging dollar that is getting a lift from investors' conviction that Donald Trump's policies will drive up US growth and inflation. Britain's economy contracted unexpectedly in September and growth slowed to a crawl over the third quarter, data showed on Friday. Sterling has turned negative on the year against the dollar for the first time since July, down 0.4%. For most of 2024, it's been the best-performing major currency, on the grounds that UK interest rates will take longer to fall meaningfully vs the US.

Sterling looks to be testing the support level around 1.2600, with 1.2400 next in sight.

XAU

Gold prices on Friday were on track for their biggest weekly decline in over three years as expectations of less aggressive interest rate cuts by the US Federal Reserve lifted the dollar, denting allure for bullion among investors. The dollar was set for its biggest weekly gain in more than a month, making gold more expensive for other currency holders. Markets now see a 62% chance of a 25bp rate cut in December, down from 83% a day before, according to the CME Fedwatch tool.

The precious metal could weaken towards 2500 as the next psychological barrier.