Macro Update:

Inflation figures in-line before Thanksgiving

The much anticipated PCE inflation figures in the US were in-line with expectations on headline and core. Hence, the December FOMC meeting remains in play with a close call whether the Federal Reserve cuts rates by 25 bps or not. Our base is for a cut. Bond yields continue to drop after the figures. The back up in yields that we saw a few weeks ago are good opportunities to add to bond exposure. In the US, markets will be closed on Thanksgiving today and will have shortened trading hours on Friday.

Main Upcoming Macro Indicators

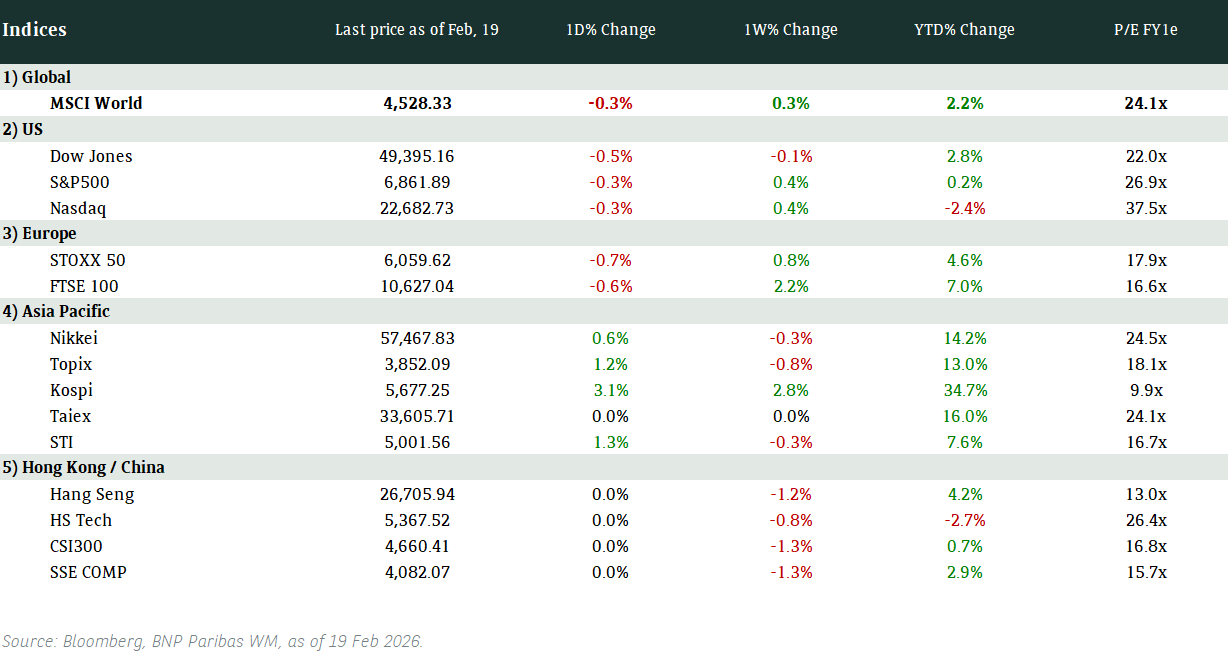

Equity Market Updates

US EQUITIES

US stocks fell on Wednesday, led lower by technology companies, as investors digest the latest US inflation data.

EUROPE EQUITIES

European stocks traded lower on Wednesday, dragged by French blue chips on concerns about whether the country's belt-tightening budget will get approved in parliament

HK EQUITIES

Hong Kong stocks surged on Wednesday, gaining for a second day amid mounting optimism about potential supportive policies from China to counter tariff risks.

Microsoft (MSFT US)

The US Federal Trade Commission has reportedly opened an extensive antitrust investigation into Microsoft on Wednesday, focusing on its cloud computing and artificial intelligence offerings.

The investigation is said to center on how Microsoft integrates its popular office productivity and security tools into its cloud services, raising concerns about its market power. Additionally, Microsoft's recent cybersecurity challenges and its position as a government contractor have drawn attention to the company's significant influence on the market.

This marks the latest set of regulatory hurdles to hit US megacap tech companies, which could potentially inject volatility to Microsoft’s share price in the near term.

MARKET CONSENSUS: 63 BUYS, 5 HOLDS, AVERAGE TP USD500.27

EasyJet (EZJ LN)

EasyJet on Wednesday proposed to more than double its dividend payout for 2024 to GBp12.1/share from GBp4.5/share a year earlier on the back of strong outlook, helped by robust demand for its package holiday offerings. This is likely to provide support to the company’s share price going forward.

EasyJet also posted results that were in line with market estimates with revenue at GBP3.4B and adjusted pre-tax profit at GBP724M.

In recent months, the company’s all-Airbus fleet has managed to avoid the supply chain issues that have hamstrung its low-cost rivals.

MARKET CONSENSUS: 17 BUYS, 6 HOLDS, AVERAGE TP GBp658.67

Just Eat Takeaway (TKWY NA)

Just Eat Takeaway said on Wednesday that it plans to delist its shares from the London Stock Exchange as it maintains its Euronext Amsterdam listing.

The move is intended to minimize administrative burden, complexity and costs, with the Dutch online food delivery company also citing low liquidity related to its London listing. This could potentially be a positive for Just Eat Takeaway in the long run.

MARKET CONSENSUS: 14 BUYS, 4 HOLDS, 4 SELLS, AVERAGE TP EUR20.6

SoftBank (9984 JP)

SoftBank is reportedly starting a tender offer to buy shares worth USD1.5B in OpenAI from employees of the startup behind ChatGPT as it aims to bolster its presence in the AI space. The Japanese technology investment company is making the investment through its Vision Fund 2, adding that current and former OpenAI employees will have until 24 December to decide whether to sell their shares.

Softbank has previously invested about USD500M in OpenAI through its Vision Fund 2 when the startup raised USD6.6B in a recent round of new funding.

MARKET CONSENSUS: 18 BUYS, 5 HOLDS, AVERAGE TP JPY11826.5

Chow Tai Fook Jewellery (1929 HK)

Shares of Chow Tai Fook surged on Wednesday after it announced a share buyback plan of up to HKD2B, adding support to the company’s share price in the near term.

This was despite Chow Tai Fook posting weaker-than-expected net income for FY1H25 at HKD2.53B vs. HKD3.15B expected, although revenue was in line at HKD39.4B.

MARKET CONSENSUS: 22 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP HKD8.37

Earnings Announcements

US Market

-

European Market

Remy Cointreau SA

HK - China Market

China New Higher Education Group

Global Indices Changes (%)

Fixed Income Market Updates

S&P affirmed Philippines' sovereign rating at BBB+, and revised the outlook from stable to positive. We find certain emerging markets sovereign debt trading at favourable valuations and provide diversification from standard financial names. Over in Europe Banco BPM unsurprisingly rejected Unicredit's takeover bid as too low, saying that the bid does not reflect profitability and value creation of Banco BPM.

EUROPEAN BANK COCO (AT1)

AT1 closed the day about 0.125pts lower, with French paper underperforming in the morning session, down 0.5pts on average (and down 0.75pts for longer calls and recent deals). This stabilized in the European afternoon with some tentative buying seen from private wealth and from short covering. Volumes were generally lower as liquidity fades ahead of Thanksgiving.

ASIA INVESTMENT GRADE (IG)

Activity was lighter ahead of Thanksgiving. Spreads were largely unchanged in Korea IG space with preference for low beta quasi-sovereign names as well as financial names such as Shinhan and Woori banks. Technology, Media and Telecom sector in China IG widened, driven by selling after Bloomberg reported that Tencent is considering primary issuances in USD and CNH as soon as the coming weeks. India IG continued to trade defensive with spreads overall around 2bps wider.

ASIA HIGH YIELD (HY)

China HY property space was mixed with Dalian Wanda traded around 0.5-1 point higher while Longfor and Vanke traded weaker especially in the longer end. Outside of China, Adani continued to dominate news flow. Adani complex opened 0.5point higher and traded up 1-2 points on better buying from asset managers and hedge funds. Statement from the company that the chairman and his aides have not been charged under US FCPA helped sentiment. Other Indian HY names stabilised as well. We expect headline risk to remain for Adani complex in the short-term.

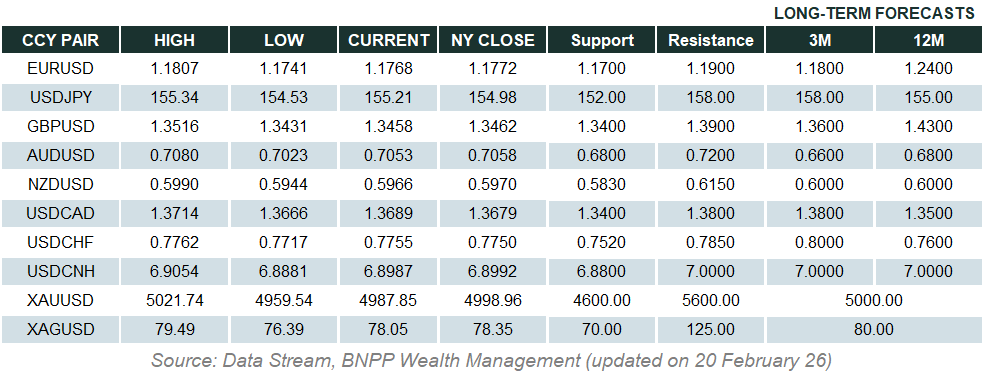

Forex Market Updates

The US Dollar fell amid economic data dump before the long weekend while market was digesting a slew of indicators that underscored US economic resilience.

USD

The US Dollar fell broadly on Wednesday in thin pre-holiday trade. The decline further unwound the dollar's recent rally. The Dollar Index fell to its lowest since 13 Nov and in afternoon trade was off 0.74% at 106.06. That put it down 1.9% from a two-year high hit last Friday. Neither did consumer spending data that showed progress on lowering inflation appears to have stalled in recent months while the economy retained much of its solid growth momentum early in the fourth quarter.

USD should continue to test its support level of 106 with market’s growing inflation concerns.

GBP

The British Pound rose against the dollar and was little changed versus the euro on Wednesday, with investors focused on the market reaction to Donald Trump’s tariff promises. GBPUSD extended above its 200 hour moving average of 1.2613 and also above the high prices from Monday and Tuesday. That gave the buyers the go-ahead to push higher. The BoE's Clare Lombardelli said on Wednesday that Trump's proposed tariffs would also pose a risk to growth in the UK.

Sterling could test its resistance level of 1.2720 going forward.

CAD

The Canadian dollar extended its recovery from a four-and-a-half year low against its US counterpart on Wednesday as investors bet on Canada avoiding threatened US trade tariffs through negotiation and looked ahead to domestic GDP data. The loonie was trading 0.2% higher at 1.4025 per US dollar after moving in a range of 1.4010 to 1.4077. Canadian third-quarter gross domestic product data, due on Friday, could offer clues on the pace of further interest rate cuts expected from the Bank of Canada. Economists forecast growth slowing to an annualized rate of 1%.

USDCAD looks to be hovering between 1.3900 and 1.4200 as shock over US Tariffs threat fades.

XAU

Gold prices rose on Wednesday, rebounding from an over one-week low hit in the previous session, on a weaker dollar. Before the release of the US PCE figures, bullion climbed up to 1%. The rebound followed a dramatic $100 plunge on Monday, marking gold's sharpest one-day drop in over five months, as safe-haven demand waned following the announcement of a long-negotiated ceasefire between Israel and Lebanon's Iran-backed Hezbollah.

The precious metal should find support at 2600 in the near term with more consolidation of insights into the Fed’s monetary policy outlook.