Macro Update:

German inflation mixed

German consumer prices in November rose +2.4% vs. +2.6% expected, while core prices registered +3.0% up from +2.9% the previous month. Euro-zone inflation will be released Friday. We would expect further rate cuts in Europe given the sluggish economy.

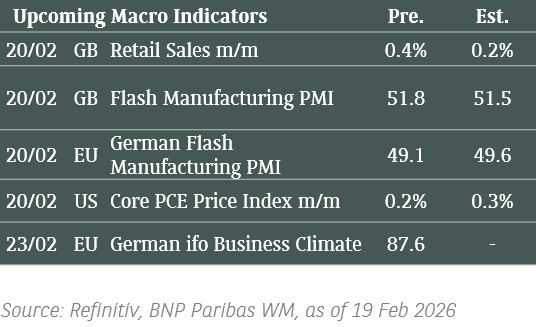

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stock markets were closed for Thanksgiving Holiday.

EUROPE EQUITIES

Stocks in Europe traded higher on Thursday, led by a rise in the region's chipmakers, as markets take stock of political developments in France.

HK EQUITIES

Hong Kong stocks fell on Thursday as investor concerns regarding an escalation of the trade war between the US and China re-emerge

Alphabet (GOOGL US)

Canada’s antitrust watchdog on Thursday sued Alphabet’s Google over alleged anti-competitive practices in online advertising and technology services in the country, marking the company’s latest regulatory hurdle in the antitrust front. Further developments on the case may potentially add volatility to Alphabet’s share price going forward.

The Canadian antitrust watchdog specifically wants the tribunal to force Alphabet to sell two crucial pieces of advertising-market software and pay a fine of as much as 3% of the company's global revenue.

MARKET CONSENSUS: 59 BUYS, 13 HOLDS, AVERAGE TP USD210.43

ASML (ASML NA)

Shares of ASML rose on Thursday after reports saying that the US could impose less-strict-than-expected tech export curbs to China, lessening its impact to the chipmaker’s bottom line going forward.

The report came after ASML stated at an investor day two weeks ago that the company said it expects sales of its tools to China to drop to 20% of total sales in 2025 from nearly 50% over the previous six quarters.

MARKET CONSENSUS: 30 BUYS, 10 HOLDS, AVERAGE TP EUR858.1

Heidelberg Materials (HEI GY)

Heidelberg Materials said on Thursday that it has struck a deal to buy US company Giant Cement and its subsidiaries for USD600M, marking the latest acquisition by the German company to expand its foothold in the US, which may positively impact the company’s bottom line, and thus share price going forward.

Heidelberg stated that the transaction, to be completed in 1Q25, is expected to contribute around USD60M in earnings before interest, taxes, depreciation and amortisation (EBITDA) in the first year of operation.

MARKET CONSENSUS: 18 BUYS, 8 HOLDS, 2 SELLS, AVERAGE TP EUR124.14

Hyundai Motor Co (005380 KS)

The US National Highway Traffic Safety Administration (NHTSA) announced recently that Hyundai is recalling over 226,000 small cars and SUVs in the US due to defective rearview cameras. This could potentially hurt the company’s reputation and thus share price in the near term.

The recall affects specific Santa Fe and Elantra models from the 2021 and 2022 production years, whereby cracks can develop in solder joints on the cameras' circuit boards, causing the camera feed to fail, which increases the risk of accidents by reducing visibility.

MARKET CONSENSUS: 33 BUYS, AVERAGE TP KRW322185.19

Toyota Motor Corp (7203 JP)

Toyota on Thursday announced that its global output declined for a ninth straight month in October, dragged lower by big falls in production in the United States and China. Nevertheless, the decline was milder compared to previous months, showing that a turnaround may be on the cards in the near term.

In China, where competition against local brands remains intense, Toyota’s output slid 9% in October. Meanwhile, production in the US tumbled 13%, hurt by a four-month production halt of SUV models Grand Highlander and Lexus TX due to an airbag issue.

MARKET CONSENSUS: 18 BUYS, 6 HOLDS, AVERAGE TP JPY3273.16

Earnings Announcements

US Market

-

European Market

-

HK - China Market

Meituan

Global Indices Changes (%)

Fixed Income Market Updates

In an otherwise quiet Thanksgiving holiday Nissan bonds widened after it's Issuer Outlook was revised to Negative by Moody's in a sign of the wider stresses facing the automotive sector. This puts the Japanese carmaker at risk of becoming a fallen angel and we would do not find current valuations on longer term debt beyond 4-5 years favorable given the clouded operational outlook. Over in Europe, with concerns around the government budget coming to the fore French government bonds widened to match Greece yields at the 10-year tenor.

EUROPEAN BANK COCO (AT1)

AT1s closed the day slightly higher with French names managing to marginally outperform as early weakness saw dip buying primarily in the ultra short (<1 year) and longer end (7-10 year) call buckets. Lloyds and Nationwide both announced calls of their AT1 paper, making it a 100% call record for standard AT1 paper in 2024 (the exceptions were 2 smaller issuances by Raffeisen Bank zrt and Tatra Banka).

ASIA INVESTMENT GRADE (IG)

Overall quiet day ahead of US holiday with most investment grade names marked 0.125-0.5pts higher as spreads ground slowly tighter. Buyers were seen on longer end sovereign paper such as Philippines and Indonesia.

ASIA HIGH YIELD (HY)

India HY was busy in an otherwise quiet Asia Credit market with Adani rebounding strongly off the back of US buying (particularly on the Ports and Green entities). Real money investors were more keen on short dated risk with bonds trading as high as 3.5pts higher before seeing some profit taking.

Forex Market Updates

The US Dollar rose slightly in lower-volume trading due to the Thanksgiving holiday as the Euro slipped further with the market taking on a more dovish view on the common currency.

USD

The US Dollar edged up from a two-week low against its major peers in holiday-thinned trading on Thursday, though the yen headed for its strongest week in nearly three months on growing bets that Japan will hike rates in December. Broad trade was lightened due to the U.S. Thanksgiving holiday, though while the majors were in a bit of a lull there was some action in emerging markets.

USD should continue to test its support level of 106 with market’s growing inflation concerns.

EUR

The Euro dipped against the dollar on Thursday as traders reined in bets of more interest rate cuts by the European Central Bank, while broader currency moves were muted. Euro slipped 0.2% to $1.0546 after its sharp rise on Wednesday following hawkish remarks from European Central Bank board member Isabel Schnabel. The comments prompted investors to pull back on more aggressive rate cut expectations and buy the common currency which is on track for its worst month in two-and-a-half years.

The common currency may find some resistance at the 1.0600 psychological barrier.

CAD

The Canadian dollar edged higher against its U.S. counterpart in holiday-thinned trading on Thursday as oil prices rose and investors assessed the chances of Canada avoiding stiff trade tariffs pledged by U.S. President-elect Donald Trump. Canada's federal government and the premiers of the 10 provinces agreed to work in a united and coordinated way against the tariff threat, Finance Minister Chrystia Freeland said on Wednesday. The price of oil, one of Canada's major exports, rose 0.4% to $68.99 a barrel after Israel and Lebanese armed group Hezbollah traded accusations that their ceasefire had been violated.

USDCAD looks to be hovering between 1.3900 and 1.4200 as shock over the US Tariff threat fades.

XAU

Gold prices rose on Thursday as geopolitical uncertainty and trade war concerns boosted safe-haven demand, with low trading volumes expected as U.S. markets are closed for the Thanksgiving holiday. Geopolitical risks remain elevated with ongoing war in Russia-Ukraine, and while an Israel-Hezbollah ceasefire is in force, Israel's contingencies for retaliation keep tensions alive. Data on Wednesday showed progress in lowering U.S. inflation appears to have stalled in the past months, suggesting the Fed may proceed cautiously with further rate cuts.

The precious metal should find support at 2600 in the near term with more consolidation of insights into the Fed’s monetary policy outlook.