Macro Update:

US elections, looks like a sweep for the Republicans

This morning it looks like it is going to be a sweep for the Republicans and it is not even close : Presidency , Senate , and the House. Donald Trump is about to win the popular vote itself. A redsweep probably means the market needs to price in a greater chance of fiscal , good for risk, good for the USD. As a result this morning we are seeing the US dollar gain very strongly, together with the US stock market futures up around 2%. On top of that there hasn't been conflict around the legitimacy around the election results so far, so that has helped propelled markets in a releif rally.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks rallied on Tuesday on the back of solid economic data, although investors are likely to brace for volatile trading this week as voting was underway in the US presidential election.

EUROPE EQUITIES

European shares were largely flat on Tuesday as investors assessed a series of downbeat earnings, although industrials gained throughout the session.

HK EQUITIES

Hong Kong stocks closed at a three-week high on Tuesday as encouraging services and manufacturing data boosted sentiment.

Meta (META US)

The South Korean government on Tuesday ordered Meta to pay KRW21.62B in fines after finding that it had collected sensitive user data and given it to advertisers without a legal basis, potentially hurting the tech giant’s reputation within the country.

According to the South Korean Personal Information Protection Commission, Meta allegedly obtained information from about 980,000 South Korean Facebook users on issues such as their religion and political views while failing to seek agreement from users.

MARKET CONSENSUS: 67 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP USD648.14

Emerson Electric (EMR US)

Emerson Electric on Tuesday proposed to fully acquire AspenTech (which it already owns partially) at a valuation of USD15.1B. The deal provides further evidence of Emerson’s intent to sharpen its focus on industrial automation and could further solidify the company’s position within in the space.

Emerson Electric previously in 2021 merged its software units with Aspen Technology and took control of about 55% of the combined entity. The company is now looking to pay USD6.53B to buy the rest of Aspen.

MARKET CONSENSUS: 20 BUYS, 4 HOLDS, 2 SELLS, AVERAGE TP USD128.13

Cummins (CMI US)

Cummins’ 3Q24 results on Tuesday featured both top- and bottom-line beats, boosted by robust demand for its power generation products from data centers. The company’s revenue stood at USD8.46B vs. USD8.29B expected, and net income was at USD809.0M vs. USD658.2M expected.

Rising demand from the technology industry's energy-hungry AI data centers has bolstered the results of power solution providers in recent quarters, including Cummins, and is likely to continue to do so going forward, providing support to the company’s share price.

MARKET CONSENSUS: 7 BUYS, 12 HOLDS, 4 SELLS, AVERAGE TP USD353.66

Ferrari (RACE IM)

Ferrari on Tuesday posted strong beats in its FY2Q24 earnings with revenue at EUR1.7B vs. EUR1.6B expected, and net income at EUR413.0B vs. EUR365.3B expected. The company’s full year revenue guidance was also supportive, raising the figure to EUR6.55B from EUR6.4B previously.

Despite the good news, Ferrari’s share price still fell throughout Tuesday’s session as the luxury auto manufacturer said that it had shipped fewer supercars as weak demand in China weighed on the luxury goods market, raising questions on whether it can maintain the recent quarter’s strong growth in the near to medium term.

MARKET CONSENSUS: 13 BUYS, 11 HOLDS, 4 SELLS, AVERAGE TP EUR428.66

Nintendo (7974 JP)

Nintendo on Tuesday lowered its operating profit guidance for FY2025 by 10% to JPY360B as sales of its ageing Switch console lost steam. The move raises questions on Nintendo’s growth prospects going forward, which could potentially add downward pressure to the company’s share price in the near to medium term.

Nintendo on Tuesday also announced results that significantly missed net profit estimates at JPY27.7B vs. JPY49.4B expected, despite posting a slight revenue beat at JPY276.7B vs. JPY269.1B expected.

MARKET CONSENSUS: 20 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP JPY9186.84

Earnings Announcements

US Market

McKesson Corp, Lyft, Zillow, Qualcomm, Gilead Sciences

European Market

Novo Nordisk, BMW, Credit Agricole, Vonovia

HK - China Market

Link REIT

Global Indices Changes (%)

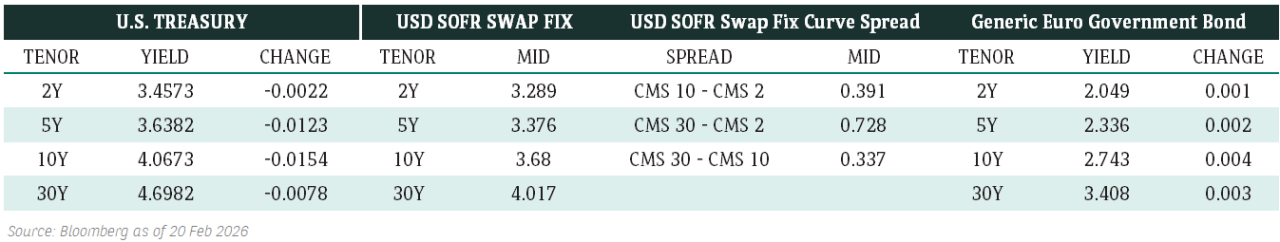

Fixed Income Market Updates

Market volatility has spiked up significantly due to US election, which creates good buying opportunity for fixed income investors. We expect US Treasury yield would come down after US election as investors would start to unwind the crowded pre-election trade. We reiterate that the sweet spot is 7-10 year good quality IG bonds.

EUROPEAN AT1

European AT1 remained soft with more profit taking. Overall bond prices were 0.125 point lower. Despite recent sluggish price movement, we believe European banks’ credit fundamentals remain solid as shown in their recent earnings results. We expect to see some good entry opportunity if AT1 bond prices further correct in the next 1-2 months.

ASIA INVESTMENT GRADE (IG)

It was a stable day for Asia IG. In China and HK IG, market tone was constructive with overall better buying due to the stronger-than-expected Caixin PMI. Investors were also looking forward to the policy stimulus that will be discussed in the National People Congress meeting this week. Outside of China, India and Korea IG space was still solid with credit spreads unchanged and limited selling. Overall, we expect Asia IG to remain stable.

ASIA HIGH YIELD (HY)

Asia HY had a mixed day. China HY Property was largely stable with bond prices unchanged to 0.5 points higher. India HY was slightly weaker due to some profit taking. Overall, we saw more institutional investors trimming HY exposures due to election uncertainty, especially for relatively more expensive sectors like India HY.

Forex Market Updates

The US Dollar eased amid election uncertainty, with cautious trading keeping price action muted.

USD

The US Dollar retreated on Tuesday as Americans headed to the polls, with uncertainty over election outcomes driving cautious trading. The tight race between Trump and Harris has kept currency and asset markets on edge, as markets expect each candidate's policy agenda to lead to divergent economic impacts. Elsewhere, US Services PMI figures accelerated to a more than two-year high in October as employment rebounded strongly, suggesting that poor job growth figures last month were an aberration, which supports a slower pace of Fed rate cuts moving forward.

The Dollar Index looks likely to be capped by technical resistance around 104.50 for the time being.

CNH

The Chinese Yuan rose yesterday as October's Caixin Services PMI rose to 52.0, signalling expansion amid Beijing's stimulus efforts. Increased new business and employment growth boosted confidence, though the Yuan is likely to face pressure from potential US policy shifts regarding tariffs in the event of a Trump presidency, which analysts say could drive USDCNH to 7.3000, while a Harris victory might support a rebound below the key 7.0000 handle.

USDCNH is likely to trade with a downward bias below 7.1950 moving forward.

JPY

The Japanese Yen strengthened around 0.4% against the USD overnight as speculation grew over potential BoJ rate hikes in early 2025. Ex-BoJ member Sakurai indicated January as a likely timing for an increase, given clearer political and market conditions, with the target rate potentially reaching up to 2% by 2028. Additionally, BOJ Governor Ueda’s recent statements reinforce a commitment to gradual tightening if wage and inflation goals align with projections.

USDJPY looks primed for some near term consolidation above 148.00.

XAU

Gold prices gained around 0.2% yesterday as markets awaited the results of a tightly-contested US election. Analysts suggest that prolonged election uncertainty as well as ongoing geopolitical tensions should further boost the safe haven appeal of gold. With markets also eyeing the Fed’s anticipated rate cut on Thursday, bullion is also likely to enjoy more support in the medium to long term due to the low-rate environment.

The precious metal looks poised to be supported above 2670 for the time being.