Macro Update:

He has “Don” it again!

The Polls were wrong again! This was the one of the biggest comebacks in political history as President Trump widened his popularity and votes with major groups across the spectrum.

In that regard, he turned the Blue Wall into a Red Wall shocking the pollsters. The Senate has flipped as expected. We await the House of Representatives, which is key for fiscal policy – rollover of tax cuts from 2016 as well as any additional possible cut in corporate tax rates. Possible tariffs can largely occur without Congress.

The reaction by the market was the classic Trump Trade – higher stock prices including especially financials on deregulation (KBW banks index +10.7%) and small caps (+5.9%), higher bond yields, and higher dollar. We may not know the House result for several days so that could have an impact on the bond/dollar side. Keep in mind the Trump trade was also well in motion ahead of the election already. We now move to the Fed meeting where we expect a quarter point cut. Will they be more hawkish on the outlook given the move in yields?

Main Upcoming Macro Indicators

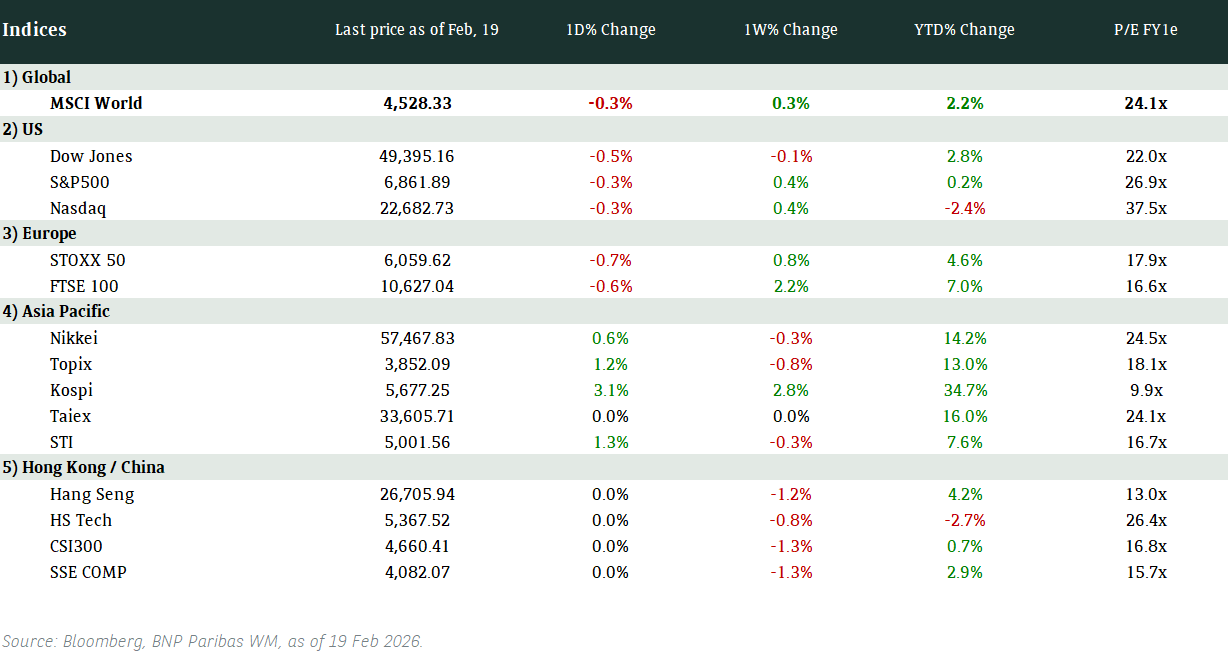

Equity Market Updates

US EQUITIES

Stocks in the US rallied sharply on Wednesday as markets cheer a US election win for the Republicans.

EUROPE EQUITIES

European shares ended lower on Wednesday, following a broad rally earlier in the session, as a drop in utilities weighed.

HK EQUITIES

Hong Kong stocks closed lower on Wednesday as investors digest US election results

Qualcomm (QCOM US)

Qualcomm on Wednesday posted its forecast for sales and profit in the current quarter (FY1Q25) that exceeded Wall Street estimates, as the company benefits from a wave of Chinese smartphone launches. The announcement provided further evidence of Qualcomm’s solid growth prospects and is likely to support the company’s share price in the years ahead.

Qualcomm on Wednesday also posted FY4Q24 results that beat estimates with revenue at USD10.2B vs. USD9.9B expected, and net income at USD3.04B vs. USD2.90B expected.

MARKET CONSENSUS: 28 BUYS, 15 HOLDS, 1 SELL, AVERAGE TP USD205.43

CVS (CVS US)

Shares of CVS jumped on Wednesday as the company posted a 3Q24 revenue beat at USD95.4B vs. USD92.8B expected, primarily driven by growth in the Health Care Benefits and Pharmacy & Consumer Wellness segments, while being partially offset by a decline in the Health Services segment.

The company during its results announcement also named Steve Nelson, a former UnitedHealth insurance head, to run its Aetna business, which could be positive evidence of its ongoing efforts to turn around its business from recent struggles after increasing pressure from activist investors.

MARKET CONSENSUS: 15 BUYS, 13 HOLDS, AVERAGE TP USD68.84

Lyft (LYFT US)

Lyft said on Wednesday that it will partner with Mobileye and two other companies in the robotaxi industry to bring self-driving cars onto its ridehail platform and bolster research and development in the sector.

The company will specifically incorporate cars owned by third-party fleet operators, equipped with the Mobileye Drive self-driving system, as it looks to compete with rival Uber, which had already signed a slew of autonomous taxi agreements.

MARKET CONSENSUS: 12 BUYS, 34 HOLDS, AVERAGE TP USD14.76

BMW (BMW GY)

BMW on Wednesday posted a significant miss in 3Q24 earnings, with net income at EUR389M vs. EUR721M expected. Revenues also came in below estimates at EUR32.4B vs. EUR33.9B expected, weighed by a China sales slump as well as a slew of technical issues in the company’s products.

The results miss sent BMW shares lower on Wednesday and is likely to continue to put downward pressure going forward.

MARKET CONSENSUS: 12 BUYS, 14 HOLDS, 3 SELLS, AVERAGE TP EUR89.29

Credit Agricole (ACA FP)

Credit Agricole on Wednesday reported better-than-expected earnings for 3Q24, with net income at EUR1.54B vs. EUR1.48B expected, as both corporate and retail banking activities remained supportive. This is despite revenues coming in slightly below estimates at EUR6.49B vs. EUR6.51B expected.

Credit Agricole has benefited in recent years from its broad diversification across countries and product offering, and the recent results adds weight to the bank’s claim to be in the top tier of investment banks in the segment. Better days are likely ahead for the company.

MARKET CONSENSUS: 10 BUYS, 11 HOLDS, 2 SELLS, AVERAGE TP EUR16.75

Earnings Announcements

US Market

Halliburton, Moderna, Rockwell Automation, Datadog

European Market

Engie, Munich Re, Rheinmetall, ArcelorMittal

HK - China Market

Hua Hong Semiconductor

Global Indices Changes (%)

Fixed Income Market Updates

The recent bout of volatility in U.S. Treasury yields and the rates market open pockets of opportunities for better entry points. In building and/or rebalancing a fixed income portfolio, we continue to favour our triangular strategy with preference for good quality investment grade bonds and AT1s/hybrids with high coupon and short-call dates..

EUROPEAN AT1

Rates volatility will likely continue to drive the price action in AT1 CoCo space. USD AT1 closed 0.125pt to 0.5pt lower while GBP AT1 were unchanged to 0.25pt lower at market close yesterday. EUR AT1 generally held up well (+0.125pt to +0.625pt), better than USD and GBP AT1s, in line with the rates movement. In the USD space, there were two-way flows with a decent volume. Buying interests were skewed to USD AT1s with 5-year to 10-year call dates as well as those recently issued USD AT1s whose yields also hovered around mid-6% to 7% area.

ASIA INVESTMENT GRADE (IG)

IG credit spreads tightened 2bps (i.e., mostly low beta names) to 7bps across the board. High-beta names and bonds with 5-years to 10-years maturities were outperformers in the space. With the sell-off in rates and surges in U.S treasury yields, all-in yield buyers and demand for duration play emerged. Nevertheless, volumes remained light amid current tight levels throughout the day. Investors were adding the likes of Australian banks’ 10-year Tier 2 bonds and Japanese insurance long-dated subordinated bonds/perpetuals as cash prices dipped. Indian IG spreads tightened 2bps to 5bps with some buying interests seen on the 5-year to 10-year bonds. We think volatility may stay for the rest of the week with the FOMC meeting and China's NPC session ending this Friday.

ASIA HIGH YIELD (HY)

China HY space was quiet, closing unchanged to 0.25pt lower on the day. Two-way, light flows were seen on the bonds of Shui On (i.e., close 1pt higher post restructuring headline), Yanlord, Vanke, Longfor, and RoadKing. Macau gaming names held up well, closing unchanged to 0.125pt lower. Outside of China HY, bond prices opened 0.5pt to 1pt lower in line with the rates sell-off. Buyers emerged in the afternoon, helping bond prices recover to close unchanged to -0.25pt. There were some demand seen on Resorts World while tight long-dated Indian HY bonds (e.g., Adani Green and JSW Infrastructure) underperformed.

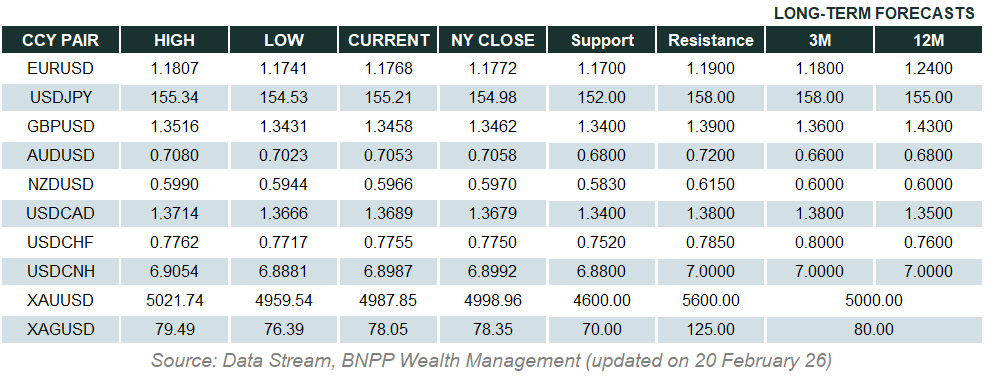

Forex Market Updates

The US Dollar advanced on Wednesday, buoyed by expectations that US rates will stay higher for longer as Trump won the race to the White House.

USD

The US Dollar surged to four-month highs against a basket of other major currencies yesterday as Trump’s victory in the US Presidential Election triggered a sharp rise in US Treasury yields on expectations that his proposed economic policies would keep US interest rates elevated. After two days of consolidation, Trump trades came to the forefront again yesterday, especially on the strong likelihood of a “Red Sweep” scenario. On the central bank front, markets are currently pricing only 91bps of Fed easing by June 2025, down from around 150bps a month ago.

The Dollar Index could see more near term gains towards technical resistance around 106.00.

GBP

The British Pound recorded its biggest one-day decline against the USD since March 2023 as the greenback soared on Trump’s successful bid for the US Presidency. Also weighing on Sterling was data showing that a slowdown in British construction activity, underscoring the challenge facing the new Labour government in its aim to speed up the building of new homes. Elsewhere, the BoE is expected to cut rates by 25bps at tonight’s meeting, with markets likely to be eyeing the policy statement for any tweaks to the central bank’s hitherto cautious approach to rate cuts given sticky underlying inflation and stubbornly high wage growth.

Sterling looks vulnerable to more losses for the time being, with immediate support around the 1.2800 handle.

JPY

The Japanese Yen slumped on Wednesday in tandem with the currencies of other major Asian exporters as markets grappled with the implications of Trump’s election win and his proposed tariffs. The Yen was also dragged lower by expectations that there could be less narrowing in Fed-BoJ rate differentials moving forward than previously expected, given the likely inflationary effect of Trump’s economic plans. Elsewhere, minutes from the BoJ’s September meeting revealed that officials agreed that the Japanese economy was making progress in meeting the necessary conditions for hiking rates, but decided on a pause due to global market uncertainties.

USDJPY looks primed for more gains moving forward, with 155.00 the first likely upside target.

XAU

Gold prices tumbled by around 3% on Wednesday, caught in the slipstream of broad USD strength and a sizeable reduction in Fed rate cut expectations moving forward thanks to Trump’s election as the next US President. Analysts say that in the medium term, the precious metal will be torn between the risk of rising inflation, potentially slowing the pace of Fed easing, as tariffs are rolled out and continued demand for safe haven assets amid trade wars and geopolitical conflicts.

While the medium to long term outlook for gold remains bullish, the precious metal could see some near term losses toward 2620 on broad USD strength.