Macro Update:

Fed cuts as expected & Trump 2.0 equity rally continues

The Federal Reserve cuts policy rates for the second time by the expected 25 bps this time, in-line with our expectations. The statement confirmed that achieving inflation near 2% and maximum employment are balanced. In short, the Fed is more confident of a soft landing. Yields and the dollar dropped after the meeting.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks closed higher on Thursday, extending a sharp rally in the session prior, as the Fed announced its 25bps cut in interest rates.

Gradual and well-communicated rate cuts continue to be viewed as positive for equities

EUROPE EQUITIES

Stocks in Europe rebounded on Thursday, led by technology and resources shares, as investors turned their focus to the Fed’s policy rate decision.

HK EQUITIES

Hong Kong stocks rebound from its prior session on Thursday, boosted by an encouraging surge in Chinese exports for October.

Moderna (MRNA US)

Moderna on Thursday announced 3Q24 results that beat expectations, with revenue at USD1.86B vs. USD1.25B expected, and net income at USD13M vs. an expected loss of USD710.8M, surprisingly due to higher-than-expected COVID-19 sales.

Moderna on Thursday also reiterated its product revenue guidance for 2024, expecting to generate product sales in the range of USD3.0B-USD3.5B. This reassures investors in terms of the company’s financial health and should limit downside to share price for the time being.

MARKET CONSENSUS: 8 BUYS, 16 HOLDS, 2 SELLS, AVERAGE TP USD88.64

Amazon (AMZN US)

Amazon is reportedly in talks for its second multi-billion-dollar investment in artificial intelligence (AI) startup and OpenAI rival Anthropic. This comes after the company had previously announced an investment of around USD4B in the AI company in September 2023.

So far, Amazon has asked Anthropic, which uses Amazon's cloud services to train its AI model, to use a large number of servers powered by chips developed by the cloud computing major.

MARKET CONSENSUS: 77 BUYS, 5 HOLDS, AVERAGE TP USD231.64

Stellantis (STLAP FP)

Stellantis announced on Thursday that it will partner with German chipmaker Infineon Technologies to collaborate on the next generation of the power architecture of the company’s electric vehicles. Innovations coming as a result of this partnership could potentially swing Stellantis’ share price to the upside going forward.

Stellantis and Infineon signed multiple supply and capacity agreements to support their cooperation. These include replacing traditional fuses with Infineon's smart power switches, improving the performance of Stellantis' electric vehicles by implementing silicon carbide semiconductors and using Infineon's microcontrollers that target Stellantis' intelligent power network.

MARKET CONSENSUS: 13 BUYS, 17 HOLDS, 3 SELLS, AVERAGE TP EUR15.03

Daimler Truck (DTG GY)

Daimler Truck’s 3Q24 results on Thursday showed slight beats to estimates. EBIT was at EUR1.19B vs. EUR1.13B expected, while revenue was at EUR13.1B vs. EUR13.0B expected.

The company also confirmed its full-year revenue forecast of between EUR53B and EUR55B, providing evidence of business resilience which could provide support to its share price going forward.

Daimler Truck’s share price rose by more than 5% on Thursday.

MARKET CONSENSUS: 15 BUYS, 4 HOLDS, AVERAGE TP EUR46.47

Nissan Motor (7201 JP)

Nissan on Thursday said it would slash 9,000 jobs and cut global production capacity by a fifth. The company also revised its annual profit outlook by 70% as headwinds in China and the US continue, marking its second downward revision after a 17% cut earlier this year. This is likely to put downward pressure to the Japanese carmaker’s stock price in the near to medium term.

Nissan on Thursday also posted a significant FY2Q25 results miss, with revenue at JPY2.99T vs. JPY3.05T expected, and net profit at JPY-9.34B vs. JPY49.07B expected.

MARKET CONSENSUS: 3 BUYS, 8 HOLDS, 8 SELLS, AVERAGE TP JPY435.38

Earnings Announcements

US Market

Paramount Global

European Market

Richemont

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Market is pricing in about 70% chance of another 25 bps rate cut in the December Fed meeting as of this morning. Credit spreads will likely remain range-bound as yield-driven demand continues while new issue supply wanes towards the year-end. Investment grade USD bonds up to five-year maturity remains a sweet spot.

EUROPEAN AT1

AT1s generally closed -0.125pt to +0.25pts, lagging the broad rally seen in equities, rates and U.S Treasury yields. Flows were lighter than previous sessions but remained skewed to net buying across the space.

ASIA INVESTMENT GRADE (IG)

Asian IG markets traded on a firm tone with flows skewed to better buying in general. Thus, credit spreads continued to grind tighter, closing 2bps to 5bps on average. In the China IG technology space, buyers continued to add Meituan 2028 and 2029 and Weibo 2030 while the rest of the space (Baba, Baidu, Tencent, JD, Taisem, etc.) remained firm. While there were some profit-taking at tight levels (e.g., Lenovo bonds), these selling flows were well-absorbed. Blue-chip Hong Kong names like AIA, CK Hutchison, and CLP Power as well as Singapore and Thai banks’ Tier 2 bonds were sought after by investors, too. Better buying flows in the Japan insurance space continued with Meiji Yasuda Life Insurance and Nippon Life 2054s finishing the day about 0.5pt higher.

ASIA HIGH YIELD (HY)

In China HY space, Vanke and GLP curves were 0.25pt to 1.5pt higher. Macau gaming sector also finished on a strong footing (+0.5pt) with better buying flows. Non-China HY space were also active with prices marked 0.5pt to 2pt higher at close. There were two-way flows in low beta names while high beta names with 7%-10% yield saw better buying interests. Low beta Indian HY bonds (e.g., higher quality non-bank financial companies, and renewables) closed +0.25pt to 0.75pt. Meanwhile, Genting complex outperformed (+0.5pt to +2pt) as investors picked up previous laggards Resorts World Las Vegas (+2pt) and New York (+0.75pt).

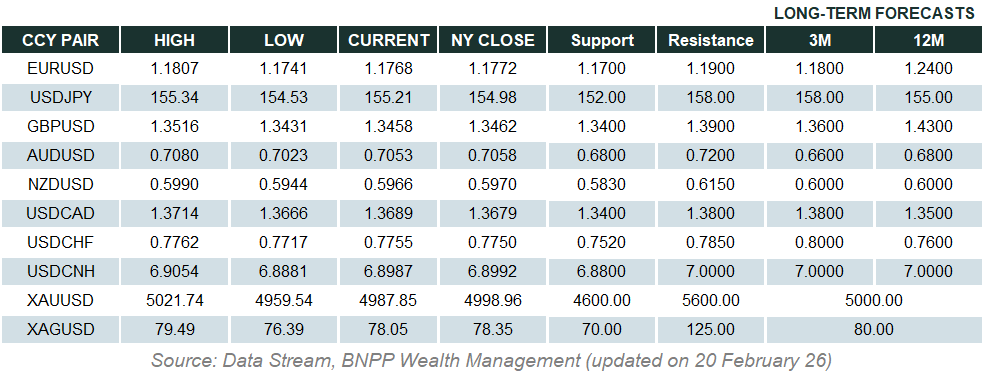

Forex Market Updates

The US Dollar gave back some gains after the US Fed, as expected, cut rates by 25bps, while markets took profit from the previous day's rally.

USD

The US Dollar held onto earlier losses on Thursday after Federal Reserve Chair Jerome Powell failed to offer any strong clues that the U.S. central bank was likely to pause rate cuts in the near-term, after a widely expected 25 basis point reduction. Traders also closed out some profitable bets on a Donald Trump presidency after his election victory on Tuesday.

The Dollar Index could see more consolidation, with support at around 104.00.

GBP

The British Pound rallied sharply on Thursday, solidifying its position as the best performing major currency of 2024, while UK-focused stocks rose after the Bank of England cut rates but indicated future cuts may be more gradual than many had thought. The BoE, which delivered its second rate cut since 2020, said that after Labour Party finance minister Rachel Reeves' high-tax, high-spend budget last week, it expected higher inflation and growth.

Sterling looks to have found support around the 1.2800 handle and could see some resistance at 1.3050.

CNY

The Chinese Yuan recovered from a three-month low to inch higher against the dollar on Thursday, as encouraging export data and state bank support outweighed worries about higher U.S. tariffs on Chinese goods after Donald Trump's presidential election win. China's outbound shipments grew at the fastest pace in over two years in October as manufacturers rushed inventory to major export markets in anticipation of further U.S. and European Union tariffs, with the threat of a broader trade war looming.

USDCNH looks to be more range-bound, with resistance at 7.1700 as markets take profit.

XAU

Gold prices rose more than 1% on Thursday, helped by a retreat in the U.S. dollar, while the Federal Reserve cut interest rates by a quarter of a percentage point as widely expected. At the end of a two-day policy meeting, the U.S. central bank lowered the benchmark overnight interest rate to the 4.50%-4.75% range, with policymakers taking note of a job market that has "generally eased". Traders are currently pricing in another 25 basis point cut by the Fed in December.

While the medium to long term outlook for gold remains bullish, the precious metal could see some near term consolidation with support around 2620.