Macro Update:

China’s latest stimulus falls short of market expectations

The long-awaited NPC Standing Committee meeting concluded last Friday with approval of a total of RMB 10 trillion in local government debt swap for 3-5 years. The Ministry of Finance estimates the swap program can reduce local governments’ interest burden by RMB 500 billion in the next 5 years. However, the debts will continue to be carried by local governments, rather than being shifted to central government.

Market was disappointed as fiscal measures for housing de-stocking, bank re-capitalisation and consumption support were not mentioned. The next focus will be on the Central Economic Work Conference in December as Beijing will set the economic policy direction for 2025

Main Upcoming Macro Indicators

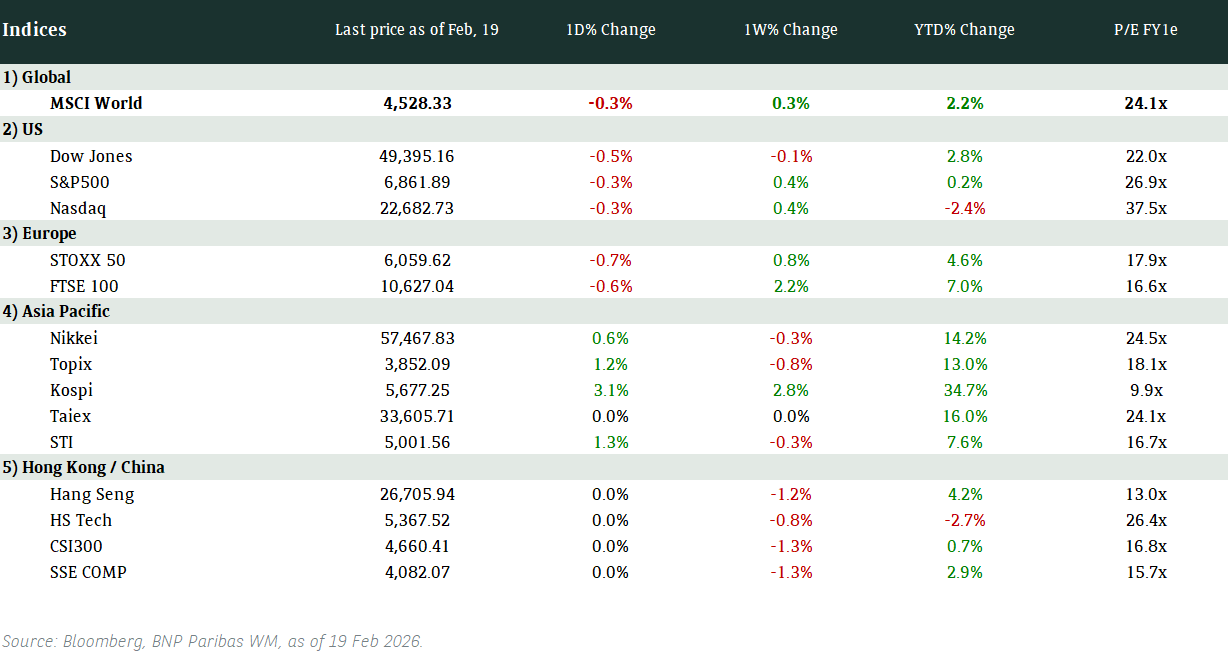

Equity Market Updates

US EQUITIES

US equities closed at a record high on Friday as investors continued to cheer Donald Trump’s election victory.

The positive mood in US markets is likely to continue in the near term.

EUROPE EQUITIES

European stocks ended lower to log its third consecutive week of declines on Friday, hurt by underwhelming stimulus measures from China as well as concerns about tariffs.

HK EQUITIES

Hong Kong stocks pared early gains to close lower on Friday as investors awaited for stimulus announcements from China’s National People’s Congress.

Salesforce (CRM US)

Salesforce is reportedly hiring more than 1,000 workers to sell its new generative AI agent product, Agentforce, which the company launched in October. This is likely to be a positive for Salesforce as it assures investors that its AI strategy is going smoothly, supporting share price in the near term.

Agentforce is a tool that allows companies to build and deploy AI agents that can perform any complex business-related task without human oversight or involvement, and this is an area where Salesforce recently pivoted its AI strategy towards.

MARKET CONSENSUS: 42 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD319.56

Richemont (CFR SW)

Shares of Richemont slumped on Friday after it posted a larger-than-expected profit drop in FY1H25, with operating profit at EUR2.21B vs. EUR2.47B expected, hurt by weak China demand where the company’s revenues fell around 27%.

Richemont’s profit miss raises questions on the European luxury sector’s growth prospects going forward, putting downward pressure to shares of not only Richemont but rivals such as LVMH as well.

MARKET CONSENSUS: 18 BUYS, 15 HOLDS, 1 SELL, AVERAGE TP CHF144.03

TSMC (TSM US)

TSMC reportedly told its partners in China that it will stop sending them its most advanced AI-powered semiconductors to align with the US’ new policies toward Beijing's chip sector.

The decision will reportedly become effective today and will apply to AI semiconductors at advanced process nodes of seven nanometres or smaller.

This could raise questions on whether TSMC will be able to continue its stellar growth trajectory it enjoyed in the past couple years, adding volatility to the company’s share price going forward.

MARKET CONSENSUS: 22 BUYS, 2 HOLDS, AVERAGE TP USD235.77

SMIC (981 HK)

SMIC on Friday posted a 3Q24 profits miss at USD148.8M vs. USD206M expected, dragged by higher interest expenses and FX losses. This is despite revenues coming in roughly in-line at USD2.17B.

Nevertheless, the company’s shares still gained on Friday as it announced a higher-than-expected 4Q24 revenue guidance, indicating robust orders from local chip designers and potentially supporting share price in the near to medium term.

MARKET CONSENSUS: 18 BUYS, 8 HOLDS, 4 SELLS, AVERAGE TP HKD24.64

Sony (6758 JP)

Sony’s FY2Q25 results on Friday featured a solid net profit beat at JPY338.5B vs. JPY246.7B expected, supported by stronger contributions from its game and image-sensor businesses. This provides evidence of solid growth potential which is likely to be a positive for the company’s share price.

Sony on Friday also maintained its FY2025 operating income forecast of JPY1.31T, largely in-line with estimates.

MARKET CONSENSUS: 25 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP JPY3339.08

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

We expect the bond market sentiment will gradually stabilize from recent US Treasury panic sell-off after the election. We remain comfortable with 5-10 year good quality IG bonds. Fixed income remains a good defensive instrument amidst this volatile market environment, as it will likely be a while until we see how Trump’s action impact the economy.

EUROPEAN AT1

European bank AT1s was largely stable but the market to question what will happen to the AT1 market after a Republican Sweep. It is also unclear how the growth outlook in Europe could be impacted especially when AT1 credit spread is already very tight. Going forward, we expect the AT1 market could turn more volatile and could see some correction as valuation is not cheap. However, any meaningful correction would be a good opportunity to add given we remain comfortable on European banks’ long-term credit fundamental.

ASIA INVESTMENT GRADE (IG)

Asia IG was relatively quiet as US was out for holiday. Sovereign and quasi-sovereign bonds traded in a muted tone with the Treasury market closed. IG credit spreads were largely unchanged with some selling seen in the long end, particularly in Philippine IG. Likewise, Indonesia IG was also under some selling pressure. Overall, we expect Asia IG will stay quiet as we approach year-end.

ASIA HIGH YIELD (HY)

Asia HY had a muted day. China HY was again the spotlight with the overall sentiment being quite weak after the smaller-than-expected debt swap package announced by the Central government last Friday. Within China HY property, Dalian Wanda and Shui On Land traded 0.5-1.5 points lower. We expect China HY will stay weak until we see more Government stimulus package. Outside of China, Indian HY space saw some institutional investors selling, but generally well absorbed by private bank investors. The Adani complex was particularly active with short-dated bonds relatively well bid by hedge fund investors.

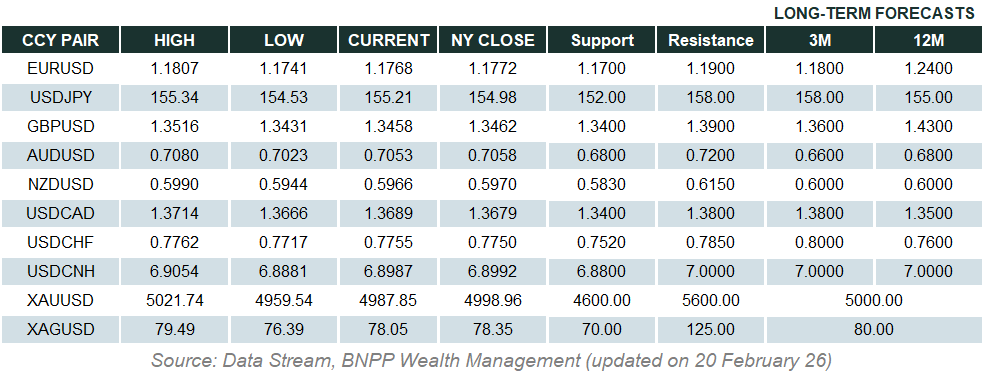

Forex Market Updates

The US Dollar rose at the end of the week as markets continued to evaluate the likely impact of Trump's return to the White House on the American economy.

USD

The US Dollar rebounded on Friday as risk-sensitive currencies took a beating on concerns about Trump’s proposed tariff plans. The greenback was supported by a broad consensus that dips presented buying opportunities, a scenario that could yet persist for a while more, particularly after Fed Chair Powell left the door open for a possible pause at December’s FOMC Meeting and said that the US economy is faring stronger than the central bank’s expectations. On the data front, an upbeat UoM survey on US consumer sentiment saw its highest reading since April, reinforcing Powell’s remarks about the strength of the world’s largest economy.

The Dollar Index looks set to be supported above 104.00 moving forward.

CAD

The Canadian Dollar retreated on Friday after a mostly downbeat jobs report, with business investment and hiring remaining muted even after four rounds of rate cuts by the BoC as high interest rates and inflation have throttled demand. Analysts say that not enough jobs are being created while the labour force continues to grow due to record-high levels of immigration, culminating in the unemployment rate hovering at the 34-month high of 6.5%. However, BoC Governor Macklem expressed hope that continued rate cuts would help to stimulate the economy and increase employment, with markets currently seeing a 60% possibility of 50bps of easing in December.

USDCAD could retest recent resistance around 1.3960 in the near term.

JPY

The Japanese Yen posted modest gains to close out the week, with an index that tracks current domestic economic conditions showing improvement in September due to the recovery of production output in certain key industries. Elsewhere, Tamaki, the head of the opposition DPP whose partnership Japanese PM Ishiba needs to stay in power, said that he expects US President-elect Trump’s proposed economic policies to cause the JPY to further weaken against the greenback, adding that the BoJ should refrain from hiking rates until wage growth consistently outpaces inflation.

USDJPY could see some near term consolidation above 151.30.

XAU

Gold prices fell on Friday, posting their steepest weekly decline against the USD since June, pressured by rising Treasury yields as markets continued to grapple with the implications of Trump’s victory and its potential impact on the US interest rate outlook. Analysts say that Trump’s victory has also slightly dimmed the allure of the safe haven precious metal, with investor demand moving out of bullion and into riskier alternative assets such as equities and crypto. Nevertheless, analysts expect concerns about the impact of a Trump presidency on global growth as well as ongoing geopolitical uncertainty to remain supportive of gold in the medium to long term.

The precious metal should see some consolidation above technical support around 2620 for the time being.