Macro Update:

US CPI data in line with expectations

US headline and core CPI rose 0.2% MoM and 0.3% MoM respectively in October, meeting consensus estimates. The numbers keep market expectations of a December Fed rate cut in play, in line with our forecast.

The US election outcome with a “Red Wave” is a game changer. We expect potential tax cuts and tariffs to push up US inflation in 2H next year. Hence, we move our Fed rate cut forecast from 4 cuts to 3 cuts in 2025, with terminal policy rate at 3.75% in September 2025. We also revise up our 12-month US Treasury 10-year yield target to 4.25% from 4.0%.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks were flat on Wednesday as investors digest the country’s October inflation data, betting that the Fed will cut interest rates again in December.

EUROPE EQUITIES

European shares ended Wednesday lower with losses in real estate companies offsetting a rise in energy stocks.

HK EQUITIES

Stocks in Hong Kong closed slightly lower on Wednesday as investors continue to digest last Friday’s China National People’s Congress announcements as well as the potential impacts of another Trump term.

Meta (META US)

Meta is reportedly planning to introduce advertisements on its growing social media platform, Threads, in early 2025. This could potentially add a significant revenue stream for the company going forward, bolstering its growth trajectory.

By the end of 3Q24, Threads’ monthly registered users surged 175% year on year, amounting to around 275 million. During that period, advertisements also accounted for around 98% of Meta’s total revenue.

MARKET CONSENSUS: 67 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP USD651.67

Verizon Communications (VZ US)

Shareholders of Frontier Communications on Wednesday greenlit Verizon’s USD20B takeover offer for the company, thwarting a campaign led by some disgruntled investors to seek a higher price.

The transaction, which still awaits regulatory approval, would expand Verizon's fiber network to a size that would rival major competitors like AT&T and Comcast by adding back lines in states such as California and Texas.

The shareholder approval on Wednesday removes a significant chunk of uncertainty regarding the deal and could potentially swing Verizon’s share price to the upside in the near term.

MARKET CONSENSUS: 13 BUYS, 14 HOLDS, 3 SELLS, AVERAGE TP USD47.02

Tencent (700 HK)

Tencent on Wednesday posted solid beats in 3Q24 revenue and profits, boosted by strong momentum in its gaming business. The company’s revenue grew by 8% YoY to RMB167.2B while net profit jumped 47% YoY to RMB52.2B.

Despite a slowdown in the world’s second largest economy hurting consumer confidence, Tencent’s results showed that its high-quality growth strategy, with businesses spanning games, social network, digital payment and cloud, is working. This could support the company’s share price going forward.

MARKET CONSENSUS: 70 BUYS, 2 HOLDS, AVERAGE TP HKD501.89

Siemens Energy (ENR GY)

Siemens Energy on Wednesday raised its Midterm outlook on growing demand for its grid technologies and an ongoing turnaround in its wind turbine unit. This is likely to support the company’s share price going forward as investors become more confident on Siemens Energy’s growth prospects.

Despite this, Siemens Energy has not proposed a dividend for FY2024, citing limitations to its payout policy as a result of obtaining project guarantees last year that are backed by the German government.

Siemens Energy’s FY4Q24 revenue stood at EUR9.74B vs. EUR9.78B expected, while adjusted loss per share stood at EUR0.34 vs EUR0.40 expected.

MARKET CONSENSUS: 11 BUYS, 11 HOLDS, 3 SELLS, AVERAGE TP EUR36.53

Seven & i Holdings (3382 JP)

Seven & i Holdings, owner of supermarket chain 7-Eleven, is reportedly considering going private on Wednesday via a management buyout to dodge a takeover attempt by Canada’s Alimentation Couche-Tard.

Further developments in this proposal could inject volatility into the company’s share price in the near term, although it surged almost 12% on Wednesday.

Seven & i has now started approaching financial institutions about raising funds for its plan to go private, although the company also stated that nothing has been decided.

MARKET CONSENSUS: 6 BUYS, 10 HOLDS, AVERAGE TP JPY2400.77

Earnings Announcements

US Market

Walt Disney

European Market

Siemens, Deutsche Telekom, Merck, Burberry

HK - China Market

Bilibili, NetEase, Lenovo, Alibaba Health, JD.com

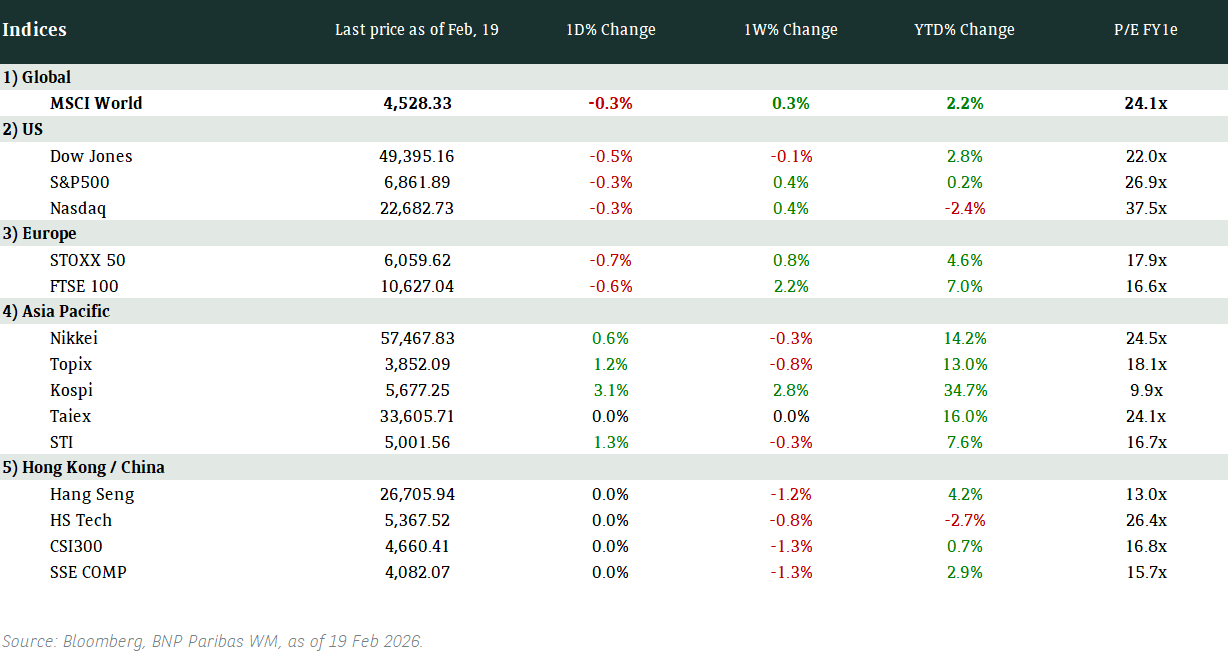

Global Indices Changes (%)

Fixed Income Market Updates

US Treasury yield curve steepens further. We are mindful of very long duration bonds, tactical in the 10-year part of the curve and our sweet spot remains in the 5-year. Financial bonds remain our most favoured sector.

EUROPEAN AT1

European bank AT1s was slightly weaker. Bond prices were 0.125-0.25 points lower. There was more selling in the long end as investors worry about Trump’s inflationary policy. Going forward, we expect the sector could be under some selling pressure as the valuation is not cheap. But any meaningful correction will be a good opportunity to add, particularly the ones with short call date.

ASIA INVESTMENT GRADE (IG)

Asia IG consolidation continued. Overall market flows were mixed and quiet. Private bank clients are skewed towards buying whereas institutional investors were reducing fixed income exposures. In China-HK, we saw good demand on good quality names such as Meituan, AIA, and CK Hutchison. Outside of China, short-dated Korea IG papers were popular. In India IG, Adani continued to outperform and we saw more demand in its short-dated papers. Overall, we expect Asia IG trading activities will be low as we approach year-end.

ASIA HIGH YIELD (HY)

Asia HY remained slow. China HY property traded with a slightly better tone with Dalian Wanda rebounding 0.5 points higher. However, the sector is losing momentum after the weaker-than-expected credit data in China. We expect China HY will stay weak until we see more updates on government policy stimulus. Outside of China, India HY was mostly unchanged across various bonds.

Forex Market Updates

The US Dollar rose to hits highest level in a year after inflation data met expectations, leading markets to believe that rate cuts will continue.

USD

The US Dollar advanced to one-year high against major currencies on Wednesday powered by so-called Trump trades and after U.S. inflation for October came in as expected, suggesting the Federal Reserve will continue lowering interest rates. Labor Department data on Wednesday showed the U.S. consumer price index rose 0.2% for the fourth straight month, in line with economists' expectations, amid higher costs for shelter such as rents. In the 12 months through October, the CPI advanced 2.6%.

The Dollar Index could see more near term strength, with USD bulls likely to target the 107.00 level.

CAD

The Canadian Dollar weakened to a 4-1/2-year low against its U.S. counterpart on Wednesday as investors weighed U.S. inflation data and the prospect of a wider divergence in economic growth between America and Canada. The Bank of Canada expects the Canadian economy to grow 1.2% this year compared to 2.8% in the United States.

The Loonie could see some testing of the psychological resistance at 1.4000 while the dollar continues its bullish run.

GBP

The British Pound hovered near three-month lows against a stronger dollar on Wednesday, after a sharp fall in the previous session following data that showed inflation was easing in the UK. Data showed regular pay for British workers grew at its slowest pace in two years in the third quarter, supporting the Bank of England's confidence that inflation pressures will continue to ease. The BoE last week lowered interest rates for the second time since 2020 and said the Labour government's first budget would lead to higher inflation and economic growth.

Sterling looks poised to see more near term losses towards immediate support around 1.2600.

XAU

Gold prices extended losses for the fourth straight session on Wednesday, weighed down by a stronger dollar and elevated bond yields on news that October U.S. consumer prices increased as expected. The dollar advanced near a seven-month high against major currencies, while benchmark U.S. 10-year yield climbed. Traders are pricing in an 82% chance of a Fed rate cut in December, up from around 58% before the data, according to CME FedWatch tool.

The precious metal could weaken towards 2550 on a firm break below technical support around the 2600 handle.