Macro Update:

US equities reach new record highs

US stocks head into December positively after the S&P 500 and Dow closed higher in a shortened trading session on Friday. Markets are clearly optimistic on the business friendly approach of the second Trump administration. The upcoming nonfarm payroll figure this Friday should give a better indication of Fed's interest rate path. We continue to stay positive on US equities, particularly mid/small caps. Elsewhere in China, factory activity grows for a 2nd month. Official NBS Manufacturing PMI rose to 50.3 in November 2024 from 50.1 in October, shedding hope that a recovery in the manufacturing sector is underway.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities ended November higher as traders returned from the Thanksgiving holiday for a shortened trading session. We continue to expect positive momentum heading into the last month of the year.

EUROPE EQUITIES

European stock markets closed higher in Friday trading after recent reports showed that the inflation rate rose to 2.3% in the Eurozone.

HK EQUITIES

Stimulus bets drove Chinese stocks higher. Hong Kong and China equities ended higher on Friday with the market expecting greater economic support at a key policy meeting in December.

MUFG (8306 JP)

MUFG plans to buy Japanese robo-adviser WealthNavi for as much as JPY99.7B, as it looks to expand its financial-technology capabilities and cater to households going online to invest more of their savings.

MUFG took a 15% stake in WealthNavi earlier this year.

Japanese financial firms are expanding services to help households invest more of their $7.5T in cash as inflation emerges in Asia’s 2nd largest economy. The acquisition could augment the firm’s prospects for developing a more comprehensive financial solution.

MARKET CONSENSUS: 14 BUYS, 4 HOLDS, AVERAGE TP JPY1945.36

Alibaba (9988 HK)

Alibaba’s 1688 platform unrolled the "1688 Source Choice" labeling business brand, aiming to satisfy the demand of homemakers for products with high cost performance and foster the digital transformation of the supply chain of source factories.

Through this platform, factories can more conveniently carry out labeling business and realize direct connection with consumers.

MARKET CONSENSUS: 39 BUYS, 3 HOLDS, AVERAGE TP HKD119.95

Meituan (3690 HK)

Meituan’s quarterly revenue climbed a better than expected 22%, signaling a gradual recovery in online commerce and travel as Beijing tries to jumpstart the economy.

The outperformance suggests online commerce and travel remained resilient in the months leading up to stimulus measures that Beijing hopes will boost consumer confidence and boost the economy.

MARKET CONSENSUS: 58 BUYS, 2 HOLDS, 2 SELLS, AVERAGE TP HKD194.45

Shiseido (4911 JP)

Shiseido aims for a modest margin recovery through 2026 as it unveiled a restructuring plan on Friday to drive growth across Japan and other international markets, and cushion the impact of a continuing slump in China. It now expects China’s contribution to total sales to shrink through 2026, and aims to drive more growth from other international markets.

Demand from Chinese consumers for its once popular cosmetics cratered amid safety concerns over Japanese goods fueled by social media posts and Chinese media reports.

MARKET CONSENSUS: 8 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP JPY3563.33

Stellantis (STLA US)

Stellantis, the world's fifth-largest automaker by volume, announced on Sunday that its CEO, Carlos Tavares, has stepped down with immediate effect.

Travares will hand over leadership of the maker of Jeep SUVs and Fiat cars to an interim committee headed by Chairman John Elkann.

The CEO is leaving sooner than expected as his views of the carmaker’s future differed from those of the board and some shareholders, the firm said.

The change is likely to positively impact share price in the near term, especially after shares are down 53% from March's peak.

MARKET CONSENSUS: 13 BUYS, 18 HOLDS, 3 SELLS, AVERAGE TP USD15.97

Earnings Announcements

US Market

Zscaler

European Market

Prosus

HK - China Market

-

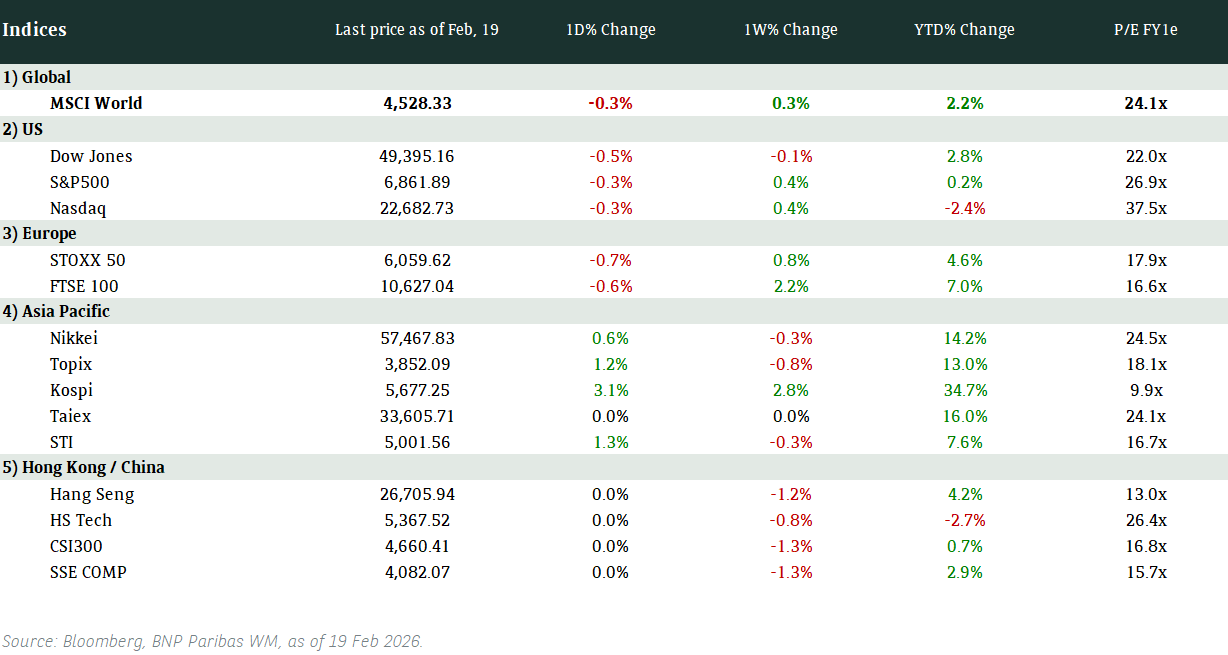

Global Indices Changes (%)

Fixed Income Market Updates

With US Treasury yields heading lower last Friday on speculation that Trump will temper his most extreme trade policies, we have a preference to be in the front to belly of yield curves unless spreads can compensate for the duration extension. There are several new issue mandates for corporate hybrids this week. We expect continued issuance in first quarter 2025 and like these corporate hybrids from strong credits for carry in 2025.

EUROPEAN BANK COCO (AT1)

AT1s closed the day slightly higher +25-50cnt (cents), with strong month end flows into an illiquid backdrop. Asia flow was only marginally skewed to buying although fast money and the street are covering shorts. French risk is out-performing by only around +0.125pt (point) to only partially cover Thursday's move. Having gapped lower, investor interest was predominantly to buy and hence it does feel like we have seen the local lows. In general, longer call bonds are getting the most attention, yet to materially bounce despite the recent strength in rates.

ASIA INVESTMENT GRADE (IG)

Activity was slower last week going into month end and Thanksgiving week. Overall, spreads in China tech was 4 to 11 bps (basis points) wider as the market was still digesting the Alibaba new issues. Korea IG was unchanged to 5bps wider. The 7-10yr part of the curve was trading softer and there is more interest on the 2-7yr bonds. India IG ex Adani settled 5-15bps wider overall on average.

ASIA HIGH YIELD (HY)

China HY was quiet except for New World Development where the unexpected CEO change led to a 4-6 point drop in their curve. In Macau gaming, November GGR was a modest beat. Gross gaming revenue (GGR) grew +15% y/y to MOP18.4B (or MOP615m/day) in November, representing an 81% recovery vs. pre-COVID to show a modest improvement of 77% recovery year to date. We continue to like Macau gaming front end for carry and would wait for yield curves to steepen.

Forex Market Updates

The US Dollar dipped during lower-volume trading due to the Thanksgiving long weekend, but markets are still wary of the heightened expectations on inflation next year due to new tariffs.

USD

The US Dollar fell slightly on low trading volumes with many traders still out on the Thanksgiving long weekend. It is on track for a 1.78% rise in November as investors adjust for the likelihood that the new U.S. administration under Donald Trump next year will loosen business regulations and enact other policies that boost growth. Analysts also say that proposed new tariffs and a promised clampdown on illegal immigration could reignite inflation.

USD should continue to test its support level of 105 with market’s growing inflation concerns.

EUR

The Euro gained 0.24% to $1.0578. The single currency has tumbled 2.8% in November as the dollar has rallied, putting it on course for its worst month since May 2023. Data on Friday showed that French consumer prices grew in line with expectations in November. Germany’s inflation report on Thursday showed price pressures remaining flat in November despite expectations of a second consecutive increase. ECB policymaker Francois Villeroy de Galhau said on Thursday that the central bank should keep its options open for a bigger rate cut next month, countering hawkish comments from peer Isabel Schnabel the previous day.

The common currency may find some resistance at the 1.0600 psychological barrier.

CAD

The Canadian dollar edged higher against its U.S. counterpart on Friday but was still headed for a weekly and monthly decline as domestic gross domestic product data bolstered bets for an outsized interest rate cut from the Bank of Canada in December. Canada's economy grew at an annualized rate of 1% in the third quarter, undershooting the Bank of Canada's forecast of 1.5%, after growing 2.2% in the prior quarter. Investors see a roughly 50% chance the BoC opts for a second consecutive unusually large half-percentage-point move at the Dec. 11 policy announcement, up from 31% before the data, swaps market data showed. A 25-basis-point step is fully priced into the market.

USDCAD looks to be hovering between 1.3900 and 1.4100 as shock over the US Tariff threat fades.

XAU

Gold prices gained on Friday, boosted by a drop in dollar and persistent geopolitical tensions, but bullion was still set for its worst monthly loss since September last year after a post-election sell-off driven by Donald Trump's win. Gold has dropped 3% so far this month, its worst monthly slide since September 2023, as "Trump euphoria" lifted the dollar earlier this month and stalled gold's rally, triggering a post-election sell-off.

The precious metal should find support at 2600 in the near term with more consolidation of insights into the Fed’s monetary policy outlook.