Macro Update:

US manufacturing PMI beats expectations

The ISM Manufacturing PMI for the US topped forecasts at 48.4 for November, suggesting a softer contraction in the factory sector. Upcoming economic data, including PMIs, JOLTs, and jobs reports will be closely monitored, to better gauge potential Federal Reserve moves. According to CME, market is currently pricing in a 76% probability of a 25bps rate cut on the 18th of Dec FOMC. This is similar to our view, and we expect further 25bps rate cut quarterly next year, until September 2025, bringing us to a terminal rate of 3.75%.

Main Upcoming Macro Indicators

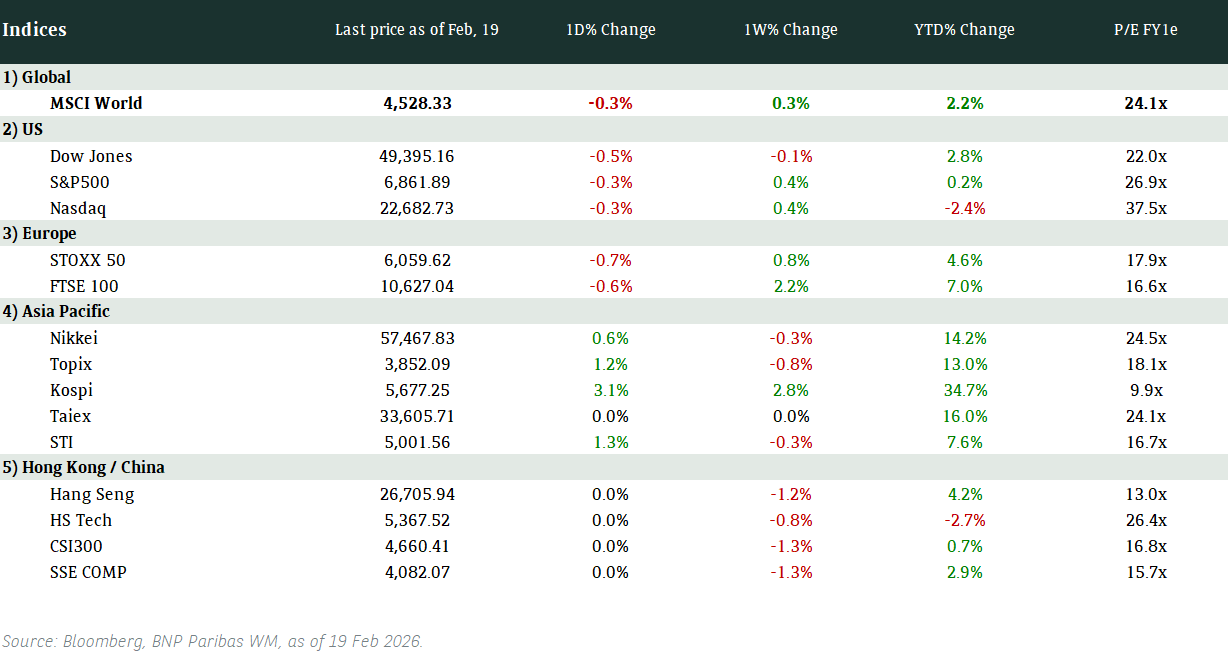

Equity Market Updates

US EQUITIES

US equities closed mixed with Nasdaq logging another record high as the biggest tech companies gained.

We continue to see tech outperforming, and mostly shrugging off the latest China rules.

EUROPE EQUITIES

European stock markets closed mostly higher in Monday trading after different sectors had opposite reactions to polarizing data across Eurozone.

Luxury stocks outperformed with rebound said to be in sight.

HK EQUITIES

HK equities started December higher with Macau gaming names rallying after data showed gaming revenue in the city rose 14.9% YoY, exceeding expectations.

China macro data also showed that manufacturing activities are expanding faster than expected, a positive catalyst for the market.

Baidu (9888 HK)

Baidu has won Hong Kong’s 1st license to test autonomous vehicles in the city as the company seeks to expand its driverless technology beyond mainland China.

Baidu’s Apollo International unit will be allowed to conduct a trail of 10 autonomous vehicles in the North Lantau area. Autonomous driving and machine learning have been core tenets in Baidu’s broader ambitions to expand within the AI sector.

Positive developments are potential catalyst for upwards momentum.

MARKET CONSENSUS: 24 BUYS, 9 HOLDS, AVERAGE TP HKD108.03

Blackrock (BLK US)

BlackRock is said to be nearing a deal to buy HPS investment Partners, a purchase that would vault the firm into the top ranks of private credit as it seeks to become a major force in alternative assets.

BlackRock has moved aggressively to expand in private markets, and buying HPS would mean BlackRock has clinched the 2 largest ever acquisition of alternative asset managers in less than a year.

MARKET CONSENSUS: 19 BUYS, 4 HOLDS, AVERAGE TP USD1110.27

Guangzhou Auto (2238 HK)

Guangzhou auto shares jumped 25% on Monday, the most since Jan 2021, after signing an agreement with Huawei to collaborate on a new high-end smart EV brand.

The new brand will leverage the companies’ strength in intelligent connected vehicles and smart manufacturing and focus on market demand and product competitiveness.

MARKET CONSENSUS: 10 BUYS, 10 HOLDS, 3 SELLS, AVERAGE TP HKD3.18

Prosus (PRX NA)

Prosus reported a 1H profit as the technology investor sold stakes in online businesses in China and South Africa. The group sold more than $2B of assets during the period, including exiting its Trip.com position in China.

The firm will invest in AI across its businesses but will consider writing “larger checks” to companies operating in its ecosystem. India is one of the more attractive growth markets, the firm said.

MARKET CONSENSUS: 21 BUYS, 2 HOLDS, AVERAGE TP EUR49.65

Intel (INTC US)

Intel’s CEO Pat Gelsinger was forced out after the board lost confidence in his plans to turn around the chipmaker, adding to turmoil at one of the pioneers of the technology industry.

Whoever replacing will face the same set of problems Gelsinger was brought in to fix, including the fallout from poor decisions made by his predecessors. The next CEO has to take on competitors with greater resources and catch up in AI computing.

Markets initially applauded his departure, with shares gaining as much as 6% but closed Monday 0.5% lower as uncertainty ensures in the near term.

MARKET CONSENSUS: 7 BUYS, 37 HOLDS, 8 SELLS, AVERAGE TP USD24.37

Earnings Announcements

US Market

Salesforce

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

This week will feature key U.S. labour market reports and Fed comments ahead of the FOMC blackout. We may see moderate interest rate volatility and increased profit-taking on the long end as year-end approaches. Japanese insurance companies' H1 2024 results highlight strong capitalisation and earnings, presenting opportunities in their bonds for carry.

EUROPEAN BANK COCO (AT1)

The AT1 market opened relatively firm, despite the spread between French and German government bonds widening to 87 basis points. Buyers showed interest in HSBC and Standard Chartered AT1s, with HSBC rising by 0.25 points. Conversely, French AT1s declined by 0.125 to 0.5 points due to increased selling pressure, likely exacerbated by ongoing political uncertainties in France that are impacting liquidity.

ASIA INVESTMENT GRADE (IG)

In the China IG market, benchmark names rose by 1 to 2 basis points in cash price. As rates dropped approximately 20 basis points from recent highs, profit-taking led to selling pressure across the sector. Outside China, Malaysian IG, including Petroliam Nasional and Khazanah Global bonds, widened by 1 basis point, although flows remained balanced in the long end. Korean IG stayed largely unchanged amid muted flows as the year-end approaches.

ASIA HIGH YIELD (HY)

The China HY market remained stable, despite speculation about further stimulus not materializing last week. Demand for higher-quality names like China Jinmao and Yuexiu increased, with both up by 0.25 points. Other issuers, such as Vanke and Longfor, also saw solid demand on the long end, rising by 0.25 to 0.75 points. The Macau gaming sector traded firmly, maintaining a constructive overall tone. Outside China, the Adani complex gained another 0.25 to 1 point, driven by hedge fund buying and limited selling from Asia. Additionally, Vedanta’s new issue rose by 0.25 points, supported by institutional account interest.

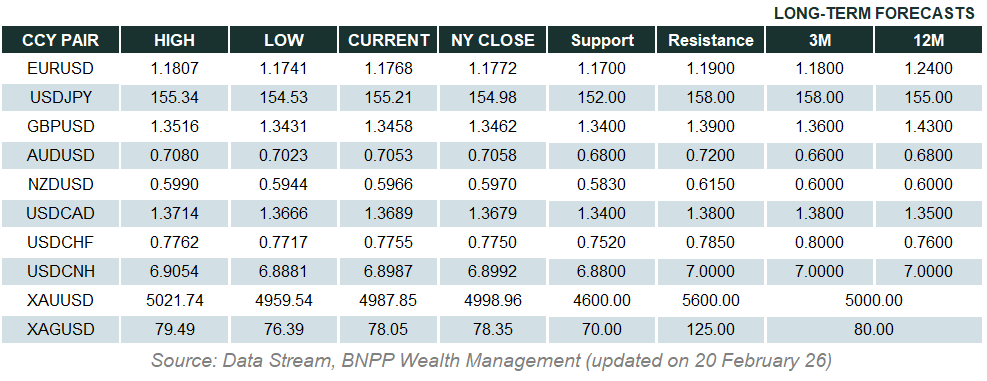

Forex Market Updates

The Dollar rose further on stronger manufacturing data, but there were some mixed reactions in the market as Fed Governor Waller stated his intentions on cutting rates this month.

USD

The US Dollar extended gains after strong U.S. manufacturing data from both the Institute for Supply Management and S&P Global reports, which once again pointed towards a resilient American economy. However, despite the generally upbeat data, Federal Reserve Governor Christopher Waller said on Monday he was inclined to cut the benchmark interest rate at the Dec. 17-18 meeting as monetary policy remained restrictive, which is in line with our view.

USD should continue to test its support level of 105 with market’s growing inflation concerns.

AUD

The Aussie started December on a downbeat note after two straight months of declines, with their fates largely depending on overseas events now that uncertainties over local interest rates have settled. Adding to the pressure, the onshore Chinese yuan hit a four-month low on Monday and broke a key level of 7.26 per dollar as U.S. President-elect Donald Trump warned BRICS member countries against replacing the dollar or face 100% tariffs. As a result, the Aussie - which is often sold as a liquid proxy for the Chinese yuan given China's status of Australia's biggest trading partner - fell 0.3% to $0.6499.

The Aussie could test the support level of 0.6400 as Dollar strength continues.

CNY

The yuan fell to a four-month low on Monday, as tariff threats and mixed purchasing managers' index (PMI) data raised concern China's economy might need additional policy support. The onshore yuan dropped to a low of 7.2675 per dollar, its weakest since July 24, despite a private manufacturing survey on Monday showing China's factory activity expanded at the fastest pace in five months in November. The upbeat Caixin/S&P Global survey data followed a modest improvement in the official manufacturing PMI, but a worse-than-expected non-manufacturing PMI, which includes construction and services, over the weekend.

USDCNY could trade towards the resistance level at around 7.2800 with the current economic and geopolitical developments.

XAU

Gold prices slipped on Monday, snapping a four-day winning streak, as the U.S. dollar staged a sharp rally and investors braced for pivotal economic data and Federal Reserve insights on the path of interest rates. A firmer dollar driven partly by U.S. President-elect Donald Trump's comments that BRICS nations should refrain from trying to replace the dollar is pressuring gold prices, said Peter Grant, vice president and senior metals strategist at Zaner Metals.

The precious metal should find support at 2600 in the near term.