Macro Update:

China signals negotiation over trade dispute with the US

President Xi sent a strong signal that Beijing was ready to work with Trump’s economic and trade teams to resolve trade disputes amid risks of a potential trade war.

Another positive news is China extended the private pension scheme nationwide, effective from 15 December 2024. The scheme allows tax deductions and can invest in funds that track major A-share indices, an important step to encourage inflows to onshore equity market from household savings.

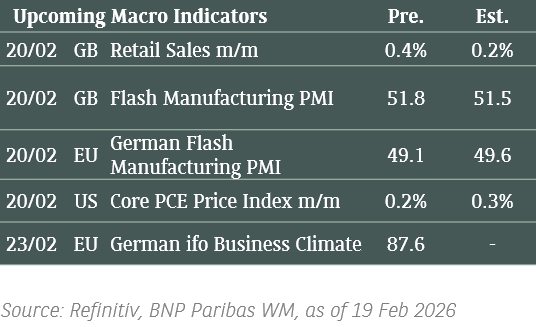

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

Stocks in the US ended Friday almost unchanged, awaiting the Fed’s policy decision this week.

EUROPE EQUITIES

European equities closed lower on Friday, snapping a three-week winnings streak, with markets looking to the region’s latest economic data releases for more clues on the ECB's policy rate trajectory.

HK EQUITIES

Hong Kong stocks dropped on Friday as investors reflected on redouts from the key Chinese Central Economic Work Conference.

T-Mobile (TMUS US)

T-Mobile said in a regulatory filing on Friday that its board has approved a new USD14B shareholder return program running through 31 December 2025, which could be supportive to the company’s share price going forward.

The program will include share repurchases and cash dividends and will be funded with cash on hand and potential debt issuances or other borrowings. This is done as part of T-Mobile’s previously announced business plan to allocate up to USD80B in investments and capital returns between 18 September 2024, and the end of 2027.

MARKET CONSENSUS: 23 BUYS, 7 HOLDS, 2 SELLS, AVERAGE TP USD247.18

Porsche SE (PAH3 GY)

Porsche SE, Volkswagen’s top shareholder, on Friday warned that it may write down the value of its stake in Europe's top carmaker by up to EUR20B, in the latest sign of how VW's cost crisis has shaken investor faith in the carmaker. This could significantly impact Porsche SE’s bottom line going forward.

Volkswagen is currently suffering from high costs, fierce Asian competition and a prolonged bitter conflict with powerful unions over plant closures and wage cuts.

Porsche SE also expects to take a charge of between EUR1B and EUR2B related to its stake to Porsche AG, the sports car maker.

MARKET CONSENSUS: 6 BUYS, 5 HOLDS, 3 SELLS, AVERAGE TP EUR40.73

UniCredit (UCG IM)

UniCredit on Friday filed its buyout offer for rival Banco BPM with Italy's market regulator, making its EUR10B all-share offer, which UniCredit announced on 25 November, binding while also setting a price floor. UniCredit also applied to relevant authorities for regulatory approval.

Shares in Banco BPM closed at EUR7.846 euros on Friday, well above the EUR6.657 a share UniCredit is offering based on the bid's exchange ratio, indicating that investors are betting on an improvement of the proposal in the near future.

MARKET CONSENSUS: 16 BUYS, 6 HOLDS, AVERAGE TP EUR47.02

Novo Nordisk (NOVOB DC)

Shares of Novo Nordisk dropped more than 3% on Friday after its weight loss drug Ozempic had been reportedly linked to a rare form of vision loss called non-arteritic anterior ischemic optic neuropathy. This could negatively impact the company’s reputation and spawn numerous regulatory implications going forward, putting downward pressure to share price.

The study linking Ozempic to vision loss, which has yet to be peer-reviewed, was published on medRxiv and supports findings reported in a Harvard University study from this past July.

MARKET CONSENSUS: 20 BUYS, 8 HOLDS, 4 SELLS, AVERAGE TP DKK952.13

HSBC (5 HK)

Australia’s corporate regulator has recently sued HSBC Bank Australia for failing to protect customers who lost millions of AUD in scams, alleging that the company took, on average, 145 days to look into matters related to unauthorised payments and transactions. This could negatively impact HSBC’s reputation in Australia in the short to medium term.

HSBC received about 950 reports of unauthorised transactions between January 2020 and August 2024, resulting in customer losses of about AUD23M, among which AUD16M occurred in the six months between October 2024 and March 2024.

MARKET CONSENSUS: 15 BUYS, 8 HOLDS, 1 SELL, AVERAGE TP HKD80.73

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

US Treasury yields have risen notably mainly due to supply on US 10-year Treasuries with yields now at 4.4%. How the 30-year Treasury auction goes will also impact yields with some expecting it to test 4.65%. We prefer shorter duration bonds while this plays out, especially as the entire Treasury yield curve has moved higher.

EUROPEAN BANK COCO (AT1)

European AT1 space closed -0.125 pts (points). Euro-denominated AT1 was extremely well-bid. The dollar space in AT1 had much lighter flows. AT1s outperformed rates signficantly, as US Treasury yields were 25 basis points higher and AT1s were at highs in cash price. We prefer shorter duration AT1 with high resets.

ASIA INVESTMENT GRADE (IG)

China space was unchanged in spreads with higher outright yield offsetting a bit in the risk-off sentiment. For China state-owned entity space, overall better buying in Huarong front-end and two-way interest in the single A ones were seen. In Korea, it remained to be better buying in BBB space. In SEA, slightly better buying was seen in corporate bonds as the rates selloff brought out yield buyers. Singapore dollar space saw slightly better selling as core rates sold off, with some financials and long-end corporate bonds were offered.

ASIA HIGH YIELD (HY)

China property rallied in beginning of the week as China announced plans to loosen monetary and expand fiscal spending next year. However, as there was no clear strategy to stabilize the property sector (just similar rhetoric to before), most of the gains were given back over the week. Gaming continued to trade very firm with Asia PB and real money demand adding onto the US demand especially in the higher yielding tickers. In India HY, most bonds -0.125-0.25 point lower post the overnight US Treasury move. The net selling continued with liquidity getting tougher into year-end, although bits of real money inflow buying helped to keep bonds near tight spreads.

Forex Market Updates

The US Dollar posted modest gains on Friday as expectations ticked higher for a slower pace of Fed cuts in 2025.

USD.

The US Dollar rounded off its best week in a month on Friday as markets priced in the possibility of the Fed cutting rates more slowly than previously expected next year. Markets fully expect a cut at this week’s FOMC meeting, but are currently only pricing in a 24% chance of another round of easing in January, with March the most likely point for another move lower in rates according to CME. This is in line with Fed guidance of late, with policymaker Daly saying recently that she was comfortable with a rate cut in December but advocating “a more thoughtful and cautious approach” on further reductions in 2025.

The Dollar Index is likely to remain supported above 105.50 heading into this week’s FOMC meeting.

EUR

The Euro rebounded from three-week lows against the USD at the end of the week, although gains were capped by mostly dovish comments from ECB officials. Policymaker Muller, in particular, reflected growing concern at the central bank about the current level of interest rates vis-à-vis the Eurozone growth outlook, saying that he sees rates as being “too high relative to economic performance” and calling for another 100bps worth of easing by the ECB in 2025. His colleague Villeroy added that the ECB remains “significantly above neutral” and suggested that more rate cuts are in store.

The common currency continues to look heavy and could see a near term return to below 1.0450.

GBP

The British Pound closed the week with its third straight day of losses after data showed that the UK economy shrank unexpectedly in October, prompting markets to slightly dial up the prospect of speedier rate cuts by the BoE next year. This was also the first time since the onset of the Covid pandemic that UK GDP figures dropped in consecutive months, adding to a recent run of disappointing data for the British economy, with business surveys falling flat and trade data showing weakening momentum. Still, markets are currently pricing in an 87% chance of the BoE keeping rates on hold later this week with the next rate cut likely to come in February.

Sterling looks poised for a period of consolidation between 1.2500 and 1.2800 moving forward.

XAU

Gold prices retreated on Friday after hitting a five-week high in the previous session as markets digested the probability of a slower pace of Fed rate cuts next year. Given the precious metal’s explosive performance this year, analysts expect some unwinding of long bullion positions heading into the tail end of the year that could limit gains in the immediate horizon. Looking ahead, this week’s FOMC meeting is likely to see gold traders focus on Fed Chair Powell’s comments on the 2025 monetary policy outlook, especially in light of incoming US President Trump’s proposed tariff plans, which economists say would stoke further inflation.

The precious metal could see an extension of recent losses towards immediate support around the 2600 handle.