Macro Update:

Nasdaq closes at new all time high

The Nasdaq 100 surpassed the 22,000 mark for the first time as tech stocks propelled the market ahead of the crucial FOMC this week. On the data front, the flash PMIs showed a surprisingly strong growth in private sector activity, led by a surge in services albeit the manufacturing downturn deepened. Investors now turn their attention to the Federal Reserve’s upcoming decision. We continue to expect a 25bps cut this week, followed by 3 quarterly cuts in 2025, with US terminal rates at 3.75% by Sep 2025.

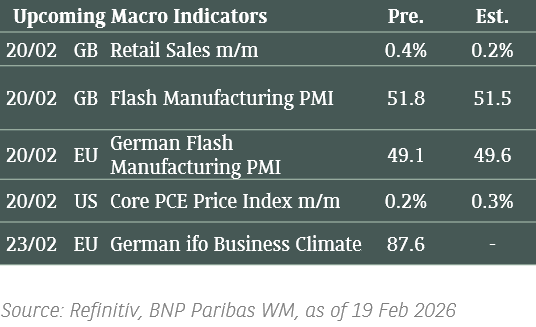

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities rose on Monday, led by tech megacaps as investors readied for the Fed’s policy rate decision this week.

EUROPE EQUITIES

Stocks in Europe closed lower on Monday, bogged down by heavyweight luxury and energy shares, as investors reevaluate China’s growth trajectory.

HK EQUITIES

Hong Kong stocks fell on Monday as recent slower-than-expected Chinese economic data subdued sentiment.

Ford (F US)

Ford’s joint venture with South Korean electric vehicle (EV) battery manufacturer SK On on Monday secured an up to USD9.63B loan from the US government for the construction of three new battery production plants in Tennessee and Kentucky, a likely positive development for Ford’s EV strategy.

The new facilities are expected to enable more than 120 gigawatt hours of annual battery production, potentially adding more than 5,000 construction jobs while they were being built, with up to 7,500 operational positions at BlueOval SK.

The low-cost government loan for the BlueOval SK joint venture is the largest ever from the government's Advanced Technology Vehicles Manufacturing loan program.

MARKET CONSENSUS: 7 BUYS, 14 HOLDS, 6 SELLS, AVERAGE TP USD11.61

Alphabet (GOOGL US)

Alphabet’s Google announced on Monday the rollout of its new image-generating artificial intelligence (AI) tool, Whisk, in the US. The tool allows users to prompt with images instead of text, which was the norm up until now.

Google also announced Veo 2 on the same day, a next-generation video-generating AI and the successor to Veo. The tool can create two-minute-plus clips in resolutions up to 4k, which is four times the resolution OpenAI’s Sora can achieve.

Both announcements are likely to be positives for Google’s position in the AI space, potentially supporting share price going forward.

MARKET CONSENSUS: 60 BUYS, 13 HOLDS, AVERAGE TP USD210.37

Honeywell (HON US)

Honeywell announced on Monday that it was considering a plan to separate its high-margin aerospace business in a move backed by activist investor Elliott Investment Management, which has been pushing for the company's breakup.

The company, one of the last surviving US conglomerates, has been on a deal-making spree this year under CEO Vimal Kapur, as it focuses on automation, aviation and energy businesses, while shedding segments that do not align with its plans.

MARKET CONSENSUS: 13 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD242.83

Novo Nordisk (NOVOB DC)

Novo Nordisk on Monday committed USD1.2B to build a new factory in Denmark as it took steps toward meeting demand for its blockbuster drugs. This could potentially impact the company’s top line and thus share price going forward.

The news came after Novo Nordisk got the green light for its USD11.7B purchase of three large facilities abroad.

According to Novo Nordisk, the new 40,000 m² state-of-the-art facility will support rare disease treatments like hemophilia, utilizing advanced technology. The project is set to create 400 permanent jobs by 2027, with up to 1,000 workers employed during construction.

MARKET CONSENSUS: 20 BUYS, 8 HOLDS, 4 SELLS, AVERAGE TP DKK954

Gree Electric Appliances (000651 CH)

Chinese home appliance manufacturer Gree has reportedly developed its own chips six years after the firm embarked on efforts to do so, potentially granting the company a significant competitive advantage going forward.

In 2018, Gree set up a subsidiary to design chips for air conditioners as the company announced that it wanted to move into making more smart home products. At the time, Dong Mingzhu, the company’s chairwoman, said that Gree spent around RMB4B a year on buying chips for its air conditioners.

Other Chinese smartphone and appliance makers such as Xiaomi and Midea have in recent years also developed their own chips in pursuit of self-reliance and supply chain resilience.

MARKET CONSENSUS: 37 BUYS, 1 HOLD, 1 SELL, AVERAGE TP CNY51.26

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

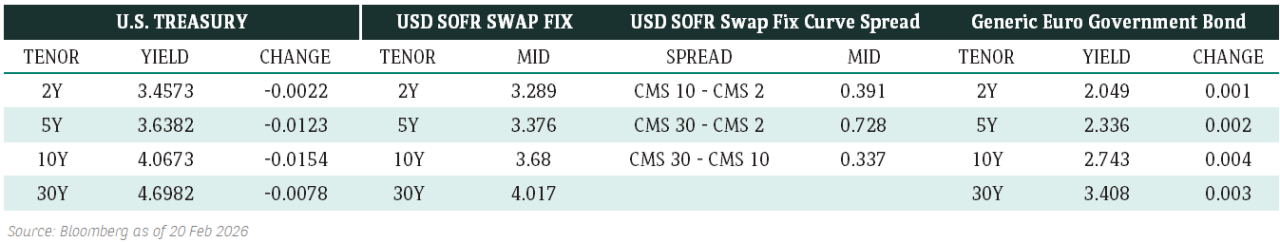

Fixed Income Market Updates

Central banks' actions will be the focus this week ahead of Christmas holiday. With spread on IG bonds at the tightest level since 1998, we advocate a more cautious approach for year-end.

EUROPEAN BANK COCO (AT1)

European AT1 space was down 0.125-0.25point in general as traders trimmed risk ahead of the holiday season. French Banks' AT1 bonds were around 0.25point lower after Moody's downgraded French sovereign rating to Aa3 from Aa2 with outlook remaining on negative. The ongoing political drama in France risks weakening its fiscal position. There were selective buying in AT1 bonds with short call dates (2025-2026) as a form of carry to park cash.

ASIA INVESTMENT GRADE (IG)

Trading activities were relatively muted as we head nearer to Christmas holiday season. There were better buying in Korean beta names with spreads around 2bps tighter on average. Asset mangers were picking up bonds of Woori Bank and SK Hynix. President Yoon was finally impeached over the weekend which saw him suspended from office. In China and HK IG space, trading was thin with spreads roughly unchanged as most investors stayed on the sides. Sovereign names in South East Asia saw selling by Exchange-Traded-Funds which saw prices dip 0.25 to 0.75point. We prefer a more conservative approach towards year-end.

ASIA HIGH YIELD (HY)

China HY market was quiet as well. Greentown and Fosun had some small demand especially in the front end, with bonds trading around 0.125point higher. Outside of China, Indonesia and India HY names were mostly unchanged. We do not see any panic selling even as the Indonesian Rupiah weakens past key level of 16,000 per dollar. In India. Adani complex was slightly lower. We do not view valuation in the HY space as favourable and would adopt a wait and see approach especially as we head towards year-end.

Forex Market Updates

The US Dollar weakened ahead of the Fed decision, with markets focused on a measured easing cycle for 2025 amid persistent inflation concerns.

USD

The US Dollar eased on Monday, retreating from a three-week high on Monday ahead of a pivotal Fed decision this week. Markets anticipate a quarter-point rate cut but expect officials to signal a measured easing cycle for 2025 amid persistent inflation concerns. Traders are cautious, with policymakers likely emphasizing a cautious outlook given inflation risks and potential policy shifts under the incoming administration.

The Dollar Index is likely to remain supported above 105.50 heading into this week’s FOMC meeting.

CNH

The Chinese Yuan strengthened slightly against the US Dollar on Monday as the PBOC pledged to maintain currency stability amid sliding bond yields and capital outflows. The PBOC set the yuan midpoint stronger than expected, reflecting efforts to prevent excessive volatility. However, growing expectations of further monetary easing next year, coupled with US tariff risks, continue to weigh on the currency’s outlook. Analysts expect near-term stability as year-end corporate dollar settlements offer support, but rising US-China trade tensions could renew downward pressure on the yuan heading into 2025.

USDCNH should remain well-supported above 7.2400 handle in the near term.

GBP

Sterling edged higher against the dollar yesterday after PMI data showed British businesses cutting staff at the fastest pace since 2021 while raising prices at the steepest rate in nine months. Persistent price pressures have heightened concerns for BoE. Analysts expect the BoE to hold rates steady this week, prioritizing inflation risks over weak growth. Despite ongoing economic uncertainty linked to tax increases and labour costs, sterling regained ground, supported by expectations of a slower BoE easing cycle compared to the ECB.

Sterling looks poised for a period of consolidation between 1.2500 and 1.2800 moving forward.

XAU

Gold prices had little change yesterday as investors anticipated a potential interest rate cut by the Fed this week. Markets are now focusing their attention on the Fed’s outlook for 2025 amid persistent inflation and economic uncertainties. Non-yielding bullion remains supported by demand as a hedge against equity risks and geopolitical tensions, with Israeli strikes in Gaza adding to safe-haven interest. $2,720 seems to be a key resistance level for gold. Lower interest rates are expected to further bolster gold’s appeal in the months ahead.

The precious metal should remain range-bound staying between 2560 and 2720.