Macro Update:

US jobs openings beat expectations

Investors digested stronger than expected October JOLTS data on Tuesday. Job openings rose to 7.74 million from 7.37 million previously, underscoring the continued resilience of the US labour market. The market will now focus on the upcoming key jobs report and speeches from several Fed officials to gauge the Fed's potential policy moves at the December FOMC, where we see a 25bps cut in interest rates. Aside from the US, market participants are also keeping a close eye on political turbulence in France, where the government is bracing for an upcoming no-confidence vote.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stock market close mixed with S&P 500 on another record.

Tech continues to be a bright spot with both Marvell and Salesforce rallying 10% in extended trading after announcing great results.

EUROPE EQUITIES

EU equities closed higher in Tuesday trading after the European Commission announced its investment worth $4.6B in maintaining the bloc’s industrial competitiveness

HK EQUITIES

HK equities closed Tuesday at a 3-week high as investors await fresh Beijing stimulus.

China is expected to unveil fresh measures to boost the economy following reports that authorities will hold a key meeting next week.

Tencent (700 HK)

Tencent has a potential new hit on its hands with Path of Exile 2, a game set to release on Friday. The game this week became the top selling software on PC platform Steam’s charts in key markets from US and Canada to France and the UK.

Tencent is hungry to develop what it calls evergreen games, titles that can sustain monetization over the long run and help feed the company’s various content platforms.

PoE2 has been lauded by online streamers as a major leap forward for its genre, notable for its improvements over Blizzard’s Diablo 4. A better than expected sales and feedback could fuel investors demand and drive share price.

MARKET CONSENSUS: 70 BUYS, 2 HOLDS, AVERAGE TP HKD521.01

US Steel (X US)

US President elect Donald Trump reiterated his opposition to the sale of US Steel to Nippon Steel, saying he’d instead use tariffs and tax incentives to revive the American steelmaker.

Nippon Steel is “determined to protect and grow US Steel in a manner that reinforces American industry, domestic supply-chain resiliency and US national security,” the firm said, responding to Trump’s comments.

Near term share price will be influenced by deal developments.

MARKET CONSENSUS: 7 BUYS, 3 HOLDS, AVERAGE TP USD42.82

Total (TTE FP)

Total is close to acquiring VSB from PE firm Partners Group, in a deal that values the renewable project developer at ~EUR2B, according to people familiar with the matter.

VSB offers services including project management and environmental planning in the renewable energy sector.

MARKET CONSENSUS: 16 BUYS, 12 HOLDS, AVERAGE TP EUR68.81

Tesla (TSLA US)

Deliveries from Tesla’s Shanghai factory fell for a 2nd month in November, despite an increase in subsidies from the Chinese government aimed at enticing more consumers to buy an electric car.

The Chinese market is a hugely important market for Tesla and deliveries this quarter will be crucial to whether it can close out 2024 with record sales.

Tesla will have to sell a record number of Evs globally in the final 3 months of 2024, at least 515,000 units, to make good on its guidance of “slight growth” in annual sales.

MARKET CONSENSUS: 28 BUYS, 17 HOLDS, 16 SELLS, AVERAGE TP USD253.3

Salesforce (CRM US)

Salesforce reported quarterly revenue that topped estimates, boosting investor hopes that the firm’s much-hyped strategy for AI products will lift financial results. The shares gained about 10% in extended trading.

Salesforce, the top seller of CRM software, pivoted its AI strategy this year to focus on tools called agents, which are designed to complete tasks such as customer support or sales development without human supervision.

The product, dubbed Agentforce, was launched in October. Deals related to Agentforce are largely initial roll-outs and will take time to show up in the company’s results.

MARKET CONSENSUS: 43 BUYS, 11 HOLDS, 2 SELLS, AVERAGE TP USD356.86

Earnings Announcements

US Market

PVH, Synopsys

European Market

-

HK - China Market

-

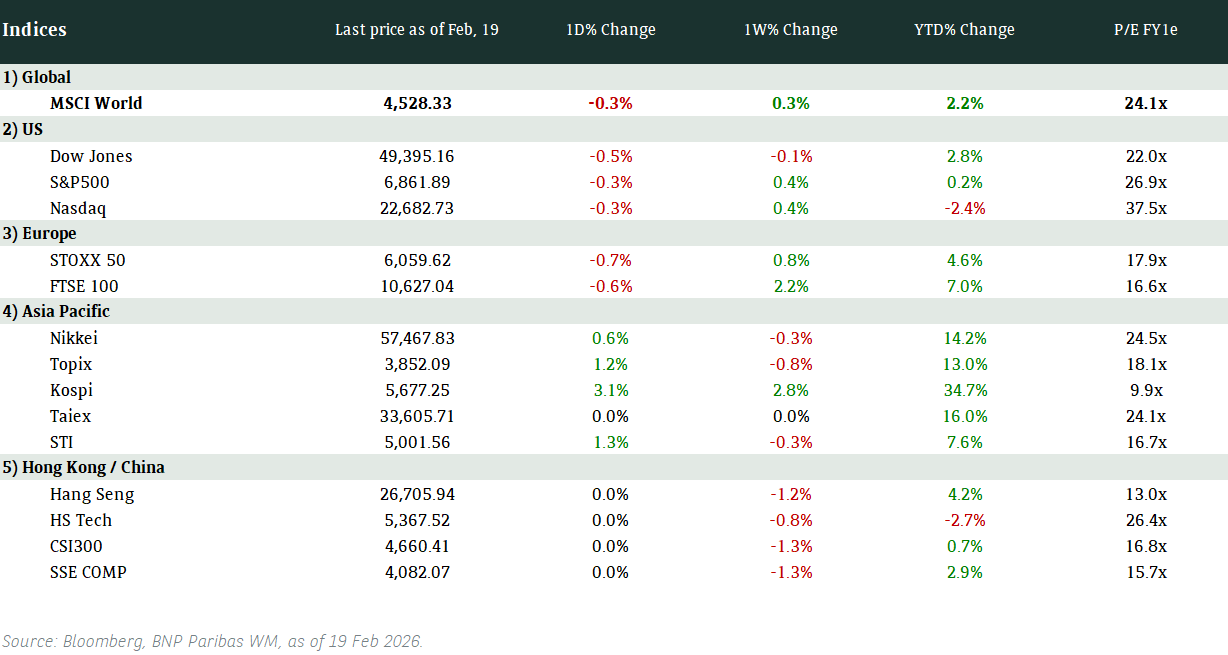

Global Indices Changes (%)

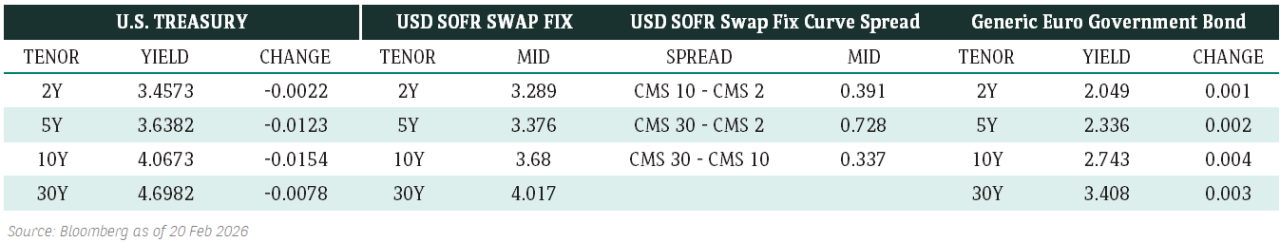

Fixed Income Market Updates

The French OAT spread has been widening against the German Bund to a new high due to France’s worsening debt dynamics. This spread widening is likely to continue until political and fiscal risks are settled. We prefer a cautious approach, accumulating exposure limited to the short end of French credits, allowing us to take advantage of any deeper market corrections that may occur.

EUROPEAN BANK COCO (AT1)

The AT1 market opened slightly higher after a robust close the previous day. This resilience was evident in the divergence between French bank risk—down by 0.5 to 0.125 points—and the broader market, which rose by 0.125 to 0.375 points. Despite volatility in French banks due to widening France OAT spreads, sentiment in the AT1 market remained unaffected. Notably, demand for USD-denominated AT1s with long call dates surged from both Asian and US investors. Conversely, some EUR-denominated AT1s with low coupon resets faced profit-taking pressure as leveraged investors sought to reduce their balance sheets heading into year-end.

ASIA INVESTMENT GRADE (IG)

In China, the IG market was generally stable, with balanced flows observed in the technology sector. The Tencent curve experienced increased buying, while the Alibaba curve saw selling pressure. Outside China, Korean IG showed strong demand for higher-beta corporates from institutional accounts. Japanese IG spreads remained mostly unchanged, although Nissan Motor attracted attention as its 2030 bond reversed the selloff, trading at +290 basis points tight.

ASIA HIGH YIELD (HY)

The China HY market exhibited typical December characteristics, with slow activity. Nevertheless, sentiment remained firm as investors anticipated additional economic support measures in China for the coming year. China property names rose by 0.25 to 0.5 points overall. Outside China, levels were unchanged or increased by up to 0.5 points as the market tone gradually improved. Vedanta launched a consent solicitation for its 2028 bond to amend terms, triggering a 0.5-point rally that lifted the rest of the curve by 0.5 to 1 point. Rakuten experienced two-way flows, with domestic accounts selling to offshore investors.

Forex Market Updates

The US Dollar briefly rose after data US jobs opening data while tariff risks and weakness in China's economy pushed the yuan to a 13-month low.

USD

The US Dollar index was little changed to slightly down on the day at 106.33. It trimmed losses after the stronger than expected JOLTS job openings data. Three Fed officials spoke on Wednesday and said they all saw inflation progressing toward their 2% target, but none pushed strongly for or against doing so when they next meet to set rates in two weeks.

USD should remain well supported at the 105 handle moving forward.

AUD

The Aussie was pressured by a sliding yuan on Tuesday as investors waited to see if Beijing would step up to rescue its currency, while mixed local data provided little lift. The Aussie slipped 0.2% to $0.6458, having fallen 0.7% overnight to as low as $0.6443. Local data showed on Tuesday net exports added just 0.1% to Australia's economic growth in the third quarter, but government spending - on defence and infrastructure - boosted growth by 0.7%, likely carrying the entire economy in the quarter.

The Aussie could test the support level of 0.6400 as Dollar strength continues.

CNY

The yuan weakened past a key threshold to the lowest level in more than a year against the dollar on Tuesday, pressured by the widening yield gap between the world's two largest economies and Trump's renewed tariff threats. The offshore yuan breached the psychologically important 7.3 per dollar level. Monetary policy divergence between China and US has sharpened in recent weeks as investors bet that Beijing will deliver more easing to support the economy.

USDCNY could trade towards the resistance level at around 7.3000 with the current economic and geopolitical developments.

XAU

Gold prices up as much as 0.7% on Tuesday. before trimming gains after the release of the stronger than expected JOLTS data, which signals a more resilient labour market, and eased fears of a significant slowdown in job markets ahead of Friday's US non-farm payrolls report. Bullion has been mostly rangebound since correcting from a record high of $2,800.80 on 30 Oct this year.

The precious metal should find support at 2600 in the near term with investors awaiting further economic clues from US data.