Macro Update:

US jobless claims hit 6-week high

Weekly jobless claims in the US rose to 224,000, slightly above expectations, indicating a cooling labour market. Nonetheless, investors tread cautiously ahead of Friday's pivotal jobs report, which could influence the Federal Reserve's December rate decision. The upcoming nonfarm payroll report is anticipated to show a gain of 200,000 jobs, with softer data potentially bolstering expectations for rate cuts. Market is pricing in a 74% probability of a 25bps cut at the December FOMC, similar to our view. For 2025, we continue to forecast quarterly 25bps cuts until September 2025, giving us a terminal rate of 3.75%.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities gave up some ground Thursday ahead of key macro data. A better than expected data could further support the Santa Claus rally in December.

EUROPE EQUITIES

European stocks gained for a sixth straight session in the longest winning streak since May, as investors weighed the latest developments in turbulent French politics.

HK EQUITIES

Hong Kong equities fell on Thursday as geopolitical tensions between the US and China spurred risk aversion. The developments come ahead of a key policy meeting in Beijing where China’s top leaders will convene next week to outline the nation’s economic agenda for 2025.

Hongkong Land (HKL SP)

Hongkong Land is reportedly considering selling its closely held property developer arm MCL Land. The firm is seeking to divest the MCL at a premium to book value of S$1.1B, people familiar with the matter said.

Deliberations are ongoing and HK Land could still opt to keep the assets, they added.

HK Land said in late October it plans to forgo residential development in a move that will eventually see it set up REITs.

MARKET CONSENSUS: 5 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP USD4.74

Dollar Tree (DLTR US)

Dollar Tree tightened its full year earnings outlook range as it reported better than expected Q3 results, while the discount retailer said Jeff Davis will step down as its CFO.

DG continues to expect comparable store sales to grow by low-single digits for the ongoing fiscal year. it also reiterated its low-single-digit growth outlook for its Dollar Tree and Family Dollar segments.

Shares are likely to see some relief rally as discount retailers, whose customer base was particularly vulnerable to inflationary pressures, begin to stabilize.

MARKET CONSENSUS: 11 BUYS, 18 HOLDS, 1 SELL, AVERAGE TP USD84.27

Hon Hai (2317 TT)

Apple’s major manufacturing partner Hon Hai reported a 2nd consecutive month of single digit sales growth, rising concerns that demand for AI infrastructure isn’t enough to offset weak iPhone sales.

Hon Hai have enjoyed a boost from the massive spending on servers and data centers from tech firms. However the firm is still highly reliant on Apple and the muted smartphone market is expected to put exert pressure on share price.

MARKET CONSENSUS: 23 BUYS, 2 HOLDS, AVERAGE TP TWD254.41

Shell (SHEL LN)

Shell and Equinor will combine their UK offshore oil and gas assets to form a new company, which they said will be the UK North Sea’s biggest independent producer.

The deal reflects the declining status of the UK’s offshore oil and gas industry. As production from existing fields dwindles, and the average size of new discoveries shrinks, the global majors have been shifting their focus to more attractive investment opportunities elsewhere.

MARKET CONSENSUS: 19 BUYS, 6 HOLDS, AVERAGE TP GBp3110.36

DocuSign (DOCU US)

DocuSign shares jumped after the e-signature company lifted its full-year outlook as business improved during the third quarter. Shares rose as much as 17% in afterhours trading.

The firm reported quarterly increases in billings, subscription revenue and new customer growth. Subscription revenue grew 8%, while billings increased 9% year over year. New customers increased 11% year over year to 1.6M.

The trajectory of the company continues to improve as it undergoes a multi-year transformation, they said.

MARKET CONSENSUS: 4 BUYS, 13 HOLDS, 4 SELLS, AVERAGE TP USD68.06

Earnings Announcements

US Market

Ulta Beauty

European Market

-

HK - China Market

-

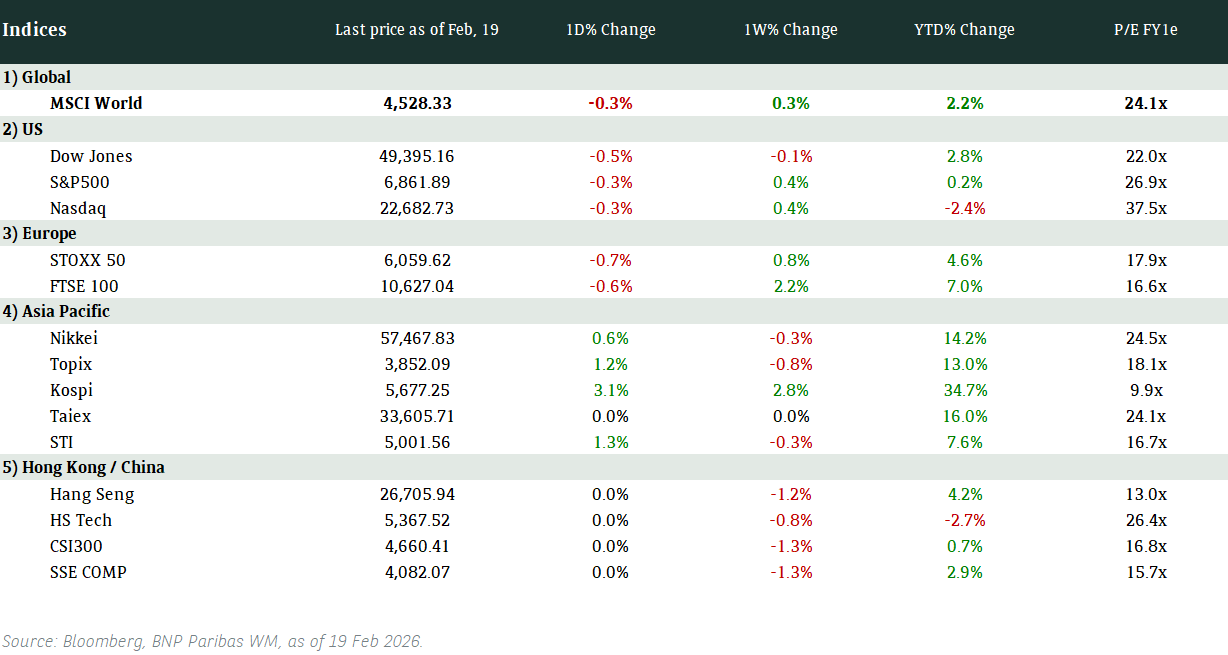

Global Indices Changes (%)

Fixed Income Market Updates

More political drama unfolds: this time in France. After the no-confidence vote, we expect the political situation in France to remain unstable. However, we are sanguine on quality French issuers and will look to be buyers on further correction.

EUROPEAN BANK COCO (AT1)

European AT1 space closed around 0.125point higher on average with French Banks' AT1 bonds performing in line with the general market. EUR-denominated AT1 bonds were still more sought after compared to USD-denominated ones. Although there were small profit taking towards market close, prices were largely unaffected. Valuations do not look cheap, and we would position more conservatively as we head towards year-end.

ASIA INVESTMENT GRADE (IG)

Asset managers were buyers of low-beta names in Korea IG space. Overall, spreads were unchanged to 2bp wider for low-beta names in the Korea IG space while the high-beta names traded around 3-5bps wider in spread. In India IG, benchmark names such as State Bank of India traded 1-2bps tighter. China IG space was held up by local demand with the 5-year benchmark names most actively traded. Longer duration bonds saw asset managers trimming in small sizes, likely due to early rebalancing. More active names in the South-East Asia space were Khazanah and Thailand banks' bonds.

ASIA HIGH YIELD (HY)

Dalian Wanda was marked 0.25-0.5point lower due to profit-taking after recent outperformance. Outside of China, Adani complex traded around 0.25point lower due to selling pressures from Asian asset managers. Vedanta outperformed the India HY space as investors are not expecting anymore taps in the near term from the company. Buyers were mainly hedge funds and priivate banks. We remain highly selective in the HY space as many idiosyncratic risks remain.

Forex Market Updates

The US Dollar weakened on higher unemployment claims than expected, while markets await tonight's highly anticipated jobs data.

USD

The US Dollar extended losses after the higher than expected claims data. The spotlight will be on tonight's U.S. nonfarm payrolls report for November. Bets on Fed rate cuts held broadly steady, however, partly influenced by Wednesday's weaker-than-expected services sector data and the higher-than-expected jobless claims. Markets are pricing in about a 70% chance of a 25-bp rate cut later this month, and a 30% chance of a pause.

The Dollar Index looks likely to be capped by technical resistance around 107.5 for the time being.

EUR

The Euro rallied on Thursday as French government bonds steadied a day after the collapse of France's government. Despite Thursday's gains, however, the euro was on track to post a loss this week, the fourth in the last five weeks. French President Emmanuel Macron met allies and parliament leaders on Thursday as he sought to swiftly appoint a new prime minister to replace Michel Barnier, who officially resigned a day after opposition lawmakers voted to oust his government.

While the common currency’s near term outlook remains bearish, technical support at 1.0410 looks poised to hold for now.

AUD

The Australian dollar was pinned near four-month lows on Thursday as investors wagered on earlier and deeper rate cuts, while the break of a chart bulwark turned the technical outlook bearish. Market pricing on rates had shifted sharply on Wednesday after data on Australian economic growth reduced hopes for a recovery, while showing an easing in wage and price pressures. The Reserve Bank of Australia meets next week and is still widely expected to hold rates at 4.35%, as it has done for the past year. Yet swaps now imply a 50% chance it will cut in February, up from 27% before the data.

AUD/USD is likely to trade with a downward bias below 0.6530 moving forward.

XAU

Gold prices dipped on Thursday as U.S. Treasury yields firmed after the release of weekly jobless claims data, while markets awaited U.S. non-farm payrolls figures for fresh insights into the Federal Reserve's stance on interest rate cuts. Traders are pricing in a 74% chance of a 25-basis-point cut at the Fed's Dec. 17-18 meeting. Bullion, which offers no yield, tends to perform well in low-interest-rate environments.

The precious metal should see some consolidation above technical support around 2560 for the time being.