Macro Update:

China’s Politburo pledges more stimulus for 2025

China’s top leaders released an unusually dovish statement yesterday with (1) the first major shift in monetary stance to “appropriately loose” from “prudent” since 2011; (2) the first time to call for “more proactive” fiscal policy since 2020; and (3) the first time to use the term “unconventional” countercyclical measures. The statement also mentioned expanding domestic demand more broadly and stabilising the property and stock markets.

The next to watch is the Central Economic Work Conference (likely to be held on 11-12 December) on the details of “forcefully boosting consumption “ or any sign of supply-side reform to curb overcapacity.

Main Upcoming Macro Indicators

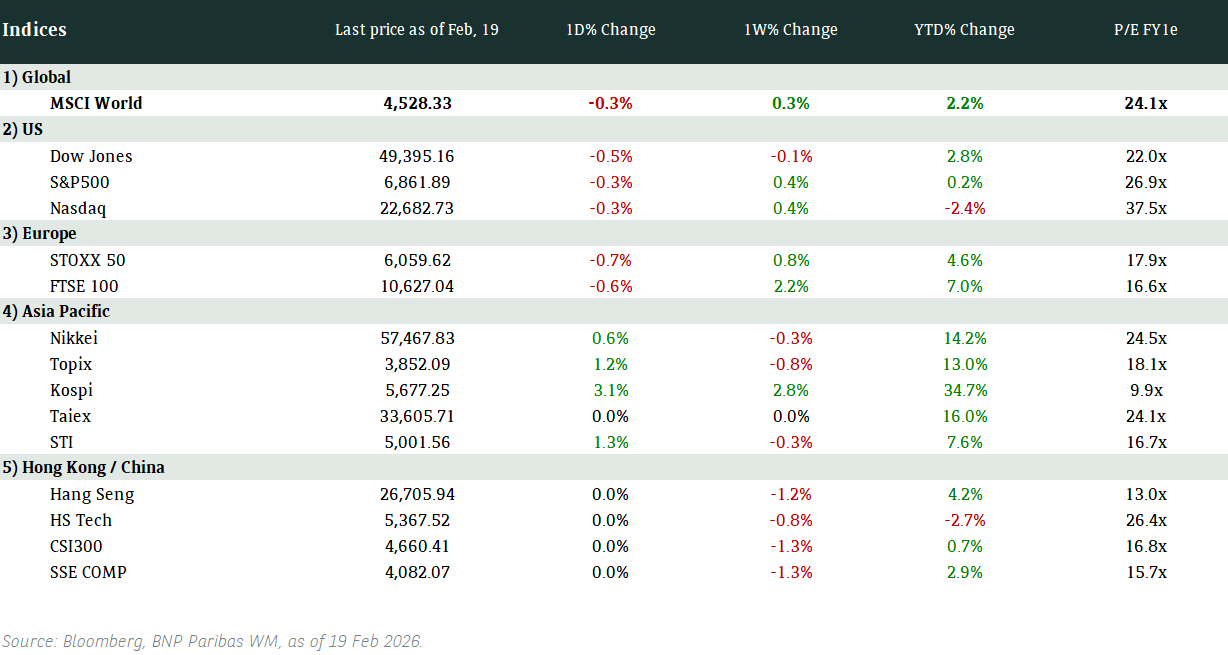

Equity Market Updates

US EQUITIES

Stocks in the US traded lower on Monday, fuelled by a decline in Nvidia, as investors looked ahead to a crucial inflation report this week.

EUROPE EQUITIES

European shares closed higher on Monday, led by mining and luxury stocks, following the optimism in Hong Kong / China.

HK EQUITIES

Hong Kong equities reversed losses to close more than 2% higher on Monday as hopes for further fiscal stimulus from China bolstered investor confidence, outweighing deflationary concerns.

Nvidia (NVDA US)

Shares of Nvidia fell on Monday following news that the company is being investigated by Chinese antitrust regulators, citing suspected violations of antimonopoly law.

Nvidia now finds itself on China’s crosshairs amid rising trade tensions between China and the US, especially after the latter recently ratcheted up controls on China's access to high-end semiconductors. This could potentially add volatility to Nvidia’s share price going forward. The company’s China revenue stands at USD13.5B in the past four quarters, accounting for around 12% of its global total.

MARKET CONSENSUS: 69 BUYS, 7 HOLDS, AVERAGE TP USD172.09

Oracle (ORCL US)

Shares of Oracle fell in after-market trading on Monday, paring earlier gains, after its FY2Q25 results failed to meet Wall Street’s elevated expectations, fuelled by optimism over deals with other cloud players as well as the general momentum in artificial intelligence.

The company’s FY2Q25 revenue stood at USD14.06B vs. USD14.12B expected, while adjusted EPS was at USD1.47 vs. USD1.48 expected.

Oracle’s pullback may be a healthy correction after its shares had rallied more than 70% so far this year.

MARKET CONSENSUS: 25 BUYS, 15 HOLDS, AVERAGE TP USD189.92

Allianz (ALV GY)

Allianz announced on Monday that it is modifying its payout policy to redistribute 75% of its net income to shareholders via dividends and share buy-backs over the next three years.

The German insurer explained that it will continue its dividend policy of paying out 60% of net profit directly. Additionally, the company plans to return at least 15% of net income to shareholders on average from 2025 to 2027. This is likely to be supportive for the company’s share price going forward.

MARKET CONSENSUS: 18 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP EUR317.27

Volkswagen (VOW3 GY)

Thousands of Volkswagen workers walked out on Monday in the second round of strikes amid the escalating conflict between unions and the company’s management over its drastic savings plans and plant closures. This could potentially inject volatility to Volkswagen’s share price in the near term.

The latest walkout is twice the length of the first “warning strike” organized by union IG Metall last week, involving a four-hour work stoppage at nine Volkswagen factories across Germany.

Pushback against Volkswagen’s cost saving plans also come from Germany’s political leadership, including Chancellor Olaf Scholz.

MARKET CONSENSUS: 14 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP EUR120.81

BYD (1211 HK)

The China Passenger Car Association (CPCA) recently released November vehicle sales data that showed further market share gains by BYD, putting the company on course to exceed its annual goal of four million units and overtake Ford and Honda in global sales, a sign that its rapid expansion this year is bearing fruit. This is likely to be supportive for BYD’s share price going forward.

The Chinese EV giant delivered 3.8M vehicles in the first 11 months of 2024, including 506,804 units sold in November. As of October, BYD’s share of the China auto market, which makes up more than 90% of its total sales, stood at 16.2%, up from 12.5% in 2023. By comparison, Volkswagen’s two joint ventures with Saic and FAW Group took a combined 12.5% market share in January to October, compared with 14.2% last year.

MARKET CONSENSUS: 34 BUYS, 4 HOLDS, AVERAGE TP HKD346.09

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Australia’s APRA confirmed that AT1 capital instruments of Australian banks will be phased out and largely replaced by Tier 2 bonds. The majority of future Tier 2 supply is likely to enter the AUD market, providing good buying opportunities for decent carry as the market digests a wave of new issues next year.

EUROPEAN BANK COCO (AT1)

The AT1 market opened the day 0.5 points higher, buoyed by stability in the rates markets and a small rally in equities. The macro dynamics continued to support AT1s, which closed broadly 0.125 to 0.25 points higher last Friday. French bank AT1s have yet to overcome their underperformance, despite a 10 basis point bounce in the spread difference between France’s OAT bonds and Germany’s Bund. Hedge funds and European investors showed the most demand last week, while flows from Asia and the US were more balanced. As a large number of AT1s are trading at their year-to-date spread tights, it is becoming less compelling to chase for now.

ASIA INVESTMENT GRADE (IG)

In China, IG spreads remained stable, with some widening of up to 1 basis point despite the firm rates rally. State-owned entities continued to attract strong market interest. Outside China, Korean IG opened slightly weaker, with selling observed in high-beta names like SK Hynix and LG Energy Solution. Some institutional accounts trimmed their positions in Korean bank bonds; however, bids remained aggressive as the market capitalized on any weakness to cover shorts.

ASIA HIGH YIELD (HY)

In China HY, buying activity improved following news from the Politburo meeting, with bonds generally rising by 0.375 to 0.5 points. Macau gaming names, including Studio City, Wynn Macau, and MGM China, saw increased buying, while Melco Resorts lagged. In Indian HY, the Adani complex traded 0.25 points lower due to profit-taking by institutional accounts amid slower overnight buying. Biocon Biologics continued to rally, gaining another 0.5 points, remaining strong despite some profit-taking.

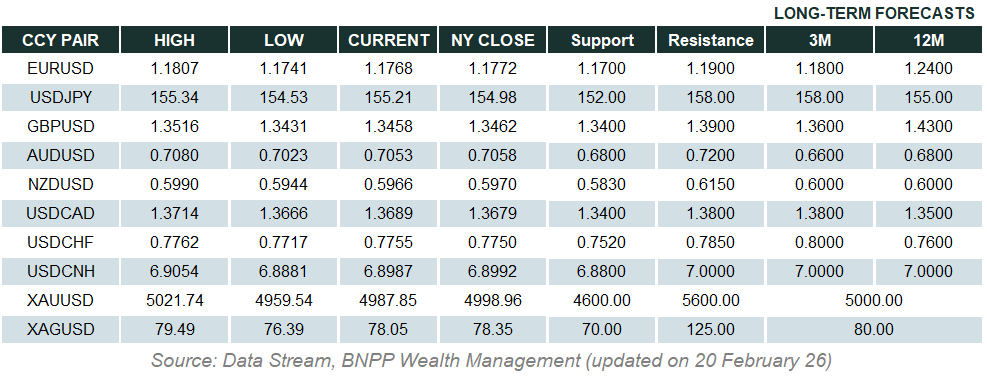

Forex Market Updates

The US Dollar rose as markets await inflation data and a possible rate cut. Markets expect a quarter-point reduction, with geopolitical concerns limiting USD movement.

USD

The US Dollar edged higher yesterday by 0.16% against a basket of other major currencies yesterday, as markets anticipate key US inflation data this week, which could influence Fed policy. Markets widely expect a quarter-point interest rate cut at next week’s Fed meeting, aligning with recent labour market trends showing easing conditions. President-elect Trump stated he would not seek to replace Fed Chair Powell, easing concerns over leadership changes at the central bank. Meanwhile, geopolitical developments and cautious sentiment ahead of significant economic releases kept the greenback's movements restrained.

The Dollar Index looks likely to be capped by technical resistance around 107.5 for now.

GBP

Sterling rose slightly on Monday, gaining around 0.05% against the dollar. Investors are eyeing key US inflation data and the ECB’s policy meeting this week, with a 25bps rate cut widely expected. However, domestic challenges weigh on the pound, with UK job vacancies at a four-year low and inflation remaining stubbornly high. The BoE is expected to keep rates unchanged on December 19. Despite recent volatility, sterling remains up 0.40% year-to-date, though sustained gains may face headwinds from the challenging macroeconomic backdrop.

Sterling looks to be on an uptrend, which could continue should BoE decide not to cut rates this week and we may see GBP test the resistance of 1.2900.

CNH

The Chinese Yuan strengthened by 0.23% against the US Dollar yesterday, following China’s decision to adopt an "appropriately loose" monetary policy for 2025. This marks the first easing in over a decade as authorities aim to boost economic growth. Despite ongoing deflationary pressures and US tariff threats, the yuan found support from stronger-than-expected PBOC midpoint fixings. The offshore yuan (CNH) traded at 7.2681 per dollar, reflecting renewed optimism in the market ahead of the Central Economic Work Conference, which will set qualitative economic goals for the coming year.

USDCNH should see some near term consolidation above technical support around 7.2291 moving forward.

XAU

Gold prices rose 1% on Monday, supported by China's central bank resuming gold purchases after a six-month pause and growing expectations of a Fed rate cut next week. Robust demand from central banks, including China's renewed buying in November, has been a key driver, alongside easing monetary policy. With geopolitical tensions persisting, gold is on track for a record year, up over 28%. Investors now await US CPI data on Wednesday, which could further shape the Fed's policy direction.

Bullion looks poised to remain well-supported above 2670 for the time being.