Macro Update:

President Xi pledges to remain global growth engine

President Xi's declaration that China will continue to serve as the world's largest engine of economic growth. His warning about the futility of tariff, trade and tech wars also underscores the importance of global economic cooperation. The market will undoubtedly keep a keen eye on any potential stimulus plans emerging from the annual Central Economic Work Conference taking place today and tomorrow.

On the other hand, it's noteworthy that the US Small Business Optimism Index has reached its highest level since June 2021. This reflects the positive sentiment among small businesses, likely buoyed by Trump's potential tax cuts and deregulatory measures. Given the valuation discounts of small- and mid-caps compared to their large-cap counterparts, we remain optimistic about their potential performance in the near term.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities closed lower on Tuesday, as technology sector losses offset gains in communications services, while investors continue to await key inflation reports this week.

EUROPE EQUITIES

European shares closed lower on Tuesday, taking a breather after its win streak last week, as investors await a policy decision by the ECB.

HK EQUITIES

Hong Kong stocks erased all its early-session gains to close lower on Tuesday as optimism over a potential policy shift from Beijing faded.

Investors now closely watch further developments from the Chinese Central Economic Work Conference this week.

General Motors (GM US)

General Motors announced on Tuesday that it will stop funding and exit robotaxi development at its majority-owned Cruise business, citing the considerable time and resources needed to scale the business, along with an increasingly competitive robotaxi market.

General Motors stated that it expects to lower its costs by more than USD1B a year once the restructuring is likely completed in 1H25. This could potentially be supportive for the company’s share price going forward.

MARKET CONSENSUS: 17 BUYS, 13 HOLDS, 2 SELLS, AVERAGE TP USD59.96

Intel (INTC US)

S&P Global Ratings on Tuesday downgraded Intel’s credit rating to “BBB” from “BBB+” on slow business recovery and uncertainty following management changes. This is likely to negatively impact investor sentiment on the company’s shares in the near term.

S&P Global also mentioned that the departure of CEO Pat Gelsinger, who was critical to the Intel's integrated manufacturing strategy, adds uncertainty to the execution of the company's turnaround plan.

Nevertheless, the Intel’s outlook is kept at “stable” by S&P Global, reflecting its view that Intel will experience growth after a modest recovery next year.

MARKET CONSENSUS: 7 BUYS, 37 HOLDS, 8 SELLS, AVERAGE TP USD24.4

Walgreens (WBA US)

Walgreens on Tuesday is reportedly in talks to sell itself to private equity firm Sycamore Partners, taking the company’s shares off the public market after its price experienced a nearly decade-long downward slide. Walgreen’s shares surged more than 17% on Tuesday.

Walgreens's market value reached a peak of over $100 billion in 2015 but had since shrunk to around $7.5 billion as of Monday. Mounting pressures on both its pharmacy and retail businesses had helped send its shares down nearly 70% so far this year.

The Walgreens-Sycamore deal is expected to close in early 2025.

MARKET CONSENSUS: 3 BUYS, 12 HOLDS, 3 SELLS, AVERAGE TP USD10.57

TeamViewer (TMV GY)

German software company TeamViewer has signed a deal to acquire London-based IT firm 1E on Tuesday for USD720M, potentially better positioning the company in the digital workplace market.

1E develops products that detect IT issues, with Adidas and AT&T among those listed as customers on its website.

Teamviewer, which signed the deal with Carlyle Europe Technology Partners, part of Carlyle, said it expects the transaction to close early next year. The company also expects 1E to contribute around EUR10M in 2026 and EUR25M in the year after.

MARKET CONSENSUS: 10 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP EUR15.72

Stellantis (STLAP FP)

Stellantis and Chinese vehicle battery maker Contemporary Amperex Technology (CATL) announced on Tuesday that, as part of their previously signed non-binding memorandum of understanding, they agreed to build a lithium iron phosphate battery plant in Zaragoza, Spain, a likely sign of Stellantis’ intent to further its position in the electric vehicle space.

The proposed facility aims to achieve an annual production capacity of 50 gigawatt-hours and is scheduled to commence operations by the end of 2026. The completion of this transaction is anticipated in 2025, contingent upon meeting standard regulatory requirements.

MARKET CONSENSUS: 13 BUYS, 18 HOLDS, 3 SELLS, AVERAGE TP EUR14.54

Earnings Announcements

US Market

-

European Market

Carl Zeiss Meditec, TUI AG

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

The 10-year Treasury yield is expected to remain range-bound between 4.1% and 4.2% ahead of the upcoming FOMC meeting. A surprising US CPI print on Wednesday could temporarily break this range, prompting portfolio rebalancing and a reduction in long-dated bonds. For now, we prefer buying investment-grade bonds with maturities of five years or less for carry.

EUROPEAN BANK COCO (AT1)

The AT1 market opened unchanged, maintaining a constructive tone after last week’s strong performance, with many AT1 bonds rallying by 1.5 points. Some consolidation occurred in recent AT1 issues and long call date ones as rates rose but buying of AT1s with short call dates continued for carry plays. Market participants expect AT1s to grind higher into year-end, potentially paving the way for a positive reception of new issues in January.

ASIA INVESTMENT GRADE (IG)

In China, IG spreads tightened by 2 to 3 basis points, fueled by risk-on sentiment toward China-themed assets. State-owned enterprise bonds were stable, with front-end curve demand amid higher US Treasury yields. Asset management companies saw interest in their 1 to 3-year paper. In Korea, IG spreads remained unchanged, while perpetual bonds rose by 0.125 points due to passive institutional buying. In Southeast Asia, IG bond spreads tightened by 1 to 2 basis points after overnight buying from US institutional accounts.

ASIA HIGH YIELD (HY)

In China HY market, benchmark names increased by 0.25 to 0.75 points, but buying interest was limited due to market fatigue over financial stimulus announcements. The Macau gaming sector saw tighter spreads, with cash prices up by 0.125 to 0.25 points amid ongoing US investor interest. Outside China, Indian HY Continuum Green bonds rose by 0.25 points, largely priced in due to the IPO application. The Adani complex continued to face selling pressure from Asian institutional accounts, albeit at a reduced size compared to the previous day.

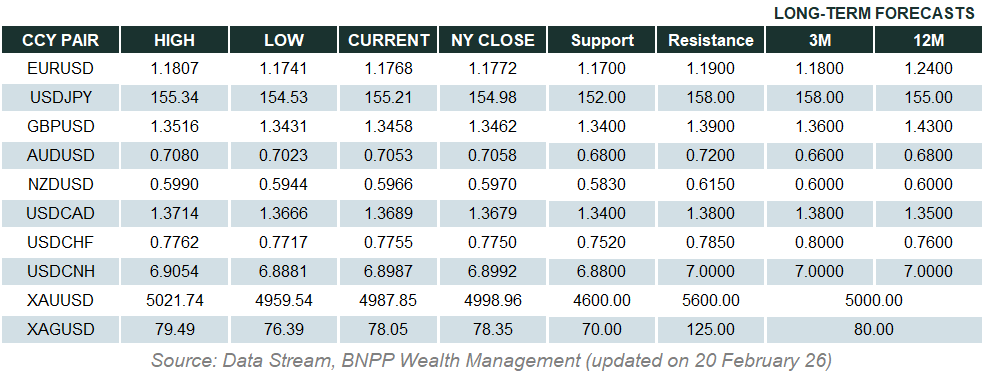

Forex Market Updates

The US Dollar rose on Tuesday ahead of key readings of US inflation before next week’s FOMC meeting.

USD

The US Dollar strengthened for the third straight session ahead of key US inflation data due today and tomorrow that should offer clues about the Fed’s monetary policy path even as markets continue to assess the likely impact of incoming US President Trump’s policies when his second term begins in January. Money markets are currently pricing in an 86% chance of a 25bps cut by the Fed next week, and some analysts say that yesterday’s downward revisions to US labour cost data bode well for the inflation outlook even though price increases have not moderated much in recent months, with the central bank likely to welcome further signs of slowing wage growth.

The Dollar Index looks poised to stay well supported above 105.50 moving forward.

GBP

The British Pound saw modest gains against the USD yesterday while rising to its highest level in more than 2.5 months against the Euro with markets expecting the BoE to keep interest rates unchanged at its policy meeting next week. BoE Governor Bailey was quoted as saying that the central bank has incorporated four rate cuts in 2025 into its most recent economic forecasts. Elsewhere, BoE official Greene argued that US tariffs are expected to hurt the Eurozone but the impact on the UK economy remains unclear, while UK PM Starmer said that he wants Britain to become the fastest-growing economy in the G7.

Sterling’s recent recovery from six-month lows could run into some resistance around the 1.2800 handle.

AUD

The Australian Dollar took a dive on Tuesday after the RBA sounded more dovish on the outlook for interest rates, sparking a rally in bonds as markets increased wagers on the prospect of an earlier easing in monetary policy. While the central bank kept rates on hold at 4.35% at yesterday’s meeting, it dropped a previous reference for policy needing to stay restrictive and noted that recent data had given policymakers “some confidence” that inflation was heading back towards its 2-3% target band.

The Aussie is likely to see more near term downside towards the 2024 low of 0.6350.

XAU

Gold prices advanced to two-week highs yesterday, underpinned by heightened geopolitical tensions out of the Middle East and growing expectations of a third rate cut by the Fed next week as the market’s gaze shifted to tonight’s crucial US inflation data. Analysts say that the appeal of bullion is further enhanced by expectations of rate cuts by other major central banks, with the BoC, SNB and ECB all likely to ease this week as well. Elsewhere, silver also gained 0.7% overnight, staying within the ballpark of one-month highs.

Gold bulls could target a breakout above the 2700 handle as momentum builds ahead of next week’s FOMC meeting.