Macro Update:

CEWC sets a pro-growth tone but no bazooka

China concluded the much-awaited annual Central Economic Working Conference (CEWC) yesterday, aiming to stabilise growth with a modest fiscal and monetary easing package in 2025. The decision to increase pension payouts could mark a step in the right direction to support consumption. That said, we expect the overall improvement will likely be moderate. We also expect a 40bp cut in the policy rate and a 100bp cut in RRR next year.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks pulled back on Thursday as investors evaluated key economic indicators ahead of the Fed’s policy meeting next week.

EUROPE EQUITIES

Shares in Europe closed lower on Thursday despite the ECB cutting interest rates by 25bps and left the door open for further easing to support the region’s struggling economy.

HK EQUITIES

Hong Kong stocks rose on Thursday on expectations of China's further supportive measures.

The US’ in-line inflation figures from two days ago also supported sentiment.

Broadcom (AVGO US)

Shares of Broadcom surged in aftermarket trading on Thursday as it forecasts a boom in demand for its AI chips. The positive sentiment on the stock is likely to continue in the near to medium term.

Sales of the company’s AI products is expected to rise by around 65% in 1Q25, far faster than its overall semiconductor growth, which is expected to be at around 10%. The chipmaker also predicted that the addressable market for AI components that it designs for data centre operators would reach as high as USD90B by 2027.

Adding to the optimism, Broadcom posted 4Q24 earnings that beat Wall Street estimates, with adjusted EPS at USD1.42 vs, USD1.39 expected. Revenue stood at USD14.05B vs. USD14.08B expected.

MARKET CONSENSUS: 42 BUYS, 5 HOLDS, 1 SELL, AVERAGE TP USD197.96

Costco (COST US)

Costco on Thursday reported FY1Q25 profit that beat estimates with adjusted EPS at USD4.04 vs. USD3.81 expected. The company also reported more members during the quarter, with about 90% of existing members renewing their service.

The results reinforce Costco’s unique position among retailers as its affluent customer base, which is willing to pay an annual membership, helps insulate the company from tighter consumer spending. This is likely supportive for the company’s share price in the long term.

MARKET CONSENSUS: 26 BUYS, 17 HOLDS, 1 SELL, AVERAGE TP USD975.17

Blackstone (BX US)

Blackstone announced on Thursday that it is buying a mixed-use office complex in Tokyo from Seibu Holdings for USD2.6B in the largest-ever real estate acquisition by a foreign fund in Japan, providing further evidence to the rising interest of global investors in the Japanese real estate market, fuelled by the cheap JPY and low borrowing costs. This is likely to continue in the near term.

Blackstone specifically plans to invest a few billion JPY into the Tokyo complex to refurbish or renew certain facilities in the coming years. The transaction is expected to close in February 2025.

MARKET CONSENSUS: 8 BUYS, 15 HOLDS, 3 SELLS, AVERAGE TP USD174.39

Boeing (BA US)

Boeing announced on Thursday that it plans to spend USD1B to support increased production of its 787 Dreamliner widebody jets as the US planemaker works to meet an earlier output target of 10 a month by 2026.

Boeing specifically plans to expand operations at its Charleston County, South Carolina, facility with the USD1B investment in infrastructure upgrades and the creation of 500 new jobs over five years.

MARKET CONSENSUS: 18 BUYS, 13 HOLDS, 2 SELLS, AVERAGE TP USD181.8

STMicroelectronics (STMPA FP)

STMicroelectronics and quantum computing startup Quobly announced on Thursday that they are collaborating to produce quantum computing processor units at scale. This could potentially give STMicroelectronics a crucial head start in this emerging technology, supporting share price in the long term.

Although specific financial terms were not disclosed, both STMicroelectronics and Quobly stated that they “aim to achieve a breakthrough in quantum computing” by working together to reduce R&D development costs and meet demand for affordable quantum computing processors.

MARKET CONSENSUS: 15 BUYS, 10 HOLDS, 1 SELL, AVERAGE TP EUR29.68

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

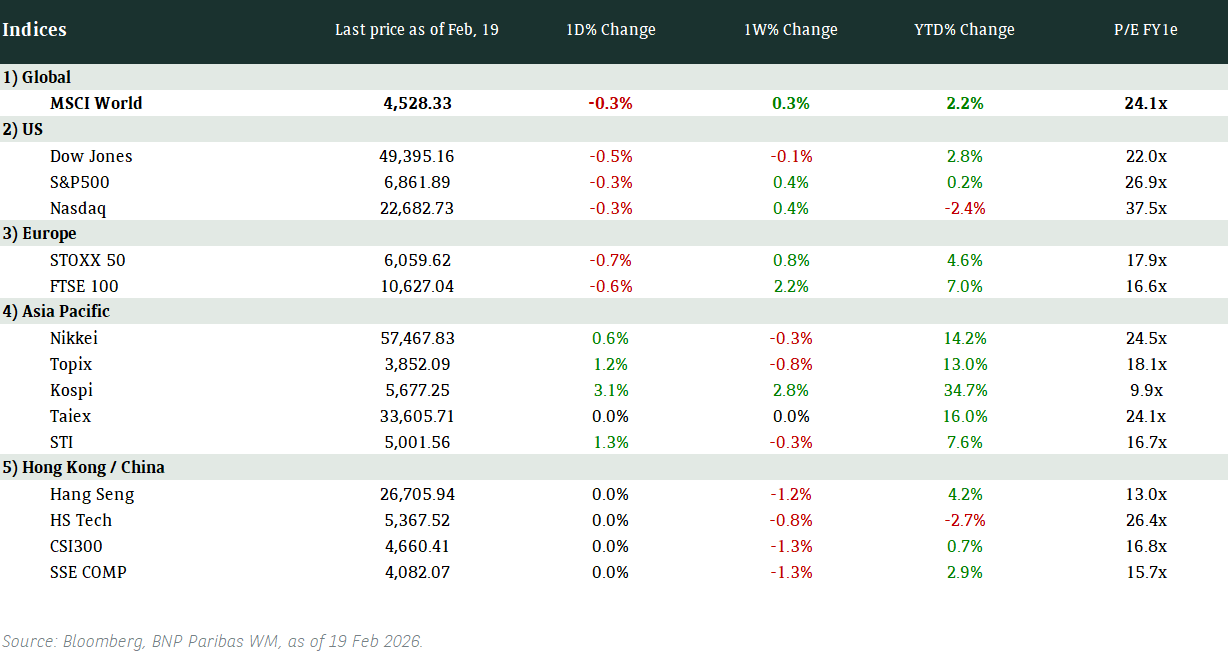

Global Indices Changes (%)

Fixed Income Market Updates

S&P affirmed Nippon Life’s A+ rating with stable outlook on expectation that Nippon Life will likely maintain a solid capital base, even after the acquisition of Resolution Life. We view Japanese Insurers favourably and are comfortable going down the capital structure for yield pickup for some of them.

EUROPEAN BANK COCO (AT1)

European AT1 space closed slightly lower in general as the weakness in Bunds affected risk sentiment. Flows were skewed towards selling as the day progressed compared to more two-ways in the morning. Volumes were lower than average as some market participants had closed for the year. We do not think valuations in the AT1 space are favourable, and will look to add selectively in French names after further correction, pending results of the political drama in France.

ASIA INVESTMENT GRADE (IG)

Moody's downgraded LG Chem from A3 to Baa1, with outlook maintained on negative. We have been neutral in the Korea IG space as we view valuations as too tight. In South-East Asia space, spreads were unchanged to 3bps tighter in general with better buying in Singapore from asset managers. Buying returned in Chinese technology, media and telecom space with Alibaba bonds sought after. This sector closed around 2bps tighter in general. We view this sector favourably, especially names which generates most of its revenue domestically.

ASIA HIGH YIELD (HY)

It was a slower day in China HY space as investors were waiting for clearer signals from Beijing. Vanke and Longfor had some small interest from hedge funds while there were some profit-taking in Fortune Star bonds. West China Cement's bond was well supported. Outside of China, Greenko was the most actively traded name in the India HY space. Vedanta 2026 and 2031 bonds were well-supported as well, with steady buying interest. Sentiment stayed firm but buying was selective.

Forex Market Updates

The US Dollar rose yesterday, driven by solid expectations for a Fed rate cut, despite labour market cooling and inflation challenges.

USD.

The US Dollar rose by 0.33% on Thursday, as markets solidified expectations of a Fed rate cut next week. November’s CPI rose 0.3%, aligning with forecasts, boosting the probability of a 25bps cut to near 100%, per the CME FedWatch tool. Jobless claims unexpectedly rose to 242,000 last week, reflecting labour market cooling amid holiday-induced volatility. Continued claims also climbed, suggesting prolonged unemployment for some Americans. Despite the easing labour market, the Fed’s benchmark rate remains elevated, highlighting persistent challenges in achieving its 2% inflation target.

The Dollar Index is likely to remain well supported above 105.50 in the near term.

AUD

The Australian Dollar dwindled by 0.12% following a sharp drop in unemployment to 3.9% in November, the lowest in eight months. Employment rose by 35,600, exceeding forecasts of 25,000, signalling continued labour market resilience. This unexpected strength reduced market expectations for a February rate cut by the RBA, with markets now pricing in a 55% chance, down from 68%. Bond yields climbed, but the dovish tone from the RBA earlier this week remains a moderating factor. Analysts highlight that December’s employment data releasing in January 16 and Q4 CPI will be crucial for policy direction.

The Aussie is likely to see more near term downside towards the 2024 low of 0.6350.

EUR

The Euro sank 0.24% after the ECB cut its deposit rate to 3% yesterday, marking its fourth reduction this year. The move was driven by fading inflation concerns and sluggish growth, signalling a shift toward neutral policy settings. The ECB hinted at further rate cuts, with policymakers estimating neutrality at 2% to 2.5%. Persistent domestic inflation and political instability in Europe, coupled with looming US trade tensions, weighed on the growth outlook. Markets now anticipate additional easing in 2025, as highlighted by President Lagarde’s cautious guidance.

EUR/USD is likely to trade with a downward bias below 1.0580 moving forward.

XAU

Gold eased nearly 1.4% yesterday, retreating from a five-week peak as risk appetite improved ahead of the European Central Bank's rate decision and U.S. PPI data. Earlier gains were fuelled by expectations of a Federal Reserve rate cut next week after U.S. CPI data showed a 0.3% rise in November, the largest since April. Support for bullion remains firm around $2,700, with resistance near $2,726. The ECB is expected to signal further easing in 2025, while geopolitical tensions continue to highlight gold’s role as a safe-haven asset.

The precious metal should see some consolidation above technical support around 2560 for the time being.