Macro Update:

US manufacturing PMI rises to 9-month high

The US ISM manufacturing PMI rose to a 9-month high of 49.3 in December with new orders accelerating to a 12-month high of 52.5. Market will focus on the non-farm payroll data this Friday with our estimates of 165k new employment in December. We expect US growth to remain resilient in 1H and a slower growth in 2H. Our forecast for 2025 GDP growth is 2.1%, down from 2.8% (estimate) in 2024.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities rebounded on Friday, led by the technology sector, as it ended its 5-day losing streak.

This is supportive of our view that momentum for US equities remain robust in the medium term.

EUROPE EQUITIES

Shares in Europe ended lower on Friday, with heavyweight luxury firms and spirits makers leading losses, as investors continue to look to economic data for more clues on the region’s interest rate trajectory.

HK EQUITIES

Stocks in Hong Kong rebounded on Friday as Chinese regulators ramped up support for institutional buying to shore up sentiment and rebuild investor confidence.

Microsoft (MSFT US)

Microsoft on Friday announced that the company plans to commit around USD80B in AI data centres in FY2025, with half of the total spending to be placed in the US.

This could potentially be a sign that momentum is building around another strong wave of AI data centre spending this year, which is will likely be supportive for companies that help either host or power these facilities, similar to what happened throughout 2024.

MARKET CONSENSUS: 63 BUYS, 5 HOLDS, AVERAGE TP USD503.51

United States Steel (X US)

US president Joe Biden on Friday had reportedly decided to block the sale of United States Steel to Japan’s Nippon Steel, ending a potential USD14.1B deal that has faced months of vocal opposition, even after Nippon Steel recently tried to appease the White House by allowing the government to have the final say when it comes to US Steel's production capacity.

The move could adversely impact both companies as Nippon Steel will now have to seek alternative sources of growth, while US still will have to restart its sale process and find another buyer.

MARKET CONSENSUS: 7 BUYS, 3 HOLDS, AVERAGE TP USD39.71

United Airlines (UAL US)

United Airlines announced on Sunday that it expects to begin testing Starlink for in-flight internet services in February, being the first to offer the connectivity on a commercial flight.

If successful, this initiative could provide a temporary edge to United Airlines’ services as peers try to catch up, supporting share price in the near term.

MARKET CONSENSUS: 22 BUYS, 1 HOLD, 1 SELL, AVERAGE TP USD109.21

Toyota Motor (7203 JP)

Toyota revealed on Friday that its 2024 US sales rose 3.7% YoY to around 2.33M vehicles, helped by higher demand for its hybrid vehicles. This shows that momentum remains strong for the Japanese carmaker, which should be supportive for its share price going forward.

Despite the annual sales rise, 4Q24 US sales dropped 2.7% YoY to 603,104 vehicles.

MARKET CONSENSUS: 17 BUYS, 7 HOLDS, AVERAGE TP JPY3214.12

Hyundai Motor (005380 KS)

South Korea’s Hyundai Motor and affiliate Kia on Friday reported a dip in 2024 sales and missed their targets.

The automakers, which together rank third in global vehicle sales, sold 7.23M vehicles in 2024, slipping 1% from 2023 as solid US sales were offset by sluggish demand in Europe and their home market.

The two carmakers are now bracing for the slowing economy and political uncertainties in the US and South Korea that threaten to dampen demand, potentially hurting their bottom-line in going forward. Nevertheless, both still expect to grow their combined global sales by 2% to 7.39M vehicles in 2025..

MARKET CONSENSUS: 34 BUYS, AVERAGE TP KRW319360

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

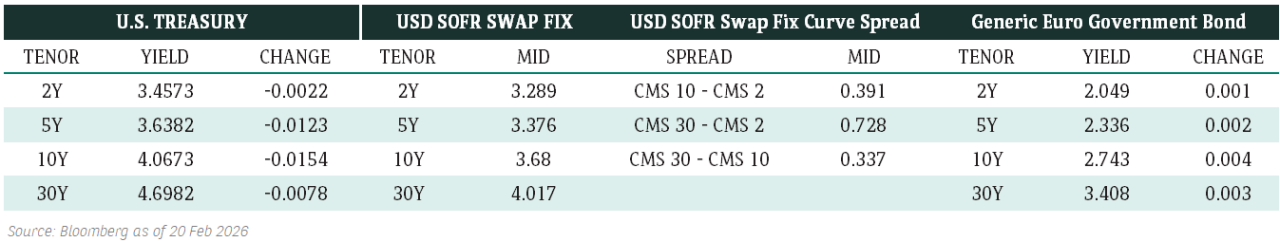

Fixed Income Market Updates

Investors are currently on the sidelines, preparing for their war chest for the anticipated surge in new issue supplies in the coming weeks. The bond market is likely to remain volatile due to concerns over rate instability and increased supply, offering favourable entry points for high-quality issuers.

EUROPEAN BANK COCO (AT1)

The AT1 market opened steady, with prices slightly lower by 0.25 points. There was decent demand from Asian investors, but full activity is expected to resume this week as more market participants return to the office. The correlation between AT1s and rate movements has weakened compared to last year, although there is noticeable softness in non-callable 10-year AT1 papers.

ASIA INVESTMENT GRADE (IG)

In China IG, activity was still subdued with many investors on holiday. Most investors remained cautious, anticipating significant new issue supplies this week. Trading has been primarily driven by yield-focused players, such as banks and insurance companies, resulting spreads tightening by 3 basis points on average. Outside China, Korean IG saw increased buying from global institutional accounts and onshore investors, particularly in 2 to 5-year senior financial papers with wider spreads.

ASIA HIGH YIELD (HY)

In China HY, property sector names remained firm, although Fosun experienced mixed flows among hedge funds. The Macau gaming sector improved by 0.125 to 0.5 points over two trading days, with better bidding from institutional accounts at the front end, while ETFs were net sellers of longer maturities amid rate instability. In Indian HY, selling pressure was observed in renewable names like Greenko Energy and ReNew Power, but this was quickly absorbed. The Adani complex remained robust, supported by private wealth accounts and hedge funds.

Forex Market Updates

The US Dollar gave back a bit of the previous day's gains but still managed to record a strong close to the week as markets expect a slower pace of interest rate cuts in 2025.

USD

The US Dollar dipped on Friday but was on track for its strongest weekly performance in a month on expectations that the U.S. economy will continue to outperform its peers globally this year and that U.S. interest rates will stay relatively higher. A still solid labor market and stubbornly high inflation have lifted Treasury yields in recent weeks and boosted demand for the U.S. currency. New policies under the incoming Donald Trump administration, including business deregulation, tax cuts, curbs on illegal immigration and tariffs, are also expected to boost growth and add to price pressures.

The Dollar Index is likely to remain well supported above 108.00 for the time being.

CNY

The Chinese Yuan slid past the key 7.3 threshold to a 14-month low against the dollar on Friday, as crumbling yields, rate cut expectations and the threat of tariffs from the incoming Trump administration dented sentiment. The spot yuan capped a fourth straight weekly loss in a stumbling start to the new year after shedding 2.8% in 2024. Worries about the Chinese economy carried into the new year, with stocks plunging nearly 3% on Thursday, the first day of trading in 2025.

The Renminbi could see more near term weakness against the USD, although strong resistance is expected around the 7.4000 handle.

GBP

The British Pound struggled to rebound against the dollar on Friday and was on track for its worst week since November, while new data added to indications of a slowing British economy. A souring outlook for the British economy, coupled with a more dovish signals from the Bank of England (BoE), has taken another chip off the pound, despite being last year's best performing G10 currency against the greenback. Markets still only price in about 60 basis points in rate cuts from the BoE this year, while it sees the European Central Bank easing rates with more than 100 bps.

Sterling looks to be approaching the previous year's low of 1.2296 which should find some support.

XAU

Gold retreated from a three-week high on Friday, pressured by a robust dollar, while markets braced for potential economic and trade shifts under U.S. President-elect Donald Trump. The new president's agenda that supports higher tariffs has boosted the dollar and created significant underlying pressure on metal markets. For most of the metals, the slowing of global trade has typically been coupled with a slowing economy and therefore slowing demand for metals. A headwind from a stronger dollar is likely to persist for gold, but it looks like debt will continue rising in the U.S. and other countries, and geopolitical issues aren't going to end soon, so it should stay supported.

The precious metal should see more near term consolidation around 2660.