Macro Update:

Cooler than expected US core inflation improves sentiment

Core inflation in the US eased more than expected to 3.2% annually and 0.2% monthly. The data provided some reassurance regarding price pressures in the economy, though inflation remains elevated as headline CPI rose (within expectation) to a 5-month high of 2.9% in December. Sentiment improved, as expectations for the Fed to cut rates increased. US equities posted their largest gains in over two months, reinforced by the cooler inflation, decline in bond yields and also strong bank earnings. We continue to see 2 Fed cuts for 2025, which should bring us to a terminal rate of 4%.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks rose sharply on Wednesday as cooler-than-expected inflation data and solid earnings from banks revived investor sentiment.

We remain constructive on US financials.

EUROPE EQUITIES

Stocks in Europe also logged solid gains on Wednesday, helped by the upbeat mood in the US.

HK EQUITIES

Stocks in Hong Kong edged higher on Wednesday as investors look forward to key economic data from the US and China this week.

JPMorgan Chase (JPM US)

JPMorgan on Wednesday posted 4Q24 results that easily beat Wall Street expectations with revenue at USD43.7B vs. USD42.0B expected, and net income at USD13.7B vs. USD11.7B expected, which soared by more than 50% YoY.

The US banking giant’s 4Q24 results beat can mostly be attributed to its traders, as they had their biggest fourth quarter haul ever, boosted by volatility tied to last year’s US elections. Trading revenue rose 21% YoY to around USD7.1B.

JPMorgan’s announcement yesterday stoked optimism around the US’ banking industry, which should be supportive for the share prices of major players in the near term.

MARKET CONSENSUS: 17 BUYS, 9 HOLDS, 2 SELLS, AVERAGE TP USD261.73

Goldman Sachs (GS US)

Much like rival JPMorgan, Goldman Sachs also announced solid beats for its 4Q24 results on Wednesday, helped by a USD472M boost from “historical principal investments” , a revenue source it has recently been trying to wind down, which included a big gain in equity bets tied to the firm’s own balance sheet.

Goldman Sachs’ 4Q24 revenue stood at USD11.9B vs. USD8.2B expected, with net income at USD3.92B vs. USD2.71B expected.

The company’s shares rose more than 6% in yesterday’s session.

MARKET CONSENSUS: 17 BUYS, 9 HOLDS, 1 SELL, AVERAGE TP USD625.39

Citigroup (C US)

Shares of Citigroup rose by more than 6% on Wednesday after it reported beats in tis 4Q24 earnings and authorised the repurchase of USD20B in common stock.

The bank’s 4Q24 adjusted net income came in at USD2.62B vs. USD2.35B expected, while revenue stood at USD19.6B, in line with estimates. The bottom-line beat was helped by a 18% YoY decline in operating expenses, a sign that the company’s organisational restructuring is going well, likely providing support to its share price going forward.

Citigroup now expectes 2025 revenues to rise to USD83.5B to USD84.5B, higher than Wall Street estimates.

MARKET CONSENSUS: 17 BUYS, 6 HOLDS, AVERAGE TP USD84.03

Nokia (NOKIA FH)

Nokia signed a licensing deal on Wednesday that allows its video technologies to be used in Samsung televisions, which could support the company’s top line going forward.

The multi-year patent license agreement will see the South Korean technology giant make royalty payments to Nokia for using the technology.

The terms of the agreement were not disclosed, but Nokia said it is separate from an existing 5G patent license agreement between the companies. The company also said that over the past 25 years, it has created almost 5,000 inventions that enable multimedia products and services.

MARKET CONSENSUS: 15 BUYS, 11 HOLDS, 4 SELLS, AVERAGE TP EUR4.47

BYD (1211 HK)

China’s largest EV manufacturer BYD announced on Wednesday a strategic cooperation with Southeast Asian mobility platform, Grab.

Under the agreement, Grab drivers will be able to use up to 50,000 BYD EVs in Southeast Asia. For Grab, the collaboration will enable its drivers to not only rent BYD EVs from Grab's fleet partners at grossly competitive rates, but also receive financing through Grab's car ownership program and an extended battery warranty.

The collaboration could be supportive for both companies’ top line and thus share price going forward.

MARKET CONSENSUS: 36 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP HKD344.09

Earnings Announcements

US Market

US Bancorp, UnitedHealth, Bank of America, Morgan Stanley

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Rates volatility has picked up, presenting favourable opportunities in structured products. Also, with US Treasury yields hitting levels not seen since November 2023 , it’s a good opportunity to extend duration to 10-year.

EUROPEAN BANK COCO (AT1)

It was risk-on after CPI data and European banks AT1 space was up 1-1.5point in general. GBP-denominated AT1 bonds outperformed the other currencies following UK inflation data and Gilts rally. United Kingdom banks' AT1 bonds saw demand across currencies. High beta high yielding names such as Deutsche Bank and Societe Generale were more than 1point higher overall. It was an active day with flows skewed to buying.

ASIA INVESTMENT GRADE (IG)

Activity in the Asia IG space was largely centered around new issues. Great Eastern perpetual bond dropped around 1point from reoffer as it printed very tight with not much relative value. Tata Capital traded around 1bps wider from reoffer. Sentiment was rather cautious in Asia hours pending the release of CPI data. Overall trading volume was below average. In China IG space, demand was seen in front-end banks seniors while 5yr and longer tenor bonds saw more selling. However, in our opinion, with where 10-year US Treasury yield is, we would be looking for opportunities to extend duration to 10-year in solid IG names.

ASIA HIGH YIELD (HY)

Sentiment remains weak in China HY space. Vanke's onshore bonds fell (again) which dragged its offshore bonds lower as well. Vanke's offshore bonds were down 4-8points with the front-end underperforming. The rest of the survivors in the real estate space were marked 0.5-2points lower as a result. Outside of China, Vedanta's new issues opened strong but saw profit takers. Overall in India HY space it was 0.125-0.25point lower with asset managers trimming risk.

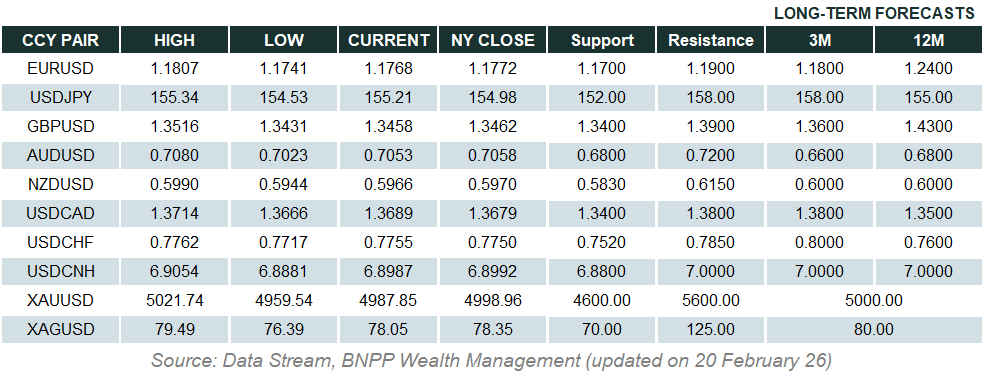

Forex Market Updates

The US Dollar fell on Tuesday while the Japanese Yen outperformed on hawkish comments by BoJ Governor Ueda.

USD

The US Dollar weakened against a basket of its major peers for the second consecutive day after the core component of US CPI data came in below expectations. Consumer prices in the world’s largest economy for the month of December, however, were higher than the previous month’s readings, pointing to still elevated inflation. With the US economy showing signs of resilience, markets expect price pressures to heat up again thanks to election pledges by US President Trump to impose broad tariffs on imported goods, carry out mass deportations of undocumented immigrants and implement tax cuts. As such, some analysts are anticipating no Fed cuts in the first half of 2025 as the central bank assesses the economic impact of the abovementioned policies.

Despite yesterday’s losses, the near term outlook for the Dollar Index remains bullish, with technical support around 107.88.

GBP

The British Pound traded on the front foot on Wednesday despite data showing that UK inflation slowed last month while core measures of price growth fell even more sharply. The cooler-than-expected inflation print saw Gilt yields fall, helping Sterling stage a tentative recovery from the recent selloff that was sparked by a spike in Gilt yields due to concerns over the Britain’s fiscal outlook. Markets currently see an 80% chance of a 25bps rate cut at the BoE’s next meeting in early February, up from around 60% before the data, and analysts say that UK price inflation is likely to “normalize to more target-consistent levels” in the year ahead.

Sterling bulls could attempt another near term push higher towards immediate resistance around 1.2360.

JPY

The Japanese Yen was yesterday’s best G7 performer after BoJ Governor Ueda echoed comments made by his deputy on Tuesday, stating that the central bank will debate whether to raise interest rates next week. Ueda also said that the economic policy of the incoming Trump administration and momentum of this year’s spring wage negotiations in Japan are key in deciding the timing of rate hikes, while highlighting that there has been “positive talk on the wage outlook” recently. Elsewhere, Japanese Fin. Min. Kato reiterated that Tokyo would take appropriate action against excessive exchange rate movements with the JPY expected to experience high volatility heading into next week’s BoJ meeting.

USDJPY could see a break below the 156.00 handle before the end of the week should BoJ rate hike talk continue to gain momentum.

XAU

Gold prices advanced to within touching distance of the 2700 handle in the face of broad USD weakness after the release of US CPI data, although there was little change to market expectations that the Fed’s first rate cut of this year will only happen in 2H2025. While analysts do not expect a repeat of the precious metal’s stellar 2024 performance, uncertainties around Trump’s tariff policies and their potential impact on global growth, as well as ongoing geopolitical tensions, are likely to sustain safe haven demand for bullion moving forward.

The precious metal is likely to be well supported above 2600 in the near term.