Macro Update:

Softer data fuelled hopes for more Fed cuts

Retail sales rose only 0.4% in December 2024, the smallest increase in four months and below expectations, while jobless claims rebounded more than anticipated in early January 2025. These data, alongside easing inflation pressures, prompting markets to reconsider the number of rate cuts later this year. The 10-year US Treasury yield fell to 4.62%, dropping 20 basis points since Monday’s 14-month high. In terms of policy, we continue to see 2 cuts of 25bps by the Fed for 2025, with terminal rate at 4%.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks eased on Thursday as the market cools after the sharp jump in the session prior. Investors are now positioning themselves as the 4Q24 results season starts to pick up.

We still see positive momentum in the US continuing in the medium term.

EUROPE EQUITIES

European shares rose on Thursday, boosted by luxury and semiconductor stocks on the back of an upbeat start to the 4Q24 earnings season.

HK EQUITIES

Stocks in Hong Kong rose on rekindled hopes of US rate cuts and further easing measures from China in the coming weeks.

Morgan Stanley (MS US)

Like its peers a day prior, Morgan Stanley on Thursday reported a strong 4Q24 results beat, driven by accelerated growth in its investment banking, as well as fixed income and equity units. This provides further evidence of a healthy US financial sector, which should provide support to the share prices of its members going forward

Morgan Stanley’s 4Q24 revenues stood at USD16.2B vs. USD15.1B expected, while net income came in at USD3.56B vs. USD2.76B expected.

MARKET CONSENSUS: 7 BUYS, 17 HOLDS, 1 SELL, AVERAGE TP USD132.76

Bank of America (BAC US)

Bank of America, the US’ second largest lender, also reported solid beats in its 4Q24 results on Thursday, driven by high investment banking fees and strong net interest income. 4Q24 Revenue stood at USD25.5B vs. USD25.2B expected, while net income came in at USD6.4B vs. USD6.0B expected.

The bank’s investment banking fees jumped 43% YoY to USD1.69B, reaching its highest level in three years, with net interest income also up around 3% to USD14.4B, beating forecasts.

Looking ahead, Bank of America signalled more growth for key metrics including net interest income, which should be supportive for Bank of America’s share price going forward.

MARKET CONSENSUS: 21 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP USD51.5

Nintendo (7974 JP)

Nintendo on Thursday unveiled its next console, the Switch 2, which will function similarly to the original Switch as a hybrid portable and console device.

The announcement lacked details, such as a specific release date, with more information to be revealed on a showcase on 2 April 2025.

Looking ahead, the exclusive games are key to watch for the success of Switch 2, although Nintendo currently has a strong lineup planned, including potential releases of a new Mario Kart, 3D Mario, and Metroid Prime 4, which could help drive demand for the new console.

MARKET CONSENSUS: 21 BUYS, 8 HOLDS, 2 SELLS, AVERAGE TP JPY9681.5

TSMC (2330 TT)

TSMC on Thursday reported 4Q24 results that slightly beat expectations, as it continued to ride the AI wave while navigating the US-China chip rivalry. This resilience is likely to support share price going forward.

4Q24 revenues of the world's largest contract chip maker stood at TWD 868.46B vs. TWD855.3B expected, while net income was at TWD374.68B vs. TWD369.60B expected.

TSMC also guided FY25 revenue to grow in the mid 20% range, with Capex throughout the year at USD38B - USD42B, 19% ahead of market consensus and sent a strong signal that the unprecedented AI spending cycle is expected to continue.

MARKET CONSENSUS: 39 BUYS, 1 HOLD, AVERAGE TP TWD1624

Renault (RNO FP)

French automaker Renault said on Thursday that sales grew by 1.3% in 2024 to around 2.26M vehicles, helped by a strong 4Q2024 due to new launches offsetting weak demand earlier in the year.

Sales growth, however, still slowed sharply from the 9% rise recorded in 2023, as the global auto sector faced a challenging year with inflation weighing on consumer appetite for new vehicles and surplus production in China flooding the market.

Nevertheless, Renault’s shares reacted positively on the news, as the carmaker’s challenges were not as severe as expected. This should also support share price going forward..

MARKET CONSENSUS: 18 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP EUR56.86

Earnings Announcements

US Market

Schlumberger NV

European Market

-

HK - China Market

-

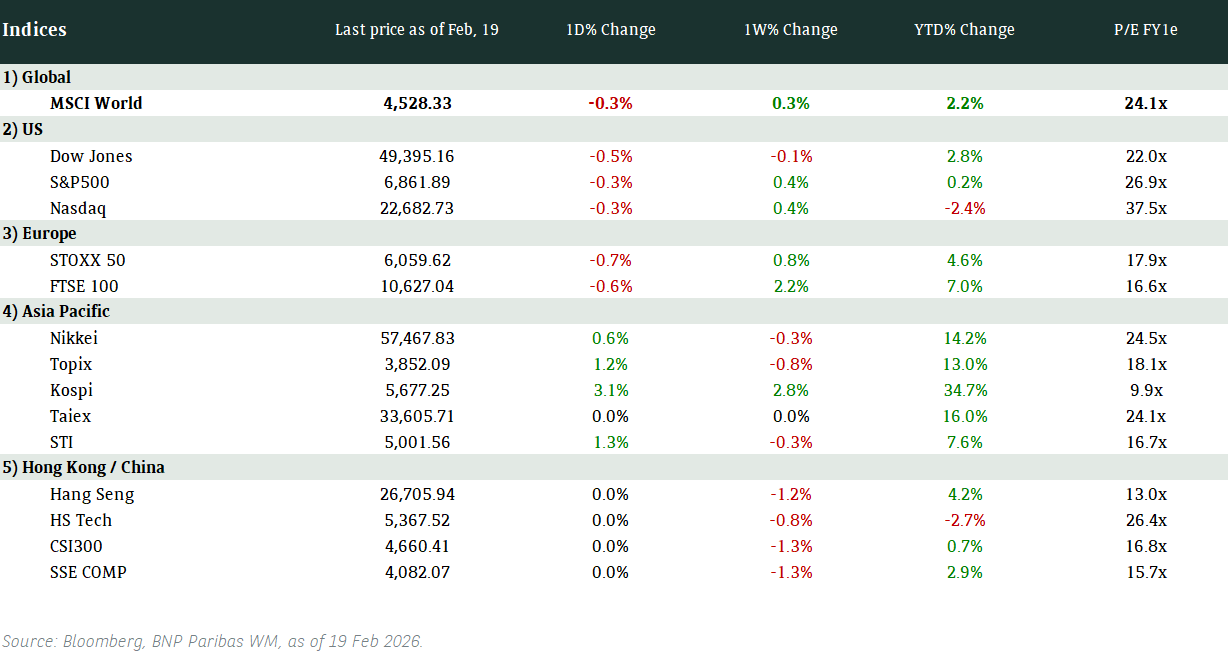

Global Indices Changes (%)

Fixed Income Market Updates

The second high yield new issue out of China this year – Health and Happiness managed to print USD300mio at 9.7%. Despite this seemingly juicy yield, we remain cautious in China high yield space and would prefer subordinated debt of quality IG issuers for yield pickup.

EUROPEAN BANK COCO (AT1)

Risk assets contniued its rally and tone was firm in the European AT1 space. However, flows were more balanced compared to the day before. Caixabank's EUR-denominated AT1 new issue was out with an initial price guidance of 6.625% which eventually tightened to 6.25% at print with books of over EUR4bio. With such strong books, the new issue traded well in secondary and was up 0.875point.

ASIA INVESTMENT GRADE (IG)

Tone was constructive overall in Asia IG space. Long duration bonds of Indonesia sovereign and quasi-sovereign Pertamina finally saw some demand. In Korea IG, benchmark names were 1-2bps tighter in general while India IG names traded broadly unchanged. In China IG space, Bank of Communications' recently issued floating rate bond was most actively traded and tightened 3bps from reoffer as local investors topped up allocations.

ASIA HIGH YIELD (HY)

Sentiment remained fragile in China HY property space. Vanke curve was down by another 1.5-2points and dragged the bonds of Longfor down 0.5-1point in sympathy. Non-property space was a different story. New issue Health and Happiness' book was more than 4x oversubscribed at final price guidance of 9.7%. Investors did not avoid China HY space on a whole and only avoided the property sector. Outside of China, Vedanta's recent issues were up 0.25-0.5point with the 2033 bond outperforming. Renewable names such as Greenko also saw demand.

Forex Market Updates

The US Dollar continued to dip lower on softer-than-expected economic data, muddling the market's views on the Fed's path of interest cuts this year.

USD

The US Dollar fell on Thursday as traders digest a slew of mixed economic data to gauge the outlook for the Federal Reserve's interest rate cuts this year. The U.S. dollar index - a measure of the value of the greenback relative to a basket of foreign currencies - pared earlier gains and was last down 0.09% at 108.92. Donald Trump returns to the White House next week, and analysts expect some of his policies to boost growth as well as increase price pressure. Treasury yields slipped on Thursday, after Federal Reserve Governor Christopher Waller said three or four interest cuts this year were still possible if U.S. economic data weakened further.

Despite this week's losses, the near term outlook for the Dollar Index remains bullish, with technical support around 107.88.

GBP

The British Pound dropped sharply against the yen and also weakened versus the dollar and the euro on Thursday as investors focused on monetary policy divergence after last week's sell-off in gilts and the pound. The Bank of England is expected to ease its monetary policy, leading sterling to drop 0.77% versus the Japanese currency GBPJPY at 190, hitting a fresh 1-1/2-month low at 189.72. In Britain, heavy government bond supply and concerns about UK fiscal challenges pressured asset prices last week, driving UK borrowing costs to their highest since 2008.

Sterling bulls could attempt another near term push higher towards immediate resistance around 1.2360.

JPY

The Japanese Yen strengthened to a one-month high against the dollar on growing confidence for a Bank of Japan interest-rate hike. Recent remarks from BOJ Governor Kazuo Ueda and his deputy Ryozo Himino have made clear that a hike will at least be discussed at next week's policy meeting. Markets see about a 79% chance of a 25 basis point increase. Japan's annual wholesale inflation held steady at 3.8% in December on stubbornly high food costs, data showed on Thursday.

USDJPY looks to be testing the 155 support level and may eye 153.00 as a potential target.

XAU

Gold prices rose to a more-than-one-month high on Thursday after the latest U.S. economic data pressured the Treasury yields further, following a soft core inflation reading this week that increased bets for a more dovish Federal Reserve policy. Gold prices extended gains on Wednesday after data showed core U.S. inflation increased 0.2% in December after rising 0.3% for four straight months, also giving hopes for easing monetary policy. Markets now expect the Fed to deliver 37 basis points (bps) worth of rate cuts by year-end, compared with about 31 bps before the inflation data.

The precious metal is likely to be well supported above 2600 in the near term.