Macro Update:

Best week for US stocks in two months

US stocks registered their best week since Trump’s election win, thanks to strong US bank earnings and softer-than-expected inflation numbers that raised expectations of further Fed rate cuts this year. Reports of a constructive conversation between Trump and Xi also supported positive sentiment last Friday.

All eyes are on Trump’s inauguration today and the suite of executive orders in the first days and weeks of the new administration, which may help remove some policy uncertainty and likely be a positive for financial markets.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks continued their move up on Friday, closing out a strong week on optimism over the path of interest rates as investors also braced for a slew of policy changes under the new Trump administration.

EUROPE EQUITIES

Stocks in Europe rose on Friday as upbeat earnings and positive news from China bolstered sentiment.

Within Europe, we favour UK equities on the back of undemanding valuations and its defensive merits.

HK EQUITIES

Stocks in Hong Kong rose on Friday due to better-than-expected China economic data which lifted the market sentiment.

Schlumberger (SLB US)

Shares of Schlumberger surged on Friday after it announced 4Q24 results that beat market expectations. Its revenue came in at USD9.28B vs. USD8.61B expected, while net income stood at USD1.09B vs. USD1.03B expected, largely driven by accelerated growth in its digital and integration division as well as increased offshore activity in the US Gulf of Mexico. This is likely to support the company's share price going forward.

Schlumberger also announced that it is lifting its quarterly dividend by 3.6% and committed to an accelerated buyback of shares worth USD2.3B.

MARKET CONSENSUS: 26 BUYS, 7 HOLDS, AVERAGE TP USD52.45

Walgreens Boots Alliance (WBA US)

The US Department of Justice announced on Friday that it filed a nationwide lawsuit against Walgreens and its subsidiaries for knowingly dispensing millions of prescriptions that lacked a legitimate medical purpose. This could hurt the company’s reputation within the US and thus add uncertainty to its share price in the near term.

According to the lawsuit, Walgreens filed these prescriptions from August 2012 up to the present, with some prescriptions being for "dangerous and excessive quantities" of opioids. The lawsuit also alleged that the company "systematically pressured" its pharmacists to quickly fill prescriptions without sufficient time to check their validity.

MARKET CONSENSUS: 3 BUYS, 12 HOLDS, 3 SELLS, AVERAGE TP USD12

PepsiCo (PEP US)

The US Federal Trade Commission (FTC) announced on Friday that it is suing PepsiCo for engaging in illegal price discrimination by discounting prices for a large, big box retailer while increasing prices for competing retailers and customers. This could inject some volatility to the company’s share price in the near term.

On top of price advantages, the US FTC also said that PepsiCo also provides its favoured retailer with various advertising and promotional tools.

MARKET CONSENSUS: 13 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD173.71

TSMC (2330 TT)

TSMC said on Friday that its new US plant is unlikely to get the most advanced chip technology before factories in Taiwan due to complex compliance issues, local construction regulations and various permitting requirements.

The company has said building the new factory in Arizona has taken at least twice as long as in Taiwan.

The US government has offered full-throated support for the investment, including a USD6.6B grant, as it seeks to spread geographic risk from an over-concentration of chip manufacturing in Asia.

Further developments in the construction of TSMC’s Arizona factory will be key to how the company can navigate around the US’ potential trade policies under a Trump administration.

MARKET CONSENSUS: 38 BUYS, 1 HOLD, AVERAGE TP TWD1440.12

Xiaomi (1810 HK)

Austrian advocacy group Noyb on Friday reportedly named Xiaomi and several other Chinese companies for illegally transferring user data from the European Union to China.

The non-profit’s organisation’s complaint to the European National Data Protection Authority is currently under review, although Xiaomi is denying such claims.

Further developments surrounding this case may impact Xiaomi’s reputation within Europe.

MARKET CONSENSUS: 43 BUYS, 1 HOLD, 1 SELL, AVERAGE TP HKD35.15

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

With a light economic data week, Trump’s inauguration will drive markets this week. This recent drop in yields has proven that US Treasury yields will be range bound and whispers of 5% for the ten-year yield is where Treasuries are oversold. We believe six-year investment grade paper is where the best value is.

EUROPEAN BANK COCO (AT1)

European AT1 closed tighter for the week in terms of spreads, approximately -10 to -15bps (basis points) tighter. Friday turned into a real compression session with Deutsche Bank and Socgen outperforming. Across currencies, EUR outperformed which led to a number of questions around USD underperformance, which we believe is mostly down to longer duration of the dollar AT1 product compared to EUR combined with the volatility in rates. That being said, there is some dip buying back into the dollar 10-year call space. The higher coupons and higher backends in the <5-year calls make sense to stay invested in the higher yield AT1s given rates volatility at the moment.

ASIA INVESTMENT GRADE (IG)

Tone was constructive overall in Asia IG space. Front-end IGs continued to get repriced, and turned over at tighter levels. Low beta papers were about 1-2bps wider, while high betas were largely unchanged. Demand from iinsurance buyers continued for longer-dated paper despite the rally in rates.

ASIA HIGH YIELD (HY)

It was a volatile week in China HY, and property names closed anywhere from 2-13pt (points) lower with Vanke underperforming and rebounding fairly quickly. Media outlets reported that the Shenzhen government may be stepping in to take over or restructure Vanke. A task force appointed by the local government is now running the company. Two way activities in Industrials though skewed towards better selling after the Vanke sell-off. For example, Fosun traded slightly higher after the company announced it is planning to list subsidiary Shanghai Yuyuan. In India HY, Vedanta did a dual tranche 5.5-year and 8.25-year. Both had a strong open but ran into profit takers. Rest of the space closed 0.25-0.5pt lower amidst an absence of buying interest.

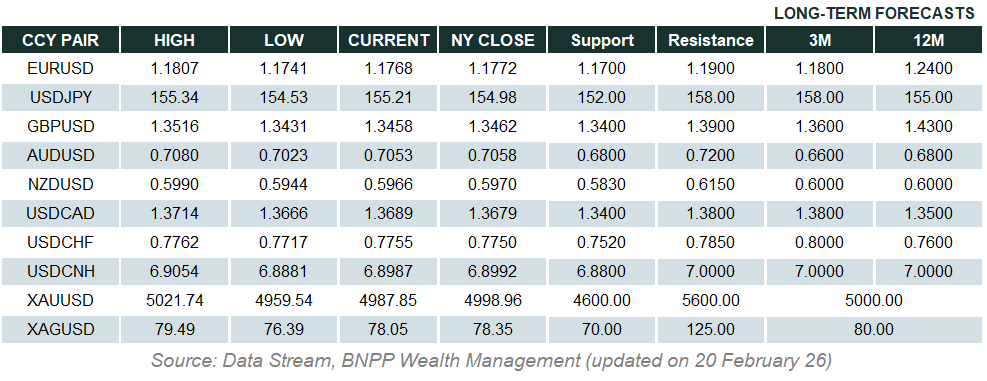

Forex Market Updates

The US Dollar closed lower on Friday as weaker economic data throughout the week increased the market's rate cut expectations, with investors focusing on the beginning of the Trump presidency.

USD

The US Dollar held gains on Friday, but ended the week lower after a six-week winning streak, as investors await Donald Trump's presidential inauguration and clarity on the course of the incoming administration's policies. The dollar has surged in the past few weeks on the back of rising Treasury yields, reflecting expectations that President-elect Trump's policies could boost inflation when the US economy is already strong. Money markets currently price in about 40 basis points in US rate cuts in 2025.

Despite this week's losses, the near term outlook for the Dollar Index remains bullish, with technical support around 107.88.

GBP

The British Pound dropped against the dollar and euro on Friday, after data showed that British retail sales fell unexpectedly in December, adding to an already-gloomy economic outlook. Traders added to their bets on Bank of England rate cuts after the figures, and now price in 66 basis points in cuts during 2025. This compares to the 42 bps of rate cuts investors expect from the US Federal Reserve this year. The pound, last year's best performing G10 currency against the dollar, has lost 2.4% so far this year.

Sterling bulls could attempt another near term push higher towards immediate resistance around 1.2360.

JPY

The Japanese Yen had its strongest weekly performance in over a month as expectations for a Bank of Japan rate hike this week grow, putting the dollar on the back foot. It climbed more than 1% against the dollar last week, reversing the previous week's decline, and touched a one-month high of 154.98 per dollar earlier on Friday. Remarks from BOJ officials along with Japanese data that point to persistent price pressure and strong wage growth have helped boost market confidence that a rate shift is in the offing, with traders pricing in an 80% chance of a hike this week.

USDJPY looks to be testing the 155 support level and may eye 153.00 as a potential target.

XAU

Gold prices were pressured by an uptick in the US dollar on Friday, but remained on track for a weekly gain as uncertainties around incoming President Donald Trump's policies and renewed bets of further rate cuts lifted bullion above the key $2,700 level. Traders are pricing in two rate cuts by year-end, with Fed Governor Christopher Waller hinting at the possibility of more cuts should economic data weaken further. Markets now keenly await Trump's inauguration on Jan. 20, and his broad trade tariffs are expected to further ignite inflation and trigger trade wars, potentially increasing bullion's safe-haven appeal.

The precious metal is likely to see some consolidation around the 2700 area.