Macro Update:

“Buy the rumour, sell the news” for the USD?

US markets were closed for Martin Luther King Jr. Day. US equity futures rallied and USD declined on the prospect of tariff relief as there was no new tariffs announcement on Day 1 of Trump 2.0. The USD Index retreated 1% to 109.3.

Deputy Chief of Staff Stephen Miller indicated that a big part of Day 1 executive orders would address government reform, border security and energy policy. As policy uncertainty may significantly reduce in coming weeks, if not days, this would be a positive for global equities where we maintain an overweight stance.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stock markets were closed on Monday for Martin Luther King Jr. Day.

EUROPE EQUITIES

European shares closed flat on Monday as investors take caution ahead of US President Trump's inauguration.

HK EQUITIES

Stocks in Hong Kong gained momentum following Xi’s and Trump’s phone call which boosted market sentiment.

Apple (AAPL US)

Belgian authorities on Monday had reportedly launched an investigation into Apple over an alleged use of "blood minerals" sourced from the Democratic Republic of Congo.

Further developments surrounding this matter could negatively impact Apple’s reputation and add legal risk to its operations going forward.

This Belgian investigation came after a separate case in December 2024 whereby lawyers representing Congo filed a criminal complaint against Apple’s subsidiaries in Belgium and France, claiming they used minerals provided by armed groups that commit atrocities in eastern Congo.

MARKET CONSENSUS: 38 BUYS, 16 HOLDS, 5 SELLS, AVERAGE TP USD246.6

Ford (F US)

The US National Highway Traffic Safety Administration (NHTSA) announced on Monday that it is upgrading a probe into 129,222 Ford vehicles over reports of collisions involving the company's hands-free driving technology, BlueCruise.

The NHTSA opened the investigation after receiving notices of two fatal collisions in April 2024, involving BlueCruise-equipped Ford Mustang Mach-E vehicles. The regulator said it is upgrading the probe to an engineering analysis, a required step before it could demand a recall.

Further deveopments surrounding this investigation could inject volatility to Ford’s share price in the near term.

MARKET CONSENSUS: 7 BUYS, 12 HOLDS, 7 SELLS, AVERAGE TP USD11.51

China Telecom (728 HK)

China Telecom announced on Monday that its number of mobile subscribers reached around 425M in December 2024, increasing by 820,000 MoM and around 16.75M YoY.

Among China Telecom’s subscribers, 5G users amounted to 351M, with a net increase of 2.11M subscribers in December 2024, accelerating from the net increase of 1.84M the month prior.

This provides evidence of China Telecom’s healthy progress in ramping up its 5G offerings, which should be supportive for its share price going forward.

MARKET CONSENSUS: 18 BUYS, 1 HOLD, AVERAGE TP HKD5.79

China Mobile (941 HK)

China Mobile on Monday announced that its total number of mobile business customers amounted to 1.0B, with a net customer reduction of 786,000 for the month.

Of which, the number of 5G network customers was 552 million, a net increase of 5.28 million MoM, faster than the net increase of 1.43 million in November.

Total number of customers for Wireline Broadband Business was around 315M, a net customer reduction of 1.3M.

How this translates into its top and bottom-line is key for the share price going forward.

MARKET CONSENSUS: 22 BUYS, 1 HOLD, AVERAGE TP HKD87.84

Country Garden (2007 HK)

China's Country Garden expects to reach terms with creditors next month regarding the restructuring of USD16.4B in offshore debt, and apply for court approval of the terms in April 2025, its lawyer told a Hong Kong court on Monday.

The property developer was granted an adjournment until 26 May 2025 in a hearing held to gauge the extent to which restructuring is proceeding ahead of a decision on a liquidation petition.

Country Garden said this month it has proposed restructuring that would cut offshore debt by 70% and that it had reached an "understanding" with a lender group..

MARKET CONSENSUS: 1 HOLD, 6 SELLS, AVERAGE TP HKD0.35

Earnings Announcements

US Market

KeyCorp, DR Horton, Charles Schwab, Prologis, United Airlines, Seagate Technology

European Market

-

HK - China Market

New Oriental Education & Technology

Global Indices Changes (%)

Fixed Income Market Updates

This week features a fresh supply of government bonds in developed markets, including US long-end Treasury bonds and UK 15-year Gilts. We expect interest rate volatility to continue as investors take time to digest new supply risks, coupled with speculation over Trump’s tariff policy.

EUROPEAN BANK COCO (AT1)

The AT1 market opened 25 basis points higher, despite low trading volume due to the US holiday. Early buying of AT1s was observed, primarily driven by Asian investors targeting shorter calls. Currently, AT1s are nearly entirely influenced by benchmark rates. The market remains robust, as demonstrated by last week’s successful issuance of CaixaBank’s 6.25% EUR perpetual bonds, which rallied strongly in the secondary market.

ASIA INVESTMENT GRADE (IG)

The China IG market was quiet due to the US holiday, but overall sentiment remained firm. Benchmark names like Alibaba, Tencent, and Meituan saw incoming buying demand, leading to spreads tightening by 1 to 2 basis points. In contrast, Hong Kong high-beta names widened by 1 to 5 basis points amid negative news surrounding New World Development. Outside China, the IG market softened slightly with spreads widening by 1 to 3 basis points and increased selling activity. Japanese IG saw concentrated selling in long-dated insurance company bonds.

ASIA HIGH YIELD (HY)

In the China HY sector, China Vanke remained the focal point, with the curve rising by 2 to 3 points following reports of increased government intervention. Conversely, New World Development’s curve fell by 5 to 12 points amid rumors of a holistic debt restructuring. Outside China, the HY market experienced slow and limited activity, with balanced flows and some private bank demand noted in front-end benchmark papers.

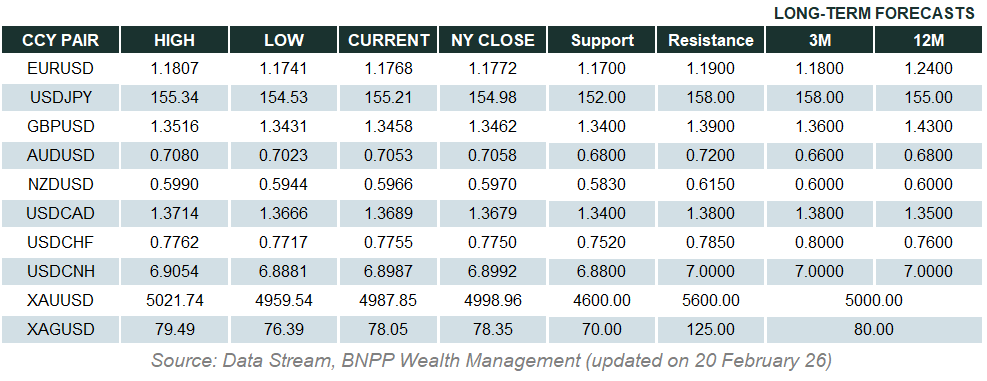

Forex Market Updates

The US Dollar weakened post-Trump inauguration, with delayed policies, soft inflation data, and Fed rate cut prospects pressuring the greenback amid market uncertainty.

USD

The US Dollar weakened against a basket of major currencies on Monday, following Donald Trump’s inauguration, with the dollar index falling 1.17% to 108.08. While Trump’s promised policy announcements on trade and fiscal stimulus boosted expectations for long-term growth, delays in immediate measures triggered a "sell the news" reaction. Softer US inflation data and the prospect of Fed rate cuts further pressured the greenback. Risk assets like Bitcoin, buoyed by Trump’s pro-crypto stance, hit record highs. Analysts warned that persistent uncertainty around US trade policies could weigh on the dollar in the near term.

The Dollar Index could see some near term weakness, with USD bears likely to be well supported above 106 handle for the time being.

GBP

The British Pound strengthened during the start of the week, supported by a weaker US dollar and optimism around the UK’s upcoming economic data. GBP/USD climbed to 1.2329, recovering from last week’s dip as markets reassessed the impact of recent BoE rate cut expectations. Comments from BoE officials signalling confidence in the UK’s financial system provided additional support. Focus now shifts to Tuesday’s labour market data and Friday’s PMI, which are expected to shape market sentiment further.

Sterling bulls could attempt another near term push higher towards immediate resistance around 1.2375.

CNY

The Chinese Yuan strengthened yesterday, rising to 7.3143 against the US Dollar, as improved US-China trade sentiment and upbeat Chinese Q4 economic data boosted confidence in the currency. The PBoC set a firmer midpoint, signalling its commitment to a stable yuan despite external pressures. Analysts noted support from rising foreign inflows and the central bank's active measures to maintain trade-weighted stability. With markets pricing in moderate depreciation over the year, the yuan's short-term performance reflects cautious optimism, even as investors monitor the impact of potential US tariffs under Donald Trump’s second term.

The Renminbi looks well supported above 7.2580 for the time being.

XAU

Gold prices edged higher on Monday, supported by a weaker US Dollar as markets assessed the potential economic impact of US President Trump's second-term policies following his inauguration. Spot gold rose 0.29% to $2,709.01 per ounce, amid thin trading due to the US Martin Luther King Jr. Day holiday. Analysts noted that concerns over inflationary policies and potential market volatility under Trump’s presidency could bolster safe-haven demand. However, the prospect of higher Fed rates may temper gold's appeal. Markets await further cues from economic data this week.

The precious metal is likely to see some consolidation around the 2700 area.