Macro Update:

No new tariffs on Trump’s Day 1

Global equity markets rallied and the US dollar weakened yesterday as President Trump did not immediately implement new tariffs on his first day in office. Instead, he noted that his administration would be evaluating trade relationships with various countries as part of the America First Trade Policy. This suggests that the administration’s approach to tariffs will be pragmatic, being used as a negotiation tactic. A measured approach on tariffs could likely avoid the risk of a sudden spike in inflation.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities traded higher on Tuesday as investors were encouraged by President Trump’s less-aggressive-than-expected tariff stance.

We see this positive momentum in the US continuing in the medium term.

EUROPE EQUITIES

Shares in Europe moved higher on Tuesday, buoyed by gains in healthcare and luxury, even as investors keep a close eye on developments from the US’ new Trump administration.

HK EQUITIES

Stocks in Hong Kong edged higher on Tuesday as Trump held off rolling out promised tariff hikes, which has provided some temporary relief to the market.

Netflix (NFLX US)

Shares of Netflix soared in extended trading on Tuesday after it posted 4Q24 results that beat expectations, with revenue at USD10.25B vs. 10.11B expected, and EPS at USD4.27 vs. USD4.18 expected.

The US streaming giant also logged 18.9M subscriber additions in 4Q24, its highest ever and more than twice the figure expected by Wall Street, buoyed by its first major live sporting events and the return of blockbuster series Squid Game.

Netflix’s strong results are likely to boost investor confidence on its ability to maintain strong growth going forward, adding support to share price.

MARKET CONSENSUS: 43 BUYS, 17 HOLDS, 4 SELLS, AVERAGE TP USD935.23

Apple (AAPL US)

Apple's smartphone sales in China fell sharply in 4Q2024, hurt by the popularity of local rivals like Huawei and others expanding into the premium market. Chinese rival Huawei climbed to the top spot for the quarter. Its phone sales rose 15.5%, helped by the launch of its mid-end Nova 13 series and high-end Mate 70 series.

Chinese consumers are not getting the latest iPhone AI services on their devices, putting Apple at a disadvantage against rival handset makers offering AI services, including Huawei, Honor and Oppo.

Looking ahead, the sales decline and higher competition in China may mean that the company is losing out in one of its largest sources of revenue. This will likely put downward pressure to stock price.

MARKET CONSENSUS: 37 BUYS, 17 HOLDS, 5 SELLS, AVERAGE TP USD245.51

United Airlines (UAL US)

Shares of United Airlines rose in aftermarket trading on Tuesday as it reports 4Q24 top- and bottom-line beats, benefitting from robust travel demand. The company’s revenue in the quarter stood at USD14.70B vs. USD14.36B expected, while adjusted EPS stood at USD3.26 vs. USD3.05 expected.

The airline also expects strong demand to continue into 1Q25, guiding for EPS at USD0.75 to USD1.25, beating market expectations. Continued strong demand is likely to support United Airlines’ share price going forward..

MARKET CONSENSUS: 18 BUYS, 1 HOLD, AVERAGE TP HKD5.79

JD.com (9618 HK)

Chinese technology and service provider JD.com introduced a campaign that allows consumers to enjoy national subsidies for buying Apple products.

With the implementation of China's subsidy policy for mobile devices, its handset sales have surged by 200% compared to the time before the policy was launched, according to the latest data released by JD's e-commerce platform.

Meanwhile, tablet sales have also increased by 300%, while smartwatch sales have risen by 100%, with smart children's watches showing particularly outstanding performance. This resilience is likely to support the share price going forward..

MARKET CONSENSUS: 35 BUYS, 1 HOLD, AVERAGE TP HKD188.53

HSBC (5 HK)

HSBC is evaluating its retail banking business in Australia and may sell it to further downsize its operations.

It was reported that HSBC might retain its commercial banking business in Australia to serve its global corporate clients.

Its retail banking business in Australia has more than 40 branches and offices. As of November 2024, the size of its mortgage loan was AUD31.8B, while the scale of its credit card and other household loans amounted to AUD516M and AUD538M respectively.

MARKET CONSENSUS: 16 BUYS, 7 HOLDS, 2 SELLS, AVERAGE TP HKD82.66

Earnings Announcements

US Market

Halliburton, Travelers Cos, Abbott Laboratories, GE Vernova, Johnson & Johnson, Alcoa

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

The main focus for Asia fixed income market was New World Development (NWD). NWD bonds had been extremely volatile due to Reorg and Debtwire reporting its bank loan extension plan. We believe there could be extension risk for NWD’s bullet bond maturing in 2026 and 2027 and coupon deferral risk for its perpetual bonds. We also expect some medium-sized local HK banks could get impacted and suggest trimming exposures to the sector.

EUROPEAN BANK COCO (AT1)

European bank coco had a good day. We generally saw better demand from institutional investors as US policy risks have moderated after Trump’s inauguration. We remain constructive on coco and European bank credit fundamental. Europe economic slowdown impact to banks’ credit profile will be manageable as we expect European Central Bank to deliver another four rate cuts this year.

ASIA INVESTMENT GRADE (IG)

Asia IG had a stable day with credit spread generally tighter. In China IG, we saw good demand for technology names like Tencent and Baidu. Outside of China, India and Korea IGs were also solid and credit spreads were 2-4 basis points tighter. Overall, market tone was generally more constructive.

ASIA HIGH YIELD (HY)

Asia HY saw China Vanke in key focus with the entire curve rebound 8-9 points after Vanke said it will make interest payment to onshore bonds. The market was stronger after Trump’s inauguration with no immediate tariff implemention. There was also better demand for Macau gaming with bonds generally 0.125-0.25 points higher. For New World Development, the whole curve continued to consolidate lower from yesterday’s relieved rally after its HKEX clarification.

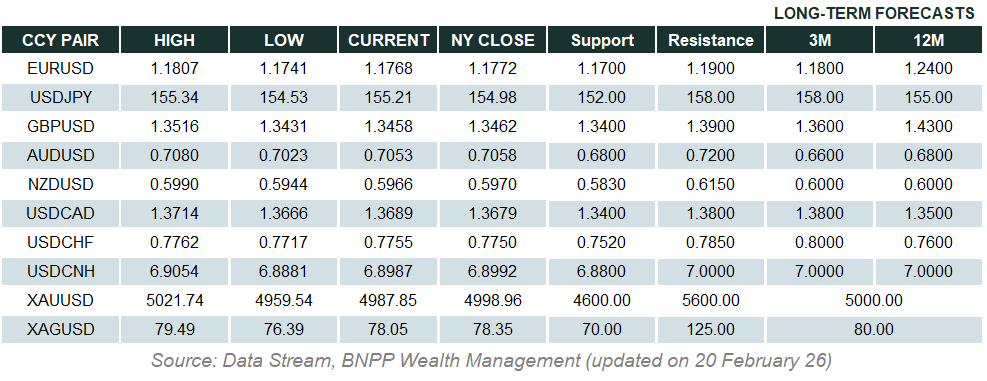

Forex Market Updates

The US Dollar weakened on Tuesday, with sentiment cautious ahead of the Fed meeting and potential trade disruptions.

USD

The US Dollar weakened on Tuesday against a basket of other major currencies. While Trump suggested potential duties of up to 25% on unspecified imports as early as February, uncertainty over their implementation weighed on sentiment. The dollar index slipped 0.11% to 107.95. Markets remained cautious ahead of next week’s Fed policy meeting. Broader sentiment remained mixed as investors weighed geopolitical and economic risks.

The Dollar Index could test the next resistance level at 110 on early potential tariffs imposed in Mexico and Canada.

GBP

The British Pound strengthened against the US Dollar yesterday, with GBP/USD closing at 1.2339. It advanced as UK labour market data offered mixed signals. Strong pay growth underscored persistent inflationary pressures, even as rising unemployment and falling payrolls pointed to a cooling job market. Markets scaled back expectations for a February rate cut by the BoE, as traders adjusted their outlook amid resilient wage data. Broader sentiment remained cautiously optimistic, despite global trade uncertainties and domestic challenges. Analysts see potential upside for sterling, with attention turning to upcoming economic indicators and central bank decisions in the weeks ahead.

Sterling bulls could attempt another near term push higher towards immediate resistance around 1.2375.

CAD

The Canadian Dollar strengthened against the US Dollar on Tuesday, following the release of December inflation data, which showed annual inflation easing slightly. USD/CAD rose 0.19% yesterday to 1.4338. A temporary sales tax break contributed to price declines in key sectors, while core inflation measures edged closer to the BoC’s target range. Markets adjusted expectations for a potential rate cut next week, with participants scaling back the odds of a 25 basis point reduction. Attention now shifts to upcoming central bank decisions and global economic developments.

USDCAD looks poised for a period of consolidation between 1.4200 and 1.4500.

XAU

Gold prices rose yesterday, reaching a two-month high as the US Dollar softened, boosting demand for the precious metal. The weaker dollar enhanced gold’s appeal to non-dollar buyers. Analysts highlighted that persistent inflationary concerns and uncertainty surrounding US policies will continue to drive investor demand for gold, which now faces potential upward momentum. Despite market challenges, the metal appears to have broken past resistance levels, reinforcing its attractiveness amid ongoing economic and geopolitical risks.

The precious metal is likely to see some consolidation around the 2700 area.