Macro Update:

Trump announces up to $500 billion in private sector AI infrastructure investment

S&P 500 hit record high, leading by the tech sector, after Netflix reported a record number of subscribers and the AI investment announcement.

President Trump, alongside the chief executives of Softbank, OpenAI and Oracle, unveiled an initial USD 100 billion investment into AI infrastructure, which could scale up to USD 500 billion over the next 4 years.

“Monetising AI” is one of our 5 investment themes for 2025. Investors can focus on those tech companies that can benefit from the investment wave, as well as the non-tech sectors that can put AI models to profitable use today.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities continued to move up on Wednesday, buoyed by a rise in technology stocks as US President Trump announced large spending plans for AI infrastructure.

We see AI as a structural theme that should continue for years to come.

EUROPE EQUITIES

Shares in Europe also continued to rise on Wednesday, driven by heavyweight technology and industrial sectors on the back of supportive announcements from the US.

HK EQUITIES

Stocks in Hong Kong tumbled on Wednesday after Trump hinted at new tariffs on Chinese imports.

Johnson & Johnson (JNJ US)

Johnson & Johnson announced on Wednesday its 4Q24 results that beat Wall Street estimates, with revenue at USD22.52B vs. USD22.43B expected, while net income stood at USD4.95B vs. USD4.81B expected, driven by strength in most of the company’s operational units.

Nevertheless, the US pharmaceutical giant’s shares still fell in yesterday’s session due to higher-than-expected foreign exchange headwind to the company’s 2025 guidance. It also reported sales for its MedTech unit that missed estimates for the fourth straight quarter.

Despite the share price weakness, Johnson & Johnson’s overall strength should still support its share price going forward.

MARKET CONSENSUS: 13 BUYS, 14 HOLDS, AVERAGE TP USD169.44

P&G (PG US)

Shares of P&G traded higher on Wednesday as it reported 4Q24 revenues that were higher than expected at USD21.89B vs. USD21.55B expected, driven by higher volume as compared to earlier quarters where most of the company’s growth came from price hikes. Its net income came in at USD4.63B, also beating the USD4.58B expected.

Companies are currently under pressure to slow inflation as Donald Trump takes office. P&G’s strong volume-driven growth is likely to give it an edge in doing so, supporting its share price going forward.

MARKET CONSENSUS: 18 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD180

Xiaomi (1810 HK)

Xiaomi’s president indicated that the recent national policy of subsidizing electronic consumption in Mainland China has captured immense attention, as the daily sales volume of Xiaomi's smartphones in the past few days has reached 4 times of what it was before the national subsidy, with the number of people visiting the stores also spiking 55%.

The group will continue to support the national subsidy policy in hopes of boosted consumption during the upcoming Chinese New Year holiday, providing much-needed support to the company’s top-line.

MARKET CONSENSUS: 43 BUYS, 1 HOLD, 1 SELL, AVERAGE TP HKD35.55

Porsche (P911 GR)

Shares of Porsche fell on Wednesday after the automaker reiterated its 2025 guidance in a call with investors on Wednesday.

While the company confirmed its 2024 outlook for a 14-15% profit margin, Porsche expects sales volume to decline in 2025 due to the withdrawal of the combustion-engine Macan and 718 from the EU from the end of June, as well as possible further supply chain issues for the 911 model.

With the challenging narrative in China and the re-emerging risk from trade tensions, it is likely to put downward pressure to Porsche's share price going forward.

MARKET CONSENSUS: 16 BUYS, 9 HOLDS, 2 SELLS, AVERAGE TP EUR74.88

EasyJet (EZJ LN)

The British low-cost airline EasyJet said on Wednesday that its pretax loss decreased in 1QFY2025, while revenue grew YoY. Headline loss before tax was GBP61M, compared with GBP126M a year ago, while its revenue was GBP2.04B, compared with GBP1.80B a year ago.

Looking ahead to the full fiscal year 2025, EasyJet said its current booking trends support the consensus for a headline pretax profit of GBP709M, keeping it on track for its medium-term target of a pretax profit of over GBP1B. This is likely to provide support to EasyJet’s share price.

MARKET CONSENSUS: 16 BUYS, 7 HOLDS, AVERAGE TP GBp705.23

Earnings Announcements

US Market

General Electric, McCormick & Co, Union Pacific, CSX Corp,

Intuitive Surgical

European Market

EQT AB, Sandvik AB,

Investor AB

HK - China Market

New Oriental Education & Technology, TAL Education Group

Global Indices Changes (%)

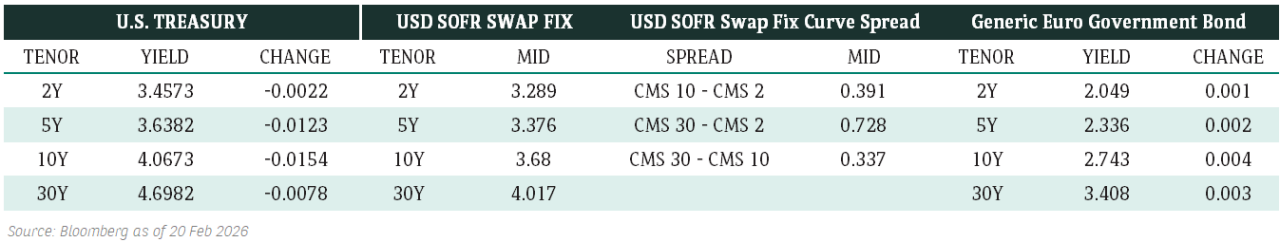

Fixed Income Market Updates

Thailand banks reported positive results which should help alleviate previous concerns on their asset quality. We have some picks in this space which we think is good for diversification from European and US banks.

EUROPEAN BANK COCO (AT1)

European AT1 space closed marginally higher. AT1 bonds with short calls remained mostly unchanged with buyers sticking to their initial price and yield targets. Recent new issues such as Caixabank and AIB Group were most actively traded. We remain sanguine in AT1 bonds of banks with solid fundamentals which have demonstrated a history of calling back the bonds on first call dates even the ones with long call dates.

ASIA INVESTMENT GRADE (IG)

BBB-rated State Owned Enterprises in China IG space traded well despite Trump hinting a potential 10% tariff on China. China Overseas Finance were sought after by hedge funds and tightened by around 5bps across its curve. In South East Asia space, Great Eastern Life Assurance's recent new perpetual issuance is still struggling below par. Malaysia IG names were around 1-3bps tighter especially in Petronas. We had downgraded our credit opinion on Thaioil to negative and expect its leverage to remain elevated with additional capital expenditure required to complete its Clean Fuel Project.

ASIA HIGH YIELD (HY)

New World Development was actively traded; the curve was down 2-4points overall with heavy selling from asset managers. The bonds have fallen 15-25points across the curve accumulatively this week. We see no near-term catalyst for New World Development's bonds to turnaround. Vanke traded in a similar fashion to New World Development, with the curve down 1-3points. Outside of Greater China, Adani complex traded largely sideways with not much conviction in the market.

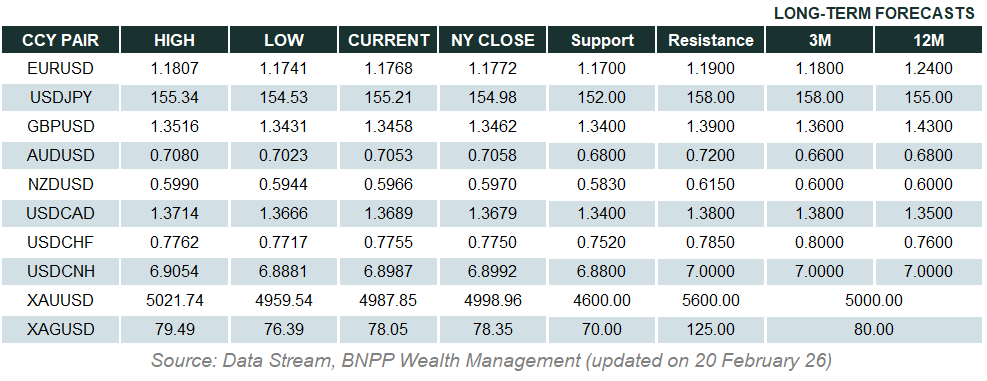

Forex Market Updates

The US Dollar was mostly lower overnight on a lack of concrete announcements about Trump’s tariff plans.

USD

The US Dollar weakened against most other major currencies as markets continued to await concrete announcements about US President Trump’s tariff plans. The Dollar Index hit a more than two-year high early last week largely in anticipation of tariffs, but the greenback has shown signs of an overcrowded trade reversing on the lack of firm plans announced since the new Trump administration took office. Elsewhere, it was reported that Trump is pushing a plan to explicitly use revenue from higher tariffs on imported goods to help pay for the extension of tax cuts, an unprecedented shift likely to face opposition from many of his fellow Republicans in Congress.

The Dollar Index could see a further near term retracement towards immediate support around 107.60.

EUR

The Euro consolidated recent gains on Wednesday, trading within the ballpark of two-week highs despite threats from US President Trump, who said that that European Union is “going to be in for tariffs” as that is the only way “you’re going to get fairness”. On the central bank front, a slew of ECB policymakers voiced their backing for further policy easing moving forward, indicating that a rate cut at next week’s meeting is all but a done deal and that further cuts are more than likely to follow even if the Fed remains cautious. Nevertheless, ECB President Lagarde appeared to argue against going too quickly, saying that the central bank was not at risk of undershooting its 2% inflation target and that it also needed to watch the impact of the weak Euro.

The common currency’s tentative recovery is likely to face stern resistance around 1.0460 moving forward.

AUD

The Australian Dollar climbed to two-weeks highs before retreating slightly yesterday as Trump warned that he is still considering imposing 10% tariffs on all Chinese imports, possibly as early as 1st February, citing China’s role in exporting fentanyl to Mexico and Canada as a reason for potential tariffs. Elsewhere, analysts say that amidst lingering worries over China’s growth prospects, markets have turned slightly bearish on the outlook for prices of key commodities produced Down Under such as iron ore, which is likely to see a continuation of weak AUD sentiment.

Aussie bulls could attempt a break above the 0.6300 resistance level should there be no escalation in Trump’s tariff threats.

XAU

Gold prices advanced to highs not seen since last October on the back of a softer USD and lack of clarity around US President Trump’s tariff plans, which markets fear could trigger trade wars and elevate market volatility. Analysts say the precious metal is “a natural place where people will gravitate to” due to uncertainty, although there is a risk that gold’s bull run could face strong headwinds if Trump’s tariffs, when enacted, force the Fed to sustain elevated interest rates for an extended period to rein in price pressures.

The precious metal is likely to be well supported above 2700 in the near term.