Macro Update:

China guides long-term funds into stock markets

Chairman of China Securities Regulatory Commission Wu Qing said mutual funds are encouraged to raise their holdings of onshore equities by at least 10% annually for the next three years and both large state-owned and commercial insurance companies are encouraged to invest 30% of their new annual premiums in A-shares from 2025. Furthermore, listed companies are “guided” to improve shareholder returns through share buybacks and more frequent dividends.

The initial impact on A-share markets may seem small, but these developments should be viewed positively from a long-term perspective as an ongoing process to formalise and institutionalise the country’s capital market.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks rose on Thursday, with the S&P500 closing at a record high, as in investors assessed a mixed bag of corporate earnings and digested further comments from President Donald Trump.

We remain constructive on US equities in the medium term.

EUROPE EQUITIES

European equities continued to move higher on Thursday, buoyed by developments in the World Economic Forum, while declines in heavyweight technology stocks tempered gains.

HK EQUITIES

Stocks in Hong Kong closed lower on Thursday even as authorities' attempt to boost the stock market through long-term investment.

Tesla (TSLA US)

Tesla will raise prices of all its cars in Canada from 1 February, according to notices on its Canadian website, with prices of the Model 3 going up by as much as CAD9,000.

Model Y variants will also see increases of up to CAD4,000, while all versions of Model S and X will rise by CAD4,000.

The company does not produce cars in Canada and imports from other factories. The unexpected move by Tesla to raise prices comes as Canadian Prime Minister Justin Trudeau reiterated on Tuesday that his government was ready to respond if Trump imposed 25% tariffs on imports from Canada and Mexico on 1 February. How this hike in price will impact Tesla’s top-and bottom-line is key to its share price trajectory going forward.

MARKET CONSENSUS: 28 BUYS, 17 HOLDS, 14 SELLS, AVERAGE TP USD326.99

Alphabet (GOOGL US)

Taiwan's HTC said on Thursday that it will sell part of its unit for extended reality (XR) headsets and glasses to Google for USD250M and transfer some of its employees to the US company. The transaction is expected to close in 1Q25.

Google said in a separate statement that the latest deal would accelerate the development of the Android XR platform and strengthen the ecosystem for headsets and glasses.

Further innovations resulting from this acquisition could support Google’s share price going forward.

MARKET CONSENSUS: 60 BUYS, 14 HOLDS, AVERAGE TP USD215.94

Intuitive Surgical (ISRG US)

Shares of Intuitive Surgical slipped in aftermarket trading on Thursday after it announced its profit margin forecast for 2025 that missed Wall Street expectations, while also warning that the potential impact of new tariffs could be material.

This happened despite the company posting solid beats in its 4Q24 top- and bottom-line, with revenue at USD2.41B vs. USD2.26B expected, while net income stood at USD685.7M vs. USD525.5M expected, boosted by a continued uptick in the use and installation of its robotic surgery system.

US Trade policy announcements from the new Trump administration this year are key to watch.

MARKET CONSENSUS: 22 BUYS, 11 HOLDS, 2 SELLS, AVERAGE TP USD600.83

Meta (META US)

The European Consumer Organization on Thursday criticized Meta's policy which gives Europeans the option to view "less personalized ads" on their social media feeds without subscribing to avoid being sent personalized advertisements by third parties.

The group argued that the policy potentially breaches multiple EU laws governing digital privacy and competition. The European Commission can impose fines of up to 10% of a company's annual global turnover for non-compliance.

The regulator is expected to advance its probe into Meta under the Digital Markets Act by March 2025, which could inject volatility to Meta’s share price.

MARKET CONSENSUS: 69 BUYS, 9 HOLDS, 3 SELLS, AVERAGE TP USD675.47

Samsung Electronics (005930 KS)

Samsung on Wednesday unveiled its newest Galaxy S25 smartphones, powered by Qualcomm's chips and Google’s AI model, hoping its upgraded AI features can reinvigorate sales and fend off Apple and Chinese rivals.

Samsung also previewed a thinner version of the flagship models, aiming to launch the Galaxy S25 Edge in 1H25 ahead of Apple’s anticipated rollout of its slimmer iPhone.

Despite Samsung's preliminary 4Q24 profit, released earlier this month, missing estimates by a large margin due to chip development costs and rising competition in the smartphone market, the newly released models could potentially support its top-line going forward.

MARKET CONSENSUS: 36 BUYS, 6 HOLDS, AVERAGE TP KRW75096.77

Earnings Announcements

US Market

NextEra Energy, American Express

European Market

Givaudan SA

HK - China Market

Hang Lung Properties

Global Indices Changes (%)

Fixed Income Market Updates

Moody's affirmed Bharti Airtel’s rating at Baa3 and changed its outlook to positive from stable driven by a significant improvement in the telecom operator’s financial profile and its steadily increasing market share. We have a positive credit opinion on Bharti Airtel.

EUROPEAN BANK COCO (AT1)

European Bank AT1 space traded weaker overall due to profit-taking after recent weeks' relatively strong performance. USD-denominated AT1 bonds with long call dates were the most hit as well as recent new issues such as AIB. Other more actively traded names include NatWest, Lloyds and Deustche Bank. The shorter calls AT1 bonds were more resilient and traded unchanged to 0.125point lower.

ASIA INVESTMENT GRADE (IG)

In Korea IG space, benchmark names were relatively unchanged with some active two-way flows in 1-3year bonds of low beta names such as Export-Import Bank of Korea, Korea Development Bank. Korean Banks' Tier 2 bonds were unchanged as well with thin trading volumne. In South East Asia, Singapore space continued to be focused on high quality bonds such as Temasek. Malaysia's Petronas traded unchanged despite softer macroeconomic environment. In India, Reliance long-end bonds were in demand and were tighter by 1-2bps. We continue to prefer IG bonds with solid credit fundamentals and with where US 10-year Treasury rate is currently, we will be progressively extending duration into 10-year.

ASIA HIGH YIELD (HY)

In China HY property space, survivors were broadly unchanged to slightly higher with light trading volume ahead of long Chinese New Year holiday. Vanke was marked around 2.5point higher while the rest of the space was 0.5-1point higher. Lots of news/speculation/rumours on New World Development and its bond prices were volatile. Flows were mostly selling by retail and asset managers and selective buying (especially in the bullet bonds) by hedge funds. Outside of Greater China, Vendata saw profit-taking from hedge funds earlier in the day.

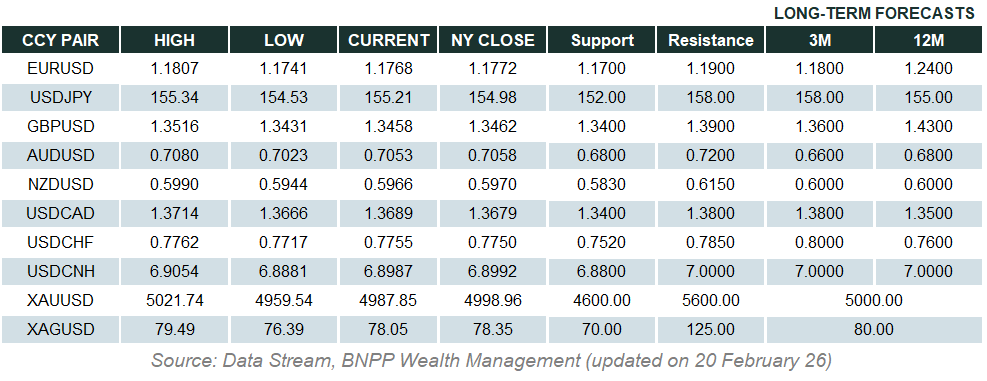

Forex Market Updates

The U.S. Dollar remained lower as investors continue to wait for clarity on President Trump's tariff announcements while also observing the upcoming round of central bank announcements.

USD

The US Dollar was modestly lower on Thursday in a choppy session, after comments from U.S. President Donald Trump called for lower interest rates while providing no clarity on tariffs, and investors awaited a round of policy announcements from global central banks. The dollar is down more than 1% on the week, largely due to a sharp drop on Monday as widely expected tariff announcements from Trump failed to materialise after his inauguration. The dollar has moved only slightly in the sessions since. Investors are awaiting a host of policy decisions from global central banks over the next week, with the Bank of Japan widely expected to raise interest rates at the end of a two-day meeting on Friday.

The Dollar Index could see a further near term retracement towards immediate support around 107.60.

CAD

The Canadian Dollar steadied against its U.S. counterpart on Thursday as investors weighed U.S. President Donald Trump's comments at the World Economic Forum and preliminary domestic data showed retail sales jumping in December. Canadian retail sales were flat in November. That missed forecasts for a gain of 0.2% but a flash estimate showed sales surging 1.6% in December when a sales tax holiday began. The price of oil, one of Canada's major exports, settled 1.1% lower at $74.62 a barrel. Trump said the United States would guarantee supplies of liquefied natural gas to Europe, even amid worries that the booming export industry could boost prices of gas for U.S. consumers.

The Loonie looks to be range trading for now, fluctuating between 1.4300 and 1.4500.

CNH

The Chinese Yuan slipped against the dollar on Thursday, as investor concerns over U.S. President Donald Trump's trade policy and pre-holiday greenback demand outweighed Beijing's latest supportive measures to underpin the stock market. China announced plans on Thursday to channel hundreds of billions of yuan annually into shares from state-owned insurers, in the authorities' latest effort to support equity markets. Currency traders said market attention remained focused on Trump's tariff plans, with his administration discussing a 10% punitive duty on Chinese imports because fentanyl is being sent from China to the U.S. via Mexico and Canada.

The Renminbi may consolidate around the current levels with the upcoming Chinese New Year holidays approaching, with USDCNH finding support around 7.2600.

XAU

Gold prices firmed on Thursday as the dollar softened following U.S. President Donald Trump's call for lower interest rates, with market attention remaining focused on the broader implications of his policies. Speaking at the World Economic Forum, Donald Trump emphasized his commitment to reversing inflation, announcing plans to push for an immediate drop in interest rates. He also urged other nations to adopt similar measures to address global economic challenges. Non-yielding bullion thrives in a low interest rate environment. However, traders see a 99.5% chance of the U.S. Federal Reserve keeping rates unchanged at its Jan. 28-29 meeting.

The precious metal is eyeing the previous high of 2790.15 as the next target.