Macro Update:

US Earnings Beating Expectations

76% of S&P 500 companies have beaten expectations with an average upside surprise of 7% thus far. As a result, while falling Friday, US equity markets rose for the second straight week. Earnings growth is impressive at 12.7%. 7 of the 11 sectors registered positive eps growth.

This fits in well with our broadening earnings growth theme, as over the past 6 months the consumer discretionary, utilities, financials, and industrials sectors all outperformed the technology sector. Continue to diversify sector exposure.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks closed lower on Friday, consolidating after the market’s powerful rally in the past couple weeks.

Investors now closely watch this week’s economic data and Fed meeting for further clues on interest rate trajectory.

EUROPE EQUITIES

European shares closed flat on Friday, weighed down by declines in the telecom and energy sectors, as rising bond yields continue to subdue sentiment.

HK EQUITIES

Stocks in Hong Kong rose on Friday, buoyed by Trump's comments that his recent conversation with Xi Jinping was "friendly", and that he could reach a trade deal with China.

Tesla (TSLA US)

Tesla’s Shanghai and Beijing operations on Friday ordered a recall of over 1.2M imported and domestically produced electric vehicles in China, according to the State Administration for Market Regulation.

The automaker announced the recall of 335,716 electric vehicles, including imported Model S and Model X, as well as domestically produced Model 3 and Model Y units manufactured between July 2023 and December 2024, citing potential damage to power supply components on the driving computer motherboard. In addition, 871,087 domestically produced Model 3 and Model Y vehicles built between January 2022 and September 2023 are being pulled back due to software issues affecting the electronic power steering system.

Tesla’s recalls could negatively impact its reputation in China and put downward pressure to its share price going forward..

MARKET CONSENSUS: 28 BUYS, 16 HOLDS, 14 SELLS, AVERAGE TP USD337.99

American Express (AXP US)

American Express on Friday announced its 4Q24 results, with revenue that beat expectations at USD17.18B vs. USD17.06B expected, boosted by strong holiday spending. Meanwhile, net income missed at USD2.14B vs. USD2.54B expected.

The company expects the strong earnings growth to continue into 2025, guiding for an 8% - 10% growth in EPS. However, its shares still fell on Friday as American Express’ 2025 outlook failed to impress investors’ high expectations on the financial sector.

Looking ahead, how the US economy will fare under a new Trump administration will be key to determine American Express’ share price trajectory..

MARKET CONSENSUS: 14 BUYS, 16 HOLDS, 4 SELLS, AVERAGE TP USD315.76

Burberry (BRBY LN)

Shares in British luxury retailer Burberry soared by almost 10% on Friday after its FY3Q25 sales fell by less than expected. Comparable store sales came in at GBP645.5M vs. GBP630.0M expected in company's third quarter, which runs to 28 Dec 2024.

Burberry said its second-half results could broadly offset an adjusted operating loss it reported in the first six months of its fiscal year, as the group continues to pursue a brand revamp strategy. The revenue beat shows that the company is making good progress, likely supporting its share price going forward..

MARKET CONSENSUS: 5 BUYS, 13 HOLDS, 5 SELLS, AVERAGE TP GBp962.14

BYD (1211 HK)

China's BYD could start selling its first plug-in hybrid vehicle in Japan this year, the company said on Friday, as it aims to expand its lineup in the country to seven or eight models over the next two years.

The Shenzhen-based automaker also said it will start selling its fourth electric vehicle purely powered by batteries - the Sealion 7 crossover - in Japan from April 2025 as it seeks to expand its offerings and dealer network in the country.

Plug-in hybrid vehicles combine a battery with a traditional fuel-powered engine and can drive on either power source. Although the exact date at which the model will go on sale depends on how quickly it can obtain necessary certification, this is likely to provide support to BYD’s top-line and share price going forward..

MARKET CONSENSUS: 36 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP HKD346.07

Xiaomi (1810 HK)

China's market regulator said on Friday that Xiaomi is set to fix software in 30,931 SU7 electric vehicles over safety hazards, which will be done via remote over-the-air updates. The affected standard version of SU7 was produced between February and November 2024.

The aforementioned software issues may result in abnormal timing synchronization, which affects the detection of static obstacles by the vehicle’s intelligent parking assistance function, increases the risk of scratches or collisions, and poses potential safety hazards.

This may negatively impact Xiaomi’s reputation within the highly competitive Chinese electric vehicle market..

MARKET CONSENSUS: 43 BUYS, 1 HOLD, 1 SELL, AVERAGE TP HKD35.46

Earnings Announcements

US Market

AT&T

European Market

Ryanair

HK - China Market

-

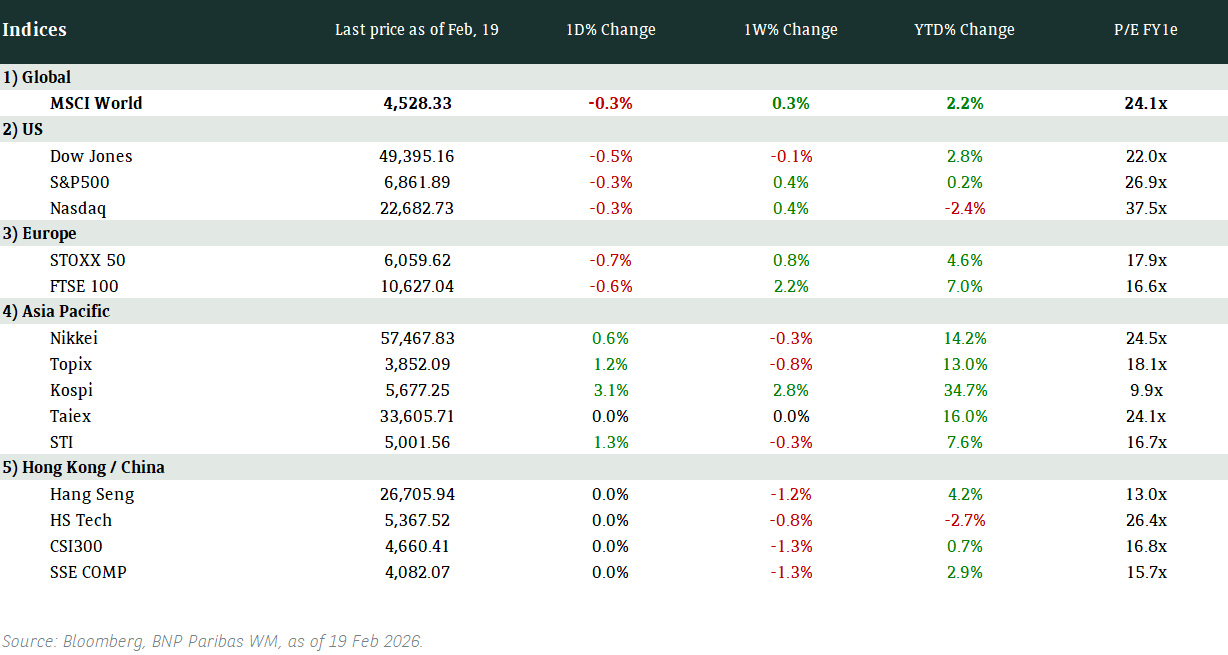

Global Indices Changes (%)

Fixed Income Market Updates

US Treasury yields have backed up and we would be extending duration as ten year Treasury yields are in the 4.6 -4.7% range. The conditions for credit broadly speaking remain extremely favorable with attractive yield and strong credit ratings trends. Hong Kong names that were affected by the New World Development (NWD) contagion also bounced off lows but remain susceptible to NWD headlines.

EUROPEAN BANK COCO (AT1)

European Bank AT1 space traded weaker overall due to profit-taking after recent weeks' relatively strong performance. However, flows are two way and we see moderate duration (i.e non-call 2029 and non-call 2030) as the sweet spot in terms of the issuer curves on a spread basis. Even with further rates widening, we expect European At1 technicals to stay firm with the positive macro sentiment.

ASIA INVESTMENT GRADE (IG)

Trump’s second term reduced concern around hawkish US central bank policy action and a less dramatic expected tariff action from the American government. Meanwhile, Chinese government rolls out another round of stimulus measures. This has help support spread tightening in Asia IG bonds, with spreads anywhere from unchanged to 10 bps (basis points) tighter. China IG high beta such as China National Chemical Corp tighten 5 bps. Outside of China, in South East Asia and Korea, spreads tighten 1-3 bps with flows focused on 2-5 year tenors. In Australia credits, spreads in both USD and AUD gradually tightened through the course of the week with likely help from an ongoing low level of primary issuance. On the other hand, Hong Kong Bank T2s had quite roller coaster session with Bank of East Asia and Nanyang Commercial Bank got hit down on street early this week and bonds tanked 20-25bps. However, post New World Development news the week that they successfully extend some HKD loans, these T2 rallied back 10bps and closed around 10 to 15 wider from last week.

ASIA HIGH YIELD (HY)

New World Development bonds stabilized after ongoing talks about its bank loan negotiations. China sentiment also improved after more easing prior to Chinese New Year. Vanke bonds are +4-5pt (point) higher amidst buying flows in a thin liquidity environment. Macau gaming is also 0.125-0.375pt higher. Most of the activities concentrated in the front end and as the macro tone firmed up and rates stabilized, there is bottom fishing on the long end 28 which were harder to move before. Outside of Greater China, Vedanta saw profit-taking from hedge funds.

Forex Market Updates

The U.S. Dollar weakened to its lowest level this year as markets now expect lower tariffs to be implemented by President Trump and for inflation to be back in the spotlight.

USD

The US Dollar fell on Friday and was on track for its worst week in more than a year on expectations that tariffs enacted by U.S. President Donald Trump will be lower than previously feared and unlikely to spur an international trade war. The prospect of high tariffs on goods from countries including China, Canada, Mexico and the euro zone has raised concerns about a renewed bout of inflation, which has helped to send Treasury yields and the U.S. dollar higher in recent months. But that move partially reversed this week as traders bet that tariffs may not be as large or as widespread as previously feared. Trump said on Thursday that his conversation with Chinese President Xi Jinping last week was friendly and he thought he could reach a trade deal with China.

The Dollar Index could see a further near term retracement towards immediate support around 106.80.

CAD

The Canadian Dollar strengthened against its U.S. counterpart on Friday, adding to its weekly gain, as few new details on proposed U.S. tariffs led to broad-based declines for the American currency. For the week, the Loonie gained 0.9%, as it recovered from a near five-year low at 1.4515, it hit on Tuesday. The premier of Ontario, Canada's most populous province, said he would call an early election, citing the need for a strong mandate to fight against potential tariffs from the U.S..

The Loonie looks to be range trading for now, fluctuating between 1.4300 and 1.4500.

CNH

The Chinese Yuan surged to a 1-1/2-month high against the dollar on Friday and looked set for the best weekly performance since July, supported by U.S. President Donald Trump's suggestion that tariffs on China might be avoided. In an interview with Fox News that aired on Thursday evening U.S. time, Trump said his recent conversation with Chinese President Xi Jinping was "friendly", and he would rather not have to use tariffs against China. His tariff threats have been one of the key factors weighing on Chinese assets and market sentiment over the past few months.

The Renminbi may consolidate around the current levels with the upcoming Chinese New Year holidays approaching, with USDCNH finding support around 7.2200.

XAU

Gold prices climbed over 1% on Friday, closing in on its all-time-high hit in October, as a weakening dollar on U.S. President Donald Trump's push for lower rates and tariff uncertainty drove the metal towards its fourth straight weekly rise. In this climate of uncertainty, zero-yield gold continued to shine as a reliable hedge against inflation and instability, while it remains particularly appealing in a low-interest-rate environment.

The precious metal is eyeing the previous high of 2790.15 as the next target.