Macro Update:

Fed keeps rates on hold as expected

The Federal Reserve maintained rates on hold at the January meeting as expected. The Fed also made no changes to its quantitative tightening or balance sheet reduction as well. The statement was slightly more cautious on inflation, however, the press conference was non-eventful. The number of rate cuts priced by the market remained just below 2 cuts for 2025. Our forecast is for 2 rate cuts for 2025.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

Major stock markets in US closed higher at the end of Thursday’s trading session as the market reacted to Fed’s decision to not modify interest rates coupled with support from key earnings reports.

EUROPE EQUITIES

European equities closed higher on the back of strong earnings and as a decision from ECB to cut interest rates came as expected.

European stocks have made an upbeat start to the year.

HK EQUITIES

Hong Kong and China markets remain closed on Friday for Chinese New Year holiday.

Microsoft (MSFT US)

Microsoft revenue in 2Q25 amounted to $69.6B, jumping 12% YoY and topping market’s estimates. However, the tech giant's intelligent cloud revenue missed estimates, despite climbing 19% to $25.5B, while Azure revenue growth was down to 31%, compared to 33% in the previous quarter.

Shares declined 6.2% on Thursday as hefty AI bets failed to drive a big increase in its cloud revenue, which we believe were magnified after the recent DeepSeek’s developments.

MARKET CONSENSUS: 64 BUYS, 6 HOLDS, AVERAGE TP USD503.83

Tesla (TSLA US)

Tesla pledged a return to growth in 2025 on Wednesday after 4Q results disappointed, capping off a year that saw revenue rise just 2% while profits fell sharply from a year ago.

Tesla expects its auto business to return to growth in 2025 after total auto revenues fell 8% in 4Q against last year and 6% in 2024 compared to 2023.

The company reiterated that plans for new vehicles, including "more affordable models," were on track to start production in the first of 2025. Tesla also said its purpose-built robotaxi, the Cybercab, is still scheduled for volume production in 2026, with fleet-testing of existing models happening "later this year."

MARKET CONSENSUS: 28 BUYS, 16 HOLDS, 14 SELLS, AVERAGE TP USD345.71

Meta (META US)

Meta FY24 results on Wednesday landed above market expectations with last quarter 2024 diluted EPS skyrocketing 50% YoY to $8.02. The revenue in the same period came at $48.4B or 21% up from the same quarter in 2023.

The better-than-expected results helped ease investor fears around Meta's plans to spend as much as $65B this year on AI, even as its 1Q forecast was muted.

The firm will eventually spend billions on AI infrastructure, imitating and improving on the best technology presented by competitors to ensure its dominance.

MARKET CONSENSUS: 70 BUYS, 8 HOLDS, 3 SELLS, AVERAGE TP USD731.25

Mastercard (MA US)

Mastercard reported results that beat estimates as the firm diversifies beyond its traditional payment network. Net revenue for 4Q24 amounted to $7.5B, jumping 14% compared to the same period a year prior.

"Our diverse capabilities in payments and services and solutions – including the acquisition of Recorded Future this quarter – set us apart and position us well for long term growth," CEO Michael Miebach noted.

The company said that its net revenue for the full year is predicted to increase by a percentage in the low double digits.

MARKET CONSENSUS: 39 BUYS, 8 HOLDS, 1 SELL, AVERAGE TP USD588.59

ASML (ASML NA)

ASML said Wednesday that low-cost AI models like China's DeepSeek R1 could increase rather than reduce demand for AI chips.

The semiconductor equipment’s CEO, Christophe Fouquet, noted that cheaper AI models could expand applications, leading to greater long-term demand for semiconductor technology. "We see that as an opportunity for more chips demand," Fouquet said.

ASML, which manufactures EUV lithography machines used in chip production, reported a strong 4Q performance with EUR7.1B in new orders.

MARKET CONSENSUS: 32 BUYS, 7 HOLDS, 1 SELL, AVERAGE TP EUR842.78

Earnings Announcements

US Market

Exxon, Colgate

European Market

Novartis

HK - China Market

-

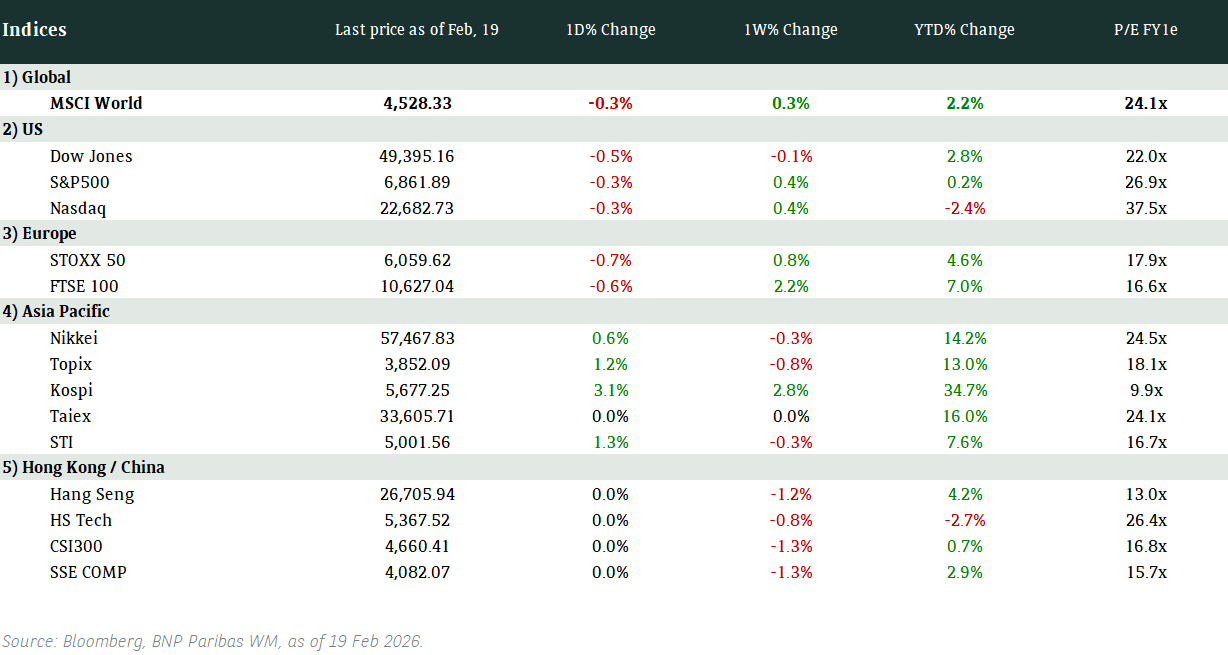

Global Indices Changes (%)

Fixed Income Market Updates

Deutsche Bank announced a decent set of results for Q4 2024. The positive trend in fundamentals continues and the confirmation of 2025 guidance is reassuring, particularly with regards to asset quality. European Banks offer the most favourable risk-reward in our view.

EUROPEAN BANK COCO (AT1)

It was a firm session in European Banks AT1 space driven by rates move. Prices were up 0.125-0.375point on average. Banco Bilbao Vizcaya Argentaria's recently issued USD-denominated 7.75% AT1 outperformed on decent results which brought price back above par. Deutsche Bank also announced results and the AT1 bonds were up 0.25-0.5points. USD-denominated AT1s saw good demand.

ASIA INVESTMENT GRADE (IG)

With Hong Kong/China still out for Lunar New Year holidays, trading is expected to be muted. Although credit spreads have compressed, we think spreads can continue to remain tight, driven by favourable technicals. We prefer Investment Grade bonds over High Yield and looking at how rates have rallied after the global technology stocks' sell-off, we prefer to stay in the 5-7-year duration bucket.

ASIA HIGH YIELD (HY)

We are cautious of idiosyncratic risks in the High Yield space. Moreover, we do not see any near-term turnaround in the property sector in China although recent news of government support for Vanke had buoyed sentiments. With most market participants still out on Lunar New Year holidays, liquidity is expected to be thin.

Forex Market Updates

The U.S. Dollar strengthened as investors bought it back on renewed tariff threats, increasing expectations on more market volatility.

USD

The US Dollar edged higher against some of its peers including the yen and euro on Thursday as markets weighed fresh tariff threats, slower-than-expected U.S. economic growth, and an interest rate cut by the European Central Bank. President Donald Trump on Thursday said the United States will put a 25% tariff on imports from Mexico and Canada, repeating his warning to the two countries which are top U.S. trade partners. The U.S. dollar jumped sharply against the Canadian dollar following Trump's comments.

The Dollar Index could see a further near term retracement towards immediate support around 106.80.

CAD

The Canadian Dollar tumbled to a near five-year low against its U.S. counterpart on Thursday and bond yields fell as U.S. President Donald Trump repeated his threat of hefty tariffs on goods from Canada and Mexico, potentially dashing hopes that the import taxes could be avoided. Remarks on Wednesday by U.S. Commerce Secretary nominee Howard Lutnick had brought some calm to the Canadian dollar market that proved short-lived. Lutnick said Canada and Mexico could avoid the tariffs if they acted swiftly to close their borders to fentanyl. The Bank of Canada on Wednesday said a tariff war could cause major economic damage as it cut its benchmark interest rate by 25 basis points.

The Loonie looks to be range trading for now, fluctuating between 1.4300 and 1.4500.

GBP

The British Pound was little changed on Thursday as markets were focused on a raft of major central bank meetings that will culminate with the Bank of England next week. Britain's currency has recovered much of the ground it lost in early January as investors sold British government bonds and sterling. The bond sell-off was largely driven by global factors, particularly a strong U.S. economy. But analysts said the drop in the pound at the same time mirrored concerns about low growth, sticky inflation and high government debt levels in Britain. Data released two weeks ago relieved the pressure, however, showing that services inflation fell to its lowest since March 2022.

The Sterling may consolidate around the 1.2440 level as markets digest this week's released data.

XAU

Gold prices rose above 2780 yesterday, the highest level since October last year, The Federal Reserve held its rates unchanged and refrained from hinting at future moves, sustaining market expectations that the US central bank is due to deliver two rate cuts this year. Central banks from major gold consumers in the PBoC and RBI also signaled looser monetary policy and higher liquidity in the near future.

The precious metal is eyeing the previous high of 2790.15 as the next target.