Macro Update:

Trump denies report about pared-back tariffs

US equities were higher and dollar declined as investors assessed a media report suggesting Trump’s tariff plan may not be as extreme as feared as it may be confined to “critical imports essential to national or economic security”. However, stocks came off their highs after Trump later denied the report.

There is still high uncertainty about the policies under Trump 2.0. That said, we remain positive on US equities, particularly financials, cyclicals and small-mid caps based on the assumptions that Trump will implement most of his campaign promises on foreign, economic and trade policies.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

Stocks in the US rose on Monday to more than one-week highs, boosted by a rally in semiconductor stocks and a report suggesting that the incoming Trump administration could adopt a less aggressive tariff stance than expected.

EUROPE EQUITIES

Shares in Europe closed higher on Monday, boosted by the auto sector as positive trade policy news from the US also boosted investor sentiment.

HK EQUITIES

Stocks in Hong Kong pared early gains to close lower on Monday after reports showing a slowdown in Chinese manufacturing activity last month.

Abbvie (ABBV US)

Abbvie on Monday lowered its 2024 adjusted profit forecast as the drugmaker sees 4Q24 earnings to include a USD1.6B expense from acquisition milestone payments as well as research and development. The company’s share price only moved slightly yesterday, potentially signalling that the announcement was well within market expectations.

The company has been focusing on expanding its pipeline since its blockbuster arthritis drug, Humira, lost patent protection last year. To that end, AbbVie bought neuroscience drug developer Cerevel Therapeutics, cancer drug developer ImmunoGen and Alzheimer's therapy developer Aliada in 2024 through deals worth over USD20B in total.

MARKET CONSENSUS: 20 BUYS, 10 HOLDS, AVERAGE TP USD204.07

United States Steel (X US)

US Steel, along with ex-potential acquirer Nippon Steel filed a pair of lawsuits on Monday accusing President Biden, the president of the steelworkers union and the chief executive of a rival company of conspiring to scuttle their USD14.1B tie-up.

The companies want a federal appeals court to overturn Biden's decision to scuttle the deal so they can secure another shot at approval through a fresh national security review unfettered by political influence.

Further developments regarding this lawsuit could inject volatility to both US Steel and Nippon Steel’s share prices in the near term.

MARKET CONSENSUS: 7 BUYS, 4 HOLDS, AVERAGE TP USD39.13

Uber (UBER US)

Uber announced on Monday a USD1.5B accelerated share repurchase programme as part of its USD7B buyback plan announced in 2024, a first in the company’s history. This is likely to provide support to Uber’s share price in the near term.

The announced USD1.5B programme, executed with Bank of America, aims to retire over 1% of Uber’s market capitalization, with transactions expected to conclude in 1Q25.

MARKET CONSENSUS: 52 BUYS, 7 HOLDS, AVERAGE TP USD90.83

Tencent (700 HK)

Chinese technology giant Tencent on Monday was reportedly added to a list of firms that the US Defense Department says work with China's military. Other new additions to this year's list include battery maker CATL and chip maker Changxin Memory Technologies. This could potentially lead to sanctions on the mentioned companies, putting downward pressure to share price going forward.

Tencent's ADRs fell more than 7% on the news.

MARKET CONSENSUS: 71 BUYS, 2 HOLDS, AVERAGE TP HKD518.75

Alibaba (9988 HK)

Alibaba announced on Monday that its AI-powered search engine, Accio, has reached over 500,000 small and medium-sized enterprise users, signalling healthy progress on its AI strategy which should be supportive to share price going forward.

Accio, which was launched in November 2024, is an AI-powered business-to-business search engine used for product sourcing.

MARKET CONSENSUS: 39 BUYS, 3 HOLDS, AVERAGE TP HKD118.07

XPeng (9868 HK)

Chinese EV-maker Xpeng and Volkswagen China announced on Monday the signing of a Memorandum of Understanding under which the two parties will open up their proprietary ultra-fast charging networks to each other and work together to build the largest ultra-fast charging network in China for their customers.

Through the strategic cooperation, the two parties will provide customers with a network with over 20,000 charging terminals and a coverage of 420 cities in China. This is likely to benefit both companies and support their share price going forward.

MARKET CONSENSUS: 31 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP HKD64.68

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

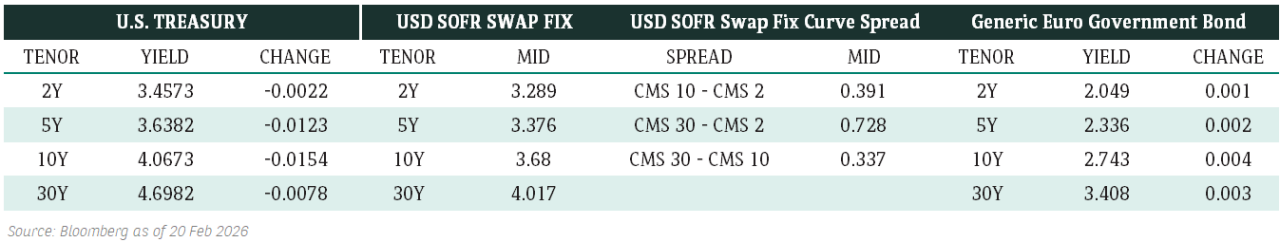

Fixed Income Market Updates

With US Treasury auctions and non-farm payroll data this week, we expect some volatility that might lead to further rise in yields. We would still take the opportunity to long duration especially with high quality new issues that provide concession such as the Dai-ichi new issue perpertual. Interestingly, China IG spread has tightened the most in Asia IG since the new year began.

EUROPEAN BANK COCO (AT1)

AT1 was unchanged to -0.25pts. Trading activity picked up into the close. Market is expecting some new issuances over the next few weeks. There is some rate watching going on, but we do not see much impact on broader risk for now, and if anything, this would just contribute to spread tightening on stable pricing.

ASIA INVESTMENT GRADE (IG)

Mixed performance across Asia IG today. Sectors with new issues being announced performed weaker. China IG was 2-10 bps tighter with one way buying flows. Hong Kong IG was in sympathy with China IG with better buying interest and with spreads ending 3-5 bps tighter. Korea IG closed mostly unchanged as we saw small selling on the back of the Hynudai Capital issuance. Japan IG was unchanged to 2 bps wider as financial papers underperformed with new issues being announced. In SEA IG, Thai Oil remains topical as one way selling on the complex as bonds leaked 5-7 bps wider. Rest of the space was marginally wider.

ASIA HIGH YIELD (HY)

China HY held up for the most part despite the weaker equity performance, especially across property stocks. There was still some retail demand in survivor names particularly in the short-dated bonds. Away from property, there was continued demand across the Fosun curve from domestic funds and PBs.

Away from China, Asian High Yield opened slightly lower in cash price because of the move in US Treasuries, but traded with a firmer tone later on the back of real money buying. Asian High Yield bond spreads were unchanged to +0.125pt higher with the majority of the demand seen in Indian renewable names.

Forex Market Updates

The US Dollar slipped following reports of targeted tariffs under President-elect Trump, easing fears of broad levies. Attention now shifts to upcoming economic data and Fed comments.

USD

.The US Dollar weakened on the first Monday of the year following reports that President-elect Trump is considering targeted tariffs on critical imports, alleviating concerns of broader levies that had been weighing on global markets. The Dollar Index fell to 108.24, retreating from a two-year high of 109.54. The potential shift in tariff policy prompted analysts to reassess their expectations, noting that the fears of sweeping tariffs, which had previously fuelled dollar strength, may have been overblown. Market focus now turns to upcoming US economic data and Fed policymakers' remarks for further insights into the economy’s trajectory and potential Fed actions.

The Dollar Index is likely to remain well-supported above 107.00 for the time being.

CNY

.The Chinese Yuan weakened to its lowest level in 16 months on Monday, driven by trade concerns and falling yields. The yuan breached the key 7.3 threshold against the dollar, marking its first breach since 2023. Analysts predict further yuan depreciation, especially if US tariffs are enacted by President-elect Trump. Despite efforts by state-owned banks to sell dollars and curb the decline, the yuan remains under pressure. China's services sector showed growth in December, but trade risks and weak external demand continue to weigh on the economy. The People's Bank of China is expected to adjust monetary policy to stabilize the yuan.

The Renminbi could see more near term weakness against the USD, although strong resistance is expected around the 7.4000 handle.

CAD

The Canadian Dollar strengthened yesterday, bolstered by domestic resilience and softer US Dollar sentiment ahead of the Fed’s decision this week. Canada’s Services PMI dropped to 48.2 in December, marking the first contraction in three months, as postal strikes and cautious demand weighed on activity. Political uncertainty also emerged as Prime Minister Trudeau announced his resignation, signalling potential shifts in economic leadership. Despite challenges in the services sector, the loonie held firm, with USD/CAD consolidating near the 1.4300 level as markets assess the BoC’s stance on excess capacity and growth.

The Loonie looks likely to be capped by technical resistance around 1.4470 for now.

XAU

Gold prices declined on Monday as investors reacted to the Fed’s recent signal of a slower pace of rate cuts in 2025, with inflation concerns remaining prominent. Spot gold fell 0.3% to $2,634.49 per ounce, pressured by a cautious economic outlook and the possibility of sustained higher rates. Despite a drop in the dollar, gold’s appeal as a non-yielding asset diminished amid expectations of persistent inflationary pressures, partly due to potential tariff policies under President-elect Trump. Market attention now turns to key US economic data, including the jobs report on Friday, for further clues on the Fed’s policy direction.

The precious metal should see more near term consolidation around 2660.