Macro Update:

Good news is bad news

Good news on US economy is bad news for financial markets. US stocks were down and yields were up after the strong JOLTs job openings and ISM Services PMI reports that further scaled back rate cut expectations. We have also revised down our Fed rate cut forecasts from three to two cuts this year with terminal rate at 4%.

China’s central bank expanded its gold reserves for a second month in December after a short term pausing purchases earlier last year. We remain bullish on gold with 12-month target at $3,000.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks tumbled on Tuesday after a batch of upbeat economic data raised concerns that an inflation rebound could slow down the Fed's pace of monetary easing.

We remain constructive on overall US equities.

EUROPE EQUITIES

European stocks on Tuesday rose for a second-straight session and held their gains after rallying on Monday following the report on US tariffs.

HK EQUITIES

Stocks in Hong Kong slumped to the lowest level in almost six weeks amid concerns over US curbs on some of China’s biggest technology companies.

Nvidia (NVDA US)

Nvidia’s CEO, Jensen Huang, on late evening in the US presented a new GeForce RTX 50 series of gaming chips for desktop and laptop computers at the CES trade show.

These chips are powered by the Blackwell architecture used for the company’s artificial intelligence (AI) processors, and will roll out for desktop users by January 2025, while laptop versions will be available starting in March 2025.

The company said the chips will boost frame rates, reduce latency by up to 75%, while powering autonomous game characters.

Looking ahead, further developments in the company’s AI chips are key to watch for further upward momentum in share price.

MARKET CONSENSUS: 70 BUYS, 8 HOLDS, AVERAGE TP USD173.07

Tesla (TSLA US)

The US National Highway Traffic Safety Administration said on Tuesday that it has opened a probe into 2.6M Tesla vehicles in the US over reports of crashes involving a feature that allows users to move their cars remotely. Further developments in relation to this probe are likely to inject volatility to the company’s share price going forward.

The new investigation comes after the US auto safety agency in October 2024 opened an investigation into 2.4M Tesla vehicles equipped with Full Self-Driving (FSD) software after four reported collisions, including a fatal 2023 crash.

MARKET CONSENSUS: 28 BUYS, 17 HOLDS, 15 SELLS, AVERAGE TP USD304.4

MediaTek (2454 TT)

Taiwanese semiconductor company MediaTek, the world’s top chip supplier for smartphones and smart TVs is collaborating with Nvidia on the new GB10 Grace Blackwell Superchip powering the Nvidia project DIGITS personal AI supercomputer.

Announced by CEO Jensen Huang at CES, this latest collaboration builds on MediaTek’s work with Nvidia on Dimensity Auto Cockpit chips for cars.

The collaboration is likely to provide further support to share price going forward.

MARKET CONSENSUS: 23 BUYS, 7 HOLDS, AVERAGE TP TWD1473.66

Mercedes-Benz (MBG GY)

German carmaker Mercedes-Benz will reportedly lower mid-term profitability targets in its next capital markets day for its passenger car business due to prolonged weakness in the market and the switch to electric-powered vehicles. An outlook downgrade is likely to put downward pressure on the company’s stock price going forward.

In its initial target, Mercedes aimed for an adjusted profit margin of up to 14% in positive market conditions and of no less than 8% in more difficult times.

MARKET CONSENSUS: 14 BUYS, 10 HOLDS, 5 SELLS, AVERAGE TP EUR66.31

Volvo (VOLVB SS)

The Volvo Group announced on Tuesday an 8% year-on-year increase in the FY2024 sales, with a total of 763,389 units sold over the period.

Sales of Volvo’s electric vehicles experienced a 54% surge in 2024 where they accounted for 23% of the company’s global sales. In Europe, Volvo also saw a 25% year-on-year increase in sales, but business in US and China declined by 3% and 8% respectively.

The positive numbers are likely to be supportive to their share price in the near term.

MARKET CONSENSUS: 15 BUYS, 10 HOLDS, AVERAGE TP SEK313.78

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

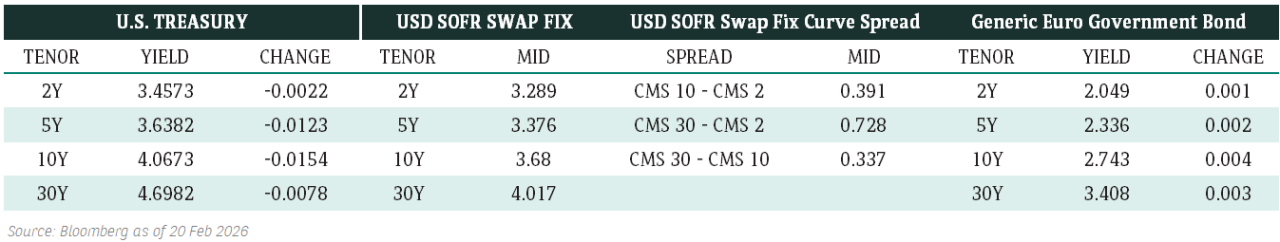

Bond market sentiment has been weak since the hawkish FOMC. The market has been one-way selling on US Treasury. However, if we have a weak nonfarm payroll this Friday, we expect some of the US Treasury selling could get unwind. We believe the recent panic-selling on US Treasury is market over-reaction and we suggest utilizing it to gradually build your fixed income portfolio.

EUROPEAN BANK COCO (AT1)

European bank coco started to turn weaker due to more new bond issuance. However, we believe the valuation is still not cheap enough. We expect if US Treasury yield climbs higher from here, coco valuation would become more interesting and warrant bottom fishing opportunity.

ASIA INVESTMENT GRADE (IG)

The spotlight in Asia IG was China IG on the back of Tencent news. As a result, China tech IG was generally a touch weaker. Outside of China, India IG was slightly weaker and traded 2-4 basis points wider. Overall, market tone was cautious due to higher US Treasury yield but we expect the market will soon find direction after Trump’s inauguration.

ASIA HIGH YIELD (HY)

Asia HY had a quiet day and we continued to see buying in short duration bonds for carry play. China HY remained sluggish due to Sunac’s restructuring 2.0 news and was overall 1-2 points weaker. We expect the sector will remain weak in medium term due to lack of positive catalyst. Having said that, Hongqiao’s new bond issuance outperformed and was 0.5-0.75 points higher.

Forex Market Updates

The US Dollar strengthened on Tuesday amid surging US yields and broad risk-off sentiment.

USD

The US Dollar rose on Tuesday after data showed that US job openings unexpectedly increased in November while hiring softened, suggesting that the labour market continued to slow at a pace that probably does not require the Fed to be in a rush to cut interest rates. Elsewhere, US President-elect Trump’s rebuttal of a report that said he was considering applying tariffs only to critical imports added to concerns that inflation will continue to remain sticky in the world’s largest economy, with markets now seeing only 34bps worth of Fed rate cuts before June.

The Dollar Index looks well supported above 107.75 for the time being.

EUR

The Euro retreated from one-week highs yesterday despite data showing an acceleration in Eurozone inflation in December, an unwelcome but anticipated blip that is unlikely to derail further ECB rate cuts. The central bank cut interest rates four times in 2024 and markets expect more policy easing to come, even if the speed and timing remains subject to debate, as even the most hawkish ECB policymakers recognize that economic growth is weak, the labour market is softening and recent wage deals point to a major slowdown in income growth.

The common currency’s price action is likely to be constrained below 1.0460 in the near term.

GBP

The British Pound weakened overnight after briefly touching a one-week high against the USD despite UK Construction PMI figures coming in below expectations. On the central bank front, news that three members of the BoE’s voting committee had voted for an immediate rate cut in December triggered a new debate at the end of 2024 about how growth and inflation risks would feed into the BoE’s policy decisions moving forward. Looking ahead, markets currently expect higher inflation to delay BoE rate cuts in the year ahead.

Sterling looks poised for some consolidation moving forward, although risks remain biased to the downside with immediate support around 1.2350.

XAU

Gold prices rose on Tuesday although gains were capped by a strengthening USD and rising Treasury yields after strong US jobs openings figures signalled diminishing odds of large rate cuts by the Fed moving forward. Elsewhere, data showed that China’s central bank added gold to its reserves for a second straight month in December, a trend which bullion analysts say other central banks are likely to copy, which could lend continued support to the precious metal.

The precious metal should remain in consolidation mode above 2600 moving forward.