Macro Update:

Fed minutes signal potential Trump policies increase inflation risk

The December Fed minutes confirmed that potential Trump policies bringing inflation risk was the key reason to become more hawkish and signalled a slower pace of rate cuts going forward. We expect two Fed rate cuts this year with terminal rate at 4%. Market volatility is increasing ahead of Trump’s inauguration amid policy uncertainty.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks ended slightly higher on Wednesday in a session where investors struggled for clear direction as gains from a cooler-than-expected US jobs report was offset by rising inflation risk from president-elect Trump’s policies.

EUROPE EQUITIES

European stocks closed lower on Wednesday after regional economic sentiment dropped in December according to preliminary data.

HK EQUITIES

Stocks in Hong Kong fell for a third day to a six-week low, as elevated yields in the US continue to dampen sentiment.

Honeywell (HON US)

Honeywell and NXP Semiconductors announced on Wednesday that they will expand their partnership to develop AI-driven technology for aviation and autonomous flying, whereby resulting product innovations could possibly support both companies’ share price going forward.

Under the partnership, the companies will specifically combine Honeywell's Anthem avionics, a cloud-connected cockpit system, and chipmaker NXP's computing architecture to improve planning and managing flights.

MARKET CONSENSUS: 13 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP USD245.43

eBay (EBAY US)

Shares of eBay surged on Monday, hitting a 52-week high as news emerged that Meta will integrate eBay listings into its Facebook Marketplace, potentially bringing in significant amounts of online traffic and supporting the company’s top line going forward.

Meta said that it plans to carry out a test in the US, France, and Germany. After browsing eBay’s offerings in Facebook marketplace, they would be able to go to eBay and finalize transactions.

The news follows a EUR797.7M fine by the European Commission, which accused Meta of antitrust abuse over its Facebook Marketplace.

MARKET CONSENSUS: 11 BUYS, 21 HOLDS, 2 SELLS, AVERAGE TP USD62.9

Roche (ROG SW)

Roche announced on Wednesday that it has completed the tender offer for all outstanding shares of Poseida Therapeutics, a clinical-stage biopharmaceutical company and a specialist in complex immune cell therapies to treat several types of blood cancer.

Roche said it has accepted for payment nearly 65 million shares in Poseida - equivalent to 66% of the California company's stock.

The move, announced in November 2024, is Roche’s latest move to boost its development pipeline. Contributions from Poseida could potentially support Roche’s top line going forward.

MARKET CONSENSUS: 14 BUYS, 8 HOLDS, 4 SELLS, AVERAGE TP CHF306

Shell (SHEL LN)

The London-based energy giant, Shell on Wednesday trimmed its liquefied natural gas production outlook for 4Q2024 and said oil and gas trading results are expected to be significantly lower than in the previous three months.

The company also warned of a hit to cash flow due to USD1.3B in emissions-permit payments in the fourth quarter, while the production miss was driven by scheduled maintenance at a facility in Qatar.

Shell’s outlook cut is likely to put downward pressure to the share price going forward.

MARKET CONSENSUS: 21 BUYS, 5 HOLDS, AVERAGE TP GBp3129.97

Samsung Electronics (005930 KS)

The South Korean electronics company, Samsung Electronics, said on Wednesday that it expects its consolidated operating profit for 4Q2024 to be around KRW6.5T, down 29% from 3Q2024. The figure missed market expectations.

Sales for 4Q2024 are forecast to land at KRW75T, compared to KRW67.78T in 4Q2023.

Samsung will announce its full earnings data later this month. The company’s cost competitiveness and growing demand in the AI segment are still likely to be supportive to its top-line.

MARKET CONSENSUS: 36 BUYS, 6 HOLDS, AVERAGE TP KRW75782.76

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

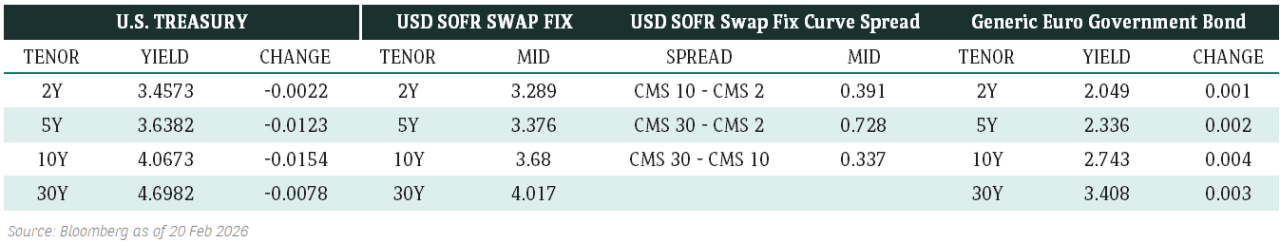

Primary market has been very active since Monday, providing good opportunities to build up bond positions especially in currencies (such as SGD and AUD) where bond inventories have been difficult to source. We continue to favour 3-7 years Investment Grade bonds given the current volatility in rates.

EUROPEAN BANK COCO (AT1)

Activity picked up in the European Bank AT1 space but the sentiment was generally weak. USD-denominated AT1 bonds struggled and was 0.25-0.875point lower as markets became concerned on UK risk with the Gilts and GBP movements. GBP-denominated AT1 bonds, however, fared better down 0.375-0.625 point but could hardly find a clearing level. EUR-denominated AT1 bonds outperformed and was down 0.125-0.375point. Investors' preference remained in the AT1 bonds with short call dates.

ASIA INVESTMENT GRADE (IG)

China IG space traded unchanged to slightly wider overall. Tencent was the underperformer as its curve widened 5-8bps due to asset managers trimming positions. The rest of the technology, media and telecom space was 1-2bps tighter with Meituan, Xiaomi and Baidu bonds seeing demand. New issue Clifford Capital (which carries a guarantee from the Singapore Government) traded very well in secondary market, tightening around 10bps. Korea IG space traded slightly wider although most of the activity was on the new issues. Export-Import Bank of Korea mostly hovered around reoffer with the exception of the 10-year which tightened around 5bps.

ASIA HIGH YIELD (HY)

Macroeconomic weakness dragged China HY property bonds 1-3 points lower with Vanke and Longfor underperforming. FOSUN's new tap saw some selling, which traded 0.10-0.25point lower from reoffer. Outside of China, UPL perpetual traded up 1 point while the rates move is making the senior-to-perpetual spread wider. Biocon Biologics was unchanged despite getting regulatory approval in Japan. We are still cautious in the HY space in general and will be highly selective.

Forex Market Updates

The US Dollar rose, supported by strong economic data, including robust job openings and low jobless claims, with markets awaiting upcoming nonfarm payrolls data.

USD

The US Dollar strengthened for a second day on Wednesday, with the dollar index rising 0.28% to 109.00. Positive US economic data fuelled the gains, including a rise in job openings and robust services sector activity for December, which hinted at continued economic resilience. Weekly jobless claims dropped to 201,000, the lowest in 11 months, underscoring a stable labour market. Markets are now focusing on Friday’s US nonfarm payrolls data for further insights into the economy, while Fed officials maintain a cautious stance on future rate adjustments.

The Dollar Index looks well supported above 107.75 for the time being.

CNY

The Chinese Yuan held steady yesterday, holding firm against the dollar, as it closed at 7.3264 per dollar. The PBoC set a midpoint rate of 7.1887, aligning with market expectations. Stability in the currency comes amid ongoing US tariff discussions and a cautious economic outlook. China has expanded consumer trade-in subsidies to stimulate household spending, though investor sentiment remained muted. Consumer electronics stocks declined by 3.2%, reflecting broader concerns about sluggish economic growth despite efforts to bolster domestic demand.

The Renminbi’s weakening has slowed down, but could run into some resistance around the 7.4000 handle in the near term.

AUD

The Australian Dollar declined on Wednesday as a slowdown in core inflation strengthened expectations of a February rate cut by the RBA. Core inflation eased to 3.2% in November, approaching the RBA’s 2%-3% target, with housing costs notably moderating. Despite resilient labour market data showing a rebound in job vacancies, dovish sentiment weighed on the currency. AUD/USD dropped 0.24% to $0.6216, struggling to break resistance near $0.6300. Markets now price in a 64% likelihood of an RBA rate cut next month, reflecting growing confidence in inflation moderation.

AUDUSD looks poised for a period of consolidation between 0.6180 and 0.6280 moving forward.

XAU

Gold prices rose yesterday to a near four-week high, supported by weaker-than-expected US private employment data. Spot gold gained 0.49% to $2,663.48 per ounce, its highest level since December 13. The ADP report revealed 122,000 private sector jobs added in December, falling short of the 140,000 forecast, signalling potential economic weakness. Weekly jobless claims stood at 201,000, below expectations of 218,000. Investors are now focused on upcoming US non-farm payrolls, with analysts noting stronger than expected employment data could pressure gold prices. The Fed’s December meeting minutes are also awaited for rate outlook insights.

The precious metal should remain in consolidation mode above 2600 moving forward.