Macro Update:

Another Liz Truss moment?

The sterling was down to a 14-month low against the dollar as UK gilt yields hit their multi decade highs amid global bond selloff. The British government reiterated its commitment to fiscal rules, but the latest moves have seen comparisons drawn to the fallout from Liz Truss’ ill fated mini-budget in 2022. Policy uncertainty ahead of Trump’s inauguration will increase global market volatility in the near term.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stock markets were closed yesterday for a national holiday.

EUROPE EQUITIES

European stocks ended Thursday higher, driven by a rally in healthcare and mining sectors, despite continued uncertainties over monetary policy and the US.

Shares in Europe continue to trade at undemanding valuations, especially in the UK.

HK EQUITIES

Stocks in Hong Kong pared gains to close lower on Thursday amid concerns of continued deflation in China.

Amazon (AMZN US)

Amazon on Thursday at CES announced that it plans to sell its ad technology to other retailers through a new product called Amazon Retail Ad Service. This could significantly grow its massive USD50B Ad business and support the company’s top line going forward.

Amazon said that the technology will allow retailers to show "contextually relevant ads in the right place and at the right time" using tools that let them customize the design, placement, and quantity of ads that appear on their product pages and other parts of their websites. The product will initially be available for retailers from the US, and although the prices were not disclosed, the company noted that the fees will be based on usage levels.

MARKET CONSENSUS: 79 BUYS, 4 HOLDS, 1 SELL, AVERAGE TP USD244.2

BP (BP/ LN)

Global energy major BP on Thursday has pledged to lift oil production and gas output from India's largest field off its west coast, under a decade-long contract.

BP projected an increase in oil production by 44% to 65.41 million tons and gas output by 89% to 112.63 billion cubic metres from the Mumbai High field.

BP will specifically work as a technical services provider for Oil and Natural Gas Corporation in this project, whereby it will receive a fixed fee for the first two years, followed by a service fee based on a percentage share of the revenue from net incremental production, after recovering incremental costs. This should provide support to BP’s top line and thus share price going forward.

MARKET CONSENSUS: 9 BUYS, 13 HOLDS, 3 SELLS, AVERAGE TP GBp469.91

Hyundai Motor (005380 KS)

Hyundai Motor said on Thursday that it plans to boost domestic investment in South Korea by 19% to a record KRW24.3T this year to ensure growth as it navigates political turmoil as well as US economic unpredictability.

Its planned investment includes KRW11.5T in research and development for next-generation products, electrification, software-defined vehicles, hydrogen fuel-powered products and other technology.

It will also spend KRW12T on ordinary investment such as expanding production of EVs and new models, and about KRW800B on strategic investment such as for autonomous driving.

MARKET CONSENSUS: 35 BUYS, AVERAGE TP KRW316862.06

Fast Retailing (9983 JP)

Fast Retailing, owner of clothing chain Uniqlo, reported FY1Q25 results that featured a solid bottom line beat, as strong growth in most regions offset a decline in contributions from China. This resilience is likely to support share price going forward.

The company’s net profit specifically gained 22.4% YoY to JPY131.9B (vs. JPY112.6B expected), with revenues up 10.4% to JPY895.1B (vs. JPY893.6B expected).

Fast Retailing also maintained its full year operating profit forecast, as higher sales in North America, Europe, and Asia-Pacific region are expected to drive a 5.8% increase in the company’s operating profit to JPY530B for FY2025.

MARKET CONSENSUS: 8 BUYS, 14 HOLDS, AVERAGE TP JPY54347.06

Seven & I Holdings (3382 JP)

Japan's Seven & I Holdings, operator of the 7-Eleven convenience store chain, reported on Thursday a drop of 24% in quarterly operating profit, with the figure coming in at JPY128.4B, missing expectations of JPY132.1B. This is likely to add downward pressure to the company’s share price.

The Japanese convenience store operator’s bottom line was also a significant miss with EPS at JPY4.4 vs. JPY29.2 expected, although revenue was largely in line at JPY3.0B.

Seven & I now plans to complete its strategic restructuring this fiscal year to achieve profit growth in the coming years as it fends off a proposed USD47B buyout offer from Canada's Alimentation Couche-Tard in September last year.

MARKET CONSENSUS: 4 BUYS, 12 HOLDS, AVERAGE TP JPY2507.86

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Fiscal worries in the United Kingdom sent yields on Gilts higher. However, we do not see a repeat of September 2022 post the mini-budget and remain sanguine on United Kingdom banks under our coverage.

EUROPEAN BANK COCO (AT1)

There was a sell-off in Gilts at market open which spooked the market initially. EUR-denominated AT1 bonds were around 0.375-0.875point down in general but we did start to see clearing and bottom fishers coming in at lower levels with Gilts recovering as the day progressed. UK banks' AT1 bonds in USD performed better and were just 0.125-0.25point lower overall. Sentiment in the broader market was better with some non-UK banks' AT1 bonds even closing higher on the day. We remain sanguine on United Kingdom banks under our coverage.

ASIA INVESTMENT GRADE (IG)

Indonesia government's new issuances managed to perform, closing 4-5bps tighter on buying interests from regional banks in both the 2030 and 2035. We saw similar spread tightening in the quasi-sovereign curves as well. In Greater China IG space, HK Airport Authority's new issuances were most actively traded with good two way flows. China technology, media and telecom space continued to come under pressure especially in names like Tencent and Alibaba on the back of more selling from US investors.

ASIA HIGH YIELD (HY)

It was a volatile session in China HY property space. Vanke was down around 4pts at one point, dragged by onshore weakness before bouncing back to -2points at market close. Longfor was 1-3points lower as well. New World Development tried to open higher but that price movement faded rather quickly. Sentiment still remains weak overall in China's housing market and we expect it will take years before we see any meaningful recovery without further big policy support from the central government.

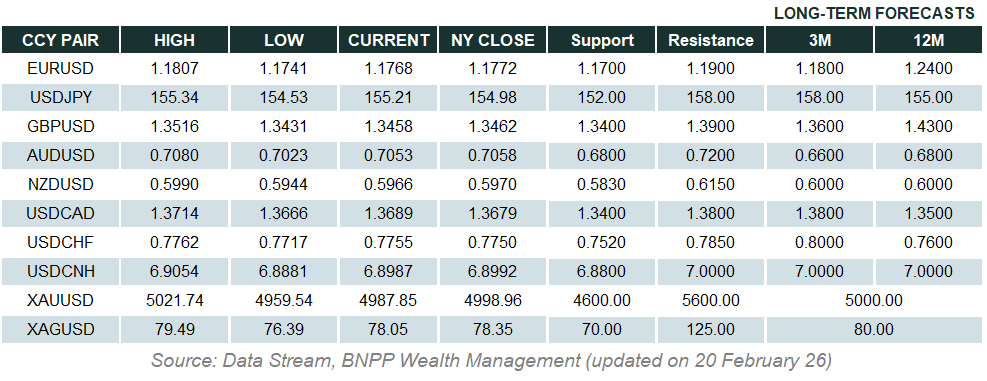

Forex Market Updates

The US Dollar rose for the third day in a row as recent data showed a resilient economy, with fears of inflation continuing markets' expectations on a path of slower rate cuts.

USD

The US Dollar strengthened for a third straight session on Thursday as Treasury yields dipped but held at elevated levels on concerns over tariffs under the incoming Trump administration. U.S. Treasury yields have been on an uptrend, with the benchmark 10-year note hitting an 8-1/2 month high of 4.73% on Wednesday as a resilient economy and likely tariffs have rekindled inflation concerns and heightened expectations the Federal Reserve will take a slower path of interest rate cuts. Investors will eye today's key government payrolls report to gauge how aggressive the central bank will be in cutting interest rates.

The Dollar Index looks well supported above 108.00 for the time being.

GBP

The British Pound hit its lowest since late 2023 on Thursday, under pressure from a selloff in global bonds that has driven the UK government's borrowing costs to their highest in over 16 years, which has reignited concern about Britain's finances. The UK Bond market has been hit particularly hard. Benchmark 10-year gilt yields have spiked by a quarter point this week alone to their highest since 2008, as confidence in Britain's fiscal outlook deteriorates. Finance minister Rachel Reeves is facing her first major test, as turmoil in the bond market could force her to cut future spending.

Sterling's continued weakness may see it approach the 1.2100 level until some consolidation.

AUD

The Australian Dollar wallowed near two-year lows on Thursday as domestic data disappointed high expectations. Figures showed Australian retail sales rose a solid 0.8% in November as Black Friday discounting attracted frugal shoppers, but that missed market forecasts of a 1.0% increase. That should be no hurdle to a February cut in interest rates, given data had already shown core inflation slowed more quickly than expected in November. Markets imply around a 75% probability of a quarter point reduction in the 4.35% cash rate next month and also see rates around 3.60% by the end of the year.

AUDUSD looks poised for a period of consolidation between 0.6100 and 0.6300 moving forward.

XAU

Gold prices rose to a near four-week high on Thursday, supported by safe-haven demand, while investors weighed how U.S. President-elect Donald Trump's policies would impact the economy and inflation. Gold also hit a near four-week high on Wednesday after a weaker-than-expected U.S. private employment report hinted that the Fed may be less cautious about easing rates this year. However, minutes of the Fed's December policy meeting showed officials' concern that Trump's proposed tariffs and immigration policies may prolong the fight against rising prices.

The precious metal could rise toward the 2700 resistance level moving forward.