Macro Update:

Strong Non-farm Payroll figures lead to Higher Yields

US Non-farm payrolls increased by +256k in December, the strongest figures since March vs. expectations of +153k. The unemployment rate fell to 4.1% from 4.2% as well. The 10-year Treasury yield rose +9bps on the data to 4.76%. In addition, Fed rate cut expectations fell to just over one cut for 2025. Given falling rents we expect slightly more, a total of 2 cuts in 2025. The back up in yields gives opportunities to add to fixed income exposure.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities closed lower on Friday as an upbeat jobs report led to expectations for less rate cuts from the Fed this year.

We remain constructive on US stocks in the medium term.

EUROPE EQUITIES

Stocks in Europe also slid on Friday as elevated yields in the US dampened sentiment in the region.

HK EQUITIES

Stocks in Hong Kong continued its move down on Friday amid concerns about China’s economy and heightened US-China trade tensions.

Eli Lilly (LLY US)

US pharmaceutical giant Eli Lilly is reportedly in talks to acquire cancer-focused biotechnology company Scorpion Therapeutics for USD2.5B as it aims to bolster its cancer pipeline, potentially supporting the company’s top line in the long term, although its stock price may face some volatility in the near term.

Eli Lilly would reportedly pay Scorpion USD1B in advance, and in a later phase it would pay up to USD1.5B if certain performance milestones are achieved. The deal is expected to be officially announced in the coming days.

MARKET CONSENSUS: 29 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP USD994.99

Hewlett Packard Enterprise (HPE US)

US technology company Hewlett Packard Enterprise (HPE) has reportedly struck a deal worth over USD1B to provide Elon Musk's social media platform X with servers optimized for artificial intelligence work. This is likely to significantly boost the company's top line and thus support its share price going forward.

The HPE-X agreement was reportedly reached late last year, adding that competitors Dell Technologies and Super Micro Computer had also bid to sell the equipment.

MARKET CONSENSUS: 10 BUYS, 9 HOLDS, AVERAGE TP USD24.59

Synopsys (SNPS US)

The European Commission (EC) announced on Friday that it cleared Synopsys’ acquisition of Ansys valued at USD35B, which signals a significant unwinding of uncertainties surrounding the deal. Although the EC stressed in a statement that the approval is "conditional upon full compliance with the commitments offered by the parties.“

The EC previously found that a deal between Synopsys and Ansys would potentially reduce competition in the global markets for the supply of optics software, photonics software, and electronic design automation (EDA) software tools. To put the European Union governing body's concerns at bay, the two companies offered to "divest to a suitable purchaser the entire overlap in terms of the merging parties' respective activities" in the aforementioned markets.

MARKET CONSENSUS: 21 BUYS, 2 HOLDS, AVERAGE TP USD642.21

Mercedes-Benz (MBG GR)

Mercedes-Benz announced on Friday that its core car sales declined in 2024, reflecting the challenges faced by the auto industry during a difficult year marked by waning demand in a weak global economy, a continuation of which is likely to put downward pressure to the company’s share price going forward.

Mercedes-Benz specifically sold 1,983,400 cars during the year, down 3% YoY, weighed down by a 7% drop in China and a 3% decline in Europe.

The German luxury automaker has cut its full-year profit margin target twice in 2024 and said it will step up cost cuts to counter softer pricing and lower sales of higher-margin cars.

MARKET CONSENSUS: 14 BUYS, 10 HOLDS, 5 SELLS, AVERAGE TP EUR66.31

TSMC (2330 TT)

TSMC, the world's largest contract chipmaker, reported on Friday 4Q24 revenue that beat market forecasts while meeting its own expectations, reinforcing investor hopes that the rapid pace of AI hardware spending will extend into 2025. This is likely to provide support to TSMC’s share price going forward.

TSMC’s revenue in 4Q24 came in at TWD868.42B vs. TWD854.7B expected, representing a growth of 34.4% YoY.

The company will report its full 4Q2024 earnings on 16 January, when it will update its outlook for the current quarter and full year.

MARKET CONSENSUS: 39 BUYS, 1 HOLD, AVERAGE TP TWD1577.29

Earnings Announcements

US Market

-

European Market

-

HK - China Market

Country Garden Holdings

Global Indices Changes (%)

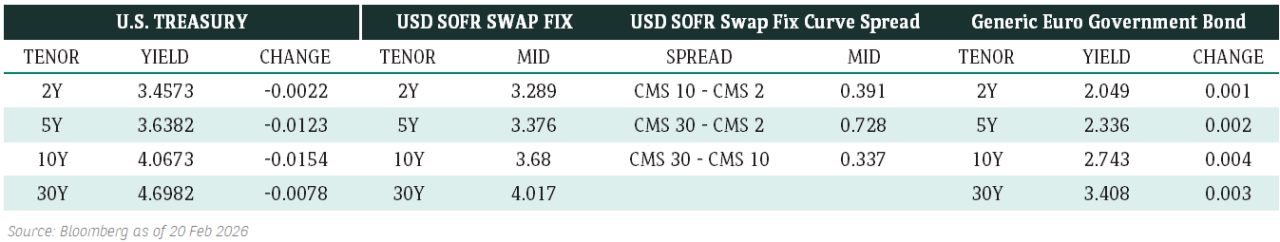

Fixed Income Market Updates

With the 10 year US Treasury yield crossing 4.75%, we would be adding duration starting with 10 year plus investment grade paper. We would prefer that over AT1’s of the same tenor for now.

EUROPEAN BANK COCO (AT1)

AT1's are anywhere from unchange to 50c (cents) lower and stable. Thematically remains the same, short calls are unchanged, lower reset annd higher beta, wider spread lines are also mostly unchanged to 25c lower and then new deals and some tight dollar denominated longer duration 25-37.5c lower . Againt, this is all rates, not worries around extension risk and credit spreads are mostly tighter. We retierate we are comfortable with the UK names under coverage and have no hesitation on shorter calls but would be cautious on duration due to rates and tight credit sreads.

ASIA INVESTMENT GRADE (IG)

Strong performance on high quality new issues including Bank of China Aviation, the triple tranche from HKAA and CLP Power perps. On Korea IGs there was better selling the recent new issues to make room for further supply.

ASIA HIGH YIELD (HY)

In HY, Macau still see very strong buying in the front end with 2026 and 2027 papers drying up across the street being lifted out into retail buyers over the last few days. That's extending slightly the belly today with most 26/27 papers barren. New World Development s responding to Chow Tai Fook sale of Alinta with investors interpreting action as possible support from the parent incoming; bonds reversing yesterday's sell off and trading 0.5-1.5points higher. Ex-China maintained a positive tone and largely stsable.

Forex Market Updates

The US Dollar soared to a new recent high, boosted by better-than-expected jobs data and further strengthened markets' expectations of a slower rate of cuts this year.

USD

The US Dollar rallied on Friday after data showed the world's largest economy created more jobs than expected last month, reinforcing expectations that the Federal Reserve will pause its rate-cutting cycle at its policy meeting later this month. The greenback also extended gains following a report that showed U.S. consumer inflation expectations for the next year and beyond jumped in January. The dollar rose to its highest since July against the yen after the data, before turning lower on the day.

The Dollar Index looks to be testing the 110 resistance level soon.

GBP

The British Pound fell for the fourth day in a row and remained under pressure from high global borrowing costs, while gilt yields rose for a fifth consecutive day. Benchmark 10-year gilt yields were up three basis points (bps) on the day to 4.84%, down from the session high of 4.889% after the US Jobs data. Yields remained below Thursday's high of 4.925%, their highest since 2008. The UK has been among the markets hardest hit by a surge in global borrowing costs, which most analysts say originated in the U.S. due to concerns about rising inflation, reduced chances of a drop in interest rates, and uncertainty over how U.S. President-elect Donald Trump will conduct foreign or economic policy.

Sterling's continued weakness may see it approach the 1.2100 level until some consolidation.

AUD

The Australian Dollar huddled near two-year lows on Friday as a major local bank joined the chorus for a rate cut in February, while looming U.S. jobs figures have the potential to shove Treasury yields and the U.S. dollar higher. Investors had already nudged up the chance of a February cut in the Reserve Bank of Australia's 4.35% cash rate to 75%, from 50% at the start of the week. The easing cycle is expected to be rather shallow, with rates bottoming around 3.60% by the end of the year.

AUDUSD looks poised for a period of consolidation between 0.6100 and 0.6300 moving forward.

XAU

Gold prices rebounded on Friday as uncertainty surrounding the incoming Trump administration's policies lifted safe-haven appeal, even as a stronger-than-expected U.S. employment data reinforced expectations the Federal Reserve might not cut interest rates as aggressively this year. Gold prices briefly slipped to $2,663.09 an ounce after data showed the U.S. added 256,000 jobs last month, higher than expectations. Bullion prices, however, quickly rebounded and hit their highest levels since Dec. 12, poised for a weekly gain of more than 1.7%.

The precious metal could rise toward the 2700 resistance level moving forward.