Macro Update:

Rising yields weight on market sentiment

Investor sentiment lowered on Monday, as Treasury yields surged, in particular the US 10Y treasury yields which neared 4.8%. This is the highest level since October 2023, as the stronger than expected payroll data last Friday further lowered expectations of Fed rate cuts while concerns over the potential inflationary Trump policies grew as we approach Trump's inauguration on 20 January. We now see 2 Fed cuts in 2025, which should bring the terminal rate to 4% by the end of the year. Attention will now shift to the upcoming CPI report, which will be crucial for assessing whether inflation will ease towards the Fed’s 2% target.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks closed slightly higher on Monday, bouncing off a two-month low, even as US Treasury yields stayed elevated.

EUROPE EQUITIES

European stocks continued its move lower on Monday as concerns surrounding central bank interest rate trajectories persist.

Within broader Europe, we are positive on UK equities as their defensive merits remain favourable in our view.

HK EQUITIES

Stocks in Hong Kong retreated to an almost four-month low as robust US jobs raises questions on the pace of rate cuts going forward.

Moderna (MRNA US)

Shares of Moderna traded significantly lower on Monday after the company lowered its 2025 sales guidance by roughly USD1B as it continues to cut costs and chart a path forward after the rapid decline demand for its COVID-19 vaccine. The muted outlook is likely to put downward pressure to Moderna’s share price going forward.

The biotech company now expects 2025 revenue to come in between USD1.5B and USD2.5B, most of which will come in the second half of the year.

MARKET CONSENSUS: 9 BUYS, 15 HOLDS, 4 SELLS, AVERAGE TP USD73.41

United States Steel (X US)

Shares of US Steel surged on Monday after Nucor and Cleveland-Cliffs are reportedly considering a joint bid to acquire the company. Valued at around USD7B, the deal would involve Cleveland-Cliffs acquiring most of US Steel and Nucor taking its mini-mill assets.

The proposed deal follows the White House's decision to block Japan's Nippon Steel from acquiring US Steel due to national security concerns.

The fact that both Nucor and Cleveland-Cliffs are US based companies mean that they are likely to face less headwinds from the US government going forward, providing support to US Steel’s shares.

MARKET CONSENSUS: 7 BUYS, 4 HOLDS, AVERAGE TP USD39.13

Johnson & Johnson (JNJ US)

Johnson & Johnson (J&J) announced on Monday that it reached an agreement to buy biopharmaceutical company Intra-Cellular Therapies for around USD14.6B as it aims to bolster its capabilities surrounding neuroscience drugs which could boost top line going forward.

Intra-Cellular’s operations focus on treatments for central nervous system disorders and has a drug for major depressive disorder in late-stage trials.

The deal is expected to be completed later in 2025, funded through a combination of cash on hand and debt.

MARKET CONSENSUS: 13 BUYS, 14 HOLDS, AVERAGE TP USD174.2

Porsche (P911 GR)

German sports car maker, Porsche AG, reported a 28% drop in 2024 China sales on Monday, as persistent weakness in the world's largest car market hit German carmakers.

The drop weighed on global sales, which were down 3% at 310,718 vehicles compared with 2023. This came despite growth in its other markets, including an 11% rise at home in Germany.

Chinese consumers are increasingly reluctant to spend money on luxury goods on faltering economic growth resulting from a real estate crisis in the country. Downward pressure on Porsche’s stock price is likely to persist if the situation continues.

MARKET CONSENSUS: 16 BUYS, 9 HOLDS, 2 SELLS, AVERAGE TP EUR78.73

GSK (GSK LN)

British drugmaker GSK said on Monday that it would pay up to USD1.15B to buy Boston-based biopharmaceutical firm IDRx.

IDRx, a privately held biotechnology firm, is developing a therapy for the treatment of gastrointestinal stromal tumours.

The deal, which comprises an upfront payment of USD1B, will add to GSK's growing portfolio in gastrointestinal cancers. The company, which has been grappling with a decline in its vaccines businesses, has stepped up its efforts in cancer treatment in recent years. How this translates into its top and bottom-line is key for a share price turnaround going forward.

MARKET CONSENSUS: 8 BUYS, 12 HOLDS, 4 SELLS, AVERAGE TP GBp1667.05

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

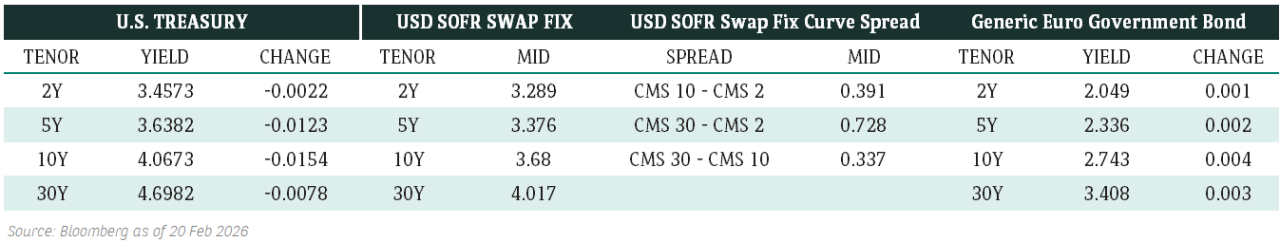

Fixed Income Market Updates

This week will feature key economic data from the US, highlighted by CPI, retail sales, and housing supply releases. Price volatility in rates is expected to persist, particularly as the 10-year yield crosses the 4.7% threshold. This presents decent opportunities for buying on dips in recent new issues and locking in favorable returns via some short-tenor structured products.

EUROPEAN BANK COCO (AT1)

The AT1 market opened 0.125 to 0.375 points lower, influenced by new issue deals and a decline in AT1s with long call date amid rates sell-off. Trade flows in AT1s remained buoyant as investors appeared to use price movements to add risk rather than chase higher yields. Technical support was bolstered by UBS’s announcement of its plan to redeem a 7% perpetual bond next month.

ASIA INVESTMENT GRADE (IG)

In China IG, trading activity was moderate, with Japan out for holiday. Short-dated financial papers tightened by 3 basis points, propelled by higher all-iin yields. Flows favored buying in fixed-rate bonds while selling in floating-rate bonds. Local accounts seeking higher yields stepped in to buy across the curve.

Outside China, Korean IG tightened by 1 basis point, benefiting from better buying amid the rates sell-off. In India, some institutional accounts sold 3- to 5-year benchmark names, such as Indian Railway Finance Corporation.

ASIA HIGH YIELD (HY)

In China HY, the China Vanke curve declined by 1 -2 points, while the broader Chinese property space remained largely unchanged or fell by up to 0.5 points. New World Development faced downward pressure from private bank sellers once again.

In the longer-dated Indian HY market, bonds declined by 0.25 to 0.375 points in line with the rates move, though without significant selling pressure. The Vedanta 2031 bonds were 0.25 points lower following the announcement of a new issue mandate.

Forex Market Updates

The US Dollar weakened, pressured by shifting sentiment, as markets reassess the resilient economic outlook and 2025 Fed rate cut expectations.

USD

The US Dollar eased on Monday, retreating from its intraday high despite last Friday's robust jobs report, which highlighted unexpected employment growth and a drop in unemployment to 4.1%. The dollar index settled at 109.61, reflecting tempered market sentiment. Traders remain cautious as focus shifts to upcoming US inflation data on Wednesday and speeches from key Fed officials.

The Dollar Index looks to be testing the 110 resistance level soon.

GBP

The British Pound continued its slide on Monday, hitting fresh lows amid persistent concerns over rising borrowing costs and the UK’s fiscal health. Sterling dropped to $1.217 against the US Dollar, its weakest level since November 2023. Analysts warned that elevated gilt yields and stagnating economic growth could pressure the government into announcing spending cuts in March. With inflation data due next week and market expectations favouring potential BoE rate cuts, the outlook for the pound remains increasingly bearish.

Sterling's continued weakness may see it approach the 1.2000 level until some consolidation.

CNY

The Chinese Yuan strengthened marginally by 0.02% yesterday against the US Dollar, with USD/CNY showing limited movement despite ongoing economic pressures. The PBoC has introduced measures to support the currency, including boosting foreign exchange reserves in Hong Kong and relaxing offshore borrowing rules. December's trade data revealed robust export growth, driven by pre-emptive shipments ahead of potential US tariffs, while imports showed signs of recovery. With a 5% growth target for 2025, China faces external challenges, such as US and EU trade risks, prompting the PBoC to prioritize currency stability amid broader economic uncertainties.

The Renminbi’s weakening has slowed down, while being well supported above around 7.2860 level.

XAU

Gold prices dipped yesterday, despite a weaker US Dollar. Spot gold fell 1.06% to $2,662.30 per ounce, as profit-taking and cautious sentiment weighed on bullion. Investors now await US inflation data this week, with persistent inflation potentially tempering gold's appeal despite dollar weakness.

The precious metal should find some support at 2595 level in the near term, with markets awaiting further economic clues from US data.