Macro Update:

President Trump delays Mexico and Canada tariffs

US President Trump is delaying new tariffs on Mexican imports after the country agreed to send 10,000 troops to the border to stem the flow of illegal drugs. Meanwhile, Canada Prime Minister Trudeau has just confirmed that the proposed tariffs on Canadian goods “will be paused for at least 30 days while we work together”. President Trump is expected to speak with President Xi within the next 24 hours.

Suspension of new tariffs would reduce any immediate concerns over their inflationary impact and supply chains disruption. Boston Fed President Collins said the Fed would try to look through tariff rises if inflation expectations remain well-anchored.

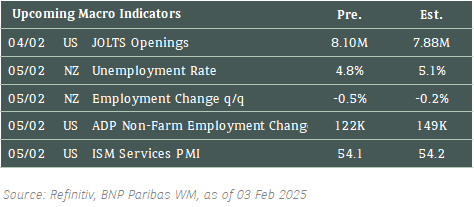

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

Stocks in the US closed lower on Monday but partly recovered from initial losses as President Donald Trump delayed tariffs shortly after his recent orders to levy them on three countries.

EUROPE EQUITIES

European shares also traded lower on Monday, led by automakers as investors digest tariff announcements from the US.

Within Europe, we remain constructive on UK shares on the back of its undemanding valuations and solid defensive merits.

HK EQUITIES

Hong Kong stocks ended largely flat on Monday, paring almost all its intraday losses as investors see US tariffs as catalysts for further stimuli from the Chinese government.

Palantir (PLTR US)

Shares of Palantir jumped in extended trading on Monday after it provided a 2025 full-year revenue forecast that beat Wall Street estimates at USD3.75B, citing “untamed organic growth” in demand for its AI software.

The company also posted an overall beat in its 4Q24 results, with adjusted EPS at USD0.14 vs. USD0.11 expected, and revenue that stood at USD827.5M vs. USD775.9M expected.

The announcements provide further evidence of Palantir’s leadership in the US technology industry, and this could lead to a continuation of the company’s stellar 2024 share price momentum well into 2025.

MARKET CONSENSUS: 4 BUYS, 14 HOLDS, 6 SELLS, AVERAGE TP USD54.78

AstraZeneca (AZN LN)

AstraZeneca said on Monday that it secured a positive opinion from the European Medicines Agency's Committee for Medicinal Products for Human Use for Imfinzi's use in treating limited-stage small cell lung cancer.

The recommendation is based on the pharmaceutical giant's Adriatic phase 3 trial, in which Imfinzi showed a 24% decrease in disease progression or death in patients, compared with placebo.

The company added that the drug is cleared in the US for limited-stage small cell lung cancer, while under regulatory review in Japan and other regions. The positive news from the company is likely to support the share price in the near term.

MARKET CONSENSUS: 25 BUYS, 6 HOLDS, AVERAGE TP GBp13515.45

Sanofi (SAN FP)

Sanofi announced on Monday that it would be buying back EUR3B (or 2.3% of its shares outstanding) from L’Oreal, with the transaction a part of the share buyback program declared on 30 January 2025.

Specifically, 29,556,650 shares will be acquired by Sanofi at a price of EUR101.50 per share, which is a 2.8% discount to the closing price on 31 January 2025. Following the exchange, L'Oreal will own 7.2% of Sanofi, "with 13.1% of voting rights.“

According to L’Oreal, the deal would also “optimize” the beauty company’s balance sheet following recent acquisitions and further diversify its financing sources.

MARKET CONSENSUS: 20 BUYS, 5 HOLDS, 1 SELL, AVERAGE TP EUR116.9

SoftBank (9984 JP)

SoftBank Group CEO Masayoshi Son said on Monday he has agreed with OpenAI CEO Sam Altman to set up a joint venture in Japan to offer AI services to corporate customers.

The Japanese investment giant will also pay USD3B annually to use OpenAI's technology across SoftBank group companies.

The joint venture, SB OpenAI Japan, will be owned by OpenAI and a company established by SoftBank and its domestic telecoms arm.

Son's backing for OpenAI reflects his reemergence as an investment force after a period of retrenchment sparked by the falling value of SoftBank's tech portfolio and a series of high-profile stumbles, which could boost its top line going forward.

MARKET CONSENSUS: 17 BUYS, 6 HOLDS, AVERAGE TP JPY11975.75

Julius Baer (BAER SW)

Julius Baer reported a net profit of CHF1.022B for 2024, beating estimates at CHF938.8M, boosted by a substantial tax release. Meanwhile, Baer's assets under management stood at CHF497B, up 16%, driven by net new money of CHF14B, rising stock markets, and a weaker Swiss franc.

The Swiss wealth manager, which a year ago announced heavy losses due to loans to failed property group Signa, said it had decided not to launch a new share buy-back programme.

Julius Baer also said it was targeting additional gross savings of CHF110M and would reduce its executive board to five members. How this translates into its top and bottom-line is key for the company’s share price going forward.

MARKET CONSENSUS: 10 BUYS, 9 HOLDS, 2 SELLS, AVERAGE TP CHF60.72

Earnings Announcements

US Market

Pfizer, PepsiCo, AMD, Alphabet, Amgen, PayPal

European Market

Amundi, UBS Group, Ferrari, Intesa Sanpaolo, Spotify

HK - China Market

-

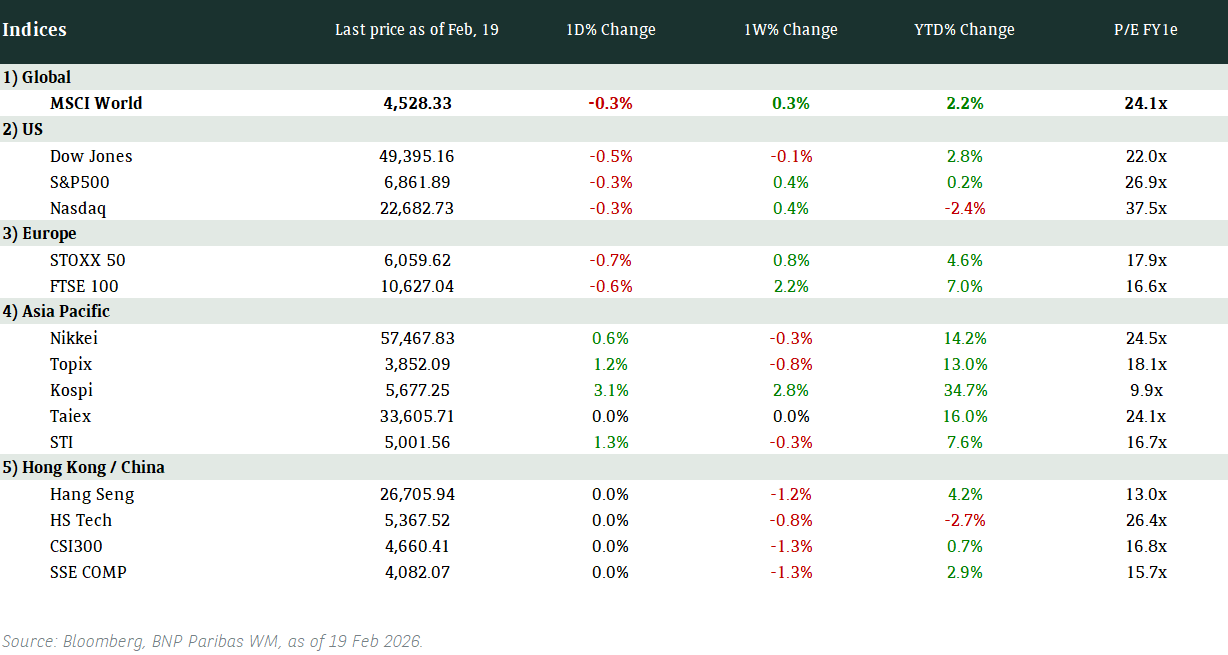

Global Indices Changes (%)

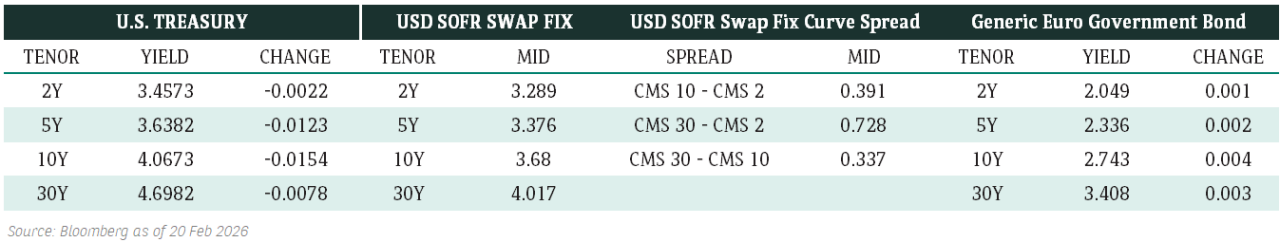

Fixed Income Market Updates

We expect to see increasing fund inflows into the fixed income space as Trump’s tariff threats intensify. Concurrently, the Trump administration plans to ramp up cost-cutting initiatives, which may cap the 10-year Treasury yield at the 4.5% threshold.

EUROPEAN BANK COCO (AT1)

The AT1 market opened 0.5 to 1 points lower, with flows skewed towards selling. This rebalancing appears reasonable after the market’s significant rally in January. Overall trade activity was muted as investors digested Trump’s traffic policy. In this context, AT1 bonds are likely to have a higher correlation to equities than to rates.

ASIA INVESTMENT GRADE (IG)

The Asia IG market opened cautiously, with investors assessing the tariff policies announced by Trump over the weekend. Trade flows remained slow as China is still on holiday. Some investors trimmed the positions in the mid to long end of the curve, resulting in spreads widening by 2 basis points.

ASIA HIGH YIELD (HY)

In China HY, there was light profit-taking on China Vanke, alongside private bank accounts selling New World Development perpetual bonds. Other property names were marked slightly lower, reflecting softer macro sentiment. The Macau gaming sector remained firm, while the industrial space saw overall flow slow. Outside of China, Indian HY bonds were broadly 0.25 to 0.5 points lower, but flows skewed towards better buying at lower levels, which demand primarily from global and Asian institutional accounts in the renewable sector.

Forex Market Updates

The US Dollar weakened modestly on Monday against a basket of other major currencies, as markets reacted to escalating trade tensions.

USD

The US Dollar gained modestly on Monday against a basket of other major currencies, as markets reacted to escalating trade tensions. President Trump announced a temporary pause on Mexico tariffs. The Dollar Index rose by 0.01% as investors assessed the economic impact of new tariffs. Markets are now reassessing Federal Reserve rate cut expectations, with inflation risks rising due to potential supply chain disruptions. The greenback’s strength reflects cautious sentiment as traders weigh the outlook for U.S. monetary policy amid ongoing uncertainty.

The Dollar Index could see a another push higher on safe-haven demand, with the previous high of 110.17 as potential resistance.

CAD

The Canadian Dollar weakened against the US Dollar yesterday, pressured by trade concerns and declining government bond yields. The Canadian Dollar fell 0.22%, as investor sentiment soured after fresh US tariffs on Canadian imports heightened fears of economic disruption. Canadian manufacturing activity expanded at a slower pace in January, with firms facing rising input costs due to currency weakness. Meanwhile, crude oil prices climbed, offering limited support to the loonie. The BoC’s recent rate cut has yet to alleviate broader uncertainty, as markets assess the impact of potential trade retaliation. The currency’s outlook remains fragile amid policy and market volatility.

The Loonie will likely weaken, with USDCAD's highest level of 1.4667 in 2020 as the next target level.

CNY

The Chinese Yuan weakened on Monday by 0.15% against the US Dollar as China's manufacturing sector slowed in January. The Caixin PMI slipped to 50.1 from 50.5, a four-month low that missed forecasts. Despite this, production improved, and new orders grew at the fastest pace since November. However, employment fell at its sharpest rate since 2020, reflecting cost pressures. Trade risks remain high as the US imposed new tariffs on Chinese imports. Beijing's response has been measured, emphasizing dialogue. Markets expect further policy support to stabilize growth amid global uncertainty.

The Renminbi looks well supported above 7.1435 for the time being.

XAU

Gold surged to a record high yesterday, as investors sought safety amid renewed trade tensions. President Trump’s tariffs on Canada, China, and Mexico heightened inflation concerns, driving demand for bullion. Spot gold rose 0.57%, and it closed at $2,816.69 per ounce. Gold touched a peak of $2,830.70 during the day, before slipping slightly. Fears of a stagflationary environment intensified as Canada and Mexico retaliated, and China vowed countermeasures. Despite short-term headwinds from equities, analysts see disruptive tariffs as a bullish factor for gold in the medium term, with further price gains possible if trade tensions persist.

The precious metal is again reaching new highs and should find some consolidation around the 2800 level before strengthening further.