Macro Update:

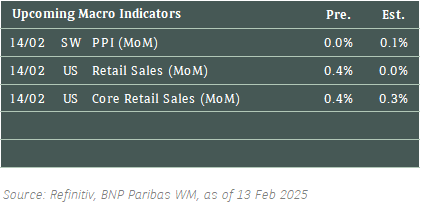

Trump orders review on reciprocal tariffs, while key components in PPI provides relief

US President Trump on Thursday signed a memorandum to review reciprocal tariffs but stopped short of imposing fresh tariffs, while also hinting at potential auto tariffs. Although investors remained anxious that tariffs may add to inflation and prevent the Fed from cutting interest rates further, Wall Street breathed a sigh of relief following the PPI figures. Key components feeding into the PCE index slowed, despite the US PPI exceeding forecasts. This suggests inflationary pressures may be cooling, which provided some relief after the hotter-than-expected consumer inflation data released earlier this week. On the monetary front, we still see 2 cuts of 25bps by the Fed this year, one in June and another in December.

Main Upcoming Macro Indicators

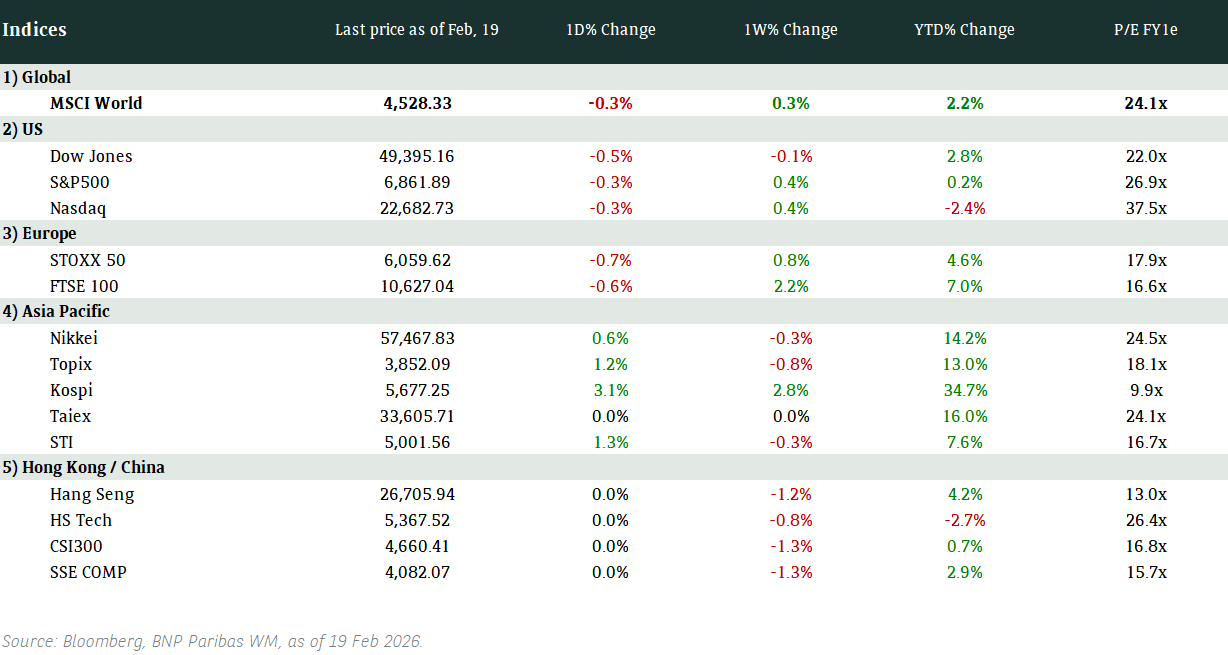

Equity Market Updates

US EQUITIES

US equities rose on Thursday as producer price figures provided relief, even as President Donald Trump unveiled a roadmap for charging reciprocal tariffs on US trading partners.

We are positive on US equities in the medium term.

EUROPE EQUITIES

Shares in Europe logged another positive session on Thursday as upbeat earnings announcements continue to bolster sentiment, further supported by a potential end to the Russia-Ukraine conflict.

HK EQUITIES

Hong Kong stocks ended lower on Thursday as fears emerged that hot US inflation may limit the Fed’s ability to cut interest rates this year.

Palo Alto Networks (PANW US)

Shares of Palo Alto fell in aftermarket trading on Thursday after the company failed to meet bottom-line expectations for FY2Q25. It also issued a disappointing earnings outlook for the current quarter, expecting adjusted EPS of between USD0.76 and USD0.77, missing analyst estimates at USD0.80.

The company’s FY2Q25 revenue stood at USD2.26B vs. USD2.24B expected, while adjusted EPS was at USD0.81 vs. USD0.84 expected.

Palo Alto’s earnings and guidance miss came after rivals Fortinet and Check Point Software posted strong results. Continued relative underperformance could put downward pressure to the company’s stock price going forward.

MARKET CONSENSUS: 40 BUYS, 14 HOLDS, 3 SELLS, AVERAGE TP USD207.49

Siemens (SIE GR)

Siemens shares jumped on Thursday after it posted strong FY1Q25 results, boosted by robust demand electrification products which showed signs of abating a long-standing slump in factory-automation sales. A continuation of this recovery is likely to further drive up share price.

The company’s FY1Q25 sales came in at EUR18.35B vs. EUR18.20B expected, while adjusted EPS stood at EUR4.86 vs. EUR3.77 expected. Guidance remained unchanged, with Siemens expecting its revenue to grow by around 7% this year.

MARKET CONSENSUS: 21 BUYS, 4 HOLDS, 2 SELLS, AVERAGE TP EUR220.1

Barclays (BARC LN)

Barclays upped its 2025 guidance on Thursday after posting a 24% rise in annual pretax profit for 2024, as its investment bank enjoyed strong income growth and slower-than-expected interest rate cuts boosted its domestic lending business.

The British corporate, consumer and investment bank reported profit before tax for FY2024 of GBP8.1B, slightly below GBP8.13B of analysts' forecasts and higher than GBP6.6B it reported for the year prior.

Barclays also plans to launch a GBP1B share repurchase program in 1Q25 which will likely be supportive to the its share price.

MARKET CONSENSUS: 17 BUYS, 4 HOLDS, 2 SELLS, AVERAGE TP GBp329.68

Unilever (ULVR LN)

Unilever said Thursday that profit for FY2024 declined, while turnover climbed YoY.

Profit attributable to shareholders' equity for the FY2024 stood at EUR5.74B vs EUR6.49B earlier. EPS moved to EUR2.29 from EUR2.56.

Unilever will also demerge its ice-cream business, which includes the Ben & Jerry's, Magnum and Wall's brands, and list it in Amsterdam, London and New York.

Looking ahead, the company expects its underlying sales to grow between 3% and 5% for 2025

MARKET CONSENSUS: 15 BUYS, 7 HOLDS, 4 SELLS, AVERAGE TP GBp4987.6

Nestle (NESN SW)

Nestle reported its weakest annual organic sales growth in more than two decades, hit by a pullback in consumer spending after years of high inflation.

The Swiss maker of KitKat chocolate bars and Nescafe coffee said Thursday that organic sales grew 2.2% in 2024. The figure marks a sharp slowdown from the organic sales growth of 7.2% Nestle reported for 2023.

Looking ahead, the company said it continues to expect 2025 sales growth to improve compared with last year, with increased investments driving growth.

Yet, higher costs for commodities like cocoa and coffee and tariff uncertainties could possibly hurt the profitability of the company.

MARKET CONSENSUS: 14 BUYS, 12 HOLDS, 1 SELL, AVERAGE TP CHF87.88

Alibaba (9988 HK)

Alibaba’s share price hit three-year high after chairman Joe Tsai confirmed that the e-commerce giant is working with Apple to roll out AI features for iPhones in China.

Tsai explained that Apple needs to work with Chinese companies on AI features due to regulatory issues.

Apple launched Apple Intelligence last year, a new AI tool that includes an improved Siri voice assistant, as well as a variety of text-generation and photo-editing capabilities.

This collaboration paired with the recent AI optimism are likely to be supportive to the company’s share price in the near term.

MARKET CONSENSUS: 39 BUYS, 3 HOLDS, AVERAGE TP HKD118.2

Earnings Announcements

US Market

Moderna

European Market

Natwest, Hermes, Umicore

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

Rating agency Moody’s downgraded West China Cement’s rating further into junk territory from B2 to B3, with negative outlook. We are cautious in the China High Yield space, as we view idiosyncratic risks remaining. For China exposure, we prefer companies with solid credit fundamentals in the Investment Grade Technology, Media and Telecom space.

EUROPEAN BANK COCO (AT1)

It was a strong day in European AT1 space with prices up 0.125-0.5point overall. Credit Agricole came with a new EUR-denominated issuance - initial price guide was 6.375% and books were around EUR7bn. Credit Agricole eventually printed EUR1.5bn at 5.875%. Given the strong books, price was up around 0.75point when market closed.

ASIA INVESTMENT GRADE (IG)

In China IG space, BBB-rated names such as Weibo, Xiaomi, Meituan and Lenovo in the Technology, Media and Telecoms space outperformed and tightened 5-7bps. Korea IG names traded on a mixed tone with bullets trading well, supported by higher all-in yields and A-rated bonds were difficult to source. IG sovereign bonds were 1-3bps tighter on demand from ETF accounts. With higher than expected inflation number, US Treasury yield has spiked. We think market always overshoots, hence, it is a good opportunity to be adding IG bonds exposure.

ASIA HIGH YIELD (HY)

In China HY space, trading activity slowed as investors took time to digest some of the property news and shifted focus to the primary market. Greentown China was out with a USD 3year non-call 2year new issuance. It has been a long time since market saw a new issue from a Chinese HY property company. Greentown China eventually printed USD350mn at 8.45% with books around USD1.6bn. While the coupon looks attractive, we are still unconvinced of the turnaround in China's property market and prefers getting yield pickup through structured products.

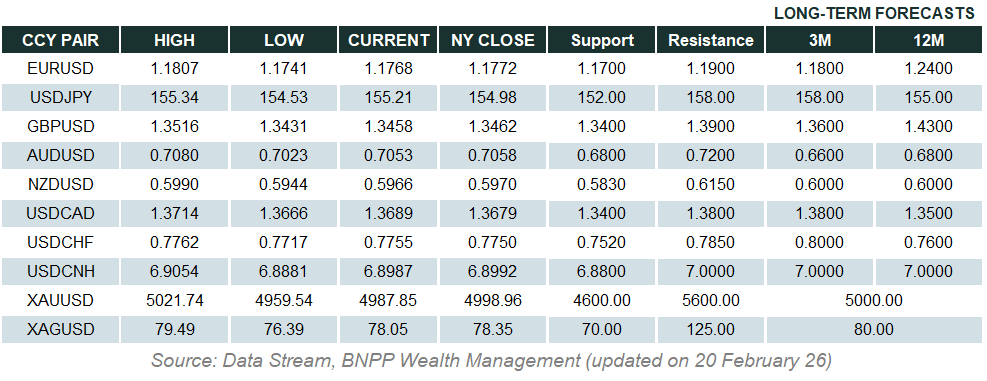

Forex Market Updates

The US Dollar weakened as concerns over Trump’s tariff plans and rising inflation offset stronger producer price data, with uncertainty dampening market sentiment.

USD

The US Dollar weakened on Thursday against a basket of other major currencies, as concerns over President Trump’s latest tariff plans weighed on sentiment. Trump announced he would unveil reciprocal tariffs but provided no details, raising fears of escalating global trade tensions. Meanwhile, stronger-than-expected US producer price data reinforced expectations that the Fed will keep rates higher for longer. Fed Chair Powell reiterated the need for restrictive policy, dampening hopes for early rate cuts. With inflation concerns rising and uncertainty over trade policy, the dollar index edged lower, reflecting cautious market sentiment ahead of key economic data releases.

The Dollar Index could see some consolidation between 107.00 and 109.00 moving forward.

EUR

The Euro strengthened on Thursday, reaching a one-week high against the dollar as optimism surrounding a potential Ukraine-Russia peace deal lifted sentiment. Reports that U.S. officials are engaging in talks to end the conflict boosted risk appetite, supporting the single currency. However, concerns over new U.S. trade policies tempered gains, with markets awaiting further details on proposed reciprocal tariffs. Meanwhile, eurozone industrial production data revealed a sharper-than-expected decline, highlighting ongoing challenges for the region’s manufacturing sector. Investors remain focused on the ECB’s policy path, with expectations of gradual rate cuts later this year.

The common currency’s recent recovery looks likely to run into stiff resistance around the 1.0500 handle for now.

GBP

The British Pound gained on Thursday after data showed the UK economy unexpectedly expanded in the final quarter of last year, providing a temporary boost to sentiment. Growth was supported by a rise in inventories, while household spending remained weak and business investment declined. Despite the surprise increase, the broader economic picture remains fragile, with sluggish domestic demand and ongoing uncertainty over monetary policy. Markets continue to price in further rate cuts from the BoE, keeping expectations for sterling cautious despite its recent gains against the dollar.

Sterling looks to be facing a period of consolidation, above technical support around 1.2160 for now.

XAU

Gold climbed on Thursday as trade tensions resurfaced after former US President Trump outlined plans for reciprocal tariffs. Spot gold rose to a record high of $2928.33. Despite solid US producer price data and Fed Chair Powell reaffirming no rush for rate cuts, safe-haven demand remained strong. However, record prices have dampened demand in key markets like India and China. Markets continue buying dips, maintaining gold’s bullish momentum amid political and economic uncertainty.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2780 for the time being.