Macro Update:

Bonds Rally After Weaker Retail Sales

On Wednesday we had disappointing CPI figures which led to higher bond yields on inflation worries. Subsequently, lower than expected PPI figures on Thursday were followed up by a miss on retail sales on Friday and bonds yields fell back down. The US 10-year Treasury bond is now 4.48% vs. 4.8% high in January. As we have recommended, any material sell-offs in Treasury yields are buying opportunities in higher quality bonds.

Main Upcoming Macro Indicators

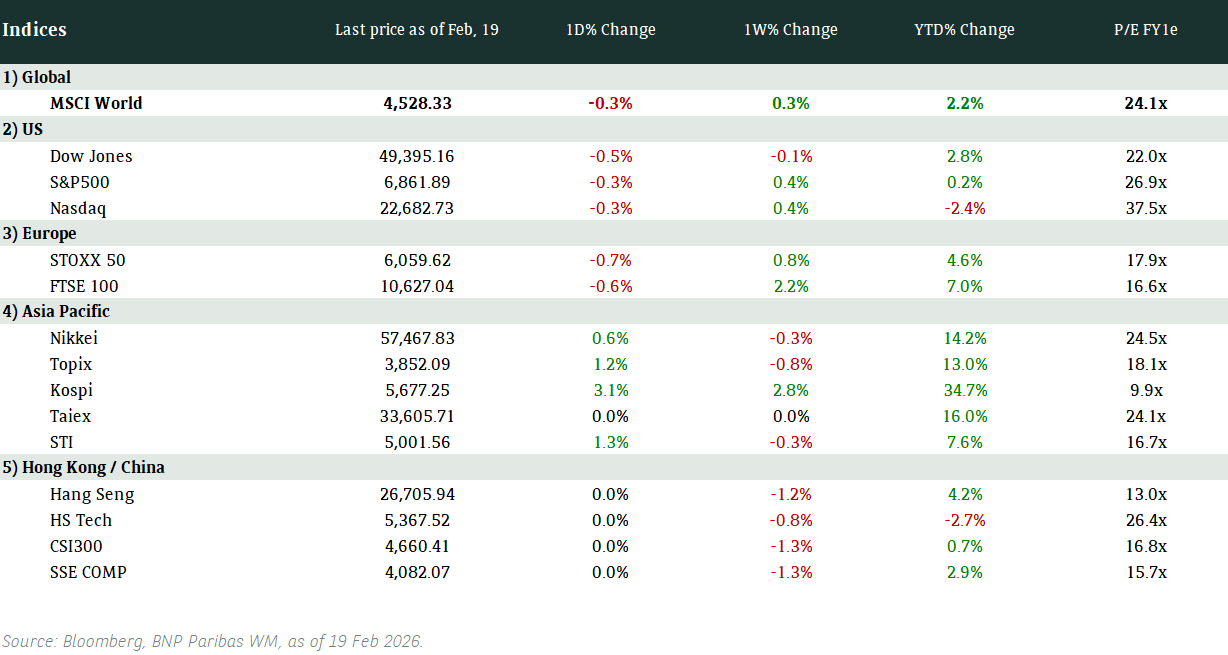

Equity Market Updates

US EQUITIES

US equities were flat on Friday as investors continue to digest the latest developments surrounding trade policy and inflation.

We remain positive on US equities in the medium term.

EUROPE EQUITIES

Shares in Europe closed lower on Friday as investors took a breather after four successive sessions of gains.

HK EQUITIES

Hong Kong stocks surged to its highest level in over four months, driven by signals from PBoC’s indicating plans to tweak its monetary policy to support the economy.

Moderna (MRNA US)

Moderna on Friday announced a larger-than-expected 4Q24 loss at -USD1.12B vs. –USD1.07B expected, weighed by an unexpected charge for a canceled manufacturing contract. The company’s 4Q24 revenue stood at USD966.0M vs. USD954.3M expected, while also guiding for top line to be between USD1.5B and USD2.5B in 2025.

Moderna’s shares tumbled right after its earnings announcement but reversed course later in the session as CEO Stephane Bancel deflected concerns over Robert F. Kennedy Jr.

The company so far has been reliant on vaccines as its main revenue source. It is now in need of another to support its share price going forward.

MARKET CONSENSUS: 7 BUYS, 17 HOLDS, 4 SELLS, AVERAGE TP USD59.14

Intel (INTC US)

Broadcom is reportedly considering a bid for Intel’s chip design and marketing business. No formal bid has been submitted yet, but it will only go forward if it finds a partner for the American chip-making giant’s manufacturing business.

According to reports, TSMC is also considering a bid to obtain Intel's chip factories, but the considerations are said to be preliminary.

Intel has been experiencing difficulties recently and has reported a 7% reduction in 4Q24 revenue of its fiscal 2024 amid stiff competition from industry rivals. A deal from both Broadcom and TSMC could potentially support its share price going forward.

MARKET CONSENSUS: 4 BUYS, 39 HOLDS, 7 SELLS, AVERAGE TP USD21.91

Natwest (NWG LN)

NatWest said on Friday its annual profit beat forecasts, boosted by progress in its growth strategy, improving productivity and active management of capital.

The lender reported total loans of GBP372B, up 3.5% YoY in its sixth consecutive year of total loan growth. Impairments also fell to GBP359M in 2024 vs. GBP578M in 2023.

Going forward, NatWest set a new performance target of achieving a return on tangible equity of between 15%-16% in 2025 and over 15% by 2027.

The solid set of results and upgraded guidance are likely to be supportive to the company’s top-line going forward.

MARKET CONSENSUS: 16 BUYS, 5 HOLDS, 2 SELLS, AVERAGE TP GBp484.67

Hermes (RMS FP)

Shares of Hermes rose on Friday after beating 4Q24 sales expectations, benefiting from strong demand during the holiday shopping season.

All divisions grew in 4Q24 and the largest unit, Leather Goods, posted a better-than-expected 21.5% increase. The company said it applied price increases ranging between 6% and 7% globally in the year.

Hermes also reported 9% growth in sales in the Asia region excluding Japan, the label's biggest market, despite the downturn in traffic in Greater China seen since the end of 1Q24.

Looking ahead, US is becoming an important growth engine for luxury companies this year, helping to offset weakness in the Chinese market. The company also said that it would hike product prices if US tariffs were applied.

MARKET CONSENSUS: 15 BUYS, 10 HOLDS, 4 SELLS, AVERAGE TP EUR2501.82

Safran (SAF FP)

French jet engine maker Safran raised its profit and cash forecasts for 2025 on Friday, after posting a 30% jump in annual core income led by increased air traffic.

Safran reported EUR4.119B in recurring operating income for FY2024, as sales rose 18% to EUR27.317B in 2024. It forecasts EUR4.8B to EUR4.9B of comparable profit for this year, with revenue still projected to be up around 10%.

Together with GE Aerospace, Safran co-produces the best-selling LEAP engine for all Boeing and most Airbus narrow-body jets through their CFM International joint venture.

The healthy trajectory is likely supportive to its share price.

MARKET CONSENSUS: 12 BUYS, 8 HOLDS, 3 SELLS, AVERAGE TP EUR250

Earnings Announcements

US Market

-

European Market

-

HK - China Market

-

Global Indices Changes (%)

Fixed Income Market Updates

With Treasury yields tightening 4-6 basis points (bps) across the curve after US retail sales, we expect rates to continue to be range bound. Credit remains firm with spreads broadly unchanged. Outflows continue out of money market paper and into credit and we advocate the same. For those waiting to sell out of some At1’s with weak technicals, we would monitor a bit longer as AT1 demands continues to be strong as we saw with Credit Agricole’s recent Euro issuance.

EUROPEAN BANK COCO (AT1)

It was a strong day in European AT1 space with prices up 0.125-0.5 (pt) point overall. The new ACAFP 5.875s were busy but they seem pretty well allocated and offers became steadily more difficult to find in the afternoon, with the bonds closing 101.125/101.375. Volumes were good, especially in 3-5yr calls. Longder dated At1's are more two-way depending on rates.

ASIA INVESTMENT GRADE (IG)

In China IG space, a very constructive week closing the week 5-20bps (basis points) tighter in general with tech and Hong Kong names leading the move. Risk sentiment is strong as stocks making new highs, with limited supply and continuous inflow to the market, spread grinds tighter everyday. Outside of China, Southeast names contunue to grind tighter with no supply and India IG is more focused on shorter duration with rates tighter.

ASIA HIGH YIELD (HY)

Another strong session in Asia HY. Key theme was chasing beta and duration - long end Adani +0.5pt (point) although there is profit taking from Europe. Indian renewable energy names better buying flows. Macau gaming aggressively tightened for another day, with all bonds trading above 7% getting chased by real money. Retail continued to lift front end bonds.

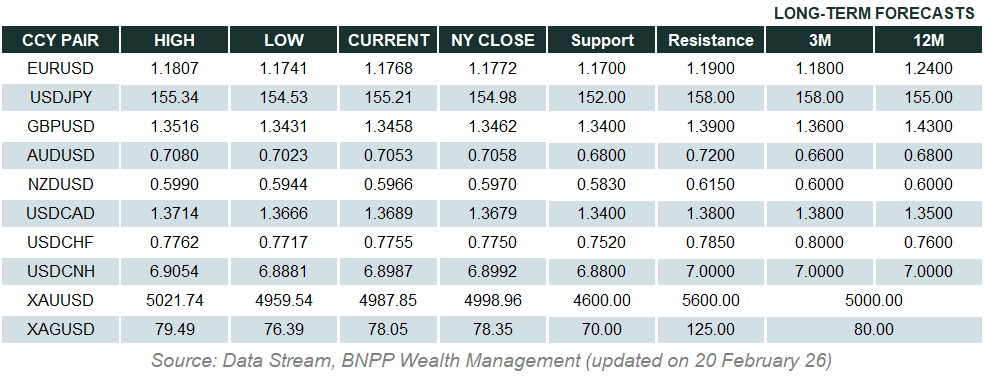

Forex Market Updates

The US Dollar weakened to a nine-week low as the January's retail sales dropped more than expectation and the rise in uncertainty of the constantly changing tariff policy.

USD

The USD index fell to a nine-week low on Friday after data showed that retail sales fell more than expected in January, leading traders to raise bets that the Federal Reserve may cut rates two times this year. In addition, President Donald Trump’s back-and-forth on tariff announcements appears to have tested the market’s patience and made the skepticism grow. However, analyst said a sturdy labour market, persistent inflation, and generally robust economic activity should keep the Greenback on solid footing, fueling expectations for another upbeat year.

The Dollar Index may see a near-term retracement but could be well supported by 3-months-low level at 105.7.

GBP

Sterling rose to its strongest level against the dollar this year on Friday, after UK GDP data earlier this week, which unexpectedly grew by 0.1% in the final quarter of last year, sweetened the mood around the strength of the British economy, while the dollar weakened on some relief over U.S. tariff threats. However, analyst claimed that the outlook of GBP remains complicated for the economy amid flat-lining growth in the second half of last year, elevated inflation, high mortgage rates and a high tax burden. Money markets are pricing in 60 basis points of further easing this year from the BoE but still looking ahead to a fourth-quarter 2024 labour report due next Tuesday for more hints.

The Sterling could test the previous high of 1.271 if 4Q 2024 labour report is better than market’s expectation.

CAD

The CAD edged up to a two-month high against USD on Friday as investors grew skeptical that the trade tariffs threatened by U.S. President Donald Trump would be as severe as first thought. A directive signed by Trump on Thursday stopped short of imposing more tariffs, instead kicking off what could be weeks or months of investigation into the levies imposed on U.S. goods by other trading partners and then devising a response. Moreover, Canadian data was mixed. Factory sales grew by 0.3% in December from November, while wholesale trade was down by 0.2%. The price of oil, one of Canada's major exports, fell 0.5% as investors weighed the potential for a peace deal between Russia and Ukraine that would likely boost global energy supplies.

The USDCAD may consolidate around the current levels and stay range-bound between 1.4100 – 1.4400 as markets await the result of Trump’s investigation.

XAU

Gold prices fell over 1% on Friday due to profit-taking, although they remained poised for their seventh straight weekly rise, driven by fears of a global trade. Analyst said the inability to get the all-time high set on Tuesday, which leaves a potential double top, and the profit-taking ahead of the weekend are two technical factors that play in the fall. However, there is still a bullish trend in gold driven by several factors like tariffs, underlying inflation, and a weaker U.S. dollar, with a growing shift from paper to physical gold further fuelling this trend.

Gold may see some profit-taking towards immediate support around $2856/ounce.