Macro Update:

President Xi attends Summit with Prominent Entrepreneurs

President Xi delivered a speech at a summit of prominent entrepreneurs in China. Some of the companies at the conference included reportedly Alibaba with Jack Ma, Meituan, Xiaomi, Tencent, and BYD.

The sectors reportedly included chipmaking, electric vehicles, and AI. Given the government’s regulatory purview, this is another important symbol of government support for these sectors after the regulatory crackdown some years ago. We remain overweight China equities which have recently benefited from the feel good factor after the introduction of DeepSeek.

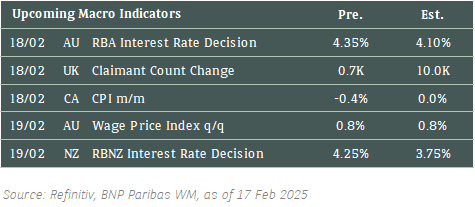

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stock markets were closed on Monday for a national holiday.

EUROPE EQUITIES

European equities continued their move up on Monday, led by defence stocks, amid a potential cooling of geopolitical tensions in the region.

HK EQUITIES

Hong Kong stocks closed flat on Monday, as investors exercised caution ahead of the Fed releasing minutes of its January meeting later this week.

We are positive on Hong Kong / China stocks in the medium term.

Tencent (700 HK)

Chinese technology giant Tencent began tests to integrate homegrown startup DeepSeek’s AI model into its Weixin messaging app, sending shares in the social-media and videogame company to their highest level since 2021.

Tencent recently started testing access to DeepSeek's AI model for searches in Weixin, in addition to its own Hunyuan model, allowing some users to click on AI Search on the search bar within the app, a Tencent spokesperson said Monday. The function isn't currently available in WeChat, the overseas version of the app.

This could mark as an important milestone for Weixin in becoming an AI super-app/agent in the future, which is likely supportive to the company’s top line.

MARKET CONSENSUS: 71 BUYS, 2 HOLDS, AVERAGE TP HKD529.38

Baidu (9888 HK)

Shares of Baidu slid almost 7% on Monday, wiping around USD2.4B off its market value, after its founder Robin Li was not spotted at a rare meeting between Chinese President Xi Jinping and corporate leaders.

President Xi’s symposium in Beijing which included Alibaba founder Jack Ma and Huawei's Ren Zhengfei, signalled the government's support for China's technology sector after years of regulatory controls as Beijing seeks to boost economic growth and navigate increasingly uncertain relations with the US.

If Robin Li’s absence eventually leads to Baidu missing out on some of China’s support measures, this could be a significant setback for the company.

MARKET CONSENSUS: 25 BUYS, 9 HOLDS, AVERAGE TP HKD104.5

Airbus (AIR FP)

European planemaker Airbus is reportedly delaying the arrival of a freighter version of its A350 jet by up to a year and faces hurdles in increasing output of its wider A350 aircraft family in coming months as it wrestles with supply problems, particularly with regards to fuselage parts from Spirit Aerosystems.

The delay in the industry's latest dedicated cargo aircraft could officially be announced as early as Thursday when Airbus posts annual results. Those delays could effectively place an informal cap on A350 production through the rest of this year, with Airbus struggling to increase A350-family production above current rates of around six jets a month. This could negatively impact the company’s top line, and thus share price, in the upcoming quarters.

MARKET CONSENSUS: 21 BUYS, 4 HOLDS, 2 SELLS, AVERAGE TP EUR178.83

Stellantis (STLAP FP)

Stellantis reportedly said on Monday that it will start making dual-clutch transmissions for hybrid vehicles in Termoli, Southern Italy, in a move that could provide an alternative strategy for a facility that was due to turn to EV battery production.

Termoli's engine making plant is one of the sites where Stellantis-led joint venture ACC is planning to build its three EV battery-making plants in Europe.

While a gigafactory in France has already started operations and investments continue for its development, plans for two similar facilities in Italy and Germany were officially paused last year, as ACC was switching to lower cost batteries amid slowing demand for electric vehicles.

MARKET CONSENSUS: 13 BUYS, 18 HOLDS, 4 SELLS, AVERAGE TP EUR14.02

Standard Chartered (STAN LN)

Standard Chartered said on Monday that its Hong Kong banking division, Animoca Brands and HKT will establish a joint venture to apply for a license from the Hong Kong Monetary Authority for issuance of a HKD-backed stablecoin.

Standard Chartered said it has entered agreements with Animoca Brands, a company which specializes in Web3 for leveraging blockchains, and HKT, a major telecommunications service provider in Hong Kong, to enable the JV to tap into crypto-native opportunities and enhance both domestic and cross-border payments.

StanChart said it looks forward to becoming one of the first issuers launching an HKD-backed stablecoin with its strategic partners, according to the CEO of the bank's Hong Kong and Greater China & North Asia division.

MARKET CONSENSUS: 14 BUYS, 6 HOLDS, 4 SELLS, AVERAGE TP GBp1144.46

Earnings Announcements

US Market

Medtronic, Vulcan Materials

European Market

Capgemini, Kerry Group

HK - China Market

Baidu, iQIYI, Hysan Development

Global Indices Changes (%)

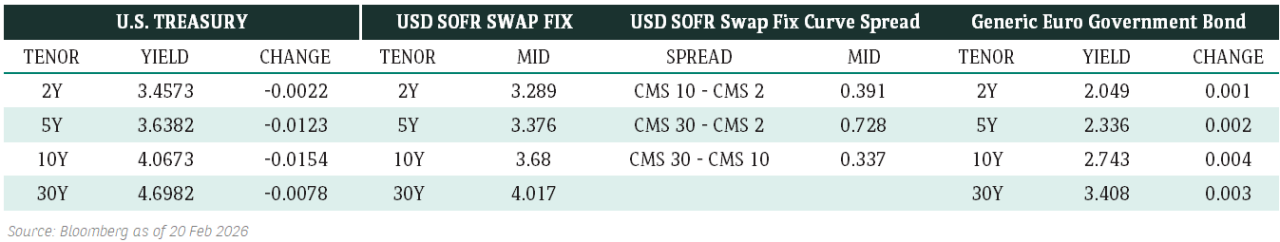

Fixed Income Market Updates

This week features a light schedule on the data front. The FOMC minutes are likely to be a non-event, as the market already priced in Powell’s rhetoric on the lack of urgency for a rate cut. The 10-year Treasury yield is expected to trade within a range this week, with a downward bias if the Treasury bond auction sees strong demand.

EUROPEAN BANK COCO (AT1)

It was a strong day in European AT1 space with prices up 0.125-0.5 (pt) point overall. The new ACAFP 5.875s were busy but they seem pretty well allocated and offers became steadily more difficult to find in the afternoon, with the bonds closing 101.125/101.375. Volumes were good, especially in 3-5yr calls. Longder dated AT1's are more two-way depending on rates.

ASIA INVESTMENT GRADE (IG)

In China IG space, a very constructive week closing the week 5-20bps (basis points) tighter in general with tech and Hong Kong names leading the move. Risk sentiment is strong as stocks making new highs, with limited supply and continuous inflow to the market, spreads grind tighter everyday. Outside of China, Southeast names contunue to grind tighter with no supply and India IG is more focused on shorter duration with rates tighter.

ASIA HIGH YIELD (HY)

Another strong session in Asia HY. Key theme was chasing beta and duration - long end Adani +0.5pt (point) although there is profit taking from Europe. Indian renewable energy names better buying flows. Macau gaming aggressively tightened for another day, with all bonds trading above 7% getting chased by real money. Retail continued to lift front end bonds.

Forex Market Updates

The US Dollar held steady on Monday, as Fed officials saw no urgency for rate cuts. Harker highlighted economic resilience but avoided a rate cut timeline.

USD

The US Dollar held steady on Monday against a basket of other major currencies, as Fed officials signalled no urgency to adjust interest rates. Philadelphia Fed President Patrick Harker highlighted the economy’s resilience, with inflation expected to ease gradually. He reaffirmed support for holding rates steady, citing balanced job markets and stable growth. However, policymakers remain cautious amid uncertainty over inflation trends and potential economic shifts under President Trump’s policies. While Harker expects inflation to return to 2% over time, he avoided a specific rate cut timeline. Markets remain focused on future Fed guidance and the impact of evolving economic policies on inflation expectations.

The Dollar Index could see a near term retracement towards 3 months low support at around 105.7 handle.

JPY

The Japanese Yen strengthened on Monday after stronger than expected fourth-quarter GDP growth, driven by higher business spending and a surprise rise in consumption. The data reinforced expectations of further BoJ rate hikes, with markets now pricing in another 37bps of tightening by year end. Analysts increasingly see a hike coming sooner, possibly by mid-year, as the BoJ remains focused on inflation risks. Attention now turns to BoJ board member Hajime Takata’s speech on Wednesday for clues on the timing of future policy moves.

USDJPY looks poised for more near term losses, with immediate support around 149.87 for now.

CNH

The Chinese Yuan weakened on Monday, as concerns over Sino-US trade tensions resurfaced. While expectations of Fed rate cuts had initially supported the currency, uncertainty over potential US tariffs weighed on sentiment. Despite stronger Chinese bank lending data, investor caution persisted, limiting yuan gains. The PBoC continued setting its daily guidance on the firmer side of market projections, signalling efforts to stabilize the currency. Markets remain focused on upcoming policy signals ahead of the National People's Congress in early March, with traders assessing Beijing’s next moves on economic support.

USDCNH could push higher towards the immediate resistance of 7.2800 handle in the near term.

XAU

Gold strengthened on Monday, supported by a weaker dollar and rising trade tensions after US President Trump threatened new tariffs. Investors sought safe haven assets amid growing concerns over a potential trade war. Ongoing central bank demand also underpinned bullion, with analysts expecting further upside. However, uncertainty remains over Fed policy, as markets await comments from Fed officials later this week. Meanwhile, discussions on the Ukraine conflict continue, with potential geopolitical developments influencing sentiment. Traders remain watchful for any signals on interest rates and geopolitical risks that could impact gold’s trajectory.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 for the time being.