Macro Update:

Earnings Matter

Why has the stock market performed well year-to-date? With 79% of companies in the S&P 500 reporting, 76% have beaten expectations with an average earnings growth of 17% vs 11% expected. Importantly, this has been across multiple sectors leading to a broadening of the market. S&P earnings are expected to be up +12% for the full year. This underpins our overweight to global equities.

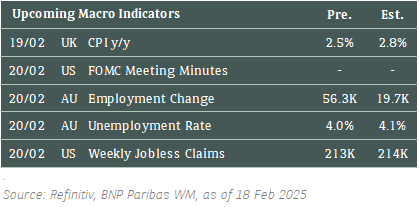

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks closed higher on Tuesday as the earnings season winds down. Investors now eye the Fed’s minutes later this week.

We remain positive on US equities for the medium term.

EUROPE EQUITIES

European equities continued to move higher on Tuesday, buoyed by banks and defence stocks, as investors priced in the likelihood of increased domestic military spending against a backdrop of peace talks to end the Russia-Ukraine conflict.

HK EQUITIES

Hong Kong stocks climbed on Tuesday bolstered by an upbeat mood after the rare gathering on Monday between President Xi and the country’s prominent tech sector figures amid mounting US rivalry.

Intel (INTC US)

Shares of intel soared more than 16% on Tuesday amid rumors of a potential breakup of the company involving Taiwanese semiconductor giant TSMC and Broadcom.

Reports suggest that TSMC may operate Intel’s US factories and own a controlling stake while Broadcom may bid for Intel’s chip design and marketing business. The idea of an Intel breakup has been discussed since last year, with the company itself considering splitting its factory and product development divisions.

If realised, this deal is likely to be positive for Intel’s share price, which has been on a downward trend since the end of 2023.

MARKET CONSENSUS: 4 BUYS, 39 HOLDS, 6 SELLS, AVERAGE TP USD22.35

BP (BP/ LN)

Oil Major BP is reportedly considering a sale of its lubricants business, Castrol, which could be worth about USD10B in a deal. The sale is one of the many options BP is considering as part of an effort to turn around its business. Castrol is also among the assets that Elliott Management has identified for potential disposals. This is likely to be positive for BP’s share price.

The news came after reports last week that activist investor Elliott management is pushing the oil company to take radical action to transform its performance after building a 5% stake. It is engaging with the company in advance of its Capital Markets Day, scheduled for 26 February.

MARKET CONSENSUS: 8 BUYS, 12 HOLDS, 5 SELLS, AVERAGE TP GBp477.04

Capgemini (CAP FP)

French IT consulting firm Capgemini reported a 2% drop in its annual constant currency sales on Tuesday, but narrowly beat market expectations, helped by sustained demand for its cloud and AI services.

Capgemini attributed the continued client demand to the appeal of efficiency and cost-optimization programs, which have boosted its Cloud and Data & AI services businesses. Its full-year sales fell to EUR22.10B vs EUR22.06B expected.

Despite the overall decline, Capgemini noted improvements in its Financial Services and Consumer Goods & Retail businesses, along with a strong performance in the unit servicing the public sector, which is likely supportive to the company’s top line in the near term.

MARKET CONSENSUS: 16 BUYS, 6 HOLDS, AVERAGE TP EUR201.11

Baidu (9888 HK)

Baidu on Tuesday reported 4Q24 results that largely beat analyst estimates, with sales dropping less than expected. The company’s 4Q24 revenue was at RMB34.1B vs. RMB33.4B expected, while net income stood at RMB6.71B vs. RMB4.83B expected.

Baidu’s US-listed shares still slid more than 7% yesterday however, as management commentary implies “near-term pressures” despite expecting AI investments to deliver more significant results in 2025.

The company’s strategic initiatives to navigate the highly competitive Chinese technology sector will be key to watch going forward.

MARKET CONSENSUS: 25 BUYS, 9 HOLDS, AVERAGE TP HKD105.51

Nissan Motor (7201 JP)

Honda Motor reportedly said it will resume talks with Nissan Motor to form the world's fourth-biggest automaker provided Nissan’s CEO, Makoto Uchida, steps down.

Japan's second- and third-largest automakers by sales after Toyota Motor had been in talks to create a USD60B firm after a lack of hybrid models in US and competition from local rivals in China had sent Nissan's earnings diving.

Those talks collapsed last week, plunging Nissan into further uncertainty and highlighting the pressure on legacy automakers, particularly from emerging Chinese giants disrupting the industry.

Uchida has been under pressure to turn Nissan around after years of faltering sales and management turmoil left the company a diminished force. Further details of this merger talk will be key to watch going forward.

MARKET CONSENSUS: 1 BUY, 9 HOLDS, 8 SELLS, AVERAGE TP JPY380.87

Earnings Announcements

US Market

Walmart, Shake Shack, TripAdvisor, Block

European Market

Carrefour, Renault, Rio Tinto, Accor, Airbus, Lloyds Banking

HK - China Market

Hang Seng Bank, HSBC, Lenovo, NetEase, Alibaba, Bilibili

Global Indices Changes (%)

Fixed Income Market Updates

We expect stable bond market sentiment this week on the back of less US macro data release. We continue to expect good quality IG bonds to outperform especially after the weak US January retail sales. The market is also concerned about the all-time-high US household credit card debt with rising delinquencies, which could signal a slowdown that will benefit fixed income investors.

EUROPEAN BANK COCO (AT1)

European bank coco was generally stronger. Bond prices were generally 0.125-0.25 points higher. The space rallied on the back of weaker US macro data. We generally see more fund inflow to the AT1 space as more investors increasing fixed income exposures.

ASIA INVESTMENT GRADE (IG)

Risk sentiment was good. Overall, Asia IG bond rallied quite well. China IG was the top performer and rallied on the back of HK equity strength with spread 4-5 basis point tighter. We saw good demand from both private wealth and institutional investors. We expect the momentum for China IG will continue but would not recommend chasing the rally as any tariff headlines between Xi and Trump could easily reverse the trend.

ASIA HIGH YIELD (HY)

Asia HY bond had a stable day. Macau gaming was active with some profit taking in longer dated papers after recent rally. Overall the space was 0.25 points lower. New World Development (NWD) bonds were 1-2 points higher which was largely due to hedge fund covering their short positions. Debtwire reported that NWD has sent out to banks its latest refinancing proposal for HKD 60bn bank loan. We expect NWD will continue to stay weak and suggest reducing exposures on any rebound.

Forex Market Updates

The US Dollar was up on safe-haven demand amid uncertainty over tariff concerns and Russia-Ukraine negotiations.

USD

The US Dollar strengthened against major currencies on Tuesday, led by gains versus the euro, driven by safe-haven bids amid tariff worries and tension-filled negotiations on the Russia-Ukraine conflict. Traders kept an eye on talks in Saudi Arabia between U.S. and Russian officials on Tuesday aimed at ending the Ukraine war. U.S. President Donald Trump, meanwhile, has threatened new tariffs on the EU due to trade surpluses it had with the United States, in a widening onslaught economists say could trigger a global economic slowdown.

The Dollar Index could see a near term retracement towards 3 months low support at around 105.7 handle.

GBP

The British Pound eased on Tuesday but stayed close to its recent two-month highs, as data showed accelerating British wage growth, reinforcing bets for a cautious rate cut path ahead for the Bank of England, despite a weak economy. British private-sector pay excluding bonuses - the BoE's main gauge of domestic inflation pressure - rose by 6.2% compared with the same period a year earlier, the fastest pace in a year, the Office for National Statistics said. The pace of pay increases, remaining far above levels consistent with the BoE's 2% inflation target, present a complication for the Bank of England, which has signalled its desire to cut interest rates.

The Sterling looks to be finding some resistance at the 1.2650 level and may have trouble breaking above.

CNH

The Chinese Yuan eased against the U.S. dollar on Tuesday as the greenback edged up from a two-month low, while market participants awaited more clues on the direction of policy in the world's two largest economies after tariffs were imposed. For now, there have been no immediate actions to offset tariff impacts in China in terms of economic growth and in the U.S. regarding inflation, despite Beijing's pledge to adjust policy. While the market waits for updates from both capitals about their next steps, the headline fatigue in the past week is only one stop on a path towards more tariff-impacted global markets.

USDCNH could push higher towards the immediate resistance of 7.2800 handle in the near term.

XAU

Gold rose over 1% on Tuesday as concerns over economic growth, due to uncertainty surrounding U.S. President Donald Trump's tariff plans, prompted safe-haven flows into bullion. Since taking office last month, Trump has swiftly redrawn the global trade battlefield with a series of tariffs, while plans are already in motion for sweeping reciprocal tariffs, aimed squarely at any nation that taxes U.S. products. The market's focus has now shifted to the U.S. Federal Reserve's January meeting minutes, due on Wednesday, for clues into the central bank's interest rate trajectory.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 for the time being.