Macro Update:

Equities off to a strong start to the year

While housing starts in the US were below expectations, new building permits were above expectations. Equities firmed in the US amid a light week in data and are off to a strong start to the year. We remain overweight global equities. Non-US equities in particular, China and European equities have been the strongest markets year-to-date.

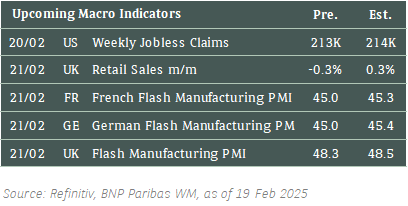

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US equities edged higher on Wednesday as investors digest the latest developments from the Fed’s meeting minutes and president Trump’s tariff plans.

We remain positive on US stocks in the medium term.

EUROPE EQUITIES

European equities logged its largest daily drop since the start of this year as concerns surrounding US tariffs loomed.

HK EQUITIES

Hong Kong stocks retreated on Wednesday as the market consolidates after the immense rally year to date.

Palantir (PLTR US)

Shares of Palantir dropped more than 10% on Wednesday following a report stating that US Defense Secretary Pete Hegseth plans to slash military spending.

Palantir, which has seen its stock soar by almost 50% this year, is a major US defense contractor in addition to selling its technology and AI products to other allied governments and private companies. The company’s government segment growth has been a key driver to the accelerated rally of its stock. A military budget cut may adversely impact its top line going forward.

MARKET CONSENSUS: 6 BUYS, 13 HOLDS, 6 SELLS, AVERAGE TP USD93.79

HSBC (5 HK)

HSBC on Wednesday reported 4Q24 results that beat expectations, with revenue at USD16.3B vs. USD15.9B expected, while pretax profit was at USD32.3B vs. USD31.7B expected. The bank’s final quarter dividend per share at USD0.36 also slightly beat estimates of USD0.35, translating to a 2024 dividend yield of about 5.9%.

Looking ahead, HSBC expects its current global restructuring program to incur USD1.8B in charges over the next 2 years. The bank hopes that the program will allow it to whittle away USD3B in expenses over the coming years, with half of that to be reinvested into priority growth areas.

How this restructuring program translates to HSBC’s top and bottom line will be key to its share price going forward.

MARKET CONSENSUS: 14 BUYS, 8 HOLDS, 3 SELLS, AVERAGE TP HKD86.72

Philips (PHIA NA)

Shares of Philips dropped on Wednesday after it said that it expects lower demand in China to continue to subdue growth in 2025, forecasting a mid- to high-single-digit sales decline in the country despite still expecting an overall sales growth of about 3% this year.

Philips’ China commentary came on the back of its 4Q24 results announcement, which was an overall miss. Revenue for the quarter stood at EUR5.04B vs. EUR5.07B expected, while adjusted net income was at EUR474.0M vs. EUR497.1M expected.

Philips’ persistent struggles in China may put downward pressure to its share price going forward.

MARKET CONSENSUS: 8 BUYS, 14 HOLDS, AVERAGE TP EUR28.37

Grab (GRAB US)

Shares of Singaporean technology giant Grab dropped in aftermarket trading on Wednesday after the company forecasts full year 2025 revenue that was below analyst estimates at USD3.33B to USD3.40B vs. USD3.50B expected, citing strong competition from rival GoTo, which it is considering to take over at a valuation of more than USD7B. Regulatory hurdles are however considerable, especially on the antitrust front.

Continued competition in the ride hailing market will likely put downward pressure to Grab’s stock price going forward.

Despite the downbeat outlook, Grab posted 4Q24 results beats, with revenue at USD764.0M vs. USD757.8M expected, while net income was at USD27.0M vs. USD10.3M expected.

MARKET CONSENSUS: 21 BUYS, 5 HOLDS, AVERAGE TP USD5.67

SingTel (ST SP)

SingTel on Wednesday announced solid beats in its FY3Q24 results, with revenue at SGD3.63B vs. SGD3.62B expected and net income at SGD1.32B vs. SGD664M expected. The company’s bottom line beat was largely driven by an exceptional gain stemming from the disposal of partial stakes in its Thai associate Intouch and Indara.

Looking ahead SingTel expects growth on its EBIT excluding contributions from its associates to be in the “high teens to low twenties” for FY2025 vs. previous expectations at “low double digits”. This positive momentum is likely to be positive for SingTel’s share price going forward.

MARKET CONSENSUS: 17 BUYS, 1 HOLD, AVERAGE TP SGD3.75

Earnings Announcements

US Market

Shake Shack, Walmart, TripAdvisor, Block

European Market

Renault, Lloyds Banking Group, Rio Tinto, Accor, Airbus

HK - China Market

Lenovo, NetEase, Alibaba, Bilibili

Global Indices Changes (%)

Fixed Income Market Updates

HSBC announced a good set of results for FY2024 which showed strength in its underlying business and stabilizing asset quality. We expect HSBC to be more active in the primary market post result announcement. Overall, we remain sanguine on major European Banks’ bonds and welcome issuances in the primary market as opportunities to pick up bonds.

EUROPEAN BANK COCO (AT1)

It was a slightly weaker session with rates moving up and supply starting to weigh in in the European AT1 space. The new ABN Amro Bank's EUR-denominated AT1 bond was most actively traded and was up around 0.625point. The recently issued Barclays USD-denominated AT1 bond was active as well, with more demand seen in the afternoon. We think spreads for subordinated bonds of banks have compressed since the start of the year, although all-in yield still looks attractive, however, the compensation for going down the capital structure of bank debt is not as compelling anymore.

ASIA INVESTMENT GRADE (IG)

Tone in Asia IG space remains firm overall although we saw some profit-taking in the Chinese Technology, Media and Telecoms space. Meituan traded tighter in spreads on two-way flows. Korea IG space traded firm, with spreads closing around 2bps tighter on average. LG Energy Solution and SK Hynix were outperformers in the Korean space. India IG ended the day slightly tighter, especially in the short-end and belly of the curve.

ASIA HIGH YIELD (HY)

China HY space was largely unchanged. Selling in short-term quality names were generally well absorbed. Notably, Vanke curve was up around 0.5point on more news of potential financing. New World Development curve was also up around 0.5-2points with bullets seeing more demand compared to the perpetuals. Outside of Greater China, Adani bonds were 0.125-0.25point lower. We are very selective in the HY space and would prefer yield pickup through structured products rather than taking on more credit risk.

Forex Market Updates

The US Dollar rose on Wednesday amid market uncertainty from Trump’s new tariff threats and stalled Russia-Ukraine talks, though it slipped against the yen.

USD

The US Dollar advanced on Wednesday against a basket of other major currencies as market uncertainty surged following fresh tariff threats from President Trump and stalled Russia-Ukraine talks. The greenback gained against risk-sensitive currencies like the euro, sterling, and commodity-linked dollars but slipped against the yen after Fed minutes highlighted inflation concerns linked to Trump's trade policies. The Fed maintained its cautious stance, signalling rate cuts are unlikely soon. Meanwhile, weak US housing data further pressured the dollar against the yen. Markets remain focused on Fed policy and trade developments.

The Dollar Index’s recent recovery looks likely to run into stiff resistance around the 108.00 handle for now.

GBP

The British Pound weakened on Wednesday as investors reassessed the BoE’s policy outlook despite stronger than expected inflation. Elevated consumer prices and rising services costs added pressure on the central bank, but uncertainty over economic growth, wage dynamics, and business costs tempered expectations of prolonged monetary tightening. Market sentiment turned cautious as markets balanced inflation concerns with evolving rate expectations and external economic risks, weighing on sterling.

Sterling could be well supported above 1.2364 for now.

NZD

The New Zealand Dollar held steady on Wednesday after the RBNZ cut interest rates by 50bps to 3.75%, while signalling a slower pace of future easing. Markets had anticipated the move, but Governor Adrian Orr’s comments about a neutral rate floor around 3.0% helped stabilise sentiment. The RBNZ expects two more 25-basis point cuts by mid-year, aligning with market pricing. However, economic uncertainty, global risks, and inflation volatility remain concerns. The kiwi initially dipped but later steadied as traders reassessed the central bank’s dovish but measured stance.

NZDUSD looks poised for a period of consolidation between 0.5550 and 0.5780 for the time being.

XAU

Gold retreated on Wednesday after briefly hitting a record high, as a stronger dollar weighed on prices. Spot gold dipped after touching $2,947.08 earlier. Market uncertainty remains elevated following US tariff threats, with President Trump signalling new duties on autos, semiconductors, and pharmaceuticals. While gold remains a key hedge against geopolitical risks, rising interest rates could limit gains. Markets are pricing in at least one Fed rate cut this year, though policymakers remain cautious about inflation and economic risks.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 for the time being.