Macro Update:

US Markets trade down after hitting highs

A warning from Walmart after talking about possible slowing consumer spending in its outlook. This follows weaker retail sales last week which led to profit taking in US Markets overnight. Given the strong start to the year, some consolidation is possible in markets.

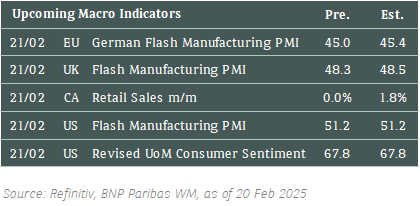

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks fell on Thursday as concerns around trade policies continue.

We nevertheless see the positive momentum continuing in the medium term.

EUROPE EQUITIES

European equities were down slightly yesterday as investors digest a mixed bag of corporate updates while also closely watching an upcoming German election that could change the country's political landscape.

HK EQUITIES

Hong Kong stocks dropped on Thursday as uncertainty mounted over Trump’s new tariff plan, which prompted Beijing to retaliate with its tariffs and file a WTO dispute against Washington.

Alibaba (9988 HK)

Alibaba’s US-listed shares soared more than 8% on Thursday after it reported solid beats in its FY3Q25 results, driven by core Taobao and Tmall businesses as well as the closely watched cloud unit.

A new ad tool and higher service charges are boosting the profitability of the domestic e-commerce business, while cloud revenue growth accelerated to the highest rate in over a year with the company touting an “explosion” in demand for AI inference.

The Chinese e-commerce giant’s FY3Q revenue was at RMB280.2B vs. RMB277.4B expected, while bottom line stood at RMB49.1B vs. RMB37.7B expected. This positive momentum is likely to support Alibaba’s share price in the near to medium term.

MARKET CONSENSUS: 40 BUYS, 3 HOLDS, AVERAGE TP HKD130.19

Lenovo (992 HK)

Lenovo Group reported better-than-expected quarterly earnings, with solid revenue growth across segments, boosted by its bet on the fast-growing use of artificial intelligence.

Net profit for the quarter ending 31 Dec 2024 more- than-doubled to USD693M vs. USD365M estimated. Revenue stood at USD18.8B billion, up 20% YoY, also topping analysts' estimates of USD18.0M estimates. Lenovo's main business, the intelligent-devices segment, which includes PCs, smartphones and tablets, delivered a 12% revenue gain.

The results reflect a solid commercial PC replacement cycle but also show that the company is reaping the benefits after launching several AI PC models in China last May, which is likely supportive to its top and bottom line going forward.

MARKET CONSENSUS: 27 BUYS, 4 HOLDS, AVERAGE TP HKD13.54

Airbus (AIR FP)

Airbus reported adjusted operating income of EUR5.35B for 2024, down 8% and below expectations of EUR5.41B, including EUR2.56B in 4Q24 as it grappled with ongoing snags in its supply chains.

Airbus flagged short-term production pressures and confirmed a delay to its A350 freighter as it predicted a 7% increase in deliveries to around 820 jets this year, while continuing to clean up troubled space and defence projects.

Airbus, which delivered 766 jets last year, roughly in line with its target, has been facing industrial delays due partly to problems in the aerospace supply chain, which have also hampered the recovery of embattled US rival Boeing. The persistence of these issues are likely to put downward pressure to shares of planemakers going forward.

MARKET CONSENSUS: 20 BUYS, 4 HOLDS, 2 SELLS, AVERAGE TP EUR180.13

Mercedes-Benz (MBG GR)

Mercedes-Benz reported on Thursday that its net profit and revenue for FY2024 decreased YoY. It also expects earnings to fall significantly this year and outlined plans to boost competitiveness that includes a 10% cut to production costs over the next couple of years.

European automakers have been scrambling to boost their competitiveness as they navigate stuttering demand for EVs and intense competition in China, while a struggling Chinese economy has also seen Chinese buyers shy away from luxury spending.

Mercedes-Benz said that dozens of new or refreshed models will reach markets through 2027, which will help sales gain traction, while actions to make its global production footprint more efficient and more flexible and a focus on bringing down both material costs and fixed costs will also be implemented.

How this transformation translates to the company’s top and bottom line will be key to its share price going forward.

MARKET CONSENSUS: 11 BUYS, 13 HOLDS, 5 SELLS, AVERAGE TP EUR66.88

Lloyds Bank (LLOY LN)

Lloyds Banking Group reported full-year profit below expectations on Thursday, weighed down by money it set aside for potential consumer redress in relation to a motor finance probe.

Britain's biggest mortgage lender reported a pretax profit of GBP6.34B for 2024 vs. GBP6.72B expected.

The group has been grappling with the uncertainty in the motor-finance sector amid a landmark case and regulatory review. Lloyds is the largest provider of motor finance in the UK and is exposed to these issues through its Black Horse brand.

Despite the downward pressure, Lloyds also announced a share buyback of GBP1.7B, as it continues to pay out excess capital towards its target of a core capital ratio of around 13% by the end of 2026.

MARKET CONSENSUS: 8 BUYS, 14 HOLDS, 2 SELLS, AVERAGE TP GBp67.24

Renault (RNO FP)

French automaker Renault reported a record operating profit for 2024 on Thursday, beating expectations, as lower costs and a string of new launches boosted margins.

The company, one of the few in the sector to have maintained its targets last year, reported operating profit of EUR4.3B, up 3.5% YoY, vs. EUR3.6B expected. Its revenue rose 7.4% to EUR56.2B, well ahead of the expected of EUR54.0B.

Renault expects to spend on discounts to sell more EVs while also raising the prices of petrol cars to help it meet the new European carbon emissions targets, but it continues to rule out pooling its emissions with other car makers.

This positive momentum is likely to be positive for Renault’s share price going forward.

MARKET CONSENSUS: 18 BUYS, 6 HOLDS, 1 SELL, AVERAGE TP EUR58.38

Earnings Announcements

US Market

Booking Holdings

European Market

Air Liquide

HK - China Market

Standard Chartered, Vipshop Holdings

Global Indices Changes (%)

Fixed Income Market Updates

Mercedes Benz reported lackluster results for FY2024 with lower sales and weak pricing driving revenues lower. We are cautious of European automotives companies given the strong competition especially in electric vehicles and the threat of tariffs.

EUROPEAN BANK COCO (AT1)

European AT1 space opened higher on rates move and a pause in new issue supply. Barclays USD-denominated recent issue traded up 0.5point. However, sentiment worsened in the afternoon as equity markets were in the red. Overall, prices were unchanged to +0.125point at market close. We prefer bank senior bonds over subordinated bonds in general as we think valuation is not as favourable currently after the compression in spreads.

ASIA INVESTMENT GRADE (IG)

Tone was softer in the Asia IG space with recent new issues around 1bp wider as primary supply keeps coming. Mirae Asset Securities printed USD400mn 3-year new issue which tightened around 2bps on the back of support from local accounts. Industrial Bank of Korea priced dual tranch in 5year which traded well too, tightening around 5bps into market close. We prefer IG names with solid fundamentals and are comfortable with tenors up to 10 year.

ASIA HIGH YIELD (HY)

China HY space were largely unchanged to 0.5point lower on average. Profit-taking in Vanke had slowed despite property stocks trading mostly lower on the day. Distressed space continues to see selling interests from private banks and asset managers. Outside of China, risk sentiment was more firm with some asset managers willing to go into lower credit quality names or extending duration. We are still highly selective in the HY space and we think idiosyncratic risks remain. We prefer to monetise rates volatility through structured products for yield pick up.

Forex Market Updates

The US Dollar weakened amid new tariffs, trade tensions, and concerns over stagflation, as Fed comments fuelled uncertainty about growth and inflation.

USD

The US Dollar weakened against a basket of other major currencies on Thursday, pressured by President Trump's announcement of additional tariffs, which added to existing trade tensions. While markets absorbed these developments, investor focus was also on Trump's shifting rhetoric about trade deals with China and ongoing geopolitical issues. Fed comments on potential interest rate cuts have contributed to uncertainty around US monetary policy, with some speculating that tariffs could slow growth and add inflationary pressures. Meanwhile, fears of stagflation are resurfacing, as persistent inflation and trade policies stir concerns about economic stagnation despite a relatively strong labour market.

The Dollar Index could see a near term retracement towards 3 months low support at 105.7 handle.

GBP

The British Pound edged higher on Thursday as markets awaited key UK retail sales and business activity data due Friday. Despite this week’s stronger than expected inflation reading, which complicated the Bank of England’s policy outlook, traders still anticipate gradual rate cuts in 2025. Analysts highlighted that while inflation remains stubborn and growth prospects could surprise positively, the BoE may adopt a cautious approach, balancing inflation control with economic stability. Meanwhile, a survey by the Confederation of British Industry showed improving sentiment among manufacturers, although weak export orders and broader economic challenges continue to cloud the outlook.

GBPUSD bulls could push the currency pair to resistance level of 1.2780 in the near term.

JPY

The Japanese Yen strengthened on Thursday, hitting a two-month high against the US Dollar as market jitters over Trump's tariff threats and rising expectations for more BoJ rate hikes boosted demand. BoJ Governor Kazuo Ueda’s meeting with Prime Minister Shigeru Ishiba reassured markets, as no concerns were raised over rising long-term interest rates. Analysts anticipate one more BoJ rate hike this year, possibly in the third quarter, with Japan standing out as a rare global outlier pushing for higher rates. Wage growth and the broader impact of January’s rate hike remain in focus.

USDJPY looks poised for more near term losses, with the pair being well supported above 148.10 handle for the time being.

XAU

Gold prices hit a record high on Thursday, driven by safe-haven demand amid escalating trade war fears following US President Trump's latest tariff threats. Spot gold steadied at $2,939.38 per ounce after peaking at $2,954.95. Trump's planned tariffs on lumber, cars, semiconductors, and pharmaceuticals heightened market uncertainty. Ongoing central bank buying and ETF inflows supported prices. While potential Ukraine peace talks could briefly weigh on gold, strong fundamentals remain. The Fed's cautious stance on rate cuts also added to the metal’s appeal amid persistent geopolitical and economic risks.

The bullion outlook continues to point upward, with gold prices likely to be well-supported above 2855 for the time being.