Macro Update:

Wall Street tumbled on economic concerns

Wall Street sold off on Friday as economic data raised concerns about a slowing US economy and persistent inflation. All three major indices in the US marked their biggest daily loss of the year, while the US 10y treasury yield fell past 4.45% on Friday, as demand for safe haven assets surged. Consumer sentiment took a hit, with the University of Michigan’s index falling to 64.7, while fresh data showed that the US services sector unexpectedly contracted in February. The weaker data supports our view for rates to be lowered. We continue to see 2 Fed cuts of 25bps each in June and December 2025, which will give us a terminal rate of 4% by year end.

Main Upcoming Macro Indicators

Equity Market Updates

US EQUITIES

US stocks traded lower on Friday, extending its selloff from the day prior as concerns surrounding tariffs and economic data loom.

We nevertheless remain positive on US stocks in the medium term.

EUROPE EQUITIES

European equities rose on Friday, recovering from a two-day losing streak even as Germany’s DAX dipped ahead of the country’s snap elections.

HK EQUITIES

Hong Kong stocks surged on Friday to their highest level since early 2022, buoyed by strong earnings from Alibaba.

Nevertheless, Hong Kong / China stocks still trade at undemanding valuations. The positive momentum is thus likely to continue.

Berkshire Hathaway (BRK/B US)

Warren Buffet’s Berkshire Hathaway reported 4Q24 results on Saturday with bottom line figures that comfortably beat expectations, driven by higher interest rates and a strong recovery in its insurance underwriting business.

The company’s operating income surged more than 70% YoY to come in at USD14.53B vs. USD9.87B expected, although revenue was a slight miss at USD94.92B vs. USD95.56B expected. Additionally, Berkshire Hathaway also declined to buy back its own shares for the second quarter in a row, signaling that the stock is currently trading above its intrinsic value.

The market’s reaction to these results will be key to watch today.

MARKET CONSENSUS: 2 BUYS, 4 HOLDS, AVERAGE TP USD502

Tesla (TSLA US)

Shares of Tesla dropped more than 4% on Friday after it announced a recall of around 376K vehicles in the US.

The move was made after the electric vehicle giant discovered a software glitch linked to the printed circuit board of the electronic power steering assist, which affected certain Model 3 and Model Y vehicles produced in 2023. The defect can potentially lead to an overstress condition "causing a loss of power steering assist when the vehicle reaches a stop and then accelerates again.“

This could potentially hurt the company’s reputation within the US and put downward pressure to its share price going forward.

MARKET CONSENSUS: 30 BUYS, 15 HOLDS, 14 SELLS, AVERAGE TP USD369.1

Standard Chartered (STAN LN)

Shares of Standard Chartered traded higher on Friday after the bank posted 4Q24 results beats, boosted by record growth in its wealth business and a strong performance of its markets division. Revenue stood at USD4.83B vs. USD4.46B expected, while adjusted EPS was at USD0.281 vs. USD0.276 expected.

Standard Chartered also announced that it is set to return USD1.5B to shareholders, bringing the total amount of distributions to USD4.9B since 2023. This is likely to be supportive for Standard Chartered’s share price in the near to medium term.

MARKET CONSENSUS: 14 BUYS, 6 HOLDS, 4 SELLS, AVERAGE TP GBP1160.2

BYD (1211 HK)

Chinese electric vehicle maker BYD's off-road brand Fangchengbao on Friday launched smart versions of its plug-in hybrid SUV Bao 5.

The Bao 5, packing BYD's proprietary 'God's Eye' advanced driver-assistance system (ADAS), is priced from RMB239K. Another version featuring Huawei's Qiankun ADAS goes for a starting price at RMB284K.

Last week, BYD introduced 21 models equipped with its 'God's Eye' system under its best-selling Ocean and Dynasty series. BYD's aggressive autonomous driving push makes higher level autonomy functions more accessible for its mass market models, which could raise the bar in EV competition, and boost consolidation in the industry. How this translates into its top and bottom line will be key to watch going forward.

MARKET CONSENSUS: 36 BUYS, 3 HOLDS, 1 SELL, AVERAGE TP HKD393.52

Nissan Motor (7201 JP)

Shares of Nissan rose on Friday on the back of reports that a high-level Japanese group has drawn up plans to seek investment from Tesla to aid the struggling carmaker after recent merger talks with Honda collapsed. An eventual investment into Nissan is likely to be positive for the carmaker’s share price going forward.

The Japanese group believes that Tesla is interested in acquiring Nissan’s plants in the US. Meanwhile, the proposal specifically envisions a consortium of investors, with Tesla as the largest backer, but also includes the possibility of a minority investment by Hon Hai Precision.

MARKET CONSENSUS: 1 BUY, 9 HOLDS, 8 SELLS, AVERAGE TP JPY396.06

Earnings Announcements

US Market

Zoom Communications

European Market

-

HK - China Market

-

Global Indices Changes (%)

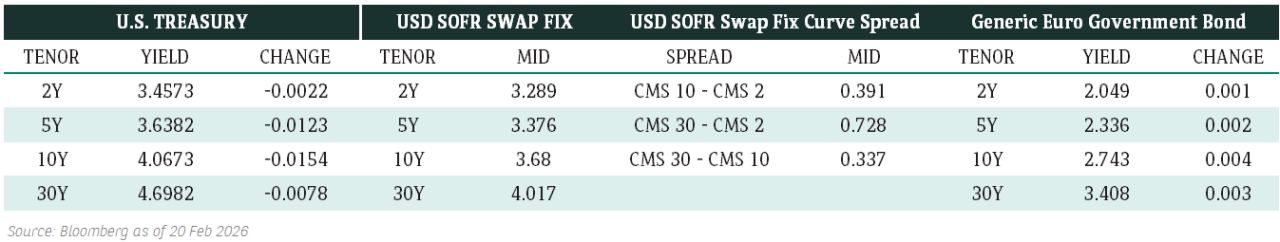

Fixed Income Market Updates

With the market worried about stagflation after Friday’s data, US Treasury yields fell 6-7 basis points across the curve. We don’t expect credit spreads to widen much but risk assets are vulnerable to the downside. Hence stick with lower beta credit.

EUROPEAN BANK COCO (AT1)

Firm week in European AT1 space with spreads closing -3bps to -5bps (basis points) on average despite primary coming to the market with new deals actually re-pricing secondaries tighter. Tone felt strong all week despite macro moves with less optimism on a ceasefire deal doing little to move the space on the whole. EUR has felt firmer than USD and that has fed into the moves with USD underperforming over the last couple weeks, accounts seem more confident on the rates oath in EUR over USD. Expect USD will continue some buying across global names

ASIA INVESTMENT GRADE (IG)

Tone was softer in the Asia IG space with the risk-off move on Friday. Bonds not really moving but reacting to the macro moves and weaker risk calling spreads 2-4 bps wider. Names such as Alibaba and SK Hynix printed in the US overnight.

ASIA HIGH YIELD (HY)

China HY space was largely unchanged with demand across performing names including industrials such as Tsinghua. Two way in Macau gaming and Adani complex while New World Development bonds are now up 10 points last week on the bullets.

Forex Market Updates

The US Dollar staged a tentative rebound on Friday as concerns over global tariffs came back into focus.

USD

The US Dollar rose against a broad range of currencies on Friday as investors consolidated positions ahead of the weekend, looked to more inflation data next week and kept an eye on tariff headlines. The greenback staged a tentative recovery after suffering a sustained selloff in recent weeks, while renewed trade concerns dampened risk sentiment and weighed on other currencies. US rate futures on Friday priced in 44bps of Fed easing this year, with this week's PCE figures likely to provide more clues on the the central bank's rate path moving forward.

The Dollar Index could see some near term consolidation between 105.50 and 107.50.

GBP

The British Pound traded around two month-highs on Friday, supported by stronger-than-expected UK consumer spending and wage growth. However, data also showed that British companies are rapidly cutting staff amid middling economic conditions. Some analysts say that recent stretched levels may limit further GBP gains moving forward, while the prospect of slow growth and sticky inflationary pressures has also prompted markets to price in no more than two more rate cuts this year from the BoE.

Sterling could retrace to immediate support around 1.2580 in the short term.

CNH

The Chinese Yuan firmed to a near three-month high on Friday, underpinned by investor optimism that the US and China may be able to come to a deal that would avert a trade war as well as improved sentiment in China's equity markets. Trump said on Wednesday that a trade deal with Beijing was possible with markets looking towards signals from US Treasury Secretary Scott Bessent's scheduled call with his Chinese counterpart on Friday. Analysts say markets could position away from the worst-case scenario of an all-out US-China trade war and shift towards looking at tariffs as a negotiating tool for both parties in an attempt to make a deal.

The Renminbi could make further gains towards 7.2000 should risk sentiment continue to improve moving forward.

XAU

Gold prices eased on Friday as investors booked profits from the previous session's record high, but were set for an eighth straight weekly gain, driven by strong safe haven demand amid concerns over Trump's tariff plans. XAU has shattered two record highs this week to trade above 2950 as uncertainties surrounding global economic growth and political instability have underscored investor appetite for bullion. Meanwhile, analysts say that the precious metal's safe haven role is not fully realized yet as the shift from riskier assets to safer ones is still not that significant, with money still on the sidelines.

Considering the solid fundamentals for gold, the precious metal may hit the next new all-time-high level at 2980 in the near term.